Quarter-End Shipping Surges Impact Rates

Do month-end or quarter-end surges still affect your transportation costs? Well, you’re certainly not alone if you’re asking this age-old question!

Those familiar with transportation know that month-end or quarter-end freight surges commonly occur, maybe in your company, or maybe in other organizations, and that your routing guide may not work as well as it usually does at those times.

Our research at Iowa State University shows that transportation costs don’t actually rise during end-of-month surges.

But they increase significantly near the end of a quarter in some regions.

Freight surges at the end of a quarter typically happen this way: A shipper takes orders for a few weeks into the next month or quarter, then gets the customer’s permission to ship early.

This increased, out-of-pattern volume gets pushed out before the end of the quarter so the orders will be counted in the current quarter’s sales figures.

Using data provided by C. H. Robinson and TMC, the managed services division of C.H. Robinson, we were able to model the effect of both end-of-month and end-of-quarter shipping surges on transportation rates.

The time frame was the 2013 calendar year, and the data set included all dry van truckload shipments managed by TMC that moved 250 or more miles.

Although no significant increases in transportation costs were found during end-of-month surges, there were significant cost impacts during the last four business days in each quarter.

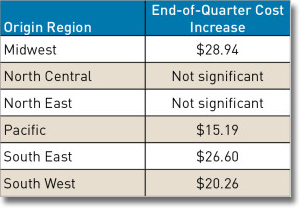

During the last four business days of each quarter, end-of-quarter shipping surges raised transportation costs by an average of $20 per shipment, with regional variance. The North Central and North East experienced no significant impact in rates due to quarter end, while the Midwest and other areas did. The results by region are shown to the right.

It isn’t clear whether the increases during the end-of-quarter surges occurred because the shippers in the dataset went deeper into their routing guides to cover their own additional loads, or because their regular carriers refused tenders so they could chase higher paying freight from other companies, sending the shippers in the dataset deeper into the routing guides.

Either scenario could be logical reasons for the quarter-end rate increases, but a combination of both scenarios likely drives the transportation cost increases.

The results suggest that managing carriers and freight during quarter end deserves special attention. Even if you no longer experience end-of-quarter surges, you are likely paying more for transportation due to surges happening elsewhere.

Key to getting the most of today’s U.S. trucking marketplace is deploying a host of practices that bring predictability and demand visibility to transportation providers.

C.H. Robinson has sponsored a host of research projects on truckload practices, from procurement through operations. These research projects suggest that a shipper can differentiate their freight and bring increased stability to route guide performance and a more predictable transportation spend.

I would also offer that to accomplish many of the suggestions in the research, a disciplined use of a Transportation Management System (TMS) or TMS service provider is needed.

Related: 7 Building Blocks to Prepare for Implementing a Global TMS

Article Topics

C.H. Robinson News & Resources

Q&A: Mike Burkhart on the Recent Nearshoring Push Into Mexico Q&A: Mike Burkhart, VP of Mexico, C.H. Robinson C.H. Robinson introduces new touchless appointments technology offering C.H. Robinson President & CEO Bozeman provides overview of key logistics trends and themes at SMC3 JumpStart 2024 C.H. Robinson touts its progress on eBOL adoption by LTL carriers and shippers Retailers Pivot Supply Chain Strategy, Seek Red Sea Alternatives C.H. Robinson announces executive hire to run new Program Management Office More C.H. RobinsonLatest in Transportation

FedEx Announces Plans to Shut Down Four Facilities The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? More Transportation