The Impact of Omni-Channel on The Supply Chain

A question and answer discussion with SCM World’s Kevin O’Marah about how digital demand and Omni-Channel shopping are radically changing supply chain practices for both retailers and manufacturers along with insights from their recent research paper.

Question (JDA Software, Supply Chain Nation): Why are digital demand and omni-channel such game-changers for supply chain management?

Answer (Kevin O’Marah, SCM World): They are big game-changers for supply chain primarily because of the complexity they drive. Digital demand drives omni-channel in the first place, and omni-channel, as a product of digital demand, creates expectations in the consumer that practically anything you can imagine is deliverable. The result, based on the field research we have done, is that effectively all industries, not just retail, are increasing their SKU portfolios, increasing the variety of service offerings they bring to market in terms of same-day, next-day, bulk, inexpensive, expedite, premium, every single configuration you can imagine.

The implications, in terms of consumer-level complexity, cause the supply chain to have to rethink how it is organized—what does a distribution network look like, what does a distribution center look like, where does the inventory live? How that all flows back up into supply chain design is affecting everything, because it’s not just about faster, which is what supply chain has been concerned about for a long time, it’s about faster and more varied. And that is a big challenge for supply chain.

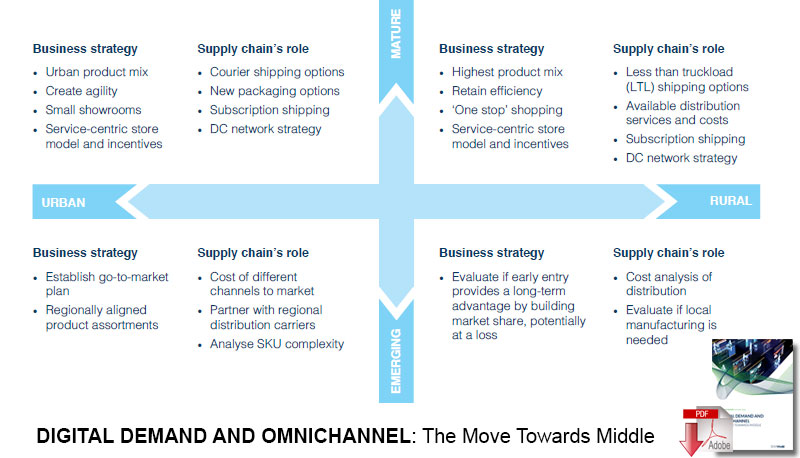

Global Market Segmentation

Source: SCM World

Some of the research we have done on this says things about complexity, which you will see in the reports, but we then go further and ask what are the implications for distribution centers and the equipment inside those centers, and the location of those centers. It’s not just faster and more complex, it is also physically different—more automation, more capital equipment, mostly larger DCs. A large DC a few years ago might have been 500,000 sq. ft. and it is now 1 million or 2 million sq. ft., and they hold potentially an order of magnitude more items or SKUs—ten times as many would not blow my mind.

And there are a whole slew of different fulfillment methods. So there are more types of material handling equipment, more types of value-added capabilities such as packaging, kitting, final assembly, software burn, disassembly, take-back, teardown, all of these things are increasingly built into the distribution centers that handle omni-channel.

Answer: Because the consumer no longer really wants a single flavor answer. Those who are primarily service-oriented are finding they are being obliged to compete on cost as well. So let’s say it’s a fashion retailer or a high-end merchant retailer—REI comes to mind—that’s a high service retail environment. They can’t afford to be ignorant of cost. The other end of the spectrum is true also. If you are a Walmart and you build your business on everyday low prices, you can no longer afford to say sorry, we’re cheap and therefore you take it the way you get it.

No, they are investing millions in e-commerce innovation because they want to enable themselves to be able to handle a wide variety of service expectations of consumers. The move to the middle is essentially a move to say I want to serve a cluster of customers whose needs may vary from a cost orientation on one product or on one day to a service orientation on another product or on another day, and not necessarily bucket myself into one or the other end of the spectrum. So the move to the middle is an exercise in accommodating the diversity of expectations of consumers and trying to keep that shopper happy as they see more and more offers available from the proliferation of channels that are out there.

Answer: It’s very hard to do because, first of all, if you’ve set yourself up to be the low-cost retailer, then you’re going to have to start accommodating additional value-added services. Here’s another example—grocery retail. Grocery retail keeps adding new types of omni-channel service capabilities. For example, Stop & Shop, which is an Ahold brand in New England, they have buy online/pick-up in store. It’s not that break-through. But the version they have is slightly different from the version they used to have, which was buy online/pick-up from store with product pulled off the shelf and packed in the store to be picked up at the normal pick-up location.

Now they have dedicated totes picked at a distribution center that serves multiple stores in the region, delivered to the store of choice and held in a separate area away from the front of the store, with dedicated staff on-site, a dedicated pick-up area and dedicated time-slots for consumers to pick up. If they come at the right time slot, great, they get a little dedicated service. If they don’t come to pick up, that product goes back to the DC or is scrapped if it is perishable.

So here they are trying to add a service layer into what we all know is a terrible margin business because they are being forced to do something different than just take another penny off of the cost of a bag of potatoes. So to your point, it is not easy at all to do this and yet you’re going to have to or lose that customer.

Answer: I think there are a couple of really key things. The first thing, and if you can only do one, I would do this, is equip yourself to do good cost-to-serve analysis. The idea of differentiated services is someone is going to want really high-end premium services, someone is going to want regular services and someone is going to want bargain-basement. Fine, you should price accordingly. But you can’t just throw premium price on and expect to make money. If the premium price is 10 percent but the premium cost to deliver is 20 percent, you lose money on every order. You have to know what it will cost to provide all of these fancy differentiated services you’re going to offer or else you run the risk of losing money on any one that is not clearly understood. So cost to serve is number one.

Number two, and it’s related, is market segmentation. You have to be able to think about the different segments you’re going to serve—what value-prop you’re going to offer them, the cost-to-serve attached to what you are going to create, and try not to get yourself into too many zillions of service differentiation packages. If the customer is left to dream up their own service package, you could end up with an infinite number and that’s effectively impossible. So you need to pick a number, say three, five or seven segments, and pursue those segments proactively. Some of them may be niche—one of the things we say is “go niche.” If you have good cost-to-serve and you’ve built a good segmented strategy, and the supply chain is segmented to serve that, you can get pretty specific. You may find there are niches of pure profitability that you can go after that are accessible to your business by some combination of your brand, your geographic location, your existing physical capabilities, or whatever, that creates a niche that may be serviceable by your company that others can’t. So there is pure profit opportunity in these niches.

Finally, we say “partner with allies,” meaning, for the most-part, all of this complexity and differentiation will entail capabilities that you have to build. The likelihood that you are going to have every possible configuration of cold-chain management or pack and repack or price or take-back or tear-down and all of these types of things is pretty slim. Chances are good that you are going to have to find somebody that excels at local loop milk-run delivery or at kitting capabilities or at final late-stage configuration—things that are perhaps beyond you but are going to be nice adjuncts to what your customers like. Find someone who is good at that, take them on as a partner, and build a route to market that has good alliance partners. Not just purchasing from them, but building an alliance and trying to get in close with them. That is going to allow you to go after all of these little oddball things without having to build everything yourself from scratch.

Answer: Yes, and you can’t do any of it without cost-to-serve. If you go and partner with a lot of allies and you don’t have good cost-to-serve, you’re going to find yourself signing a lot of contracts that are basically not good business. You go in there and create a niche and say we’re winning in the niche only to discover it is killing your margins. You have to have cost-to-serve first. After that, everything else becomes creative strategy.

For example, if you’re set up to replenish on a full truckload, pallet level of delivery going for the lowest possible transport cost or logistics cost per case, you are good at one thing, which is moving gigantic trucks full of stuff. As soon as anything gets fancy, your systems are no good, your cost-accounting is no good, your visibility is no good, your equipment is no good, your loading docks may be inappropriate—everything is faulty. So it’s not easy, but I think it is the number one move.

Answer: I think it has to do with brand loyalty. What I believe is happening with omni-channel is that consumer products companies and retail brands in the mind of the consumer both represent a brand, something like baby products, hardware, milk—it doesn’t really matter. If we as consumers attach trust and willingness to spend with a brand that is strictly a retail brand, and they go private label and they get good at all of this stuff, they are going to push the consumer brands out of the consumer’s mind. So consumer goods companies are putting themselves in a spot where the deeper the retail relationship with the consumer, the more holistic, in-store, at home on an e-commerce platform, on your phone or mobile device, and maybe it’s multi-point so they may have pick-up depots and drop-off depots and service facilities, the retailer could marginalize the consumer brands if they own that trust completely.

For a consumer goods company, they have to think about how their brand remains foremost in the consumer’s mind and doesn’t necessarily come through a retail gateway. If they want to buy it through Amazon, they can buy it through Amazon, it’s still Procter & Gamble. If they want to buy it through drugstore.com, which is just a subsidiary, fine, it’s still Procter & Gamble. If they want to buy it directly from theareofshaving.com, fine, they have a relationship with P&G that goes beyond shopping and goes into consumption. I think the loyalty of the consumer to the brand is up for grabs in an omni-channel environment. And if consumer goods companies don’t go direct, what they’ll find is that their relationship with the consumer is being overshadowed by the relationship the retail brand has with the consumer. All of this omni-channel delivery, all this service we have been talking about, creates so many ways for the consumer to get the product that the expectation of reliable, trustworthy delivery from a brand is going to be available from a retailer or a manufacturer, whoever can ultimately deliver. So it’s an opportunity to take that trust and build a sustainable relationship with that consumer, or lose that trust and have it high-jacked by the retailer. So I think they have to deal with going direct.

Answer: Yes, it’s happening everywhere and it is the number one point of anxiety. The consumer goods companies do not like to talk about their direct relationships because of the channel conflicts to their key customer. But then again, the retail customer who has to respond to the increasingly demanding consumer is going to go ahead and sign up for products from anyone. Retailers, more than any other sector, say they are going to increase their SKU offerings. They may be a heavy buyer of Unilever product, but if they want to offer diversity to the customer, they are going to look for another supplier and you will find yourself being pushed off the shelf. Someone is going to be pushed off the shelf and if you don’t take the initiative, you’re the one at risk. Everybody feels channel conflict, but you can’t really do anything about it. You just have to get in there and scrap it out. Ultimately, I think we will see the really big brands having a direct relationship with their customers.

About Kevin O’Marah

SCM World Chief Content Officer

As Chief Content Officer, Kevin and his organisation are responsible for the on-going delivery of SCM World’s cutting-edge, practitioner driven supply chain content and information. Leveraging the combined experience and learning of over 19,000 practitioners within SCM World’s membership, Kevin and his team deliver an innovative and interactive learning curriculum that meets the needs of today’s supply chain professionals across industry, through a unique peer driven approach.

More Supply Chain 24/7 content on “Omni-Channel”