Raytheon’s Supplier Relationship Management

Raytheon is on a mission to be the Customer of Choice and earn preferential treatment from its suppliers, and to get there, the defense contractor is looking to a Supplier Advisory Council for advice, ideas, and innovation.

In early May of 2014, senior executives from Raytheon’s Integrated Defense Systems (IDS) business met with senior executives from 13 key Raytheon suppliers at a hotel near Boston’s Logan Airport.

The suppliers came from all over, including one who traveled from as far away as Norway, to launch Raytheon’s first Supplier Advisory Council, or SAC (PDF).

The meeting was the first step toward a pilot program designed to be a key building block in Raytheon’s emerging Supplier Relationship Management (SRM) strategy.

The ultimate goal, according to Michael Shaughnessy, vice president of Integrated Supply Chain for Raytheon Integrated Defense Systems, is to earn and provide preferential treatment as the Customer Of Choice - the customer who receives the best terms, manufacturing capacity as needed, and gets first dibs on innovations that can win in the marketplace.

“In order to reach that level of earned preferential treatment, we have to build stronger bonds and greater trust into supplier relationships,” says Shaughnessy. Together, he adds, Raytheon and its suppliers can work collaboratively to develop winning technologies while taking costs out of the production and maintenance of products.

By all accounts, the first meeting started off slow. By the end of the day, however, there was a focus on next steps and a commitment to move forward. By the third meeting in September 2014, the suppliers were truly participatory. “We had momentum,” says Neil Perry, Raytheon Integrated Defense Systems’ director of supply chain learning.

The changes in Raytheon’s approach to supply management reflect the kinds of discussions that are going on at other industry leaders who are moving from transactional relationships based on cost and delivery times to more strategic relationships with their suppliers. This is the story of how Raytheon is implementing a Supplier Advisory Council in order to become the Customer Of Choice.

Strategic Procurement and Preferential Treatment

SACs are not new. Industry leaders like Harley Davidson and Square D, now part of Schneider Electric, have relied on them for years. Mark Lee, the chair of Raytheon’s SAC and a vice president with Whitmor/Wirenetics, a Valencia, California-based manufacturer and distributor of wire and cable, spent six years on the advisory council at Rockwell Collins prior to joining Raytheon’s SAC. “It was a great experience because it enabled suppliers like us to get in tune with where Rockwell Collins was going as a company,” says Lee.

In the best SACs, there is bi-directional sharing: A supplier like Whitmore/Wirenetics can offer up best practices it has observed at other customers while gaining an understanding of how a larger company like Rockwell Collins or Raytheon operates in ways that might improve its business processes. More importantly, suppliers are able to align with their customers’ goals.

In fact, the real point of a SAC may be that the whole is greater than the sum of its parts. “In today’s fiercely competitive global marketplace, success requires suppliers willing and able to extend more value, resources, and energy to customers with whom they have strong relationships and greater trust,” says Joe Sandor, a professor of purchasing and supply management at Michigan State University and one of the facilitators of Raytheon’s SAC.

“Your ability to influence suppliers in ways that confer competitive advantage is shaped by their perception of your willingness to help them meet their needs. The question is not why should one initiate a supplier relationship management program, but rather, how does one execute a robust SRM effort to earn preferential treatment.”

A SAC is one tool in the SRM toolbox. Done well, Sandor adds, it is an effective vehicle to overcome internal obstacles and persuade both key suppliers and critical internal managers to pursue supply network collaboration.

Supplier Advisory Councils Enable Better Buyer/Seller Relationships

By Joe Sandor

A substantial and growing body of evidence attests to a simple fact: Buyers are beginning to understand the value of enhanced relationships with their suppliers. Improved buyer/supplier relationships lead to cost reductions and cost prevention, improved quality and delivery performance, and greater innovation.

Moreover, effective collaboration with suppliers delivers an absolute and sustainable competitive advantage.

By necessity, delivering sustainable competitive advantage requires integration and alignment of key stakeholders both within and external to the firm. Such integration and alignment earns preferential treatment between supply network members. At the same time, there are often hurdles inside and outside an organization that stand in the way of collaboration.

An effective Supplier Advisory Council (SAC) is a good vehicle to overcome those obstacles and persuade both key suppliers and critical internal managers to pursue supply network collaboration.

Accordingly, an effective SAC like the one being developed at Raytheon ought to be a key feature of a firm’s Supplier Relationship Management (SRM) activities. But, like most initiatives, SAC’s can be poor, middling, or fabulous.

Here’s how to get the most out of a SAC:

- Get both senior management support and commitment to actively participate. This signals the importance of the SAC to the entire organization as well as potential SAC members.

- Have process discipline - as Dave Nelson, supply management icon, puts it, “honor the calendar.” Plan for routine involvement between the SAC and the buying firm at multiple levels.

- Consider launching the initial SAC meeting with a third party facilitator. But, don’t let the facilitator dominate the agenda or prescribe objectives. Even if it’s clumsy at first, allow the SAC to feel empowered with a sense of ownership versus simply following instructions.

- Develop and communicate a shared vision of the future state of SRM that articulates how the SAC can help set priorities for goals and guidelines by which these goals are measured. The SAC vision should not only be general and long-range but should also differentiate the joint enterprise from its competition.

- Use the SAC as trusted advisors, sounding boards and pilots. Leverage the knowledge created by routinely communicating results.

- View the SAC as change-agents. Determine SAC candidates on their knowledge and business acumen as well as importance to the buyer’s firm.

- Give the SAC access to your C-suite. Improve the frequency and durability communications at all levels.

- Regularly meet on a rotating host basis.

- Give the SAC authority while defining scope.

- SAC supplier terms should be at least two years.

- Keep the number of participants manageable - somewhere in the teens.

- Engage key stakeholders in the selection of SAC members - this should not be a purchasing only activity.

- Launch SAC supported supplier-buyer teams to address specific problems and opportunities.

- Co-host important events like annual supplier appreciation days, innovation events, etc.

- Document progress and celebrate success.

Now, here are some things not to do:

- Don’t launch a SAC without senior level participation over the long-term.

- Don’t proceed without company-wide support; don’t rush into an arbitrary start date with only lip-service support from internal stakeholders.

- Don’t launch with purchasing people only. Keep membership at a high level and don’t allow lower level folks to “substitute” for the boss.

- Don’t be cheap - budget for expenses. Treat the SAC the same way you would treat important customers.

- Don’t allow a facilitator to govern your SAC meetings.

- Don’t allow individual SAC members to dominate the discussion at SAC meetings.

- Don’t allow specific concerns or issues between SAC members and individual buyers to become agenda items unless such issues represent broader trends.

- Don’t build expectations without being able to deliver solutions.

- Don’t be the last person on the block to form a SAC - the best SAC members may be gone.

SAC success is a function of shared commitment and mutual respect that can be extraordinarily beneficial to the entire supply network when executed properly.

Joe Sandor is the Hoagland-Metzler Professor of Purchasing and Supply Management at Michigan State University.

The seeds for Raytheon’s SAC were planted in 2012, when Michael Shaughnessy, a Raytheon veteran, became vice president of Integrated Supply Chain for Raytheon’s IDS business. There, he is responsible for Raytheon’s partnerships with IDS suppliers and for providing a “single line of sight” for Mission Assurance through all phases of a program.

With $23 billion in 2014 sales and 61,000 employees worldwide, Raytheon describes itself as “a technology and innovation leader specializing in defense, security, and civil markets throughout the world.” Shaughnessy came to his new role at a time when the U.S. defense industry was experiencing a heightened focus on cost as well as competition from new players in a global market that includes competitors from Russia, France, China, and Israel to name a few.

Great technology alone could not win the day; the purchase price and the cost of maintaining a piece of equipment over its lifetime were becoming as important as game-changing technology. By necessity, Raytheon was forced to rethink how it interacts with its supply base. Procurement wanted to transition from tactical relationships, focused on price negotiations and placing purchase orders, to more strategic relationships that involved the participation of suppliers up front during the design of a new product, where there are real opportunities to take cost out of a process.

This kind of collaboration was a different way of thinking at Raytheon. Not that long ago, the defense contractor was a vertically-integrated company that designed and built almost everything it produced. An estimated 80 cents of every dollar of sales was created in house; the other 20 cents came from Raytheon’s suppliers in the form of raw materials and parts that Raytheon kitted and fashioned into products.

Procurement focused on purchase orders. “If you looked at the number of people working in procurement and logistics, about 85 percent worked on transactions that represented 15 percent of the supply chain,” Shaughnessy says.

In this new dynamic marketplace, that ratio has been turned upside down and supply drives the supply chain: Now, about 70 cents of each dollar of sales emanates from beyond the four walls. “Our suppliers are integrated into our processes,” says Perry. “Instead of delivering commodities, like screws, they are delivering completed assemblies that we bring together in our plants.” As such, he adds, there is little margin for error. “We have to understand the capabilities of the supply base to ensure that we are in compliance with regulations and quality standards. Reducing risk is an imperative.”

The goal, say both Perry and Shaughnessy, is to collaborate strategically with a select group of key suppliers to deliver absolute affordability without giving up capability or technology. That, Raytheon believes, can only be accomplished with a closer relationship with its suppliers starting at the design stage of new products. “If you engage your suppliers early on in the design stage, you can make dramatic reductions in cost without compromising the quality of the products you deliver,” Shaughnessy says.

Supplier Relationship Management

Raytheon began its journey in Supplier Relationship Management with key goals. One was to automate as many mundane tactical processes as possible so that the procurement team could spend more time on strategic initiatives with those key suppliers that are essential to moving the company forward. “We have 10,000 plus suppliers,” says Shaughnessy. “You cannot have a strategic relationship with all of them, but you can identify your key suppliers and develop a partnership and shared vision that will allow you to win programs.”

As part of this transition, Shaughnessy reached out in late 2012 to Dave Nelson to consult on the development of a supply management strategic business plan. The former head of supply management for TRW, Honda, John Deere, and Delphi and chairman emeritus of the Institute of Supply Management, Nelson is one of the world’s best recognized supply management thought leaders. “We have a continuous improvement mindset at Raytheon,” says Shaughnessy. “We needed to figure out how to take our relationship with a strong supplier base to the next level.”

Established by Raytheon IDS, the Supplier Advisory Council comprises Raytheon and supplier senior leaders who hold regular, collaborative sessions aligned to shared goals including improved partnership and collective business success. SAC meets three to four times a year and its membership rotates every two years.

One of Nelson’s recommendations in the business plan was for Raytheon to earn preferential treatment from suppliers. The concept is familiar to any frequent traveler who belongs to a hotel rewards program. “If you’ve been a loyal customer of a hotel, you get the best room at the lowest rate when you show up,” Shaughnessy says. “That’s what we want in our supply base. When we reach out, I want to know that we’re getting the best people on our team or capacity when we need it because of how we’ve worked with that partner. We’re developing those relationships in the Raytheon supply chain now.”

Customer Of Choice sounds great, but it led to an important question: How would Raytheon measure whether it was making progress toward that goal? It couldn’t just be some soft benefit. Nelson recommended conducting a supplier perception survey with Michigan State, something that Sandor had conducted for companies such as Harley-Davidson, John Deere, Sara Lee, Electrolux, ConAgra, and the United States Air Force. Working with Sandor and Nelson, Raytheon IDS developed a list of roughly 300 suppliers that represented 75 percent of the business’ total spend.

After several months of tinkering and tailoring, the survey went out in March of 2013. The results were presented in two different briefings to a cross-functional group of Raytheon managers in April and May 2013. The verdict: Raytheon received very good scores in terms of overall trustworthiness, orientation toward quality, and technical content.

Raytheon needed to work on understanding total network costs, concern for supplier profitability, willingness to share risk with suppliers, to provide an interface with senior management, and to provide one face to the supplier. And communication was an issue: Suppliers submitted bids and didn’t always know from Raytheon why they didn’t win a contract.

In one respect, the areas with low scores reflected the tactical nature of Raytheon’s approach to procurement, which was focused on issuing POs. If the company could raise those scores, it would reflect the transition to a more strategic approach to procurement that emphasized partnering and collaboration. The question for Raytheon was: How do we get there? “A partner is different than a supplier,” says Perry. “We wanted a process to get more involvement from the supply base.”

Nelson and Sandor suggested a Supplier Advisory Council. A decision was made to launch a SAC as a pilot program in the Integrated Systems business. Raytheon put the wheels in motion at its annual Industry Day event in Washington in April 2014. With about 300 suppliers in attendance, representing a mix of large and small businesses, publicly-held, privately-held, and minority-owned businesses, Shaughnessy introduced the SAC concept and asked for volunteers.

“Frankly, we were overwhelmed by the response,” Perry recalls. “We deliberated with Sandor and concluded that if we wanted to send a message that things are different at Raytheon, we couldn’t just pick our favorites. We needed a healthy cross-representation of suppliers.”

Thirteen were chosen and a first meeting date was set for May, with a goal of establishing guidelines for the SAC.

The First Meeting

Mark Lee of Whitmor/Wirenetics was seated next to Shaughnessy at the industry day event when the SAC was introduced. Having just rotated off the Rockwell Collins’ SAC after six years, Lee was interested in joining Raytheon’s initiative. “As a supplier, you want to work with customers who want to get better together,” he says. “Raytheon is realizing that they are going to get a lot more out of suppliers when both parties are listening.”

At their best, he adds, SACs not only align supply chains, they align top management of both companies with procurement and engineering. “As a supplier, we often find that there is a gap between what leadership wants to do and what procurement and engineering are doing,” Lee says. “The SAC provides an opportunity for suppliers to discuss issues that management may not be aware of without fear of retaliation. In fact, if it’s not candid, it won’t work.”

Similarly, he adds, suppliers have to realize that a SAC meeting is not a sales presentation. “You don’t talk about what your company does or try to get a price increase,” Lee says. “You’re not there to negotiate; you’re there to discuss best practices.”

Following the Industry Day event, Raytheon responded back to every company that volunteered. The goals for that first meeting were important but modest: Elect a chair of the advisory council - Given his past experience, Mark Lee was elected to lead the group and set up the ground rules for engagement of the SAC, such as two year term limits for SAC members.

The meeting was loosely scripted at best. That was intentional, according to Raytheon. “We took it very slow because we wanted our suppliers to drive the train,” says Perry. “Raytheon did not want to dictate to our suppliers how this should be organized.”

After a slow start, things got rolling. Since that first meeting, there have been three official meetings, including one that took place in February 2015, and a meeting at a supplier conference. At the end of one meeting last September, Shaughnessy asked the members whether the process was working, given that suppliers had to give up at least a day of their time, and several days in the case of international suppliers. The response was unanimous that it was worth doing. In fact, each meeting has had nearly perfect attendance.

Now that the groundwork has been laid, the SAC is beginning to look at process. At the second meeting, for instance, suppliers were briefed on a new Raytheon supplier excellence program. Based on supplier input, Raytheon developed 15 key performance measures beyond quality and delivery for a proposed supplier scorecard that was then presented to the council. “That was the moment when they transitioned to being fully effective,” Perry says.

“They spoke up and told us the things they liked, the things they didn’t like, and suggested improvements.” At the most recent meeting in February, Raytheon brought in its director of engineering to discuss innovation. “We are looking at how to get our suppliers involved early so that they want to innovate and share with us,” says Perry.

“My opinion is that they’re on track,” says Lee. “Two years from now, Raytheon is going to be better at this, the supply chain will be aligned, and there will be a better understanding of how to be successful together.”

Next Steps

By all accounts, Raytheon’s SAC is still in the early stages of maturation. The defense contractors’ other three business units are observing to see how it works and whether it is applicable to them. Several steps have been outlined to measure the success of the initiative, and a strategy team has been formed to see how best to do it across Raytheon.

For one, the company intends to conduct another supplier survey in 2015 to see if scores have improved from the first survey. For another, Raytheon is launching its first supplier excellence awards at the corporate level this spring. “We have done this at the business unit level, but now we’ll do it at the corporate level,” Shaughnessy says.

“We’ll have senior management participate, which will send a message about how important our suppliers are to our future.” What’s more, Shaughnessy will look at the success of the supplier scorecard, which was developed with input from the SAC. “Those suppliers that are scoring well are going to get more business from Raytheon,” says Shaughnessy.

At the end of the day, however, the real measure will be how well the company is able to take cost out of its product at the design stage, continue to develop game-changing technologies that are affordable today and over the life time maintenance of its products, and win with its suppliers. “We truly believe we will be a better supply chain at Raytheon,” says Shaughnessy.

Related Read: How Raytheon Uses Data Visualization, Predictive Analytics, and Big Data as A Competitive Advantage

Download the Paper: Supplier Relationship Management: How Key Suppliers Drive Competitive Advantage

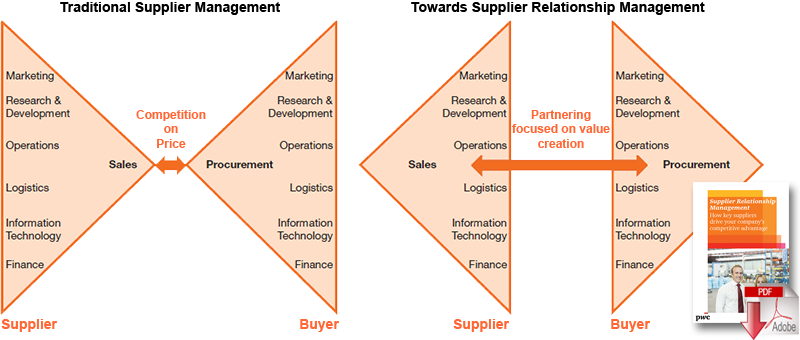

Traditional supplier management vs. supplier relationship management

Article Topics

PwC News & Resources

Ranking the Best Countries for Private Business in EMEA Tech Expectations Are Not Matching Reality For Many Companies Drone Technology: Clarity from Above Supply Chain Strategies under the Impact of COVID-19 of Large American Companies Operating in China Supply Chain: Your Brexit Competitive Advantage Digitization and Autonomous Driving to Halve Logistics Costs by 2030, finds PwC Study The Era of Digitized Trucking: Charting Your Transformation to a New Business Model More PwCLatest in Supply Chain

Let’s Spend Five Minutes Talking About ... Malaysia Baltimore Bridge Collapse: Impact on Freight Navigating TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process More Supply ChainAbout the Author