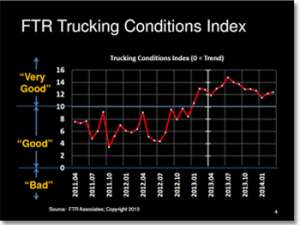

Shippers Condition Index Points to Ongoing Tough Market Conditions for Shippers

While truck capacity hasn't been as bad as we saw during last winter, it has remained tight and, as a consequence, rates have been elevated throughout the year.

The ongoing themes of tight capacity and carrier pricing power are still in full effect, much to the dismay of shippers, based on the most recent edition of the Shippers Condition Index (SCI) from freight transportation forecasting firm FTR .

FTR describes the SCI as an indicator that sums up all market influences that affect shippers, with a reading above zero being favorable and a reading below zero being unfavorable and a “less-than-ideal environment for shippers.”

For the month of September, which is the most recent month for which data is available, the SCI was -6.6, which is in line with the -6.6 recorded in October.

FTR officials said that this SCI level continues to mirror current market conditions in the form of capacity shortages that it said “degrades service and push rates higher.” What’s more, the firm added that with sustained capacity tightness and fleets now announcing pay increases, the cost to ship goods is expected to remain elevated.

And the typical slowdown in freight tonnage during the winter months will only offer a minor and short term reprieve with the Shippers Conditions Index expected to remain in the current range for the foreseeable future, according to FTR.

“While truck capacity hasn’t been as bad as we saw during last winter, it has remained tight and, as a consequence, rates have been elevated throughout the year,” said Jonathan Starks, FTR’s Director of Transportation Analysis, in a statement. “Recently, concern has moved from capacity on the roads, to problems at the ports. We are seeing potential impacts to retailers’ Black Friday plans because of the port congestion.

To add to the troubles, importers are getting hit with surcharges at the ports. They are dealing with delays in getting goods and additional costs on top of that. If a resolution of the west coast labor dispute or a winter slowdown in freight doesn’t ease the situation, we could have a very tough operating environment in early 2015 for those that are dependent on those ports.”

Starks added that motor carriers are feeling bullish about getting continued favorable pricing into 2015, citing how October truck orders eclipsed 45,000 units, which is the second highest monthly total ever recorded.

But he cautioned that this increase in orders likely won’t majorly alter the supply and demand balance, as the market is likely to soften in early 2015, unless there is another harsh winter like 2013-2014. Either way, he said shippers must be ready to deal with another year of capacity and rate pressures, regardless of which mode they use to move freight.

Related: Intermodal Service Issues Persist But Conditions Are Slowly Improving, Say Carriers and Analysts

Other challenges shippers are still dealing with are the impact of the ongoing driver shortage, which has seen a higher focus on securing capacity by whatever means possible, whether it is through the spot market or using dedicated contract services or private fleet options.

And the regulatory drag of HOS and CSA also is continuing to impact production and capacity, too. On the rail and intermodal side, service metrics are not back to levels which shippers are fully comfortable with, but it appears that service is improving back to expected levels at a gradual rate.

Related: Need Truckload Carrier Capacity? Diversify

Article Topics

FTR Associates News & Resources

FTR’s Shippers Conditions Index Drops in June Trucking Conditions Index Hits Lowest Point Since November 2022 FTR’s Eric Starks Takes a Look at the State of the Freight Economy FTR’s Tranausky Provides Overview of Freight Railroad and Intermodal Markets Trucking Market Overview With FTR’s Avery Vise Upcoming trade shows and seminars to address concerns about tariffs and trade The State of the Rail/Intermodal Markets More FTR AssociatesLatest in Transportation

Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More TransportationAbout the Author