Shippers Wait for Impact of FedEx Ground Pricing Changes and Next Move for UPS

Jerry Hempstead, president of parcel consultancy Hempstead Consulting, said that last month’s announcement regarding changes in FedEx Ground’s pricing is a huge change, which he has been predicting for several years.

When FedEx announced pricing changes for its FedEx Ground services last month, many industry observers made quick note of the fact that it was a game changer, or at least has the potential to be although not necessarily for the better for shippers.

For FedEx Ground, the company said that effective January 1, 2015, it will apply dimensional weight pricing to all shipments moved via FedEx Ground, as opposed to its current method of applying dimensional weight pricing to packages that measure three cubic feet or more.

FedEx defines dimensional weight pricing as “a common industry practice that sets the transportation price based on package volume–the amount of space a package occupies in relation to its actual weight.” Company officials said that this change will align the FedEx Ground dimensional weight pricing with FedEx Express by applying it to all packages.

Dimensional weight pricing has seen its share of changes from FedEx and its main competitor, UPS, in recent years. When FedEx and UPS announced rate changes for 2011 in late 2010, they both announced they would be implementing a change to the dimensional weight volumetric divisor, which is used to tally the amount of space allocated to a specific shipment.

It is derived by multiplying a shipments length, width, and height, and then dividing that figure by its weight and then dividing it by 166, with the shipper being charged the greater of the result of the actual weight or the dimensional weight as determined by the aforementioned formula.

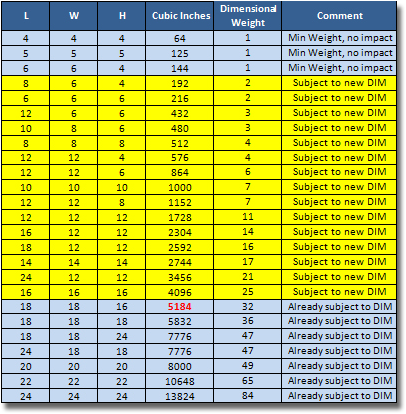

The table shows the new dimensional weight calculations applied to the 25 most common box sizes sold in the U.S. The first three box sizes result in a dimensional weight of 1 pound – the absolute minimum weight – and therefore are not impacted by the change. However, the next fifteen box sizes (highlighted in yellow) will be subject to the new dimensional policy in 2015. The remaining seven box sizes – those at or above 5184 cubic inches – are already impacted by the current dimensional rate calculation, and as such are not incrementally impacted by the announced change.

If your company ships FedEx Ground or FedEx Home Delivery using any of the box sizes highlighted in yellow, you are facing a major rate increase. The annual financial impact is well into the hundreds of millions, and that’s just FedEx. The big question is: will UPS follow suit?

Source: Rob Martinez, Shipware | 3 Steps to Adjust to Major FedEx Rate Increase

Jerry Hempstead, president of Orlando, Florida-based parcel consultancy Hempstead Consulting, said that last month’s announcement regarding changes in FedEx Ground’s pricing is a huge change, which he has been predicting for several years.

Until this change, he said shippers essentially benefitted from transactions of 3 cubic feet or less.

“Say you put 5 pounds in a box that is 3 cubic feet,” he said. “Today you get charged for 5 pounds, and January 1 you get charged for 32 pounds. Now it’s May of 2014 and the change is effective January 1, 2015. [There is] plenty of time to telegraph to their competitors that they, too, need to implement this change…because if it’s not adopted by, say, UPS then most every major shipper needs to start working on a switch of their ground carrier. My take is that this change results in such massive incremental revenue and is pure profit, ad FedEx is doing no additional work or adding any additional service to justify this enormous cost increase. This is horrible news for shippers. Hopefully they have language in their contracts to mitigate or postpone this pain.”

Taking that example a step further Hempstead explained that a 12”x”12”x12” box is one cubic foot or 1,728 cubic inches, and one cubic foot or its equivalent of 1,728 cubic inches would result in a dimensional weight determined by dividing 166 per the current FedEx formula (the divisor for international shipments is 139).

The changes in pricing at FedEx Ground were also considered noteworthy by Jaris Briski, General Manager of Integrated Parcel Solutions for Pittsburgh-based 3PL GENCO.

“We view this as a significant change that could unbelievably impact shippers if they are not either familiar with the surcharge and/or calculation or the unit of change that occurred,” he said. “There are still many shippers that are not as fully aware of this as they could be. We have done analysis of this for our customers, and the impact could be as much as a 30 percent of shippers’ packages which is for an average shipper. If the shipper has packages that are low weight but in large boxes the impact is even more. We are keen on how to help shippers address this.”

Briski said that for its customers that are not FedEx shippers and are wondering what UPS will do, as there is now a disparity for certain package characteristics between FedEx and UPS that he said GENCO is quantifying for customers and seeing what the impact would be were UPS to make the change as well.

GENCO is advising customers that there are five steps they should take:

- They need to get into the details and understand how the surcharge works by calculation and how it applies;

- They need to go through a comprehensive analysis on their packages at the package level detail and assess the landed costs difference between what is in place today and what will be in place in January, when the change for FedEx takes effect, and if they ship UPS they could do the calculations to see what the impact would be in what can be a complex analysis;

- Once they have done an analysis, he said they need to look at the current contract to identify contract levers that need to be addressed in order to mitigate and realize this impact and should allow a shipper to quantify the impact on any adjustments within the levers of the contract;

- When necessary shippers need to go back to their carriers to understand what latitude they can get in their current agreement and/or learn what alternatives they might have for surcharges to this degree; and

- They need to do an analysis whether it be monthly/quarterly/periodically to ensure once changes happen in January they understand the true impact and more appropriately get some guidance from a third party on how to address it and mitigate and minimize the impact.

As for what UPS will do in response to the pending FedEx Ground pricing changes, Briski surmised it will likely follow suite as the opportunity to gain additional revenue will outweigh the opportunity of having a competitive advantage over FedEx.

“Historically, they move primarily in lockstep with each other when it comes to this,” he noted.

And Hempstead said that traditionally UPS has always made its parcel pricing changes known at the same time-for ground, air, domestic, and international-in late November or early December, depending on the implementation date so as to give shippers 30 days advance notice.

“I don’t think that they would ever want to put themselves in a place where someone can take a shot and say ‘FedEx announces on Friday and UPS follows suit on Monday.’ UPS sees itself as a leader, not a follower,” said Hempstead.

From the perspective of UPS, Hempstead said they recognize there is a lot of money on the table if it implement the same pricing change, and then shippers do not have a recourse to go to another carrier like FedEx to avoid the pain and then it goes ahead and does the programming and planning to implement the change in January but not announce it until November. What’s more, he said they would decide to provide and exemption for two cubic feet or one cubic foot as a way to have apparent compassion for shippers.

Update: UPS Rolls Out Dimensional Pricing Changes Effective December 2014