The Perfect Formula for Determining the Right Amount of Inventory

For years, supply chain executives have asked how can they reduce inventory without affecting customer service levels or shifting cost to other supply chain partners, and the answer could be a new inventory management strategy.

Having the right amount of inventory when and where it’s needed is a key element of corporate success.

After all, losing control of inventory eats away at corporate profit margins and costs a firm its customers.

As a result, today’s CEOs are well versed in inventory strategies such as Just-in-time (JIT), collaborative planning, forecasting and replenishment, and shared point of sale data.

Yet, the wrong application of the right strategy can be just as costly as no inventory control at all.

Reducing the wrong inventory, for instance, often leads to a reduction in customer service levels (CSL) with little impact on cost.

That affects customer satisfaction. Strategies such as JIT, on the other hand, often simply shift the cost of carrying inventory back to the vendor with little impact on the total end-to-end total supply chain cost. Eventually, those costs affect all of the players in the supply chain.

The result is that supply chain executives are often left scratching their heads and wondering: How can I manage inventory in a way that doesn’t impact my customers or leave real money on the table?

Our work answers these questions using a new inventory strategy that we call the science of theoretical minimums, or STM. STM provides a simple and elegant framework to reduce cost and increase customer service levels by monetizing time delays across the extended supply chain.

Unlike other strategies, managing to theoretical minimums reduces the total supply chain cost instead of simply pushing costs onto weaker suppliers. This means that STM reveals how much profit is being left on the table in the end-to-end supply chain. This monetization of delay cost provides supply chain executives with a clear picture on where to focus their efforts.

More importantly, we contend that STM is an idea whose time has come. In the last decade, the task of managing inventory flows in ways that drive out informational delay has been a sort of alchemy that has alluded the major supply chain technology companies.

Our work with a major technology provider demonstrates that the dead weight of slow moving inventory can be turned into gold. Moreover, we can share real world examples where supply chain executives from very diverse industries are leveraging Cloud-based systems, common interfaces, and smart software systems to monetize the informational delays in their supply chains.

Simple and Insightful

In “Competitive Strategy,” Michael Porter provided business executives with a simple and insightful way to look at their businesses. A firm, he wrote, competes in two ways: It either provides what other firms do for a lower cost or it provides additional features for the same price.

In hindsight, the concept of cost- and differentiation-based competition seems intuitive, but when it was first published, it was an “ah-ha” moment that had executives asking: “Why didn’t I think of that?” The elegance in STM - the “ah-ha” moment - comes from a similar, simplistic two element view of the way inventory affects a firm’s competitive position.

The concept is not new. In the hard sciences, theoretical minimums have been used as a bench mark for years. Information technology strategists, for instance, often discuss the theoretically achievable bandwidth of a particular configuration. That is used to understand bottle necks and the opportunities to invest to reduce those bottle necks.

Theoretical minimums have a similar value in the supply chain. Here, they provide an idea of what is possible by increasing visibility, attacking latent activities, and synchronizing supply chain processes. Attacking these latencies mitigates the negative costs associated with lead times and variability. STM accomplishes this by providing the basic logic for accounting for inventory and inventory costs in terms of physical and informational delay. This simplicity removes the ambiguity that often clouds inventory related decision-making.

The key to managing by theoretical minimums is to understand how to decompose lead-time into two buckets. The first bucket is based on physical constraints such as the batching of transportation, work in process, or safety stock to support demand variation - we call this physical lead time. The second bucket is based on informational delay - this bucket includes everything that is not a true physical delay. We call this informational lead-time.

We all recognize an informational delay when we see one - lack of a precise delivery window, a purchasing order process that is given four weeks but only involves four hours of true work, or a lack of insight into inventory positions at particular moment. And, yet, we often simply accept informational delay as an unavoidable cost of doing business.

As it turns out, there is actually a great deal we can do about informational delay once it is monetized. Consider how work has been done to reduce physical delays, such as pipeline projects, JIT, direct ship, mass customization, and delayed differentiation. The goal of managing to theoretical minimums is to focus not only on the added cost of unnecessary physical delays but also to monetize the cost of informational delays.

This monetization, and the associated mathematical logic, puts into profit-based terms just how much money supply chain executives are leaving on the table due to informational delays. And, as we will show with results from real world projects we have worked on, the potential to convert that to profit is much greater than one might first believe. But before we delve into those, let’s take a few minutes to understand the science behind the STM against the backdrop of modern supply chain management.

Supply Chain Management and the Alchemy of Inventory

For supply chain managers understanding the alchemy of turning inventory lead into supply chain gold is not nearly as interesting as the alchemy of achieving high inventory service levels at the least total cost.

When supply chain management and logistics began to move to the forefront some years ago, strategies for achieving high inventory fill rates at lower and lower cost were focused at the firm level. Retailers, for example, harnessed the math behind risk pooling by shifting inventory to their distribution centers while making smaller and more frequent deliveries to their stores.

Over time, efforts aimed at increasing inventory efficiency were applied to the extended supply chain with the goal of understanding the trade-offs, hidden costs, and sources of inefficiency that could be converted into a competitive advantage. These efforts resulted in an astounding number of strategic breakthroughs. Ideas such as just-in-time, consolidation of inbound and outbound transportation, vendor managed inventory, and the rise of third-party logistics providers are just a few examples.

Yet the ability to unlock the full profit potential associated with end-to-end supply chain optimization remains elusive. Managers, and scholars, have been stymied by that key supply chain problem: “How do we take that last bit of cost out of the system when we don’t even know where that cost is hidden?” What aggregate level strategy will give us the visibility needed to convert that cost into shareholder value?

STM gives insight, and thus control, into the end-to-end supply chain inventory investment and optimization. In its simplest form, STM provides a methodical approach, and accompanying governance structure, which allows managers to uncover fundamental latency and the resulting cost, which remains in even the most aggressively managed supply chains. The key to the STM strategy is the development of a method to define supply chain-specific minimum resource requirements (time, inventory, transportation) and correlate those requirements (using an advanced algorithm based tool) to monetize potential cost avoidance.

This monetization spurs strategic investment and attention. This approach provides managers with a mechanism to determine where potential wealth remains, a decision toolset to unlock that wealth, and a way to evaluate the return on investment associated with STM driven decisions.

More specifically, STM provides the following end-to-end supply network management capabilities:

- correlate lead times and inventory levels;

- distinguish between informational and physical lead times in their value networks;

- identify theoretical minimum lead times and calculate the return on investment available by moving network toward theoretical minimum lead times; and

- demonstrate how the use of real-time consumer demand to drive time-phased shipments and production through the supply network while quantifying and mitigating the effects of demand, supply and lead-time variability, can create increased profitability for all trading partners.

What is the Science of Theoretical Minimums?

Okay, if you have stuck with us thus far, you might be asking: Just what is the Science of Theoretical Minimums? STM is a methodology that can provide guidance to supply network trading partners to move lead times toward a minimum that approaches zero.

STM provides a simplified, yet accurate, conceptualization of time in the supply chain. This simplification provides managers with the ability to more clearly link actions to results. At the aggregate, physical lead times (PLTs) is a catchall term that we use to define all other delays besides informational lead-time. PLT is a surrogate metric to include such factors as procurement and transportation lead-times. Introducing the concept of informational lead times (ILTs) when decomposing lead times into its fundamental building blocks provides critical insight into the cost of latency that is typically encountered in the extended supply chain.

We define ILT as the time it takes for information to move between supply chain participants. We monetize ILT by using a novel analytical model that allows for the correlation between informational and physical lead times, along with the demand arising at each supply chain stage.

The “a-ha” in STM comes from the model’s ability to visualize for each trading partner the cost impact of reducing their respective lead times to a theoretical minimum of zero. While this is an abstract goal, we show that STM helps align the actions of supply chain members to identify mechanisms that bring the network closer to theoretical minimums. Further we back up this abstract strategy by sharing very real results.

Quantifying ILT is accomplished by monetizing (cost, inventory, capacity) the delay that is induced while waiting on information and decisions that precede the movement between supply network participants. Involved in this quantification are the direct cost of delay and some element of indirect cost associated with delay driven degradation of information relevance and accuracy.

STM provides an ability to calculate how ILT variability drives increased inventory without increased CSL. This latency is defined as non-value added time waiting for the information that is required to perform collaborative supply network planning and execution.

Managing STM Involves Three Key Steps:

- define a supply chain with zero informational lead time;

- define the physical lead time and its corresponding variability; and

- define the cost difference between ILT and PLT.

Armed with the information created by these steps, managers can make informed decisions on the cost and benefit associated with removing delays.

To understand how well STM works, let’s first take a look at an example from a Major Spare Parts Manufacturer. This industry faces a number of initiatives that have bloated inventories as firms have attempted to dominate in this often overlooked, yet profitable, sector.

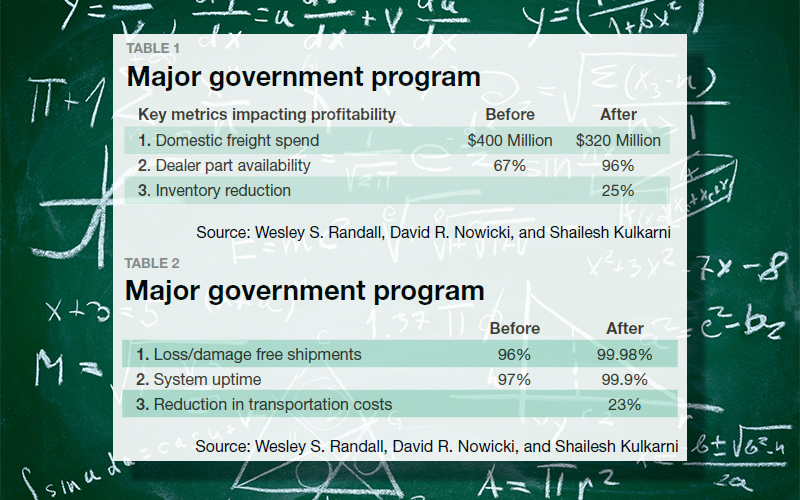

Table 1 shows how this firm managed to leverage STM to grow profitability and shareholder value.

By managing to theoretical minimums, firms can move away from an assumption of “fixed” or “uncontrollable” lead times. Further, STM highlights the very real cost of lead time variability by establishing real and achievable baselines, increasing visibility, attacking latent activities, and synchronizing supply chain processes. Attacking these latencies mitigates the negative, and often exponential, costs associated with lead time, supply, and demand variability.

Some retailers and manufacturers have already embraced STM type strategies with excellent results. For example Walmart’s new Supplier Portal Allowing Retail Coverage (SPARC) relies on real-time supply chain information to “stay in stock” with the lowest total inventory levels. The result has been improved gross margin return on inventory investment (GMROII).

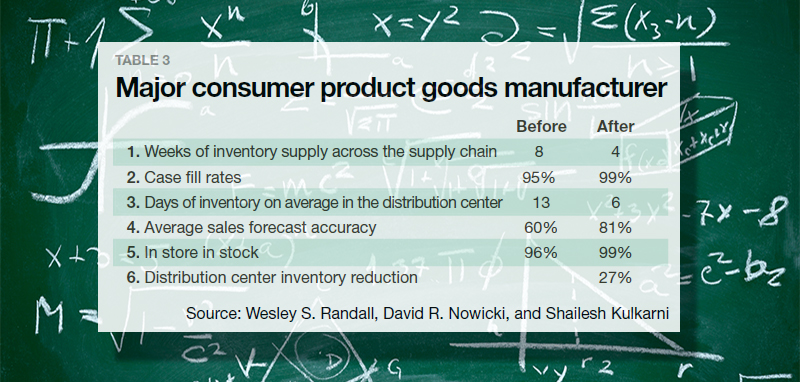

Del Monte Foods, meanwhile, decided to see what an STM strategy could do for them. The results were an eye opening 27% reduction in inventory level, an increase of in-store service levels to 99%, and a 20% increase in forecast accuracy. In Table 2, we show how a supply chain technology firm, working alongside a government customer, drove dramatic results for taxpayers and end users.

As a part of STM, we also study the interrelationships between customer service levels (CSLs), inventory costs, and inventory. Effective management of ILT results in improved profit margins for the supply chain with no negative impact on CSLs. This insight creates guidance for the governance mechanism (strategy) that identifies how decisions can reduce unnecessary lead times by identifying the costs of latency and the potential profit associated reducing these delays.

This highlights the second key aspect of management based on STM: The clear monetization of the cost of uncertainty. Uncertainty generally manifests itself as demand variability and lead-time variability, both of which result in increased inventory expenditures. As demand and lead-time variability increase there is a need to increase the amount of safety stock in order to achieve the desired CSLs. The safety stock acts as a necessary, but expensive, buffer to multiple sources of nervousness associated with uncertainty in a supply network.

Taken together, STM monetizes the cost associated with variability in demand, lead-time, transportation, order processing, and purchasing.

A Strong Foundation for STM

Ideas at the core of STM can be seen in Toyota’s efforts to reduce its lead-time problems with suppliers in the 1980s. By reducing the number of processing points and batch sizes, Toyota reduced its lead times from 15 days to one day, essentially moving toward a theoretical minimum. When the number of processing points increases, processing times increase, as does the variability of lead times, while the information delays that result from batch processing result in increased lead times.

Walmart has built a rich competitive strategy by removing the batch processing of information that causes delayed ordering decisions. It does so by assuring that orders are communicated to upstream suppliers as soon as retailers receive orders from customers. The result increases the probability of on-time deliveries.

Hewlett Packard reduced lead times and improved on time deliveries by decreasing trading partner communication delays. By doing so, HP more than doubled its on-time delivery rate and reduced its inventory expenses by $9 million. HP accomplished this by identifying informational lead time delays and implementing a three stage process that included the communication to suppliers of suppliers’ delivery dates, supplier’s production time, and product delivery times.

Various academics efforts have provided insight into inventory problems that demonstrate the ideas at the core of STM. For example, researchers have shown that linking lead times between various production systems can lead to reduced variability in the total lead time of the system. Others have shown how a reduction in lead times in certain conditions reduces reorder levels.

At Stanford, renowned supply chain scholar Hau Lee and his colleagues identified four major causes that influence bull whip effects: demand signal processing, rationing game, order batching, and price variations. All of these elements are addressed within STM.

The science of theoretical minimums is distinct from these earlier efforts in a number of ways. First, STM assumes that informational and physical lead times are correlated. This assumption is true in most practical instances.

For example, when information is not communicated quickly across supply networks, production and shipment functions are delayed which results in longer lead times and loss of sales. This may also lead to unneeded inventories when there is no demand for products. Second, it assumes that demand and overall lead times are correlated. The wealth of supply chain research, coupled with the ideas embedded in STM, allows us to derive formulae for reorder levels, safety stocks, and total costs when informational lead times are greater than zero, and total costs when informational lead time is zero.

Thus, the theoretical goal of supply chain management is quantified as the theoretical minimum, which is defined as that point where informational lead time is zero. STM provides a theoretically grounded foundation for this goal, and does so in a way that is actionable for supply executives.

How to Make STM Work: A Tool For Achieving Theoretical Minimums

The idea of theoretical minimums is only as good as the practical tools available to managers to affect decision-making based upon those ideas. We have operationalized STM by developing an analytical tool, called Theoretical Minimum Modeling (TMM), to demonstrate how end-to-end supply network performance is influenced by key supply chain levers.

TMM is structured to capture the dynamic interactions among these key supply chain levers. These levers include demand, demand variability, informational lead times, informational lead time variability, physical lead times, and physical lead time variability.

The tool also captures dependencies among demand, informational lead times, and physical lead times. It allows users to study the impact of decomposing total supply network times into information and physical lead times. Upon changing lead times and associated variability for a given consumer demand, users can see the impacts on cycle stocks, total stocks and associated inventory carrying costs.

To understand this example, think about the typical supply chain models, policies, and processes that define decisions. It is not unusual for a supplier to have a standard purchase order response time of four weeks. This kind of “policy” is often taken for granted. STM highlights the amount of time such a purchase order really takes to process and then assigns all of the other time to ILT. ILT is then monetized to show the true cost of delay, and as we will show in our next example, that delay can be significant.

Thus STM redefines models, policies, and process by quantifying the potential profit left on the table (PLT minus ILT). This calculation also accounts for the impact on variability informational lead-times, leading to shorter physical lead-times. The net-net of STM based management is that supply chain inventory levels are reduced, customer service is increased, and shareholder value is improved. Considerable opportunity exists to improve profitability by leveraging STM to harvest unrealized profit.

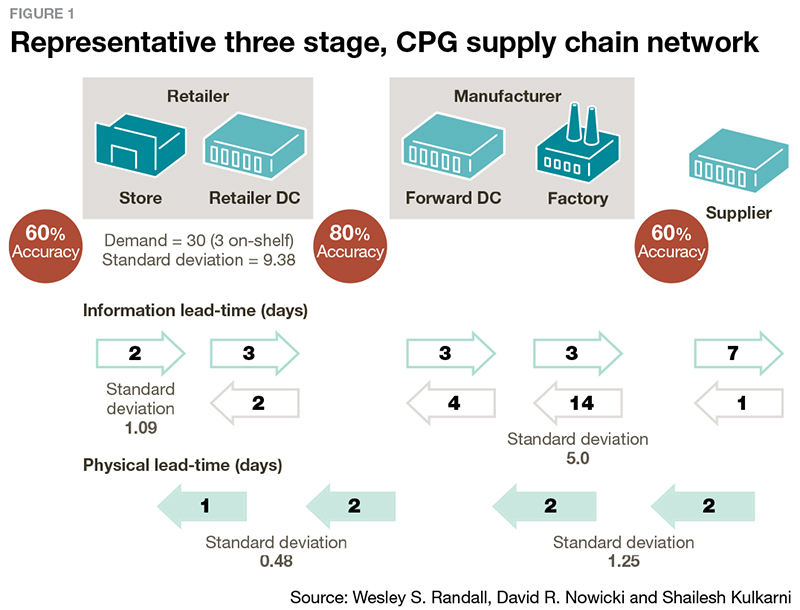

To illustrate this, Figure 1 shows a realistic but hypothetical Consumer Package Goods (CPG) supply chain network with typical informational and physical lead times. The average daily demand at the retailer is 30 units. The retailer experiences 60% forecast accuracy.

This accuracy translates to a standard deviation of daily demand equal to 9.38 units. That means that the total lead-time in this CPG supply chain is 46 from order execution at the retail store to order fulfillment through the retailer distribution centers (DC), manufacturer forward DC, the factory, and the suppliers providing raw materials to the factory for its manufacturing operations.

A savvy supply chain executive, given the right tools, can recognize that in reality there is only 7 days of physical lead time. The remaining 39 days of latency arise from informational delays that pose a very real cost.

We can then decompose that 39 days of informational lead time to show that there are 7 days of delay residing with the retailer, and that delay has a standard deviation of 1.09 days. Remember that variance, in this case standard deviation, translates to very real cost. We also see 32 days of informational delay with the manufacturer with a standard deviation of 5 days.

The average retailer’s physical lead time is 3 days with a standard deviation of 0.48 days and the average manufacturer’s lead time is 4 days with a standard deviation of 1.25 days.

In the Figures 2 and 3 we will show how the Theoretical Minimum Model (TMM) captures the three-stage CPG supply chain network described in Figure 1.

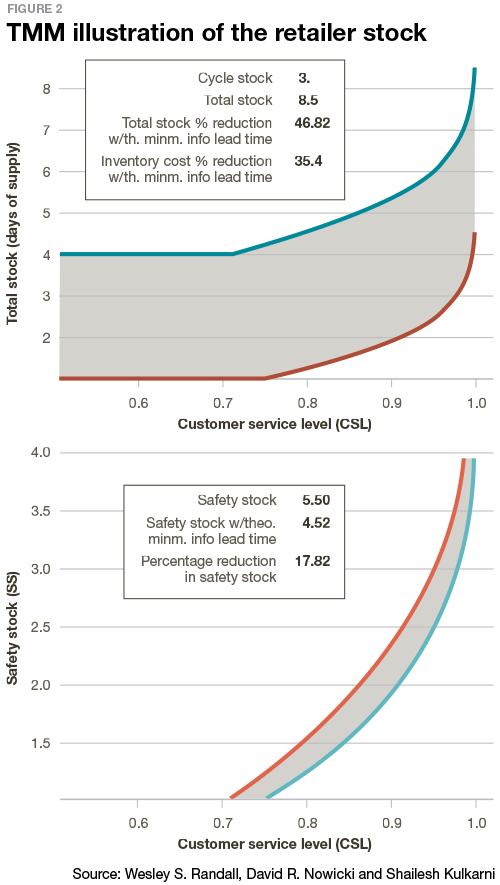

In Figure 2, we see the retailer’s stock to include cycle stock and safety stock.

The top graph shows the potential cycle stock that could be removed from the retailer if managed to theoretical minimums.

The bottom graph shows the percentage reduction in cycle stock if managed to theoretical minimums.

At the same time we show how these calculations impact customer service levels.

These numbers can easily be converted into dollars within the TMM.

Thus a supply chain executive could use this to calculate how much inventory investment would be freed up if we reduced informational delay by 30% - the monetization of informational delay.

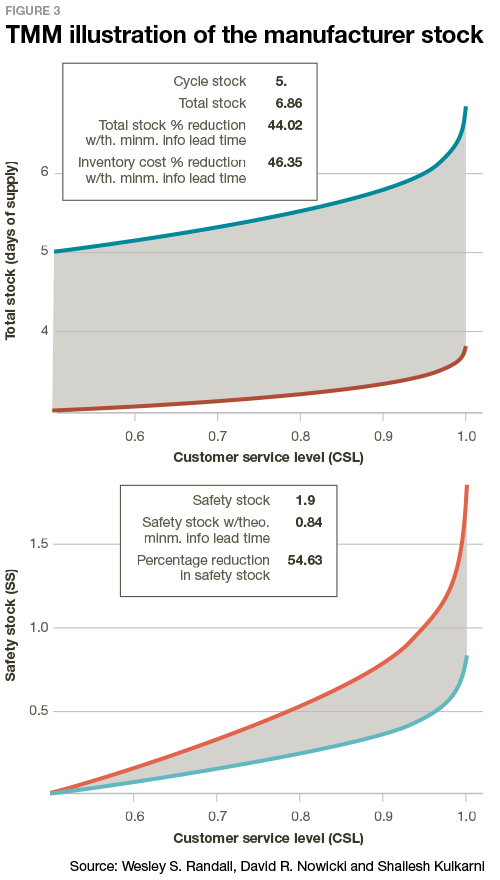

In Figure 3, we see the manufacturer’s stock. And here we can draw the same conclusions as we did with the retailer.

The graphs display the results based upon firm specific context with regard to the key variables.

These graphs dynamically update as one or more of the sliding bars are adjusted to reflect new values. As a consequence, insights through what-if and sensitivity analyses are rapidly obtained.

The grey shaded area represents the opportunity available to the supply network if it focuses on achieving Theoretical Minimums. The two green graphs on the left pertain to the retailer and the two pink graphs on the right relate to the manufacturer.

Figures 2 and 3 show the relationships between total stocks, measured in days of supply, and customer service levels.

In this example, achieving a theoretical minimum (informational lead time is non-existent) results in a total stock reduction of 85% for both the retailer and the manufacturer.

The underlying algorithms derive the specific cost savings associated with a reduction in lead time and the corresponding reduction in cycle stock and its associated inventory carrying cost.

Financially this translates into a 53% and 83% reduction in inventory costs for the retailer and manufacturer respectively. The TMM also monetizes how the positive consequence of achieving the theoretical minimum lead time has on variability reduction. This is reflected in the two safety stock vs. CSL graphs shown on the bottom of Figure 3.

In the example, we show that if it is possible for the manufacturer to reduce its information lead time by a week from 32 to 25 days, and the standard deviation of information drops from 5 days to 4 days, the cycle stock at the manufacturer drops from 36 days to 29 days, and safety stock for the manufacturer drops from 15.06 days to 12.4 days.

While we are the first to conduct an academic study aimed at defining STM in terms of the monetization of informational and physical lead times, we are certainly not the first to benefit.

In Table 3 we show the results of how a major consumer products goods manufacturer used STM to understand where the profit was left on the table.

A Leap Forward

By now, we hope we have demonstrated how supply chain technology thought leaders working alongside academics and innovative customers have managed to harness the science of theoretical minimums to shatter the glass ceiling of inventory reduction. The results are real - leading firms are turning inventory lead into supply chain gold, with very little profit left on the table.

Our results convince us that STM is a leap forward in the way extended supply chain partners visualize the cost of information delay and represents a new and efficient frontier for extended supply chain inventory management. Our initial research using STM also indicates there are still significant savings to be gained.

These strategies are already providing a competitive edge to firms like Walmart and Del Monte. The fact is that if you do not understand the concepts involved in STM, one of your competitors will. Then it will be their actions that define your competitive position, not a comfortable conversation to have with your shareholders.

Note: Readers interested in the underlying mathematical model used to compute cycle stocks, safety stocks and their associated inventory carrying costs can e-mail [email protected] for the authors’ working paper on this topic.

About the Authors

Wesley S. Randall, Ph.D. is an associate professor of logistics in the College of Business at the University of North Texas. He can be reached at [email protected].

David R. Nowicki, Ph.D. is an associate professor of logistics in the College of Business at the University of North Texas. He can be reached at [email protected].

Shailesh Kulkarni, Ph.D. is an associate professor in the College of Business at the University of North Texas. He can be reached by at [email protected]. For more information, visit unt.edu.

Related: Demystifying Inventory Optimization

Article Topics

One Network Enterprises News & Resources

Blue Yonder announces an agreement to acquire One Network Enterprises for $839 million Blue Yonder Acquires One Network Enterprises for $839M Companies Need to Develop New Innovative Approaches to Supply Chain Design How to Improve Cost of Goods Sold Horizontally Across the Supply Chain How the Global Pandemic Accelerated Supply Chain Visibility, Digitalization, and Automation AI and Data, the Future of Supply Chain Management AI and Supply Chain Problem Solving More One Network EnterprisesLatest in Supply Chain

How Supply Chains Are Solving Severe Workplace Shortages SAP Unveils New AI-Driven Supply Chain Innovations How Much Extra Will Consumers Pay for Sustainable Packaging? FedEx Announces Plans to Shut Down Four Facilities U.S. Manufacturing is Growing but Employment Not Keeping Pace The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency More Supply Chain