State of Logistics 2016: Pursue mutual benefit

While it’s currently a shippers market, the authors of this year’s report contend that we’ve entered a “period of transition” that will usher in a realignment of capacity, lower inventories, economic growth and “moderately higher” rates. It’s time to tighten the ties that bind.

Let’s start with the good news first: Freight transportation is a “shippers market” for the remainder of this year. Indeed, shippers are the fleeting beneficiaries of a brief lull in the ever-rising costs of business logistics.

However, according to the “27th Annual State of Logistics Report” (SoL) recently issued by A.T. Kearney and sponsored by Penske Logistics and the Council of Supply Chain Management Professionals, these market conditions will simply not last. This is due to the confluence of one-time factors that are now favoring shippers, including bloated inventories, a strong U.S. dollar hampering exports, and a sudden surge in extra capacity—especially in the $300 billion for-hire truckload market.

Now the reality: According to the report, excess inven¬tory will be sold off, the supply/demand equation among shippers and carriers will rationalize, and fuel and fuel surcharges are rising. In addition, truck capacity will become more limited largely due to the inability to recruit, train and hire compliant drivers in the face of toughening environmental and other costly regulations affecting the $582 billion trucking industry.

“Today, the logistics system is sound, desired services and features are generally available, and a system designed for cost efficiency is delivering pricing favorable to shippers,” say the authors of the SoL report. “However, gaps in infrastructure and accelerating trends for speed will increasingly pressure a system that was not designed for e-commerce-driven, last-mile, last-minute delivery.”

On this note, the authors are urging shippers to ratchet up the best practice of working with their carriers on a “mutual benefit” basis, becoming true operational partners. The shippers that can achieve this goal will be insulated from the harshest of the coming rate increases and will almost certainly have the have the capacity they need when they need it—leaving uncooperative shippers in the cold.

The big, big numbers

At the end of the day, business logisticians can give themselves a pat on the back for driving down total U.S. business logistics costs six basis points from the previous year. Logistics costs amounted to $2.15 trillion last year, or a scant 7.85% of gross domestic product (GDP) compared to costs being 7.91% of GDP in 2014. The all-time low was during the Great Recession in 2009, when costs were 7.37% of GDP.

Although the new report doesn’t mention it, those percentages must be put in historical perspective to realize how efficient the U.S. freight logistics system has become in the deregulated era. In 1979, the last year before the Motor Carrier Act of 1980 economically deregulated the trucking industry, logistics costs were a whopping 19% of GDP.

Over the next decade, the report warns, the logistics industry will enter into a new era. Disruptive forces such as technology (Internet of Things, analytics, robotics and 3D printing) and operational constraints (regulations, driver shortages, and infrastructure bottlenecks) “will evolve at breakneck speed and threaten to fundamentally change the rules of the game.”

In the interim, those companies that build the skills to adapt to these disruptions will likely come out ahead, the report concludes, and that certainly jives with what top experts in the logistics field are already seeing in the market.

“Consumer expectations are changing,” says Marc Althen, president of Penske Logistics, one of the SoL report’s co-sponsors. “They want their products delivered fast, and they don’t want to pay a lot of money for delivery. Shippers are struggling to meet the challenges these expectations create, and many are turning to outside logistics companies for expertise and support.”

Amid these growing challenges, logistics managers appear to be doing a bang-up job of managing consumer demands, accessing additional capacity where needed, and navigating through the maze of new regulations affecting trucking and other modes.

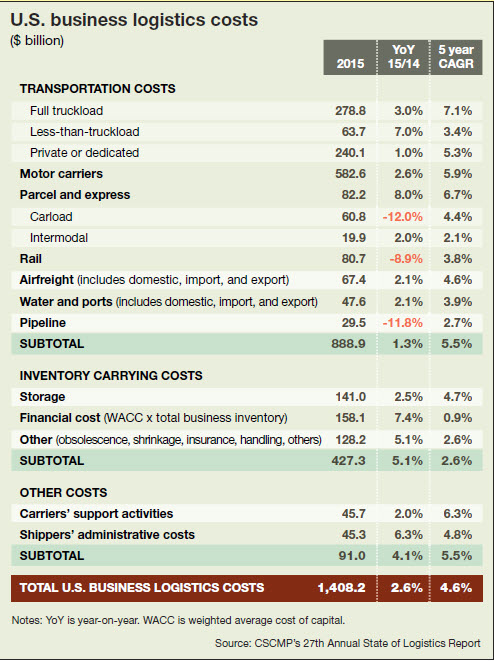

Transportation costs—the largest component of overall U.S. business logistics costs—grew by only 1.3 % last year to $888.9 billion. The largest component of that was trucking. Full truckload (TL) costs rose 3% to $278.8 billion, less-than-truckload (LTL) was up 7% to $63.7 billion, and private or dedicated trucking was up 1% to $240 billion. Overall motor carrier costs were up 2.6% to $582 billion, while parcel and express carriers jumped 8% to $82.2 billion.

Growth in trucking largely came at the expense of the rail industry. Softening demands for coal and exports resulted in an 8.9% drop in rail revenue to $80.7 billion last year. Airfreight (domestic and international) was up 2.1% to $67.4 billion, water rose 2.1% to $47.6 billion, and pipelines fell 11.8% to $29.5 billion, largely because of low crude oil prices. In the meantime, inventory and carrying costs jumped 5.1% to $427.3 billion and administration and other costs jumped 4.1% to $91 billion, according to the report.

“A closer look at the transportation cost numbers, though, suggests that 2015 may mark a turning point in the U.S. transportation bill,” say the authors. “Energy-sensitive transportation modes such as rail and pipeline saw decreased revenue, even as consumer-centric modes such as parcel and express and LTL accelerated their growth.”

Changes in inventory carrying costs may also “herald another shift in direction,” states the report. That’s because inventory costs are rising after a nearly decade-long period of falling interest rates. U.S. business inventories, which had been rising by 5% a year from 2009 to 2014, flattened out last year.

However, the stagnation in inventory growth was offset by a rise of 42 basis points in the weight average cost of cap¬ital, resulting in a 5.1% overall increase in inventory carrying costs last year.

Declining U.S. infrastructure was cited as a “critical” factor in continuing to improve the productivity of the logistics sector. Passage of the 2015 Fixing America’s Surface Transportation (FAST) Act “holds the promise of speeding the flow of logistics by investing in badly needed repairs and expanding infrastructure capacity at critical choke points,” say the report’s authors.

The FAST Act provides $305 billion in funding for surface transportation through 2020. Of that total, $226 billion will go to the Federal Highway Administration and 10% will be dedicated to rail, port, and intermodal projects. However, the FAST Act includes just $900 million per year to fund large, nationally significant freight projects, which experts say is pitifully low compared to the backlog of needs.

While the FAST Act is undoubtedly a major step forward, the report authors feel it falls well short of the more than $2 trillion that the American Society of Civil Engineers believes must be invested in surface transportation between now and 2025.

Modal highlights

As usual, trucking is the engine that drives the U.S. business logistics system. With $583 billion in revenue last year, it’s seven times the size of the U.S. rail industry, employing 7 million people—including 3 million hard-to-find long-haul drivers—and accounts for 48% of total freight expenditures.

But even as motor carriers enjoyed the lion’s share of freight, 2015 was a year of freight rate weakness, according to the SoL, and that has continued into 2016. In fact, the predominant characteristic of 2015 was overcapacity, which drove rates down after several years of rising prices. As we’ve reported, rates started off weak at the beginning of the year and declined steeply as the year progressed.

Carriers largely responded to this deteriorating environment by improving operational efficiency and holding back on fleet orders. However, slumping rates were not the only headwinds facing motor carriers. As the report reiterates, it’s becoming increasingly difficult and costly to recruit and retain truck drivers, as the labor market tightens, regulations become stricter, and the trucking lifestyle loses its appeal.

According to Truckstop.com, dry van spot market rates fell 15% last year—and they continued to fall in the early part of this year. In fact, the CASS Freight Payment Index confirms the declining rate trend, indicating that expenditures fell by 8.3% in the first quarter of 2016 while shipments dropped by just 4.9%.

According to the Bureau of Transportation Statistics, truck tonnage held steady in 2015 after a significant rise in 2014. The decline in rates, in this context, could be explained by the addition of capacity and the fact that trucking companies were pursuing lower-yield traffic such as intermodal and LTL traffic.

“Last year was a roller-coaster year for the trucking market, with good market conditions in the first half and a pretty soft second half,” says Stifel’s veteran trucking analyst John Larkin. “Contract rates held up throughout 2015 despite the soft second half of the year.

However, the softening supply/demand dynamic resulted in “significant downward pressure” on spot rates as the year progressed, adds Larkin. “However, there were many other headwinds in 2015, as inventories were high, the dollar was strong, and intermodal service quality recovered.”

Dedicated and private fleets were two of the few bright spots in the SoL report because of their high service records and the fact that they’re a primary growth area for many truckers. Similarly, the $82 billion parcel and express market enjoyed a boom year largely because of growth in e-com¬merce. FedEx ground services jumped 9%, and UPS ground gained 3%, according to the report.

At the 140,000 mile U.S. freight rail system, things weren’t as rosy. Largely due to plummeting coal volume, revenue fell 8.9% to $80 billion last year. Intermodal traffic “paused,” according to report, resulting in an overall rail volume reduction of 2.5%—a stark contrast to the 4.5% growth in 2014.

“The decline in coal carloads may be the most significant structural change for U.S. railroads since the passage of the 1980 Staggers Act that partially deregulated the industry,” says Matt Rose, executive chairman of BNSF Railway Co.

Similarly, airfreight demand was “sluggish,” according to the SoL, with domestic and import/export growth ringing in at just $67 billion last year. Using different methodology, the 2014 SoL report pegged airfreight and forwarder revenue at $71 billion.

“Not surprisingly, (air freight) rates are depressed,” conclude the authors. One example of how depressed: The Drewy Air Freight index reports that rates from Shanghai to Los Angeles plummeted 37% from January 2015 to January 2016.

Global load factors (percentage of cargo space filled by paid cargo) are at a seven year low of 41.9%, the International Air Transport Association reports. Within North America, the numbers are even lower: 34.2% in March 2016 as opposed to 37.4% just two years earlier.

And while it may not be entirely pretty long-term for shippers, those willing to do the footwork to become truly operational partners with their carriers stand the best chance of surviving this market in transition.