Price Trends: Pricing across the transportation modes

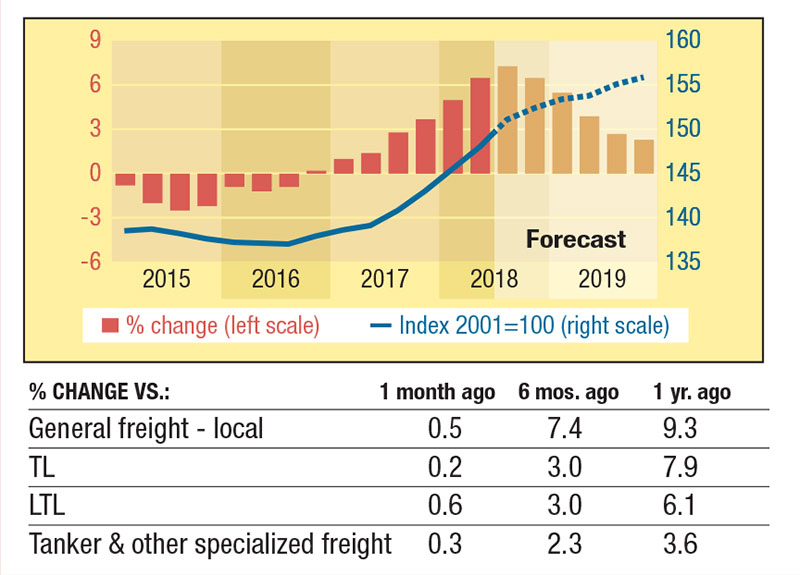

Trucking

The trajectory of inflation in the trucking industry is revealing nascent signs of finally slowing down.

Looking at the same-month-yearago rate of increase in transaction prices we see that truckload inflation peaked at 11.2% in July 2018 while LTL topped off at 8.8% in June.

The latest monthly survey reports that TL and LTL inflation slowed to 7.9% and 6.1%, respectively, in September.

This trend is a mirror image of the inflation turnaround that the trucking market experienced in the final months of 2011.

Our revised forecast calls for the industry’s average annual prices to increase 6.3% in 2018 and gain 3.6% in 2019.

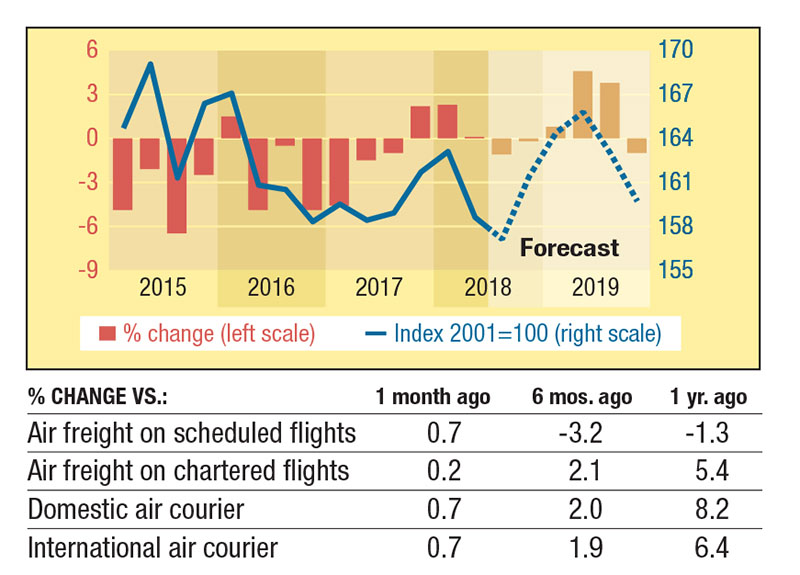

Air

Trends in prices charged by U.S. owned airlines that fly freight suggest inflation rates here, too, have passed their peak, although our airfreight data is a bit murkier than trucking.

Companies that fly freight on chartered flights reported a peak 10% inflation rate in May 2018 compared to the same month a year ago.

As of September, that inflation rate had slowed to 5.4%.

For companies flying freight on scheduled flights, the inflation rate peaked at 4% in February 2018.

Now, transaction prices in this market have fallen 1.3% from September 2017 to September 2018.

The latest forecast predicts average annual price hikes for airfreight on scheduled flights to be 0.3% in 2018 before stabilizing at 2% in 2019.

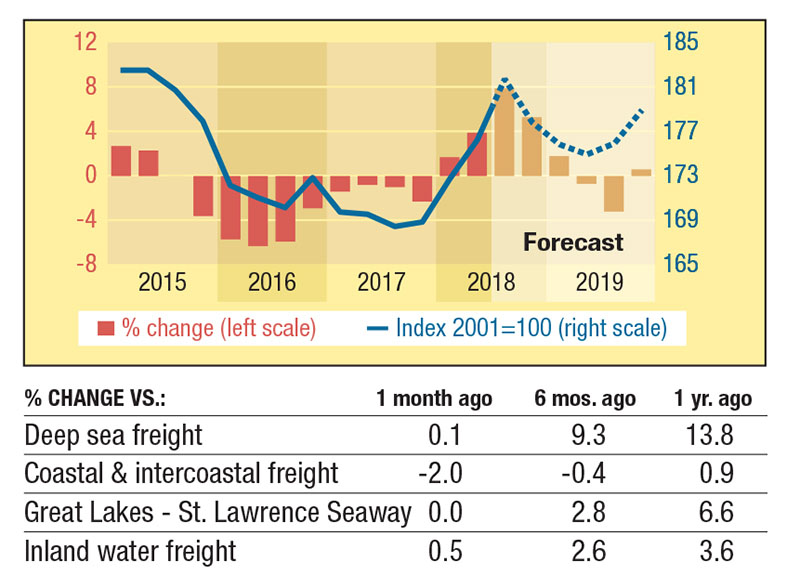

Water

Whereas inflation slowing for trucking and airfreight, water transportation prices remain rather buoyant.

Looking at the same-monthyear-ago rate of increase, we see that the industry’s inflation rate hit 9.2% in September, quickening from 5.5% in June.

All segments of the market have contributed with deep-sea prices up 13.8% and coastal and intercoastal also up 13.8%.

Added to this, prices for shipping via inland waterways accelerated 3.6% in September following a 0.7% hike in June.

With trade wars the new normal, both seaborne export and import trends are slowing.

We now forecast the water transportation industry’s average annual prices to increase 4.7% this year and decline 0.4% next year.

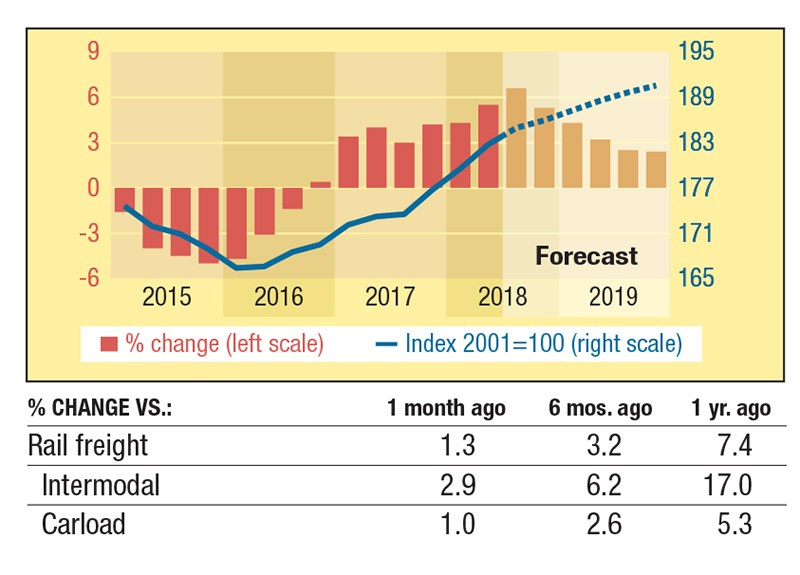

Rail

Inflation for rail services keeps outpacing our forecasts.

The latest data for September shows intermodal rail prices increased 17% from the same month a year ago.

This pushed the third quarter inflation rate to 16.3%.

In the carload market, prices were up 5.3% in September and up 4.5% in the third quarter.

Signs of a shift in the inexorable upward rail price trend are tough to find, but a chart of intermodal’s three-month moving average price inflation trend looks like it might be at an inflection point now.

Carload prices, meanwhile, show no such sign, unfortunately.

That said, our revised forecast shows average annual rail prices up 5.4% in 2018 and up 3.1% in 2019.