Suppliers in USA, Brazil, China and India Least Resilient Against Climate Change Risks

CPOs in America apparently have some work to do to ensure that their supply chain’s can weather the risks of climate change according to a new study the CDP (Carbon Disclosure Project) and consultancy Accenture.

Lack of preparation currently leaves supply chains in Brazil, China, India and the United States more vulnerable to climate risks than those in Europe and Japan.

However, suppliers in China and India deliver the greatest financial return on investment to reduce their greenhouse gas emissions and demonstrate the strongest appetite for collaboration across the value chain.

This according to research released today by CDP, the international NGO formerly called Carbon Disclosure Project, and Accenture.

Supply chain sustainability revealed: a country comparison. CDP supply chain report 2014–15 is the most comprehensive overview of the climate risks and opportunities that exist for supply chains globally.

The new research, which also incorporates information from the United Nations’ World Risk Report, is based on data collected from 3,396 companies on behalf of 66 multinational purchasers that work with CDP to better understand and manage the environmental impacts of their supply chains; they account for $1.3 trillion in procurement spend and include organizations such as Nissan Motor Co. Ltd., and Unilever plc.

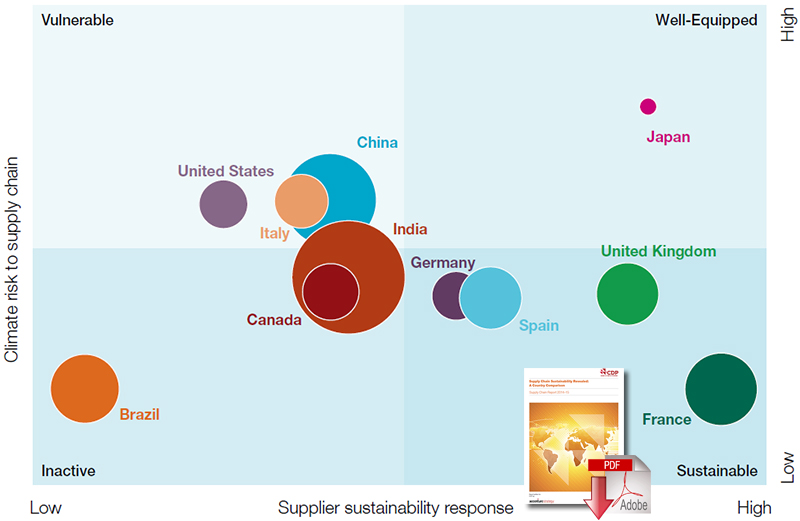

Climate and water data disclosed by suppliers to CDP were scored and evaluated to create a sustainability risk/response matrix (below). This offers a visual comparison of how well-prepared suppliers across 11 major economies2 are to mitigate and manage environmental risk.

Sustainability risk/response matrix

“While climate and water risks are apparent, the implications for businesses and economies reliant on complex supply chain models are less understood,” says Paul Simpson, chief executive officer, CDP. “That multinationals are engaging with thousands of suppliers to better manage environmental challenges and opportunities is encouraging. These companies are catalyzing progress in response to global problems.”

Mr. Simpson adds: “It is particularly exciting to see such a strong appetite for collaboration and superior financial returns on initiatives to reduce emissions from Chinese and Indian suppliers. This should attract investment, which in turn will drive greater action within these high emitting markets.”

“What is concerning is that, despite the increase in the number of companies assessing and reporting on their emissions, the data suggests that suppliers are making either marginal or no improvements in their development of sustainable supply chains capable of weathering climate risks and other natural disasters,” says Gary Hanifan, managing director, Accenture Strategy. “The good news is that as companies transform their supply chains into digital supply networks they will gain greater end-to-end visibility, traceability and access to information to report on their compliance progress and mitigate climate risks.”

The sustainability risk matrix takes climate change mitigation strategies, carbon emissions reporting, target setting, emission reduction initiatives, climate risk procedures, uptake of low-carbon energy, water risk assessment efforts and collaboration into account. It reveals that:

- Suppliers in France, the UK, Spain and Germany – in that order – are identified as the most sustainable. They have taken extensive measures despite comparatively low levels of exposure to climate risk. However, the report notes a year-on-year decline in the percentage of German suppliers implementing a number of key environmental performance indicators, such as having a climate risk management processes in place, which has dropped from 82% to 72%.

- Japan is the only country with suppliers that are well-equipped to respond to high climate risks. They have some of the highest levels of emissions reporting, target setting and climate risk awareness.

- Suppliers in China, Italy and United States are found to be vulnerable. An imbalance between high exposure to climate risk and the steps that suppliers have taken in response leaves room for improvement in these geographies.

Even so, the United States has been identified by CDP as a polarized market, given that the majority constituent of the CDP Supplier Climate Performance Leadership Index - those suppliers identified as taking the most positive actions to address climate change – are headquartered in America. - Brazil, Canada and India must do more as suppliers there who participated in the research report fewer emission reduction initiatives than the global average.

- A collaborative approach and profitable emissions reductions initiatives give China and India a competitive edge. Suppliers in China and India offer the best return on investment in terms of emissions reductions and monetary savings. Further, suppliers in both markets demonstrate the highest propensity to collaborate with partners across the value chain in order to reduce climate risk.

The global picture, which is presented alongside the country-by-country analysis, establishes some encouraging signs of global progress. More organizations than ever are assessing and reporting to CDP on their environmental impacts. The 3,396 companies that took part in the program this year represent a substantial increase of more than 40% in the past three years.

Further, the quantity and percentage of suppliers setting emissions targets, which is a crucial component of climate risk management, shows a steady upward trend: nearly half (48%) of suppliers set targets last year, compared to 44% in 2013 and 39% in 2012. There has also been an increase in the number of suppliers achieving emissions reductions since 2012, with the percentage rising from 34% to 40% in 2014.

As suppliers become more advanced at carbon management, the number of companies realizing monetary savings from their actions to reduce emissions mirrors the rising trajectory, jumping from 29% in 2012 to 33% in 2014.

Article Topics

CDP News & Resources

Plastic Pollution is a Problem Many Companies are Still Ignoring How Water Crisis is Putting Supply Chains at Risk A Paradigm Shift in Total Cost of Ownership Hardwiring Sustainability across the Value Chain to Future-Proof Business Achieving Zero Waste Across The Value Chain How Collaboration in Global Supply Chains is Critical for Tackling Climate Change Supply Chain Sustainability Revealed: A Country Comparison More CDPLatest in Supply Chain

Spotlight Startup: Cart.com Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants Apple Overtaken as World’s Largest Phone Seller More Supply Chain