Studies from CIT & Merrill Lynch Signals Confidence in Mid-Market Supply Chains

“Middle market executives are optimistic about their future, but temper this optimism over concerns related to taxes, government regulations and compliance with the Affordable Care Act.” John A. Thain, Chairman and Chief Executive Officer of CIT.

Middle market executives, whose companies take in more than $6 trillion in revenues and employ more than 30 million people annually, are expressing renewed optimism in their business prospects compared to a year ago.

However, despite this positive outlook they are concerned about potential tax increases, government regulations, compliance with the Affordable Care Act and the current strength of the U.S. and global economies.

These are just a few of the findings contained in a new study, CIT: Voice of the Middle Market – Perspectives from the Heart of the U.S. Economy, by CIT Group, Inc.

While many middle market executives are optimistic about where their companies are right now, only a minority believe the U.S. economy is doing well today and that the global economy is even weaker.

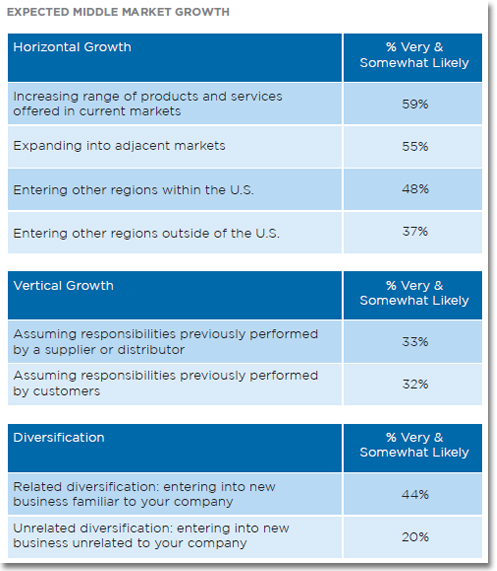

In addition to their anemic assessments of both economies, middle market leaders face a series of specific challenges ahead. This not only includes continued economic uncertainty within the U.S. and globally, but also tax increases, government regulations, compliance with the Affordable Care Act and hiring and retaining employees. Most are anticipating interest rates to rise, with a majority saying higher rates will negatively impact their business. These concerns aside, many middle market executives believe the sector is positioned for growth over the next year. This will come through a combination of horizontal growth, vertical growth and diversification, such as increasing the range of products and services offered in current markets, as well as expanding into adjacent markets.

Policymakers and their current legislative agenda create hurdles for the middle market, too. Middle market leaders disapprove of Congress’ job performance. Moreover, contrary to their own opinions about how the middle market bolsters the U.S. economy, few think Congress recognizes the impact middle market companies have on the U.S. economy. They are also bracing themselves from the impact that select legislative initiatives may have, not just on their own businesses, but also on the economic stability of their customer base.

Perceptions of The Middle Market, U.S. Economy and Global Economy

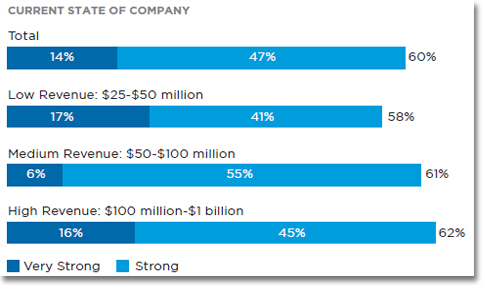

In particular, the majority of middle market executives report that their companies are in a strong position today (60 percent). This is true across revenue categories, with very few describing the current state of their company as weak or very weak.

There is renewed optimism this year, with 55 percent saying they are better off today than compared to a year ago. Thirty percent feel they are in the same place, while the remaining 15 percent say they are worse off.

Most believe the middle market has a major impact on the U.S. economy, with about three in four holding this opinion (74 percent). This is up six points from 2012, revealing that middle market executives are even more likely to believe that their companies have a strong connection with the health and strength of the U.S. economy than they were a year ago.

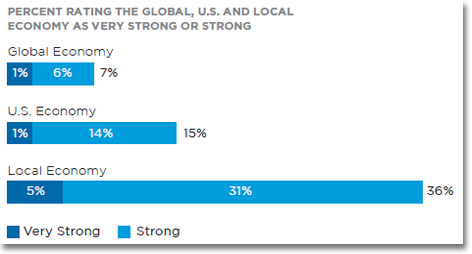

Still, only a minority believe the U.S. economy is doing well right now, and they believe the global economy is even weaker. However, there is optimism much closer to home, with a sizeable minority describing their local economy as strong. Middle market leaders are five times more likely to say their local economy is doing well than they are to offer the same rating of the global economy (36 percent vs. 7 percent). Their view of the U.S. economy falls along this continuum, albeit more closely aligned with their perspective on the global economy.

Importantly, middle market executives have confidence not only in their own companies, but also in the U.S. economy. As such, while their current assessment of the state of the U.S. economy is unfavorable, with only 15 percent describing it as strong, many expect progress over the next year. Half say the U.S. economy will be stronger 12 months from now (51 percent). The rest split between saying there will be no change in a year (33 percent) or that the U.S. economy will, in fact, be weaker (16 percent).

The Road Forward: Challenges Ahead and Expected Growth

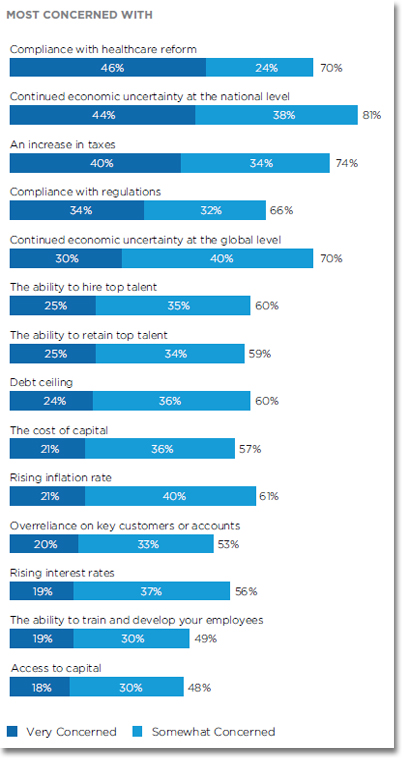

Middle market executives see many challenges ahead. Most are worried about continued economic uncertainty within the U.S. and globally (81 percent and 70 percent, respectively). There are also concerns about tax increases (74 percent), compliance with the Affordable Care Act (70 percent) and compliance with government regulations (66 percent).

Talent management – both hiring and retaining talent – also remains a challenge for the majority of those surveyed. Sixty percent say they are concerned about their ability to hire top talent, and 59 percent are concerned about their ability to retain top talent.

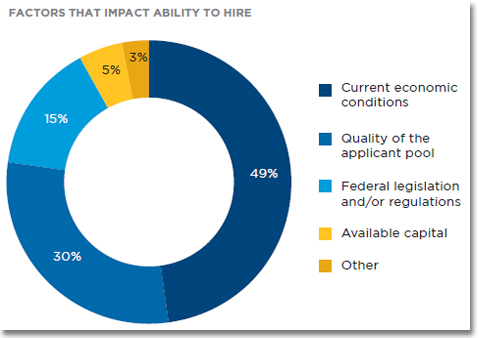

Middle market executives are most likely to say their hiring is constrained by current economic conditions. The second most common reason hiring proves difficult is the quality of the applicant pool. In addition to challenges related to hiring top talent, almost half experience difficulties when trying to retain top talent (47 percent). Notwithstanding challenges related to hiring and retaining employees, 46 percent anticipate an increase in the size of their workforce in the coming year.

Looking ahead, middle market leaders also anticipate higher interest rates. Most think interest rates will rise, though at a slow rate (82 percent say they will rise slowly, 10 percent say they will rise rapidly), and will have an effect on the middle market. The majority say this impact will be negative (54 percent). A sizeable minority does not expect higher interest rates to affect their companies (28 percent), and about one in five middle market executives think this change will be positive (19 percent).

More optimistically, though, the forecast for middle market growth includes horizontal growth, vertical growth and diversification. Horizontal growth proves most common. Across revenue categories, middle market executives are most likely to say they will be increasing the range of products and services offered in current markets (59 percent). This is followed by entering adjacent markets (55 percent), defined as markets that are similar to a company’s core markets. Almost half are forecasting growth within other U.S. regions (48 percent). International growth proves less common (37 percent).

President Obama, Congress and the Current Legislative Agenda

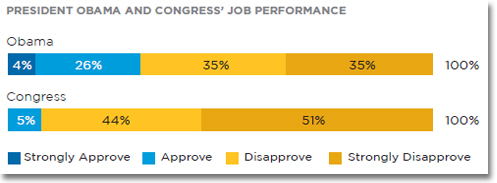

Views among middle market executives track somewhat against the general public when it comes to Congress. Recent public opinion polls show that Americans’ approval of Congress falls between 14 and 21 percent. Middle market leaders are even less favorable towards Congress’ performance. In fact, nearly all disapprove of Congress (95 percent). The middle market is more positive about President Obama’s job performance, though only 30 percent approve of his performance. Further, two-thirds disapprove of both Congress and President Obama.

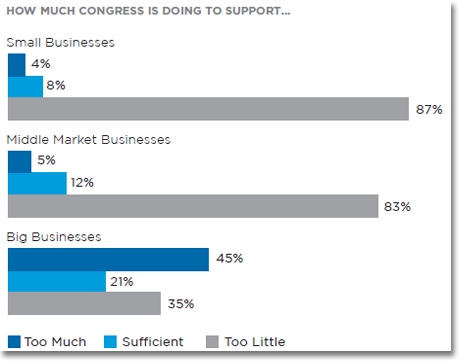

Congress may generate more favor if it paid greater attention to the middle market. The perception among those leading the middle market, however, is unfavorable. Eighty-three percent think Congress pays too little attention to the middle market. They feel similarly about Congress relative to small businesses (87 percent say too little attention). By comparison, 45 percent believe Congress pays too much attention to big businesses.

Contrary to their own opinions about how the middle market bolsters the economy (with 74 percent saying it has a major impact on it), more than three-quarters (76 percent) believe that Congress does not recognize the middle market’s contributions to the U.S. economy. Only about one in four believe Congress is aware of the middle market’s positive role relative to the U.S. economy (24%).

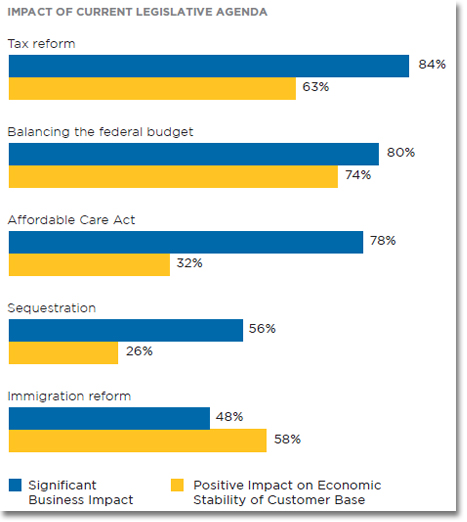

Thinking about the current legislative agenda, middle market executives are most likely to say that tax reform, balancing the budget and healthcare reform will significantly impact their businesses. They also expect sequestration and immigration reform to impact them, albeit to a lesser extent. Middle market executives were asked about the effect of these same issues on the economic stability of their customer base, as well. Half, if not more, believe balancing the budget, tax reform and immigration reform will positively impact their customers. Conversely, many expect the Affordable Care Act and sequestration to negatively impact the economic stability of their customers.

Methodology

KRC Research conducted an online survey among 301 middle market executives in the United States. Fieldwork began on August 8, 2013 and concluded on August 18, 2013. (Note: For the purposes of this research, the middle market is defined as companies with revenue between $25 million and $1 billion.)

Source: CIT: Voice of the Middle Market

These findings mirror those given recently by U.S. financial officers who were significantly more confident about economic growth in 2013 in the latest Bank of America Merrill Lynch CFO Outlook survey.

Raising new possibilities - Sharing insights to help companies take action

Businesses benefit most from knowledge that’s both credible and actionable. It’s especially important now, as corporate leaders look for signs of sustained economic recovery to embolden strategies that drive meaningful innovation and growth.

Through our annual CFO Outlook study, we gain insight into what U.S. financial executives are thinking and planning for the months ahead. Assessing their collective views of the economy, sectors, their own corporate performance, and other potential activities in 2013, it’s clear that most are proceeding with cautious optimism.

An important part of sponsoring this study — as well as the full breadth of thought leadership produced by our experts worldwide — is our commitment to providing hands-on guidance. At Bank of America Merrill Lynch, we collaborate with our clients and each other every day, across all regions and disciplines. By aggregating ideas and skill sets, and drawing on our complete range of capabilities, we help clients gain access to expertise that helps them pursue their most important objectives.

Related Article: IHS Top 10 Economic Predictions for 2013 - World Growth Will Stabilize in 2013

Article Topics

Bank of America Merrill Lynch News & Resources

Ranking the Top 20 Women in Supply Chain Bank of America Introduces Digital Supply Chain Finance Platform 2013 CFO Outlook - Annual Survey of U.S. Senior Financial Executives Studies from CIT & Merrill Lynch Signals Confidence in Mid-Market Supply ChainsLatest in Business

Ranking the Top 20 Women in Supply Chain Let’s Spend Five Minutes Talking About ... Malaysia TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process More Business