The Ecommerce Fight for Last Mile Freight Delivery

Established carriers and logistics services providers are clashing with tech-savvy newcomers to gain market share in this critical, final piece of the $2 trillion e-commerce market.

The Ecommerce Fight for Last Mile Freight Delivery

In one corner, we have some of the largest transportation and logistics services companies in the world, with the likes of UPS, FedEx, XPO Logistics and many other asset-heavy and asset-light companies looking to improve their dominant position as the key, last-mile carriers servicing the fast-growing, $2 trillion e-commerce market.

In the opposing corner, we have countless startups and relative newcomers, fueled by venture capitalist money, that are trying to crack into this highly lucrative transport market with high-tech, no-asset platforms designed to leverage available capacity in the marketplace.

Who wins this e-commerce heavyweight fight will go a long way toward shaping the face of freight transportation in the next decade.

First, let’s look at the size and scope of this e-commerce market.

FedEx Corp. chairman and founder Fred Smith recently testified before Congress that sales in e-commerce are expected to reach $2.4 trillion worldwide by 2018 - a 26% jump from 2016.

“E-commerce shopping isn’t a trend - it’s a fundamental part of retailing today in the U.S. and is growing exponentially worldwide,” Smith told the House Transportation and Infrastructure Committee on Feb. 1. “The changing landscape of the marketplace has presented FedEx with a wonderful growth opportunity well into the future.”

Adding to the projections, Smith estimated that B2C e-commerce is expected to generate $3.2 trillion in revenue by 2020 while the B2B e-commerce market is expected to be twice that size. In terms of transport revenue, global B2C e-commerce produced $85 billion in 2015 and is expected to grow by a 15% compound annual rate by 2019.

Of course, Amazon is the 800-pound gorilla in this space. However, veteran Stifel transport analyst John Larkin says that carriers and other established service providers may be in a no-win position with Amazon, which is already experimenting with its own fleet of equipment and owner-operators to deliver low-hanging, profitable last-mile freight.

“Joining Amazon may be every bit as tough as beating the e-commerce juggernaut,” says Larkin, who adds that’s due to the fact that core carriers and dedicated carriers appear to be used by Amazon only in cases where brokers can’t find cheaper capacity in the open market.

Anecdotally, several large traditional carriers privately say that they have backed away from Amazon for this reason. But that still leaves Amazon with thousands of other options among the established, for-hire carriers as well as Amazon’s growing private fleet.

Over the next couple pages we’re going put the small package and under-150 pound e-commerce segment dominated by the Big Three - UPS, FedEx and the U.S. Postal Service - aside. Instead, we’re going to concentrate on the roiling battle between traditional carriers and the tech-savvy upstarts that strive to perform heavy freight deliveries, set-up and installations, reverse logistics and a gamut of other last-mile services.

Old Guard Adapts

Nearly every large trucking company has a dedicated, last-mile division. These include such large truckload giants as Swift Transportation, J.B. Hunt, XPO Logistics, ArcBest Corp. and countless others.

In fact, ArcBest recently told Wall Street investors that it sees the last-mile “opportunity” as a $3 billion market for transport providers, while others have estimated it as large as $13 billion.

“We believe that in many ways e-commerce is still in its infancy and will continue to experience explosive, double-digit growth for the foreseeable future,” says Mark Davis, vice president of pricing and traffic for less-than-truckload carrier Averitt Express.

Beyond Amazon and Walmart, Davis says he sees “many small- and medium-sized businesses on Main Street” entering the online marketplace, and they need final-mile capabilities as much as the big boys. “The spirit of entrepreneurship is very strong within the e-commerce market, and we’re seeing countless start-ups launching daily.”

Bottom line: It’s a massive freight market, and all the competitors are gearing up for a fight. Last year, Schneider, the nation’s second-largest truckload carrier, simultaneously bought two companies - Watkins & Shepard and Lodeso - to bring together final-mile delivery and handling with a more innovative technology platform.

“We’re facing a large increase in demand for our services, and that requires investment in people, equipment and facilities,” says Ray Kuntz, CEO of Watkins & Shepard.

Perhaps the largest player in this traditional market is XPO Logistics, that recently said it arranged more than 12 million last-mile deliveries last year of things like furniture, refrigerators, ovens, computers, fitness equipment and heaven knows what else.

“Our secret sauce is 5,000 contract carriers - that’s the most capacity that anyone has in this space by a good margin,” says Charlie Hitt, president of last mile for XPO, who oversees 45 market delivery centers for “staging” goods for multiple customers, arranging pre-delivery and assembly.

“The big differentiator is technology,” Hitt explains.

“Everybody at XPO looks at technology as a leading driver as to what we do with customers. Technology manages workflows, directs the customer experience and provides visibility to all parties, customers, and retailers. In addition, all our contract carriers and operations teams can use it - and the end consumer can see it.”

Hitt adds that allowing consumers to have visibility into the process in delivering a seamless buying experience online is the goal.

“It’s not easy, and it can make or break any brand’s reputation.”

“The last-mile delivery person in the home is replacing the in-store associate, and that last-mile person is about to become the most memorable person for a consumer to have that’s connected to that company.”

Others agreed that being aligned with the customer is absolutely critical for success in the e-commerce space.

“The carrier must have a clear understanding of the customer’s expectations and their operations,” says Averitt’s Davis.

“Communication not just at the ‘deal-making’ level, but at the ground level is crucial. The key to success is constant and transparent communication.”

That communication enables suppliers to meet strict delivery windows and compliance standards that have been set forth by many major retailers. Failure to make on-time deliveries can result in costly surcharges. On the plus side, same-day deliveries can mean a 25% to 30% premium in last-mile delivery rates - another reason the last mile is being heavily invested in by all parties.

Startups Dream Big

Established companies such as XPO, UPS, and FedEx have the advantage of already having solid and suitable e-commerce networks in place. But, what about the newcomers?

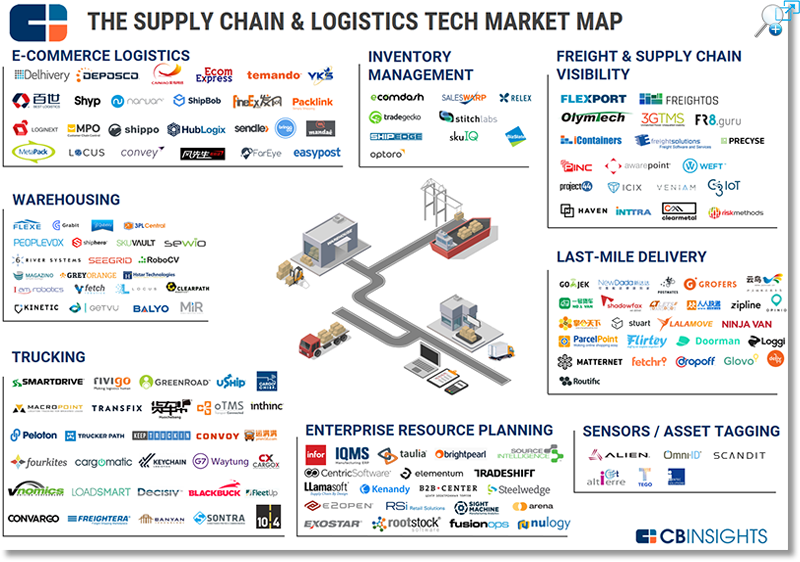

First, they’re hardly household names. Start-ups such as Cargo Chief, Cargomatic, Convoy, Deliv, Fleet, Flexport, FourKites, Craters & Freighters, Haven, HaulHound, Instacart, Transfix and Trucker Path are just some of the new players entering this space in the last two years (see Supply Chain & Logistics Tech Market Map below).

Second, they all have a dream - to make a big enough splash to be taken over by a larger fish or perhaps become the next Amazon or Google in this space.

“The startups seem to be attacking this huge industry the way large insurance companies are being pecked at by startups going after specific niches in that industry,” says Andy Kim, president of Chicago-based HaulHound. “We see our last-mile startup customers on HaulHound being able to gain incredible visibility to their niche services such as car transportation and food delivery.”

Kim says that HaulHound’s approach is to “come from a holistic model.” By that, he means the company uses a just-in-time technology model that is not wedded to any one carrier, or even one mode. “Our advantage is flexibility,” he says. “We see a lot of 800-pound gorillas in this market. But our model is to be the aggregator who brings together all pieces of the puzzle.”

HaulHound’s matching technology is free to shippers and operates nationwide, says Kim, who adds that it has the potential to work internationally as well. “It provides immediate, real-time matches at the rate independent truckers set,” he says “The goal is for our search engine to eventually aggregate all supply chain data, cutting into the brokerage market.”

150+ Companies Attacking The Supply Chain & Logistics Space

From trucking to e-commerce logistics to enterprise resource planning, tech startups are disrupting the supply chain and logistics industry.

Source: CB Insights

Source: CB Insights

Chris Cunnane, senior analyst for ARC Advisory Group, says that these newcomers want to become the “Uber” of the last-mile world.

“The first company that comes to mind is Uber itself,” says Cunnane. “It has launched UberRUSH and UberEATS, both of which are delivery services for products. Additionally, Uber has run a number of promotions that let customers get deliveries from Uber that included ice cream, cats and everything in between.”

Another startup, Deliv, is an example of a company that’s partnering with retailers for crowd-sourced delivery options. Deliv uses a smartphone app to alert pre-qualified drivers of pending delivery. The driver simply picks up the merchandise from the retailer and delivers it to the customer.

San Francisco-based Instacart is an example of crowd-sourced delivery option for last-mile services. This company connects personal shoppers with customers to deliver local groceries.

What are the common mistakes some newcomers make in this space? “The biggest mistake is not fully understanding the market,” Cunnane explains, who adds that this comes in a number of forms, including not understanding actual costs for the delivery, not understanding just how high the return rate is for e-commerce, and not understanding how to meet customer demands.

“The market is a crowded one, with more companies forming to try to take advantage of the sharing economy,” says Cunnane.

“Unfortunately, too many companies don’t have the means to scale, so they’re fighting an uphill battle.”

The biggest thing that these companies are trying to offer is same-day delivery, usually within an hour or two, adds Cunnane. Density is the key, and that means lots of deliveries over a short distance.

“The newcomers simply don’t have the density to accomplish this,” Cunnane says frankly. “These companies may be offering a more personalized experience than FedEx, UPS, or USPS, but they don’t have the required density to make it work.”

Still, some of the old guard carriers say that they’re watching these startups - and trying to maintain their edge. “Competition makes us all better, and it’s always going to be there,” says XPO’s Hitt.

“We’re not worried about competition. We watch them and we adapt. We just have to watch what’s going on.”

Cunnane’s advice for startups is to develop partnerships with major retailers as part of the process. “Without these partnerships, it will be a difficult model to crack,” he adds.

Other seasoned freight transportation experts agree. Satish Jindel, principal of trucking analyst firm SJ Consulting, says that most of these startups are “weeks away from going out of business” due to a lack of freight transportation experience.

Jindel says that the keys to last-mile success are the same as in traditional trucking - know your costs, have good processes to get productivity from your drivers and price the product correctly with customers. His forecast for startups is not rosy.

“They have high-flying hopes and a lot of venture capital, but no knowledge,” says Jindel.

“They don’t even know how many wheels there are on an 18-wheeler.”

Related: Customer Demands Reshaping Last-Mile Delivery

Related White Papers

Making the Last Mile Pay

This white paper examines the latest innovation in last-mile services and explores how companies can harness the opportunities, and keep customers happy, without undermining their businesses - or promising more than they can deliver. Download Now!

Redefining Final Mile Delivery in the Age of the Customer

In this whitepaper, you will find key insights on how to manage delivery costs while ensuring a heightened delivery experience for your customer. Download Now!

Best Practices for Optimizing Last Mile Pick up & Delivery Operations

This white paper provides an overview of the Top 10 best practices for establishing, managing and measuring effective last mile P&D delivery programs. Download Now!

Mobile-Enabling Logistics: Turning the “Last Mile” Into a Competitive Advantage

This whitepaper describes real-world examples of how companies are using mobility to optimize the last mile for increased profitability, customer satisfaction, and compliance. Download Now!

More SC24/7: “Last Mile” White Papers

Article Topics

Capriza News & Resources

Last-Mile Delivery from “Wow” to “Required” The Ecommerce Fight for Last Mile Freight Delivery Mobile-Enabling Logistics: Turning the “Last Mile” Into a Competitive Advantage Optimizing the “Last-mile” - How mobility is delivering cost efficiencies and enhancing customer exp Mobile-Enabling Logistics: Turning the “Last Mile” into a Competitive AdvantageLatest in Transportation

Talking Supply Chain: Doomsday never arrives for Baltimore bridge collapse impacts Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation