Supply Chain’s Role in Financial Performance

How firms manage inventory can be a significant source of competitive advantage and generate real, long-lasting benefits for the firm and its shareholders.

When it comes to financial outcomes, what should the CPO and chief supply chain officer focus their attention on in 2013?

The answer of course depends on the company itself, its competitive position and trends impacting the industry.

However, there are a number of broader macroeconomic trends and factors which establish the boundaries of the current business environment, and no firm can fail to pay close attention to what’s happening at the global level.

Global Growth

Count on a general economic environment of slow-to-no-growth in 2013. In January, the World Bank released its semi-annual economic forecast and is predicting global GDP will grow at an anemic 2.4 percent rate.

Its current view is revised downward from 3.0 percent as of last June and, for the glass-is-half-empty crowd, the World Bank has a track record of erring on the high side.

Business leaders understand that growth will vary significantly from region to region — there’s a clear consensus that the Eurozone will remain in recession for 2013. The United States is expected to grow at less than 3.0 percent in 2013, with considerable downside risks to that target depending on the outcome of the continuing deficit reduction debate in Washington.

With reduced demand for their export-driven industries, expect growth in China and Asia Pacific to come in between 7 percent and 8 percent — not enough, at a global level, to overcompensate for the widespread contraction in Europe.

Improved Liquidity

Unlike in 2008 and 2009, cash and access to credit really isn’t the issue anymore, at least not for most companies.

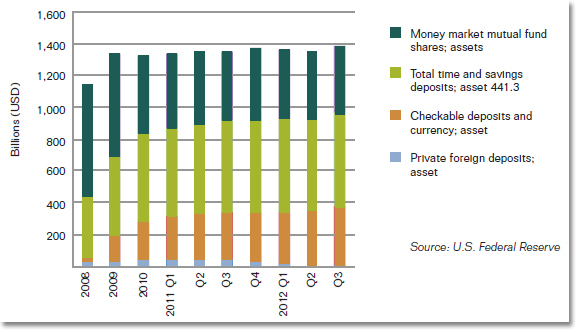

Corporate cash and short-term investment balances continue to remain at extraordinarily high levels. For example, the U.S. Federal Reserve reported in December that, as of the end of Q3, nonfinancial corporations held more than $581 billion in checkable savings and time deposits, more than 30 percent above the 2007 level (see Figure 1).

Many factors underlie this build-up, including uncertainty about access to credit and government fiscal policy, a clear corporate intention to de-risk short-term portfolios and attractive government insurance programs to insure corporate deposits.

Further, many firms have been able to access the credit markets to meet their cash needs, at historically low rates, rather than tap into their own cash reserves.

Figure 1: Nonfinancial Corporate Business Cash and Equivalents

This aggressive policy of building corporate cash reserves may be moderating. There is some indication in U.S. Federal Reserve data that companies eased off in adding to their cash positions within 2012.

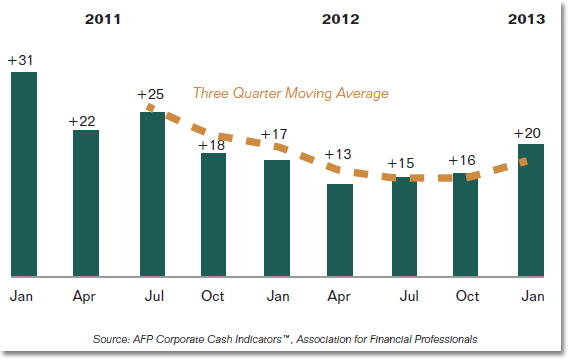

The Association for Financial Professionals (AFP) Corporate Cash Indicators index indicates a clear moderating trend since January 2011 (Figure 2).

In October, AFP reported that 26 percent of survey respondents expected to reduce cash stockpiles, versus 40 percent who expected to add to reserves.

This points to a clear “de-acceleration,” if you will, in the growth of corporate cash stockpiles.

Figure 2: Net Percentage of Organizations Increasing Year-to-Year Cash and Short- Term Investments

Siemens CFO Joe Kaeser had an interesting analysis of this situation in remarks he delivered to an investor conference in January.

As reported in the Wall Street Journal, Kaeser said companies are “holding on to liquidity,” citing concern about possible tightening of credit terms by banks faced with increased liquidity coverage ratios under Basel III.

One of the chief levers companies have to improve liquidity in the short-term is to manage working capital more efficiently and, more specifically, improving liquidity by extending payment terms with suppliers.

Kaeser told investors that Siemens expects its own free cash flow to be “burdened by… changes in customer payment behavior” in 2013.

Moving Forward

I find this take on current business conditions interesting for several reasons. It seems clear that companies are still trying to extend payment terms with suppliers.

One CPO told me recently that he sees this dynamic as a kind of financial balancing act. When customers want longer payment terms, the company simply extends payment terms with its own suppliers.

This strategy works for well capitalized firms within the supply chain, but it creates potentially serious issues for companies along the supply chain, many of whom are not able to carry their customers’ receivables for 120 days or longer.

Companies may want to assess the financial health of critical suppliers in their ecosystems and may even decide, in certain strategic circumstances, to provide financing for those suppliers.

Providing Short-Term Value. It’s not a long-term driver of value for companies to look to improve working capital efficiency at the expense of the other firms in their ecosystem.

Like the large multinational I mentioned above, most firms simply react by seeking to maintain proportionality between Days Sales Outstanding and Days Payables Outstanding.

Yes, a first mover might gain a (sometimes critical) short-term advantage in the immediate moment, but balance tends to return to the system very shortly. I believe that’s one reason why, in general, working capital levels at large companies have not continued to improve since the depths of 2008 and 2009.

Indeed, CFO magazine reported in August that the 1,000 largest U.S. public companies have generally not managed to sustain the short-term improvement in working capital levels they achieved since the start of the recession.

Generating Longer-Term Value. For longer-term value generation, CFOs, CPOs and supply chain executives need to look more deeply into the sources of working capital — and, in particular, at inventory levels.

How firms manage inventory can be a significant source of competitive advantage and generate real, long-lasting benefits for the firm and its shareholders.

A specific metric to pay attention to in 2013 is inventory turnover, a financial ratio which measures a company’s efficiency at converting inventory to sales. The ratio is calculated by dividing cost-of-goods-sold (COGS) for a given period, as reported on the income statement, by average value of inventory for the same period.

Average inventory is calculated by taking the sum of inventory values at the beginning and end of the period, divided by 2.

Inventory turnover is particularly useful for identifying which companies in a given industry are most efficient in converting inventory into sales. A higher ratio indicates better performance.

A firm improves the ratio either through reducing the denominator (i.e., decreasing the average inventory in the period necessary to generate revenue), increasing the numerator (i.e., increasing revenue on the same inventory base) or, of course, some combination of improvement in both factors.

Unlike managing receivables and payables, inventory turnover is an indicator of a company’s real advantage in creating wealth. However, it is important to note that inventory turnover should only be restricted to sectorspecific analysis.

It would not be meaningful to compare inventory turnover of say, an auto manufacturer with a biotech firm, given the different capital requirements and other factors specific to each industry.

Within an industry, sustained out-performance on inventory turnover is worth watching as an indicator that the firm has a lasting advantage over its competitors.

For instance, one large electronics contract management company had an inventory turnover ratio of 6.9 for the twelve months ending September 30, 2012. The ratio for one of its major competitors was 6.5. With a difference of only 6 percent between the two ratios, it may not appear to be a significant indicator of one firm’s prospects versus the other.

However, if sustained, 6 percent better performance in inventory turnover could be very telling in an industry with notoriously low operating margins.

Controlling Costs to Improve Margins. Finally, in a macroeconomic environment where revenue growth may be limited, and the ability to pass cost increases in the form of higher prices to customers is constrained, discipline around containing and/or reducing direct and operating expenses will constitute a significant priority for firms focused on improving earnings.

Even modest incremental improvements in the cost of direct materials and operating expenses such as transportation and warehousing add up, cumulatively, to significant improvement in earnings.

In one business case I recently saw, improvements of 5 percent to 10 percent in transportation, warehousing, inventory and direct materials costs, taken together, improved one firm’s operating margin from 7 percent to 8.2 percent. Given the “new normal,” no firm can afford to leave such improvements on the table in 2013.

As a supply leader, you have tremendous influence on your company’s financial health. By proactively focusing on financial strategies, CPOs and chief supply chain officers will assure the backbone of the global economy — the supply chain — is able to sustain whatever natural or man-made occurrences arise in 2013.

Thomas W. Derry is chief executive officer at ISM.

Editorial Insights

This article shows how inventory can drain cash.

Top CPOs realize that having inventory is a narcotic — providing a temporary escape from real problems and dulling the pain of inefficiency. However, edicts to “cut inventory” can be disastrous if you only try to cut costs without looking at total asset management effectiveness.

Extending payment terms to 75-90 days can add significant risk as the cash-flow burden is pushed downstream to the supplier who can least afford it. Peter F. Drucker said, “Efficiency is doing things right; effectiveness is doing the right things.” In supply chain financial management, efficiency is managing costs; effectiveness is delivering value.

Many organizations struggle to make use of financial data from a variety of information systems, which are often disaggregated, complex and duplicated. This makes it harder for the CPO and CFO to see the “true situation” and to skillfully manage cash, volatility and risk in the supply chain.

We are far from generating the longer-term value proposed by Tom in this article. The grand view of a synchronized integrated supply chain remains a dream for most industries that still cope with multiple systems, lack of coordinated information, Just-in-Case inventory and up-stream cash squeeze.

Some sectors, like electronics and automotive, are starting to integrate their suppliers and business systems, drive the efficient use of capital, develop accurate forecasts and incorporate a lean balanced inventory approach across the entire global supply chain.

The business community, as a whole, still has a long way to go. This is your opportunity to lead the way.

Bill Michels, CPSM, C.P.M., MCIPS is President of ADR North America LLC, a specialty-consulting firm that focuses on purchasing and supply chain management. Mr. Michels is also a Senior Vice President of the Institute for Supply Management™. His ability to transform procurement and supply chain and deliver a change process has led clients to increased profitability, enhanced staff competence, and sustainable cost and value improvements.