Supply Chains to Really Admire (sorry Gartner!)

To make our Supply Chains to Admire list, we developed a list of companies that have posted balanced performance in inventory turns, operating margin, and ROIC, while making progress on the Supply Chain Index.

On September 9, 2014, we published a new report, Supply Chains to Admire.

It is the end of a two-year research project, and identifies which publicly held companies outperformed their peer group on balance sheet results.

Here we share the answers to the questions that we get the most often about this research:

What is the source of data? The data analyzed to compile the Supply Chains to Admire report came from publicly-available information from balance sheets and income statements.

Which companies were considered in the study? We built peer groups based on like industries. Companies were selected based on three criteria. They had to be publicly traded, we had to have a nearly complete data set for the years studied, and they had to have a peer group of at least six companies to be able to draw the comparisons. We eliminated several large conglomerates. As a result, you will not find 3M or GE in the data. This left us with a list of nearly 200 companies.

How did you define peer groups? We tried to use NAICS code designations. The NAICS designation was developed by the US Federal Government to characterize groups of companies within an industry.

If the company had multiple divisions crossing over many industries, where did you place them? We placed them in the industry that they were the most like, e.g., the primary source of revenue. For example, Johnson & Johnson has many supply chains in many industries, but the majority of the revenue comes from pharmaceuticals. As a result, we report their results along with their pharmaceutical peer group. We know that this is not perfect; but it is the best that we could do, and we think that it is a fairer comparison than putting all companies in a spreadsheet and shaking them up without any consideration for peer group analysis.

How did you select the final list of fifteen companies? The companies were selected based on performance better than peer group for 2006-2013 and delivering better than average improvement within the peer group as determined by the Supply Chain Index. We think that supply chain excellence is a combination of performance and improvement.

Was the list of the Supply Chains to Admire hard to select? We thought that it would be; but surprisingly, it was not. After applying the rules for data collection, we ended up with 200 companies. Nineteen of the 200 companies met the performance criteria of improving operating margin, inventory turns, and ROIC together in concert for the years of 2006-2013 or 2009-2013. Four more companies fell out of the list when we applied the supply chain improvement criteria as defined by the Supply Chain Index. The companies that fell out at this point were Diageo, PepsiCo, Reckitt Benckiser, and The Gap.

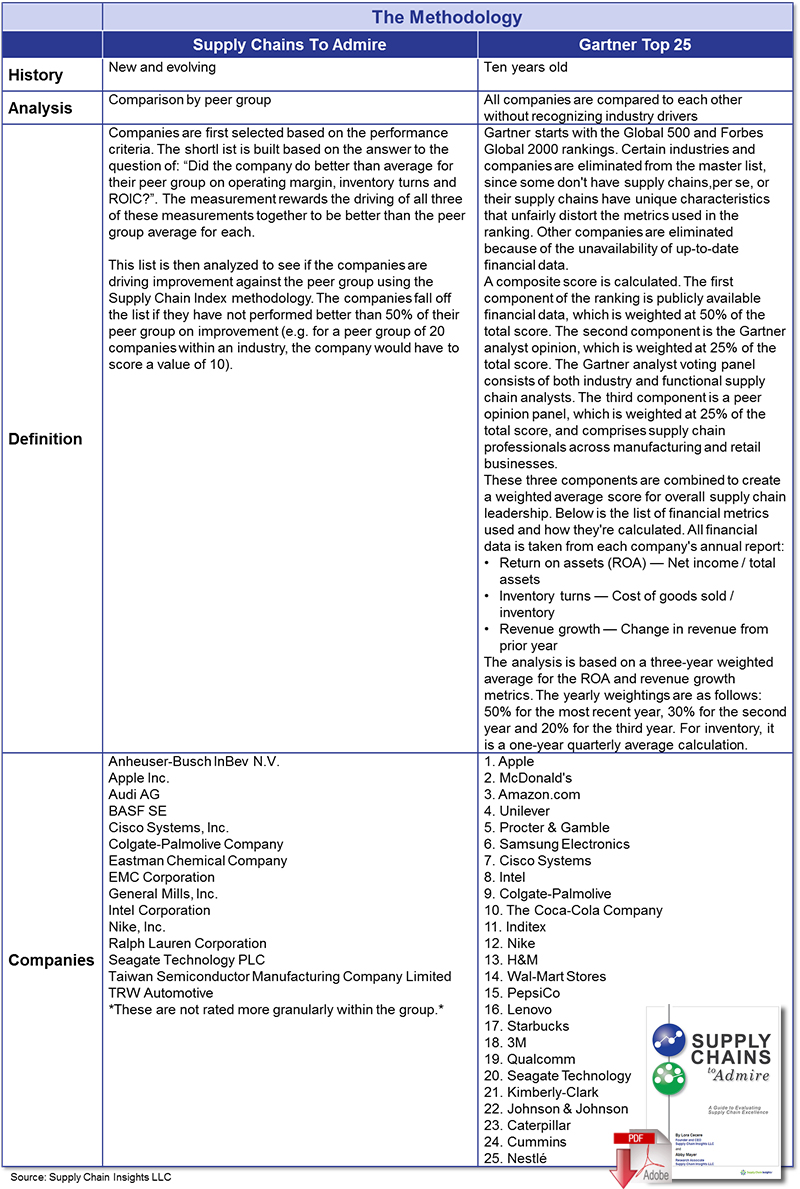

How does this compare to the Gartner Top 25? One of the reasons that we built the Supply Chains to Admire is that we don’t think that the Gartner Top 25 serves the market well.

While you need to make your own decision, here is an overview of the two methodologies:

Will you do this analysis again? Yes, we will do this study yearly in the preparation for our annual conference. This conference is designed to challenge supply chain leaders to think differently.

What is the Supply Chain Index? The Supply Chain Index is a methodology to judge supply chain improvement. It is detailed in our recent reports.

I have some input into the methodology. How do I give you feedback? We would love to hear from you either formally or informally. We get stronger through your feedback.

What did you learn in the analysis?

- Despite a rise in demand and supply volatility, companies are becoming more resilient in 11 out of 15 companies studied. However, due to a variety of factors, companies are losing ground on driving progress on both inventory turns and operating margin. We believe that this is largely due to rising complexity.

- We are not doing as well as I thought we were doing on driving balance sheet improvement. We have a lot of projects, but many companies are struggling to see these results on the balance sheet. Nine out of ten companies are stuck at this intersection.

- I am surprised at how many companies are raising improvement in one of the three metrics, but not driving performance improvements in the total portfolio. This is often due to the lack of understanding of the supply chain as a complex system. We find that companies will establish metric targets in isolation and throw the supply chain out of balance.

- There are a lot of misconceptions about inventory. It is a hot spot of misunderstanding. Inventory is one of two primary buffers in the supply chain. A buffer absorbs volatility. With the rise of demand and supply volatility, buffers are more important that ever. However, most companies are still looking at inventory levels, and we have a host of crazy consultants running from company to company advocating cutting inventory to free-up cash. Cutting inventory without right-sizing the form and function of inventory throws the supply chain out of balance. Each industry has a very different potential, and it is important to not generalize the answer.

- Excellence is easier to say than to do. Good luck in your journey! And, let us know if you have any questions.

Article Topics

Supply Chain Insights News & Resources

Talking Supply Chain Podcast: Insights on Leaders - The Top 25 CHAPTER 3: Bricks Matter Infor Aquires GT Nexus - If I Had a Magic Wand! Why Are We Letting Digital Marketers Define The Future World View of The Supply Chain? Imports & Exports Made Easier with Global Trade Management Software Maximizing the ROI in Supply Chain Planning Getting Inventory Right: Hope with Hype and Recycled Supply Chain Software? More Supply Chain InsightsLatest in Supply Chain

TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month More Supply Chain