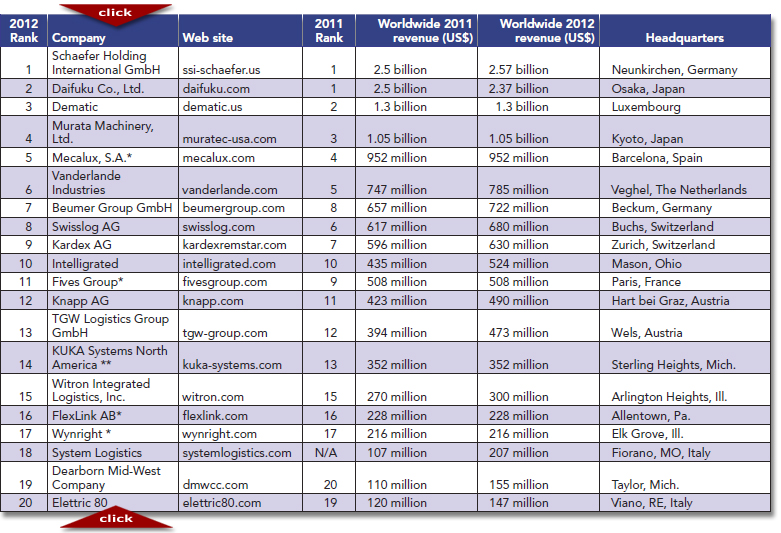

Top 20 Worldwide Materials Handling Systems Suppliers

Modern’s 16th annual survey of the world’s leading materials handling systems suppliers shows the top performers have held their ground, even as the rest of the list climbs steadily upward.

Once again, the results of an industry survey show growth is leveling off - yet remaining steady - following the release of post-downturn, pent-up demand.

The elastic band snapped back in grand fashion in 2011, when the combined revenues of the top 20 materials handling systems suppliers jumped nearly 26%.

For 2012, Modern’s 16th annual survey reflects more modest improvement, as the grand total of $14.66 billion grew just 4.1% over 2011’s $14.08 billion.

The top five held their own, accounting for 50% of the list’s total worth. Although revenues fell by a combined $60 million - less than a percent - such a small shift might simply be due to changes in currency valuations inherent in the global nature of the industry.

Those ranked sixth through 10th posted a combined $200 million in growth, with cumulative revenues up 5.6%. Overall, there wasn’t much movement at the top half of the list, with the top 10 up a combined $140 million, or 1.3%.

Top 20 worldwide materials handling systems suppliers

* 2011 revenues. 2012 revenues not available. ** 2011 revenue for North American sales.

But the real story is in the bottom 10 companies, who reported an additional $437 million, or 13.8%. The revenues of the bottom 10 still only account for 24.6% of the overall list, but that’s up two full percentage points over 2011.

The cutoff for inclusion on the list is up to $147 million from $110 million in 2011 and $100 million in 2010. Since none of the top 20 have acquired one another (as has happened in years past), the growth is almost entirely organic.

It is clear that companies on the list have not rested on their laurels, as many noted expansions into new product lines, services and geographies as contributing factors to their strong performance in 2012.

Life at the top

Schaefer is No. 1 on this year’s list with $2.57 billion in revenues, an almost 3% gain. Tied last year for No. 1, Daifuku fell to No. 2, reporting revenues of $2.37 billion after converting from yen to U.S. dollars.

Although Daifuku reported an increase in sales, the year-end currency conversion resulted in a 5% decrease over 2011 revenues.

In third place is Dematic, which finished 2011 in second place behind the first place tie between Schaefer and Daifuku. Dematic, Murata and Mecalux each held steady in 2012, matching last year’s $1.3 billion, $1.05 billion and $952 million respectively.

Following last year’s acquisition of Beewen, a German company specializing in AS/RS systems, Vanderlande took sixth place, adding 5% to come in with $785 million. Seventh-place Beumer added $65 million, or 10%.

Swisslog grew 10% to $680 million while Kardex finished 9th with 6% growth to $630 million. Intelligrated secured the 10th place slot at $524 million.

Standout performances

Intelligrated crossed the half billion mark with 20% growth, and acquired supply chain software provider Knighted, which specializes in Web-enabled logistics software. In mid-2012, Intelligrated was acquired by European private equity firm Permira, which will support the company’s global growth.

Intelligrated CEO Chris Cole says 2012 was a record year in profitability, marking an expanded footprint and new product offerings. “Our joint venture with SDI is now up and running in Brazil, and we’ve been very popular with U.S. multi-nationals expanding into Canada,” says Cole.“Activity outside the U.S. now represents 18% of our sales.”

TGW also grew 20%, and at $473 million, its 2012 revenues are up 55% over 2010. According to the company’s Web site, the growth is due to customers such as Adidas, Audi, Bentley and Gap. President Georg Kirchmayr says the long-term goal is to operate production sites on all continents.

“In the U.S., the level of automation in the materials handling business is much less than in Central Europe,” says Kirchmayr. “In warehouse logistics, automation has just started to establish itself.”

He also emphasized the possibilities for China and the growth market in Brazil, where Kirchmayr says TGW’s investment in CSI in Brazil makes them “perfectly prepared for expanding in the Latin American region.”

Knapp grew 16% to $490 million. According to marketing manager Jerry Johnson, Knapp’s sales growth can be attributed to positive economic strength in several key markets including pharmaceutical/healthcare, e-commerce/multichannel, fashion, retail and cosmetics.

“Additionally, expanded technology developments and services offered in Asian and Australian markets contributed to another record year for the company and set the stage for future sales increases,” says Johnson.

After just missing the list last year, System Logistics returned with 93% growth from $107 million to $207 million. Paul Roy, vice president of channel sales and marketing, says success in key market segments and growth in both Europe and South America were to thank for the strong showing.

Michael Paisley, controller for Dearborn Mid-West, commented on his company’s 41% spike to $155 million. “We hired more staff, found new customers, launched new product lines, and started larger projects across the board with our propriety material handling systems,” says Paisley.

Revenues from both the company’s automotive and bulk handling groups grew in 2012, with $105 million in auto, up from $90 million in 2011, and $50 million in bulk handling, up from $20 million in 2011.

At nearly $20 million more than its next competitor, Italy-based Elettric 80 secured the 20th spot on the list. Company revenues hit $147 million in 2012, 23% more than the previous year.

Ones to watch

After ranking 19th on the list in 2011 and 18th in 2012, viastore is one to watch. The fact that it missed the list this year despite growing 25% from $104 million to $130 million in two years is a testament to the competitiveness of the market.

The same can be said for SDI Industries, which would have taken 19th place just two years ago with its $115 million in revenues.

Savoye is a business unit of Legris Industries, which has been reported on this list for the past few years where it floated around between 8th and 14th place. This year, in an effort to keep the list focused on materials handling systems, Savoye was broken out of the overall revenue of Legris, which includes business units in other markets.

Savoye’s 2012 figures were not available by press time, but last year’s $128 million means they could make an appearance on next year’s list.

The outlook

As the industry continues to reinvent itself, the companies on this list will play an important role. And like the larger industry, some players will find success, some will lose some ground, and some will hold on tightly to what’s already theirs.

The list’s average growth rate lines up nicely with the overall industry growth estimates from Material Handling Industry (MHI). In last month’s annual Industry Outlook, George Prest, CEO of MHI, said growth is projected to improve into 2014.

Following industry growth rates of 14% in 2011 and 10% in 2012, 2013 could hover around 6% before breaking double digits again in 2014.

Making the list

To qualify for Modern’s Top 20 list, companies must be suppliers of materials handling systems, not just equipment providers. In addition to manufacturing at least two major handling system components, a company must also employ full-time staff that designs, installs and integrates materials handling systems.

These systems include at least two of the following: transportation devices, storage and staging equipment, picking units, sortation systems, information management systems, data capture technologies and other types of handling equipment.

To be considered worldwide suppliers, companies must have a presence in North America and must also be able to report materials handling revenues to Modern.

(Lockheed Martin, for example, is a systems supplier with a North American presence, but isn’t included in our Top 20 list because they can’t single out the revenue that comes from materials handling contracts.)