The Future of Supply Chain Management

Predicting the future of supply chain management is a fool’s game, but new findings from CAPS Research gives a glimpse into how supply managers are preparing for tomorrow.

When it comes to predicting the future, we’ve all heard the sayings that no one has a crystal ball and that the only certainties are death and taxes.

In supply chain management, we like to say that the only thing certain about a forecast is that it is always wrong.

While researchers like those of us at CAPS Research may not be able to predict the future, we do know that it does not exist in isolation: It depends on the past and the present.

This means that if we could compile the collective projections of managers who are well informed about the past and present, we might be able to gain a glimpse into what is to come. Or, at the least, what the collective wisdom expects to occur.

That was the catalyst behind a project CAPS Research initiated in 2015 (Futures Study 2020: Overview PDF). We asked more than 400 supply management professionals with titles such as vice president of supply management and senior procurement manager to look ahead five years into the future to 2020 and tell us what they think might happen.

We distributed a lengthy questionnaire that typically took about 30 minutes to complete and we received back 113 responses. There were no incentives other than the opportunity to advance the body of knowledge in the profession.

In order to consider both the past and the present, the 2015 survey built upon the last “futures” survey CAPS Research administered in 2007. While some items were updated to reflect today’s business environment, most of the items remained the same.

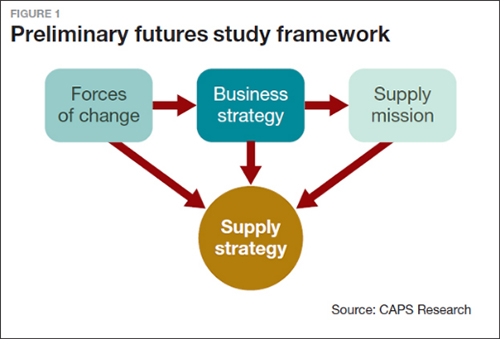

The preliminary framework (See Figure 1) recognizes that external forces of change drive corporate-level business strategies while supply missions are shaped by business strategies. Specific supply strategies are influenced by forces of change, business strategies and supply missions.

Based on this framework, the survey explored the following four areas: (1) external forces of change, (2) business strategy, (3) supply mission and (4) supply strategy.

In the following sections, we present the top items from each section; we also compare the 2007 and 2015 results to gain insight into what is changing for the supply management profession. Items are ranked by their average level of importance assigned by the respondents.

Forces of Change

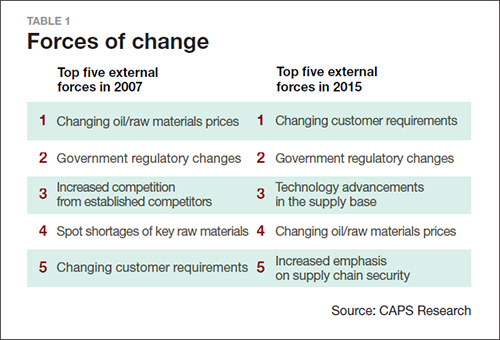

The top external force of change in 2015 is “changing customer requirements.” As shown in Table 1, this particular force of change is more important today than it was in 2007.

It could be that supply professionals perceive that this external driver is moving them, comparatively speaking, away from an upstream focus on their supply base and more toward downstream concerns in the customer base.

Corroborating this observation is (1) that a key upstream concern from 2007 - i.e., “spot shortages of key raw materials” - is no longer listed in the top five forces in 2015 and (2) that “changing oil and raw materials prices” dropped from first position in 2007 to fourth in 2015.

In other words, supply managers are telling us that in coming years they will have to contend more with what’s happening with their downstream customers.

Interestingly, “government regulatory changes” still remains the second most important force of change. We suspect the Sarbanes-Oxley and Dodd-Frank acts may still be looming large, as well as the U.S. government’s cyber security mandate.

In relation to this, an “increase emphasis on supply chain security” also appears for the first time in the top five in 2015. Another important change is “technology advancements in the supply base,” which is listed as the third most important force of change. Technology advancements in 3-D printing and real-time IT tools may be weighing heavily on the minds of supply professionals.

Business Strategy

Business strategies represent the long-term goals and action plans of an organization’s top-management in response to external forces of change. Supply professionals see that their organization’s business strategies are becoming more customer-oriented, reflecting the shift in the forces of change toward meeting downstream customer requirements.

Consistent with that change, we see in Table 2 that “achieve high service quality” appears as the top future strategic goal in 2015, moving up considerably from what it was in 2007. However, to “reduce the cost of purchased goods/services” and to “reduce internal costs” still remain as the second and third most important business strategies. In the supply management world, cost containment continues to be top of mind.

Newly listed in the top five business strategies, the goal to “realize synergies across divisions/SBUs,” may reflect the widely-held sentiment that supply professionals are being asked to do more with less: They must not only continue to handle upstream and internal cost issues, but now they are also responsible for downstream service quality and internal integration issues.

Nonetheless, this condition may also highlight a potential opportunity for supply professionals: Because they play a boundary-spanning role across the organization, supply professionals are perhaps best qualified to play key roles in integrating different divisions and strategic business units within their organizations. Data clearly suggest their expanding roles within their organizations.

Supply Mission

Supply mission focuses on the future direction of the supply management function. We expected supply missions to fully reflect the ongoing environmental and organizational changes.

What we see instead is a disconnect between supply missions and the changes in external forces and business strategies from 2007 to 2015. While forces of change and business strategies are increasingly concerned about the downstream requirements of customers, supply missions still largely focus on the traditional upstream activities associated with suppliers.

For example, as shown in Table 3, “achieve consistent cost savings from suppliers” and “ensure continuity of supply” were the first and second most important supply missions in 2015. Moreover, “improve all aspects of supplier performance year-over-year” is in fourth place in 2015, albeit down from the second place in 2007.

Each of these are clearly supplier, rather than customer, in focus.

We also observe that standardization and de-proliferation were critical in 2007 but are no longer a top-five supply mission in 2015. It could be that the supply management functions of many organizations already achieved a desired level of standardization in their products and processes.

Related to Table 2’s business strategy of realizing synergies across divisions/SBUs, “improve the efficiency of the supply management function” newly appears as a major supply mission.

Lastly, the supply mission to “acquire new value-adding technologies and innovations from supply markets” directly relates to the third most important force of change in Table 1: “technology advancements in the supply base.” Such relationships show how the mission of supply management is directly being influenced.

Supply Strategies

Supply strategies are about the specific goals and plans of the supply management function. Similar to what we observed with supply missions, the external pressure for a downstream focus has not yet trickled down to overall supply strategies.

Yet, as the supply function strives to be aligned with the top-management, the number one supply strategy shown in Table 4 remains the same in both 2007 and 2015: “align supply management strategy with overall company goals.”

Other supply strategies for internal alignment and cross-functional integration frequently appear in the top 10 list of 2015 - instead of showing the top 5 strategies, we show the top 10 because of the extensive list of supply strategies we examined.

As supply base rationalization has advanced and the popularity of supply chain jobs has increased, “decreasing the number of suppliers” and “talent development,” both important in 2007, are no longer listed as top supply strategies in 2015.

Instead, supply professionals increasingly recognize the importance of centralized key spend category management and data analytics. Regarding data analytics, the focus seems to be shifting from sharing market intelligence to forecast analytics.

Influences of the External Forces of Change

In the next few sections, we examine the correlations between the forces of change and the other three sections. Doing so statistically represents some of the relationships in Figure 1, while also examining how external forces relate to supply missions.

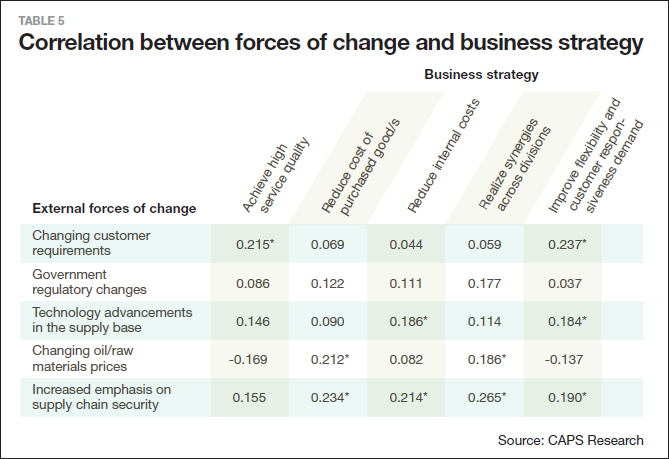

The values in these correlation tables represent the degree to which the importance given to one item is related to the importance given to another item. Values range from -1 to 1, where 1 means managers would rate both items similarly (i.e., both high or both low), and -1 means managers would rate the items completely opposite (i.e., one high and one low). An asterisk next to a value indicates that that value represents a significant or statistically meaningful correlation.

Regarding the correlation between forces of change and business strategy, as one would expect, “changing customer requirements” is significantly correlated with “achieve high service quality” and “improve flexibility and responsiveness to customer demand.” (See Table 5.) These correlations confirm our earlier observation that organizations are increasingly becoming customer-oriented.

“Changing oil/raw material prices,” “supply base technology advancements” and “increased emphasis on supply chain security” have significant correlations with business strategies for “reducing costs” and “realizing synergies across divisions/SBUs.” These trends imply that organizations are taking advantage of the recent decreases in oil/raw materials prices to reduce costs while increasing cross-functional efforts to increase security and innovation.

Interestingly, “government regulatory changes” do not show any significant correlations with the top five business strategies. As we discuss below, it seems that government regulatory changes are penetrating directly to the supply management function, without significantly influencing overall business strategies. This point becomes clearer as we consider correlations between external forces of change and supply mission.

Table 6 shows the correlations among the forces of change and supply missions. Unlike their non-significant influences on business strategies, “government regulatory changes” seem to have direct effects on multiple key supply missions: cost savings from suppliers, supply continuity and supplier performance improvement.

“Technology advancements in supply base” and “increased emphasis on supply chain security” are the two most salient forces that influence every key supply mission. Through this trend, we can surmise that supply professionals now fully recognize the opportunities provided by technological advancements from upstream supply chains as well as the potential security threats from supply chains.

Moreover, the cost savings from changing oil/raw material prices are providing opportunities for the supply function to invest more in performance improvements. Importantly, however, changing customer requirements do not seem to be a leading supply mission.

As we previously observed, there is a disconnect between external pressures for customer-orientation and the supply missions. While business strategies are fully embracing customer-centric trends, the supply function is yet to adjust to these changes. This disconnect is observed again in the correlation between forces of change and supply strategy.

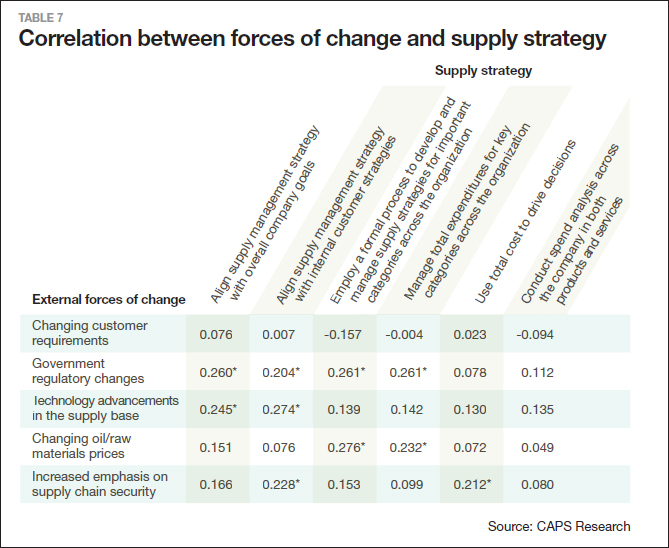

As shown in Table 7, external forces of change in terms of government regulation, technology advancements, raw material prices and supply chain security are largely shaping supply strategies. Such influences are similar to supply missions in Table 6. Again, “government regulatory changes” have prominent effects on both supply mission and supply strategy.

However, when it comes to the most important force of change - changing customer requirements - we also observe that supply strategies have not yet fully embraced this looming change. While external forces such as government regulatory changes bypass business strategy and penetrate directly into supply mission and strategy, changing customer requirements are still limited to top-management’s concerns.

This may indicate that the supply function is still developing strategies about how to respond to customer requirements. For the next five years, translating customer requirements into supply missions and strategies will be important areas to focus on for supply professionals.

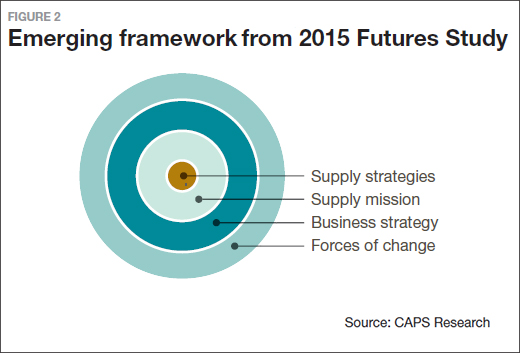

Emerging Framework from 2015 Futures Study

Based on the observations so far, we revised the preliminary framework from the 2007 Futures Study (see Figure 1) and now present the emerging framework from the 2015 Futures Study in Figure 2.

In the revised framework, the external forces of change penetrate directly into supply mission and strategies. In particular, government regulations, supply base technological advancements and supply chain security issues are directly shaping the changes in the supply management function.

Key Takeaways

When we look at the main findings of the 2015 Futures Study, five key takeaways stand out:

- Customer-centric supply management has the potential to become the most important driving force for supply management in the near future.

- Rapidly changing technologies are driving integrations within and between organizations and enhancing visibility across supply chains.

- The importance of supply disruptions has been de-escalated.

- With the increasing importance of cross-functional alignment, supply professionals must further the organization’s strategy, not just supply management’s strategy.

- We find that macro-level changes with customers, government and technology directly influence micro-level supply plans.

Take this one step further, and the new study reveals the evolving role of supply professionals in the future. To perform in these new roles, a proactive understanding of changes outside the traditional supply management function is required.

We believe that the proactive supply professional of tomorrow will be an integrator who balances the needs of different organizations in supply chains as well as different functions within their organization.

Supply professionals will also be keeping the core of supply management by achieving efficiencies in the supply base and within the supply function. Lastly, supply professionals will serve as the source and disseminator of knowledge by capturing and using supply-related knowledge.

And while we do not have a crystal ball, we do believe an exciting future awaits the supply profession and we hope this report helps today’s supply managers prepare for what comes next.

About the Authors

Thomas J. Kull, Ph.D., is an associate professor of supply chain management at the W.P. Carey School of Business and Thunderbird School of Global Management at Arizona State University. He can be reached at [email protected].

Sangho Chae is a doctoral candidate in the Department of Supply Chain Management at the W.P. Carey School of Business at Arizona State University. He can be reached at [email protected].

Thomas Choi, Ph.D., is executive director of CAPS Research and the Harold E. Fearon Eminent Scholar Chair of Purchasing Management at the W.P. Carey School of Business at Arizona State University. He can be reached at [email protected].

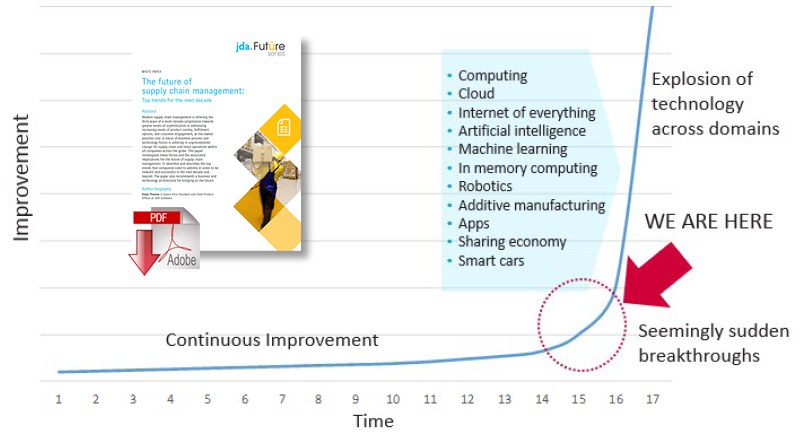

Related Third-Party White Paper

The Future of Supply Chain Management: Top Trends for the Next Decade

Technology Improvement Curve

Article Topics

Blue Yonder News & Resources

Blue Yonder announces an agreement to acquire One Network Enterprises for $839 million Blue Yonder Acquires One Network Enterprises for $839M Frictionless Podcast: Understanding Your Supply Chain Goals with Ann Marie Jonkman Blue Yonder announces acquisition of flexis AG Supply Chain Management (SCM) applications keep the supply chain humming How Collaborative Efforts Can Enhance Reverse Logistics Netlogistik partners with SVT Robotics to resell SOFTBOT platform More Blue YonderLatest in Supply Chain

TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month More Supply Chain