SCM Races into the Cloud

As Cloud computing morphs into a $216 billion market over the next four years, an increasing number of supply chain management applications—and their users—are making the move from enterprise based software to Cloud-centric platforms.

As one of the most disruptive information technology (IT) forces to hit the computing world since the very early days of the digital age, Cloud computing is expected to spur more than $1 trillion in overall IT spending over the next four years, according to Gartner.

As such spending steadily shifts from traditional, enterprise offerings to Cloud services, the latter is expected to bring in $216 billion in 2020—up from $111 billion this year. That represents a nearly 100% increase across the platform as a service (PaaS), infrastructure as a service (IaaS) and software as

a service (SaaS) sectors.

Combined, these three deployment models have become increasingly popular within a computing style that Gartner defines as an environment in which “scalable and elastic IT-enabled capabilities are delivered as a service” using the Web.

“As organizations pursue a new IT architecture and operating philosophy, they become prepared for new opportunities in digital business, including next-generation IT solutions such as the Internet of Things (IoT),” says Ed Anderson, Gartner’s research vice president. “Furthermore, organizations embracing dynamic, Cloud-based operating models position themselves better for cost optimization and increased competitiveness.”

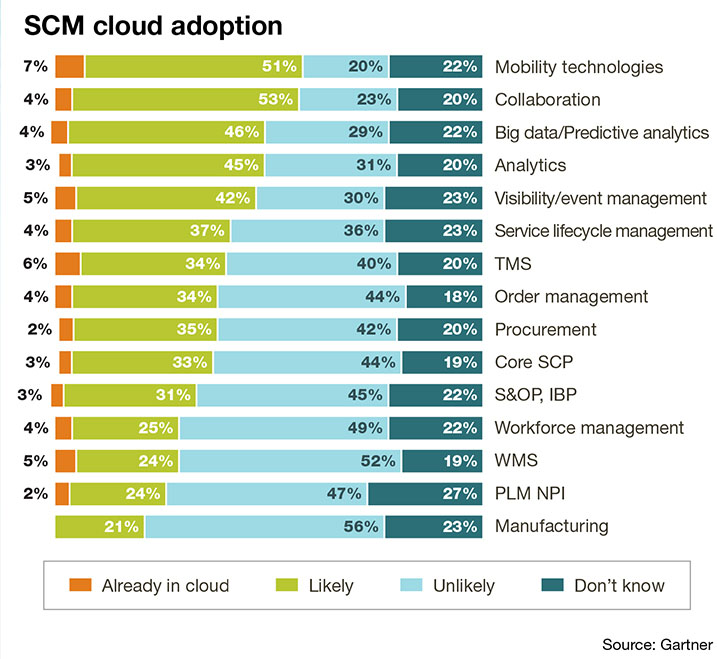

Eager to leverage benefits like cost optimization, easy and fast deployment, and increased competitiveness, logistics operations of all sizes and across most industries have been adopting more and more Cloud-based supply chain management (SCM) software. In fact, what started out as a particularly efficient way to deploy and use transportation management systems (TMS) has since moved into nearly all other sectors of SCM.

In response to this trend, a growing number of vendors have answered the call by developing Cloud-based warehouse management systems (WMS), global trade management systems (GTM), yard management systems (YMS) and various other SCM applications. Over the next few pages, we’ll explore the growth of SCM in the Cloud, highlight some of the new and upcoming developments of interest to shippers, and see how one company is benefitting from its move to a Cloud-based TMS.

From on-premise to the Cloud

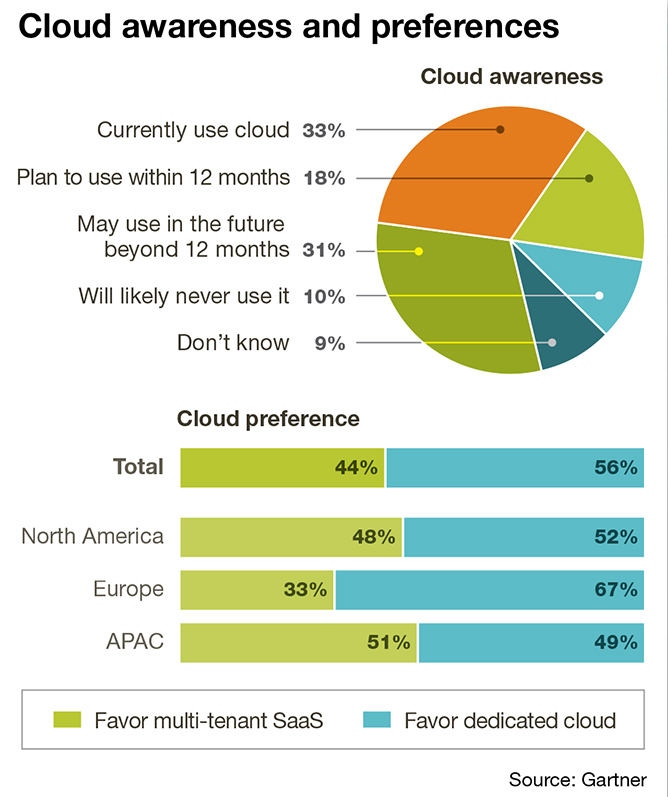

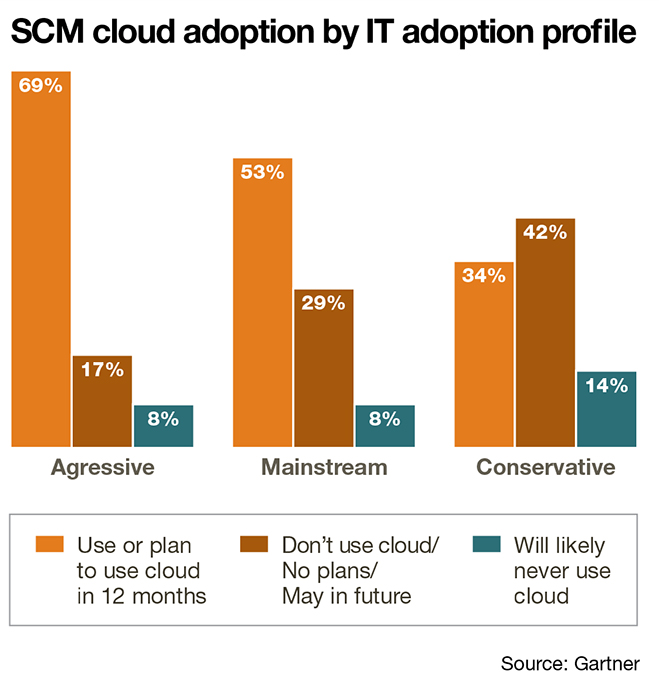

Dwight Klappich, Gartner’s research vice president, has been keeping a close eye over the transition from on-premise and managed SCM to those applications that are hosted in the private, hybrid or public Cloud. Right now, he says that about 33% of companies are using the Cloud, while 18% plan to use it within the next 12 months and another 31% saying that they may use it in the future—beyond 12 months.

For the more than 80% of logistics professionals that are either already using or considering Cloud-based applications, 56% say that the decision is driven by the fact that the software is easier and faster to deploy than traditional models. Another 51% of shippers say that they’re attracted to Cloud’s lower total cost of ownership (TCO) opportunity, 45% say that the capital expense is lower, and 25% credit their own companies’ lack of IT expertise with driving their Cloud-based initiatives.

Klappich adds that a growing number of shippers are changing their IT strategies and moving once-private Cloud platforms out into the public Cloud. He breaks that public Cloud into two categories: dedicated and multi-tenant.

The former finds vendors running a single instance of the WMS for every customer, while the latter involves multiple logistics operations all using the same instance of the software. For the most part, Klappich says that the lines between these two options are blurring. “The shipper doesn’t necessarily see the difference between dedicated and multi-tenant on a day-to-day basis,” he points out, noting that in North America roughly 50% of logistics professionals favor dedicated options, while 50% like multi-tenant.

The bottom line, says Klappich, is that demand for SCM is increasing and the “needle is pretty much on the Cloud side right now.” He sees TMS, GTM and sourcing/procurement as the applications that are leading the charge, adding that the vast majority of new deals for those platforms are Cloud-based right now.

And while Cloud is still a “newer phenomenon” in WMS, order management, supply chain planning and vehicle routing/scheduling arenas, he says that these and other sectors are also moving away from on-premise models.

Robert Hood, a principal at consulting firm Capgemini, says that TMS vendors, in particular, are being “pushed hard into the Cloud” right now by their customers. “In fact, many of those vendors are reluctant—if not completely resistant—to deploying on-premise applications,” says Hood. “On the WMS side, that’s not so much the case.”

For the WMS users, applications are real-time with heavy user interface and either voice or radio frequency. “There’s also materials handling equipment to consider and concerns about latency and performance,” adds Hood. “As a result, we’re not seeing much adoption of Cloud deployment models from traditional, on-premise providers like JDA and Manhattan.”

Taking the good with the bad

According to Gartner, there are still a few issues holding companies back from using Cloud-based platforms.

Forty-six percent say security concerns outweigh the benefits of using the Cloud, for example, while 34% say IT management doesn’t support the options. Another 28% of respondents are satisfied with their current on-premise solutions, and 22% say regulations prohibit the use of off-site data storage. Performance and downtime concerns and the fact that they are “locked in” by their current solutions were other concerns shippers mentioned.

Klappich says that in most cases, companies with risk averse cultures tend to be most ambivalent about using the Cloud. “I think there’s going to be a certain set of logistics operations hanging onto these issues, because culture is as much a determinant of Cloud adoption as anything else,” he notes, adding that most security breaches that have taken place over the last few years have been conducted behind a firewall, and not out in the Cloud. “At this point, evidence suggests that the vendors’ security is no worse than people’s own security,” he says.

Tom Cassell, vice president and supply chain solutions leader at Capgemini, observes that the issues holding shippers back from using Cloud-based software tend to be more a matter of perception than reality. “Ninety-nine percent of the time, the security models that vendors are using are much better than any shipper probably has,” he says. “When you think about it in that light, the whole security issue becomes much more palatable.”

Challenges aside, Cassell expects Cloud adoption in SCM to continue down its current growth path. In fact, he sees a particularly large opportunity in the small- to mid-sized business (SMB) segment, which has historically steered clear of complicated IT landscapes and huge enterprise systems that aren’t always easy to alter, upgrade or replace.

“For larger firms, carving out a piece of IT infrastructure can be complex, but SMBs don’t generally face those issues,” says Cassell. “Instead, they can quickly and economically build out SCM capabilities and start driving value very quickly. That’s going to be the hottest growth area for Cloud.”