The Importance of a Thorough, Well-Managed Supply Chain Risk Strategy

Supply chain risk management is necessary, but it requires efficiency too.

Events in recent years have made supply chain management professionals think differently about risks to supply chain stability and resiliency.

Natural disasters, extreme weather, and human-driven factors such as political instability all have the potential to significantly affect the operations of organizations and their suppliers.

In April 2013, APQC conducted a survey of supply chain and finance professionals to gain insight into how they view and address three specific causes of supply chain disruption:

- high-impact natural disasters (such as tsunamis and earthquakes);

- extreme weather events; and

- political turmoil in vitally important world regions.

Survey respondents represented 196 organizations from more than 22 industries. Eighty-three percent of survey respondents had experienced at least one unexpected supply chain disruption in the last 24 months.

Of those who had experienced a disruption, 78 percent indicated that the disruption had been significant enough to have drawn the sustained attention or intervention of the top executives at their organizations.

With the potential for disruption comes the need for organizations to examine their supply chains for weak points and make appropriate changes. APQC looked at steps organizations are taking to help mitigate risk. APQC found that many organizations conduct infrequent assessments of disruption risk for their supply chains, and that there are also many organizations that conduct infrequent or no risk assessments of suppliers that are strategic to the business.

APQC also aimed to determine how the frequency of risk mitigation activities could affect the overall cost of assessing supply chain disruption risk. The survey results indicate that for organizations that conduct formal risk assessments of strategic or preferred suppliers, there is room for improvement on the amount that they spend to assess supply chain risk.

Assessment of Resiliency and Suppliers

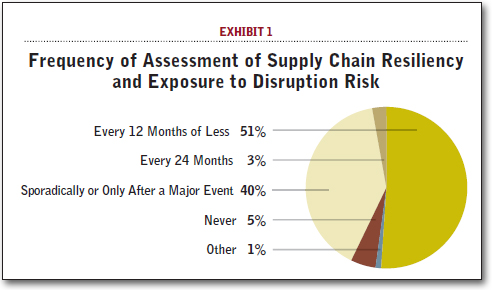

An initial step to addressing and mitigating supply chain risk is to conduct regular assessments of the supply chain’s resiliency and exposure to potential disruption risk. On its survey, APQC asked respondents to indicate how often their organizations conduct such assessments.

About half of the respondents indicated that their organizations conduct these assessments every 12 months or less, but the second largest group of respondents indicated that their organizations conduct these assessments sporadically or only after a major disruption incident (see Exhibit 1).

These results indicate that while many organizations regularly (and often frequently) review their supply chains’ ability to withstand a potential disruption as well as factors that could lead to a disruption, there is almost an equal amount of organizations that do not conduct these types of analyses regularly or wait until a disruption occurs before they even consider how risk can affect their supply chains. Interestingly, the organizations for 5 percent of the respondents to APQC’s survey never conduct assessments of their supply chains at all.

APQC also looked at the frequency with which organizations conduct formal risk assessments of individual suppliers. Survey respondents were asked to indicate the frequency for three types of suppliers:

- strategic or critical suppliers;

- preferred or important suppliers; and

- all other suppliers.

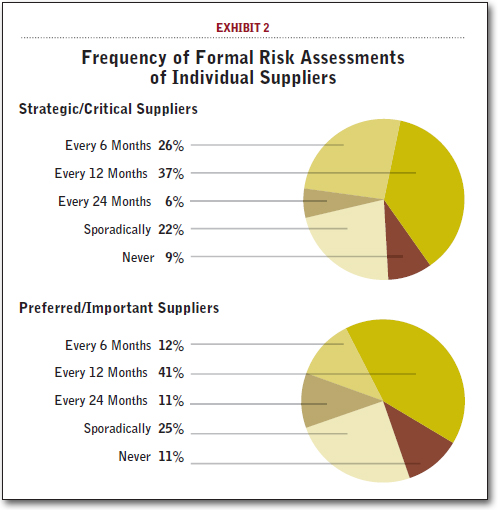

Exhibit 2 presents the frequency of assessments for strategic and preferred suppliers. Not surprisingly, the largest group of respondents indicated that they assess their strategic suppliers every 12 months or less.

However, the organizations for 9 percent of the respondents never conduct formal risk assessments of their strategic suppliers. With much potential supply chain risk associated with key suppliers and their suppliers, these organizations leave themselves open to a major supply chain disruption that could be avoided through an advance assessment of risk.

The survey responses were more varied with regard to preferred suppliers, with the largest group of respondents indicating that their organizations conduct assessments once a year. The second largest group of respondents conducts sporadic formal assessments of this group of suppliers.

Eleven percent of the organizations never conduct formal assessments of preferred or important suppliers, which again leaves open the possibility of a supply chain disruption that could be avoided or reduced through risk detection and mitigation.

APQC aimed to determine whether the frequency of formal risk evaluation for strategic or preferred suppliers could have a significant effect on the overall cost of assessing supply chain disruption risk. Respondents to APQC’s survey were asked to provide a range for their total cost to conduct these assessments.

In APQC’s survey, this cost was defined as including any labor, IT, outsourced services, and travel costs associated with determining supplier risk or risks to the supply chain overall. Exhibit 3 provides the frequency with which organizations conduct formal assessments of strategic and preferred suppliers, as well as these organizations’ total cost to assess supply chain risk.

The results are somewhat surprising. Among organizations that regularly evaluate strategic or preferred suppliers, there are similar costs to assessing supply chain disruption risk regardless of the supplier type and frequency of evaluation. The largest group of organizations conducting assessments every six, 12, and 24 months spend $50,000 to $250,000 annually to assess supply chain risk.

This is especially interesting given that organizations conducting more frequent supplier risk assessments (every six or 12 months) also indicated on APQC’s survey that they conduct more in-depth assessments that review suppliers’ compliance with local labor laws, safety procedures, financial health, and process quality. For both groups of suppliers, most organizations conducting assessments sporadically spent less to assess supply chain risk: $1 to $50,000 annually.

Several factors could contribute to the similar costs among organizations conducting regular assessments of these two groups of suppliers. Those conducting assessments most frequently (every six months) may spend the same amount to assess supply chain risk as organizations conducting supplier assessments every two years because they have less sophisticated technologies associated with their formal assessments.

These organizations may also have suppliers located closer to their operations, which could result in lower travel expenses. Finally, it may be that because these organizations conduct their assessments more frequently, they have found ways to streamline their processes so that assessments cost less. Regardless of the reason, the survey results indicate that there is room for organizations conducting less frequent supplier assessments to improve so that they can reduce the cost spent on supply chain risk evaluation.

Balance the Need for Assessment with Efficiency

APQC’s recent survey on supply chain disruption risk indicates that the leaders of many organizations are concerned about how supply chain disruptions can impact their businesses, but that there is room for organizations to improve their strategies and processes for mitigating risk. Nearly half of the organizations participating in APQC’s survey conduct risk evaluations for their supply chains on an infrequent basis, if at all.

Although many of the responding organizations have processes in place to conduct formal risk assessments of suppliers that are strategic to the business, over 30 percent conduct assessments sporadically (or never). Among organizations that conduct regular, formal assessments of strategic and preferred suppliers, there is room to improve the amount that they spend on assessing individual supplier risk.

Creating and maintaining an effective supply chain disruption risk detection and mitigation strategy requires an investment. However, there are steps that organizations can take to ensure that the amount of time and expense invested in risk assessments can provide the largest return. APQC recommends that organizations secure appropriate resources for risk identification and mitigation efforts. If needed, organizations should seek outside assistance to complete tasks that cannot be taken on by internal staff.

APQC also stresses the importance of identifying all of the potential risks and assessing the impact of the risks on business continuity. This involves not only a close examination of the organization’s weak points, but also sources of potential disruption for key suppliers and, if possible, the suppliers’ suppliers.

Gaining insight into multiple tiers of the supply chain involves establishing close relationships with key suppliers that are built on the promise of mutual benefit. If a supplier knows that by collaborating with a customer it is ensuring continued or increased business as well as gaining an opportunity to improve its own risk strategy, it may be more willing to share in the risk planning process.

APQC also stresses the importance of having a recovery plan in place for when a disruption does occur. This allows the organization to take immediate action, and can lead the organization to quickly find alternative sources of materials or make other changes within its supply chain if necessary.

Once an organization has risk identification and mitigation processes in place, it can take steps to improve efficiency. However, this will not completely eliminate the costs associated with these processes. Managing the risk of supply chain disruption does take an investment of resources and funds.

Organizations should consider how the costs of managing risk balance out with potential lost revenue and damage to reputation that can result from a disruption to operations caused by a natural disaster or political instability in key supplier regions. To be a global business, supply chain risk management is a necessity. The key is to determine how to do it efficiently and effectively.

About APQC: A member-based nonprofit founded in 1977, APQC is the leading resource for performance analytics, best practices, process improvement, and knowledge management. For more information, visit www.apqc.org or call 713-681-4020.