Redesign to Improve Value: A Case Study of a Supply Chain Leader

While other analysts may put the vendors into a four-square evaluation model and declare it magic, I think that this approach does a disservice to the industry.

This week, I will speak at Llamasoft’s conference on improving supply chain network design.

I am also busy this Saturday writing reports for our Tuesday newsletter. One of the reports that I am writing is on the state of Supply Chain Planning (SCP).

While other analysts may put the vendors into a four-square evaluation model and declare it magic, I think that this approach does a disservice to the industry.

Why do I feel this way?

The SCP market is a fruit basket of vendors with very different capabilities. It cannot be adequately equated in a four-box model. The capabilities are just too different. (Bear with me on this rant. This old gal has built hundreds of four-box models in her decade of being an analyst.)

By and large, no one is happy with SCP as it exists today.

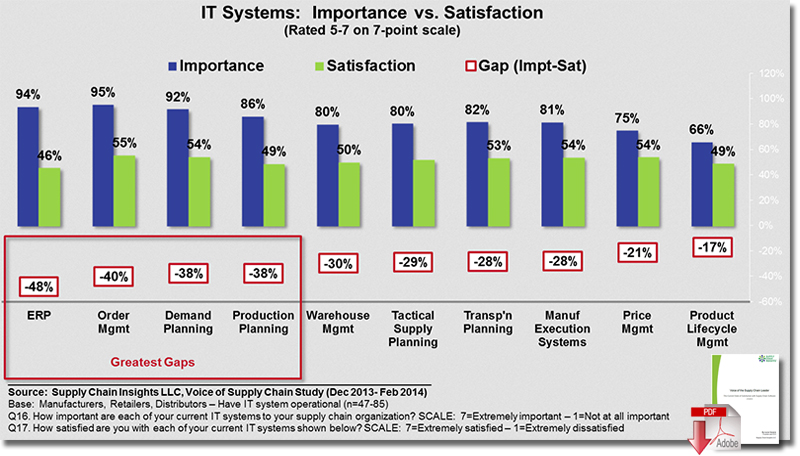

In the recent study of the Voice of the Supply Chain Leader, we find that the gaps are large, and growing.

As shown in Figure 1, the gaps with the major categories of supply chain planning are great.

Figure 1. Current Levels of Satisfaction

I recently presented this slide to a group of consultants, and a person that I love in the audience raised his hand and said, “Lora, let’s just face it. No one likes what we have today. This slide supports that what we have today just sucks. What can we do about it?”

My advice to him, and to all my readers, is to focus on what drives value. The gaps in our technologies are a barrier, but should not stop us from redesigning to improve performance.

While innovation has slowed in Enterprise Resource Planning (ERP) and Supply Chain Planning, I am bullish about some of the innovation coming from the supply chain network design technology providers like JDA, Llamasoft and Solvoyo. These tools are now enabling new capabilities to make trade-offs between volume and cost while helping companies to redesign flows and decoupling points. I also think that Quintiq’s leadership in concurrent planning to solve new problems is promising, especially in the design of transportation and inventory flows.

Interview of a Supply Chain Leader: Redesigning for Value

While technology is both an enabler and a current barrier, for me, the journey is less about technology and more about leadership.

One of my favorite interviews on this topic, that I recently completed for my upcoming book Metrics That Matter, was with Amway’s Chief Supply Chain Officer George Calvert.

George is the head of operations for the direct-selling leader of health, beauty and home care products.

They had just implemented a number of changes, and were proud of their progress.

Here are some interview excerpts:

Tell me about yourself.

My path into managing operations is different than most because of my background in chemistry.

The path I took came through R&D where I had many different roles including R&D management and quality assurance.

When my boss retired, I took over the combined functions of R&D and supply chain operations. You don’t often see R&D and operations together, but for me it is a perfect fit.

My skill set is really more focused on pattern recognition, and operations is a numbers-based business, making that easy to do in Supply Chain. I look at patterns to construct business models to deliver both on efficiency and effectiveness.

What have you learned?

Before we took on the supply chain redesign, we had a whole series of ideas that we thought we should be doing. When we started, we developed this big list of ideas on things that we could do. Turns out many of the ideas were wrong because they were not based in fact, just perceptions.

It wasn’t that easy. In researching the ideas, like moving a business to the point of sale, we discovered that the base numbers of the business revealed new strategies. For example, we discovered that transportation and duties are 5x the expense of labor and overhead. This is a very different mix of inputs than the garment industry where labor would be a major driver. The opportunity was in reducing the transportation and duty cost, not in moving to low-cost labor markets.

In prestige beauty and nutritional supplements, the cost to ship the product is minuscule. The product is light, compact, and high value. However, this is a different story in home care where an item is mostly water. As a result, we had to analyze what the drivers were of the supply chain cost. And what the opportunities were by business line that were unique to our model.

We found that in addition to each country’s nuances, each business line had specific requirements. For example, people want prestige beauty from the US, Europe or Japan. Customers are not looking for prestige beauty from the emerging economies. Take another example – few people know where their TV was made, but the buyer cares greatly about the reliability of that product. Product reliability, in the case of durable goods, is the driving factor for product satisfaction. So, when you are designing your supply chain, it is just as important to analyze distribution costs, material variability, and the costs of labor, along with the perception that the consumer has with the country of origin. Through this analysis, you are able to develop an effective and efficient supply chain.

How did you redesign to improve value?

It took six to nine months to look at the numbers. To do this, great modeling is critical. The strength of your decisions is directly dependent on having accurate data going in. For example, we produce in Vietnam and China. We produce there because the regulations say that you need to manufacture there to sell there. Vietnam is a low-cost market to produce products. Our factory is efficient; yet, it costs us more to manufacture the product in Vietnam because of a lack of local raw materials – compared to manufacturing it in the US, shipping it, and paying duties on a landed basis. You have to have a model that helps you to see the interrelationships. Free Trade agreements also matter. In our business, there is not one lever, there are 20 levers.

Our operations serve the globe. We are in 100 countries and territories around the world. Our activities are broad. We are engaged in everything from raising crops to making home deliveries.

Service level is our most important metric. If someone is building an Amway business, they may choose to primarily focus on selling water treatment systems. If we do not have them in stock and available, that Amway Business Owner is out of business. We must be responsive to demand, and be diligent to reduce demand interruptions. We must also have a consistent supply of quality product. As a result, our focus is to make it right the first time. Reliability in both of these metrics is critical.

Most companies inherit supply chains. To a great extent, we inherited the supply chain that we had. When we got into it, some things did not make sense. If you are not going to add value, why do it yourself? The question we always asked was, “Why?” For example, we made our own corrugated packaging. The equipment was 20 years old. It did not make sense, so we outsourced it and focused our efforts on what we are good at – nutrition, beauty and home/personal care products.

We invested, where it made sense. We grow and process many of our own crops. Our investment focus shifted to getting the right seed, controlling the planting, and ensuring quality conversion all the way through finished products. We have three large-scale farms heavily invested in the production of botanicals and an ongoing $332 million manufacturing expansion supporting the many new nutrition plants needed to support our growth.

What suggestions do you have for others?

Communication to the work teams is critical. Go slow and be clear. Don’t expect that something that took you nine months to figure out is going to be effectively communicated in one meeting. It has to be communicated in the right way. Our restructuring of operations meant a lot of communication. We believe in transparency, and we told people why we were making the decision, and shared the drivers. We were going to invest where it made sense.

My second suggestion to other supply chain leaders is to seek to understand your model and the fundamental drivers of your supply chain. Find out what it is. Is it labor? Is it duties, or is it transportation? Actively define both efficiency and effectiveness.

We started with consultants, but we kicked them out after a few days. I trusted my team to know the business. Collecting the data is not easy. I suspect that many companies have great capabilities to get data, but we did not. We spent the time to overcome our data challenges. We made better decisions doing it ourselves because we know the business. We were not impatient. We asked ourselves hard questions. I think that our results are better because of it.

Summary

I love George’s wisdom in this interview. I especially value his quote, “Communication to the work teams is critical. Go slow and be clear. Don’t expect that something that took you nine months to figure out is going to be effectively communicated in one meeting.” When he said that in the interview, I softly whispered, “Amen” under my breath.

In closing, I want to thank all of my readers for their help during my 2 1/2 year journey as the founder of Supply Chain Insights. On this Saturday, I will write our 45th report, and ready all of our blogs for our monthly newsletter. It is a monthly cadence of working on what we hope you believe is insightful research. It is never pay-for-play, and it is always available for you, and your teams, in front of the firewall. We believe that research should be actionable, independent, and accessible.

It is a process where you give to us and we give back to you. In the process, we keep all of our responses and contacts confidential. Interviews like this one with George Calvert are based on a detailed process of interviews, edits and approvals. We do not take this process lightly. We value the input and support of supply chain leaders. We want to give supply chain leaders a voice through our webcasts, blogs and podcasts. (We now have 95 podcasts available through iTunes and Stitcher.)

We are on countdown for our Global Summit of 230 supply chain leaders that is limited to 15% attendance of technology and consulting providers. It is designed for supply chain leaders to network with supply chain leaders. It is deliberately located at the Phoenician to enable the networking in a beautiful place where you can hike, golf and even complete a 5K with other supply chain leaders.

During the countdown for the Summit, we are completing research studies on Big Data Analytics, Supply Chain Talent, Supply Chain Planning, and Digital Manufacturing. If you complete one of our surveys, we will share the results with you and your team in a one hour call.

We are also releasing the work that we are doing on the Supply Chain Index in a series of reports and webinars. It is a methodology that is applicable to all public companies to judge supply chain improvement against peers. We think that the definition of a measuring stick is important. In the countdown for the summer, we will be getting your input to understand which supply chains have made the most progress for the period of 2009-2012. In the spirit of open research, as we learn, we share it with you. We would love to hear from you on the methodology.

This week, I will be in Chicago on Monday and Ann Arbor at the end of the week. Next week, it will be time in New York. I would love to catch up and hear your thoughts on what we are doing. Until next time….

About the Author

Lora Cecere is the Founder and CEO of Supply Chain Insights, the research firm that’s paving new directions in building thought-leading supply chain research. She is also the author of the enterprise software blog Supply Chain Shaman. The blog focuses on the use of enterprise applications to drive supply chain excellence. Her book, Bricks Matter, published in December of 2012.