Six Supply Chain Strategies for Negotiating the Foreseeable Economic Downturn

Procurement and supply chain management executives need to ensure supply chain continuity, safeguard the viability of key suppliers and retain the ability to pivot and scale up production and business activity as we come through the current crisis and enter an eventual recovery.

Financial Crisis of 2007-2008

Early in the Financial Crisis of 2007-2008, we laid out six supply chain strategies to address unprecedented challenges.

Although circumstances are very different now, companies once again confront imminent recession, operational dislocation, and great uncertainty.

A March study released by the Institute for Supply Management found that 81% of U.S. companies expect their procurement operations to be affected by COVID-19.

And, 29% report that it will have a “moderate” to “severe” impact on operations for the rest of the year, while 40% say the impact is still “unknown.”

In our view, these results suggest many companies are underestimating the impact of COVID-19.

The pressure to reduce costs is escalating rapidly, but procurement and supply chain management groups also need to ensure supply chain continuity, safeguard the viability of key suppliers and retain the ability to pivot and scale up production and business activity as we come through the current crisis and enter recovery.

Below we reprise and update strategies we shared in 2007-2008 as a playbook for navigating turbulent times.

1. Revisit Supplier Agreements - Take a Collaborative Approach to Negotiations

Many companies are finding themselves saddled with supply contracts that have been rendered obsolete by abrupt changes in market conditions. We caution against what some companies are doing, namely, refusing to take delivery of contracted volumes and/or demanding price reductions. Rather, we suggest that companies systematically analyze their major supply contracts to determine if there is a legitimate basis for renegotiation and if so, engage negotiations in a collaborative fashion. For example, many current supplier contracts are based on peak commodity, material, and labor costs. Particularly when companies agreed to high pricing based on high supplier input costs, and markets where demand significantly exceeded supply, customers have a reasonable basis to open discussions with suppliers.

Acting with urgency and speed is critical. The longer customers and their key suppliers take to adjust, the more painful those adjustments will be - and the more limited the options will be for customers. Consider that the COVID-19 crisis began (unlike the Financial Crisis) as a supply-side disruption. Social distancing policies have now massively reduced economic activity, and we now see typical recessionary reductions in demand. But the third phase of disruption is coming. As many suppliers, especially small and medium-sized companies, go out of business, and many remaining suppliers reduce production capacity (shutting down plants and production lines, reducing shifts and furloughing workers), many customers will see an escalation in supply bottlenecks and shortages - even before the recovery begins.

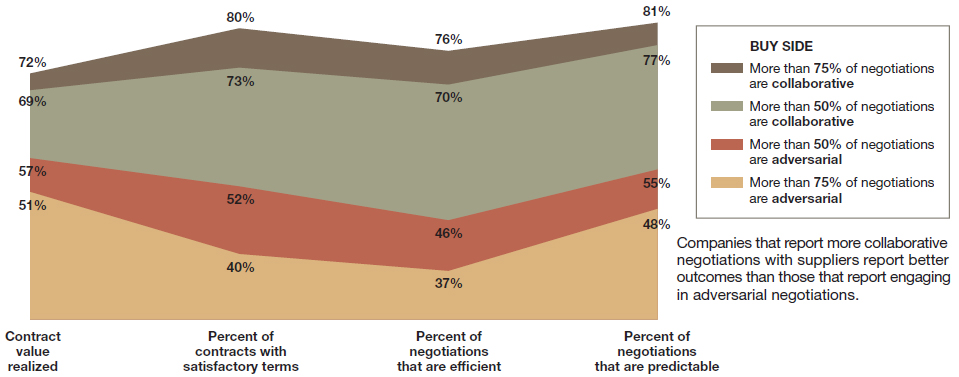

According to an April 8th poll we conducted in collaboration with the Institute of Supply Management, 64% of more than 300 respondents reported an increase in the renegotiation of contracts with suppliers, though only 8% reported “a great deal” of renegotiation activity as a result of COVID-19 and related economic dislocation. Based on our research and analysis of the Financial Crisis and recession, we believe many companies are underestimating the number of supply contracts they will need to negotiate, and are at risk of being disadvantaged in those negotiations by not taking urgent action to prepare for them and engage suppliers earlier - thereby creating more space to negotiate creative solutions with less time pressure. A collaborative approach to negotiations leads to better outcomes (see Figure 1). Sourcing and supply management groups that act quickly, and take a creative and collaborative approach to negotiations, can ensure that they are not put on allocation by key suppliers, even as their competitors are.

Figure 1: Collaborative versus Adversarial Negotiations

Source: Vantage Partners 2018 Customer-Supplier Negotiation Study

2. Assess and Act to Safeguard the Viability of Critical Suppliers

Regardless of what your company does, many of your suppliers will be facing significant price pressure and a reduction in demand from other customers. As important as cost reduction is in the current environment, minimizing avoidable revenue losses should also be a key priority. This means that procurement and supply chain management organizations need to place significant emphasis on identifying, and preempting or remediating, supply chain bottlenecks and breakdowns. They also need to ensure that quality and safety standards are not compromised as suppliers come under significant financial pressure and confront disrupted operations and their own supply chain challenges.

Companies that have already invested in creating transparent, high-trust relationships with suppliers, and that put in place supply chain risk monitoring systems, are already reaping benefits. Others must now redouble efforts to reassess risks within their supply base and work jointly with suppliers to develop and implement risk mitigation strategies. Those companies that have given their suppliers reason to distrust them will find this a difficult task. They are likely to experience costly supply chain disruptions as their suppliers try to protect themselves by hiding risks and problems, rather than collaborating on joint efforts to address them at the earliest sign of trouble.

As our own companies face significant financial pressures, making commitments and investments to support suppliers is not easy. Creative thinking is called for, and many options should be considered. For example, companies with strong cash-flows can accelerate payment to key suppliers that would otherwise need to make major cuts to operations and output. In addition, medium- and long-term purchase commitments to suppliers can sometimes be leveraged by those suppliers to secure loans. There are also opportunities to purchase commodities or parts for suppliers at a lower cost than they can do so on their own. In some cases, there is a compelling business case to make equity investments in critical suppliers, acquire them outright or acquire portions of a key supplier’s business. These ideas are further explored below.

3. Streamline Your Supply Chain

A company’s supply chain is only as strong as the weakest link, and current economic conditions put disproportionate pressure on weaker suppliers. During periods of growth, many companies find themselves moving too fast to carefully analyze their supply chains and eliminate suppliers that add little value or introduce unnecessary risk. Now is the time to scrutinize distributors and brokers, and aggressively pursue dis-intermediation. While intermediary links in the supply chain provide convenience and (perhaps) increased speed to market in good times, there are three key (interrelated) reasons to subject such suppliers to a high degree of scrutiny.

- They introduce an extra layer of cost: When your company was scrambling to keep components coming in the door to meet your customers’ orders, benefits may have outweighed the costs; but now is the time to explore efficiencies through better direct linkage with original equipment manufacturer (OEM) suppliers.

- They complicate and often distort communication between a company and its key OEM suppliers: That often compromises effective demand and capacity planning, thus introducing further cost and supply continuity risk.

- They limit the ability of a company to build partnerships with key OEM suppliers, which in turn limits the ability to creatively reduce costs through specification implication or redesign, materials changes, and enhanced joint forecast and demand management.

4. Enhance Cross Supply Chain Collaboration

During this new season of uncertainty and economic contraction, some companies will quickly react by squeezing suppliers and/or shifting risk onto them, rather than working with partners across the supply chain to collectively reduce total costs and reduce the risk for the entire extended value chain. Forward-looking companies are using the economic downturn to engage suppliers in innovative efforts to achieve cost savings while safeguarding supplier viability - often by forging new links of collaboration across multiple nodes in the supply chain.

Significant opportunities can often be found when companies bring together Tier 1 suppliers along with critical upstream suppliers of raw materials or commodity components. In some cases, significant risks exist because OEMs are critically dependent on certain raw materials (e.g., platinum, nickel, copper, various reagents and reactants) - often purchased in relatively small amounts. Opportunities exist for companies to purchase critical raw materials and basic components, (leveraging spend across multiple categories) and supply them to OEM suppliers, thus reducing cost and risk in a mutually beneficial manner.

Another example: As shipping and logistics capacity has been severely reduced, some companies can provide access and attractive pricing to their suppliers under their own shipping contracts, or access to their own logistics expertise and warehouse capacity. Such arrangements are often complex (and negotiating them is not simple), but they can often produce significant cost savings and risk reduction in the short term and set the stage for even greater benefits coming out of an economic downturn.

5. Focus on Collaborative Innovation

Research that we have conducted over the last two years shows that companies that focus on leveraging external assets and capabilities of suppliers and business partners have experienced significantly higher growth than companies that rely primarily on their own assets and capabilities. Indeed, the top quartile of companies we analyzed (in terms of leveraging external assets and capabilities) generated 285% greater revenue growth compared to the average from 2014-2018.

Recent examples abound of companies acting with striking urgency and flexibility to innovate in response to the current crisis. Dyson (best know for its vacuum cleaners) designed the CoVent ventilator in 10 days in collaboration with TPP. Ford worked with Detroit area hospitals, the University of Wisconsin, and suppliers to rapidly develop and manufacture a new intubation splatter shield - moving from initial work on the design to products in hospitals for testing in a week.

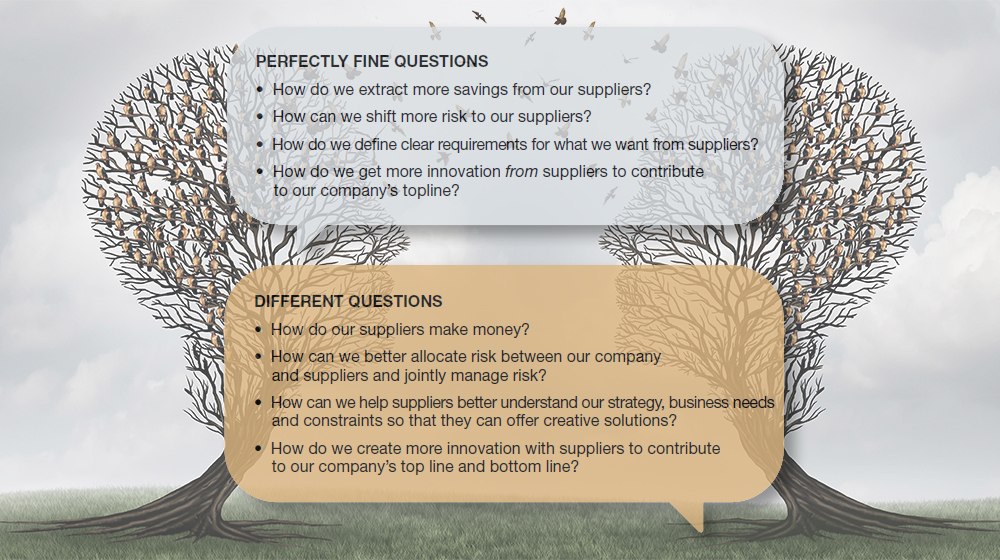

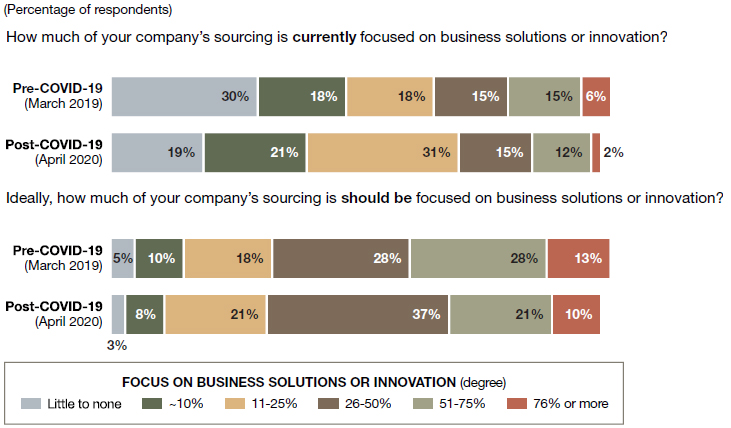

Most supply management professionals see the value in sourcing business solutions and innovation (versus products and discrete services) and believe their companies should do much more. However, there is, and has been, a large gap between those aspirations and reality (see Figure 2).

Figure 2: Comparison of pre- and post-COVID-19 Sourcing Focus

Source: (Pre-COVID) 40 respondents to poll in Vantage Partners-ISM “Future of Sourcing” webinar, March 19, 2019, | (COVID) 185 respondents to a poll in Vantage Partners-ISM “Sourcing Innovation” webinar, April 9, 2020

What’s fundamentally different about sourcing solutions or innovation? It requires more information-sharing and transparency with suppliers. Rather than figure out internally how to reduce costs or overcome supply chain bottlenecks and then ask a supplier to propose how they would implement your solution, you explain the problem and ask for their creative ideas on how to address it. Sourcing innovation requires bringing technical and commercial people, from both customer and supplier, together to identify and explore cost reduction and risk mitigation opportunities. Joint ideation sessions and customer-supplier hackathons need to augment or replace, traditional RFx processes. Asking different questions is required to find new and innovative solutions (see Figure 3).

Figure 3: To Get More Value from Suppliers, We Need to Ask Different Questions

Source: Vantage Partners, LLC

6. Become a “Customer of Choice”

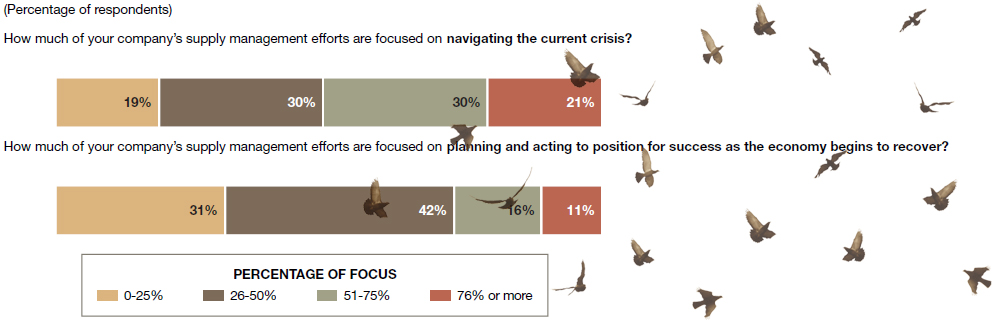

While each company confronts a unique set of trade-offs between navigating immediate challenges and addressing longer-term opportunities (see Figure 4 for recent data on how companies are striking this balance), becoming a “customer of choice” with key suppliers is equally valuable in good times and bad.

Our research indicates that companies that are seen as easier to do business with and more collaborative are 29 times(!) more likely to get the best people, pricing, and ideas from suppliers.

Buy-side respondents that put a high priority on creating a foundation of mutual trust, understanding, and respect with suppliers also report realizing 24% more of the value from their supply contracts compared to those companies that place a low priority on building and maintaining collaborative relationships.

Figure 4: Supply Management Focus, in light of COVID-19

Source: 156 respondents to a poll in Vantage Partners-ISM “Sourcing Innovation” webinar, April 9, 20200

Companies face a window of opportunity during which they might be able to lock in supplier pricing that will provide a cost-advantage as the economy recovers, while simultaneously cementing preferred relationships with key suppliers.

As companies seek elusive optimality between supply chain efficiency and resiliency, collaborative relationships with key suppliers offer a way to do both, while avoiding painful and unnecessary trade-offs.

About the Author

Jonathan Hughes is a partner at Vantage Partners, where his practice focuses on business strategy and organizational transformation. He has worked with leading companies and state-owned enterprises across a range of industries in North and South America, Europe, Asia, Australia, and Africa, with particular focus on developing and implementing new strategies that leverage enhanced collaboration – across internal organizational boundaries, and with external business partners. Hughes can be reached at [email protected].

Related Article: Enhance the Value of Your Supply Chain Supplier Relationships

Related White Papers

Supply Chain Lessons Learned from The Coronavirus and SARS Outbreaks

This white paper contains insights from recent interviews with leading organizations on how they are responding to the new coronavirus crisis.. Download Now!

Supplier Management: The Best-in-Class Approach to Drive Performance

This report examines the comprehensive approach, taken by the Best-in-Class, toward Supplier Management, and begins with supplier selection, followed by establishing and measuring key performance metrics and ends with focusing on visibility with their suppliers to ensure ongoing success. Download Now!

Avetta's Auditing Service Accelerates Screening Process for Qualified Contractors

This case study shows how with the Avetta network, DocuGUARD, AuditGUARD, and InsureGUARD, Vertical Limit improved search efficiency by over 50% with instant access to thousands of contractors across the U.S., and reduced supply chain risk with in-depth supplier audits and verification of contractor safety compliance and insurance. Download Now!

Unpacking Sourcing Business Models: 21st Century Solutions for Sourcing Services

This white paper is a collaborative effort among the University of Tennessee, the Sourcing Industry Group, the Center for Outsourcing Research and Education, the International Association for Contracts and Commercial Management, and was the inspiration for the 2015 book, Strategic Sourcing in the New Economy: Harnessing the Potential of Sourcing Business Models in Modern Procurement. Download Now!

More Avetta Resources

Article Topics

Avetta News & Resources

Compliance Risk: A Significant Impediment to the Modern Supply Chain Protecting Supply Chains Against Economic Uncertainty Supplier Classification: A Differentiator in the Modern Supply Chain Landscape New Cybersecurity Requirements Needed for Supply Chains Building End-to-End Risk Resiliency in Supply Chains Supply Chain 2030: Evolving Challenges, Opportunities and Technological Possibilities Extending ESG Best Practices Into the Supply Chain More AvettaLatest in Supply Chain

Spotlight Startup: Cart.com Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants Apple Overtaken as World’s Largest Phone Seller More Supply Chain