Optimizing Third-Party Logistics Relationships and How to Avoid Commoditization

New research indicates that there’s considerable concern about the value of long-term, strategic relationships - Industry analysts explain how innovation and a deeper commitment to collaboration will become the key differentiators in the 2015 marketplace.

In business literature, commoditization is defined as the process by which goods that have economic value and are distinguishable in terms of attributes (uniqueness or brand) end up becoming simple commodities in the eyes of the market or consumers.

A recurring theme seems to be surfacing in the complex world of global third party logistics providers (3PLs) these days.

The sector is booming, but shippers are still “shopping around” for a better price or more complete service.

Explaining the friction that exists between 3PLs and the customers that they serve in key manufacturing and retail sectors was a daunting challenge for researchers at advisory firm SCM World, but a recent study may finally provide some answers.

“The disconnect between 3PL performance levels and their reluctance to embrace new technologies was something we hoped would change by now,” says Barry Blake, vice president of research at SCM World. “But that hasn’t been the case at all. Shippers say that they’re still searching for more value.”

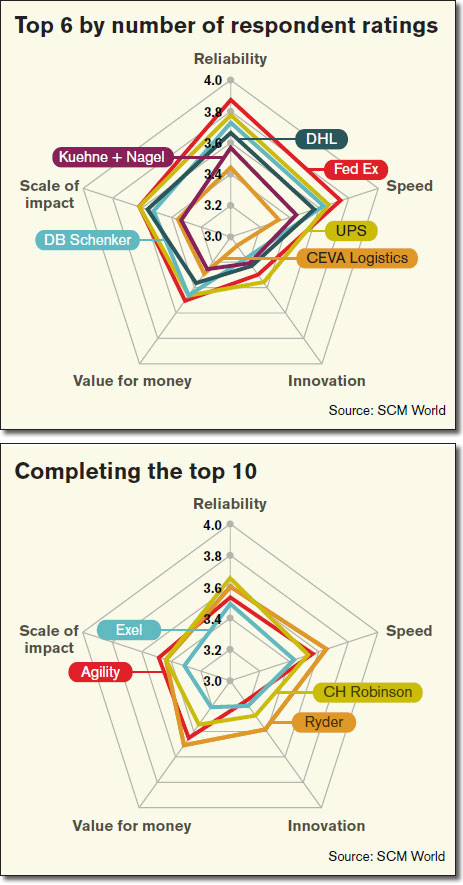

Between January and May of this year, SCM World fielded a six-question survey in order to understand the supply chain community’s perception of its 3PLs. After sifting through the remarks made by 557 global shipper organizations, the results were made public last month.

“The story emerging from the data is compelling,” says Blake. “Third-party logistics providers are seen as fast and fairly reliable…but not innovative. Furthermore, logistics managers are questioning the value received for the cost of their 3PL services.”

Blake asked respondents to rate 3PLs on the following metrics: reliability; speed; innovation; value for the money; and scale of impact, or how vital the 3PL is to the shipper’s strategic needs. With a few exceptions, most 3PLs scored well, with over 50 percent of respondents rating them “good” or “excellent” at the aggregate level when it comes to the basics, such as reliability.

However, shippers don’t seem completely confident that they’re receiving the degree of value expected for the money they are paying for 3PL services. Moreover, the results showed that the 3PL community collectively struggles to deliver innovative solutions in the eyes of their customers.

“The message coming across loud and clear through the data and follow-up discussions with logistics professionals is that 3PLs need to do a much better job understanding the businesses of their customers if they are to move up the innovation curve,” says Blake.

Blake adds that, while the results didn’t surprise him, shippers need to keep in mind that this is a two-way street. Unless a shipper “incentivizes” its 3PLs to focus on innovation, it’s difficult for the provider to make the necessary investments to support it.

“Innovations don’t typically sprout overnight, nor even during the yearly tender cycle between parties,” says Blake. “Shippers and 3PLs should have a one-on-one discussion about risk mitigation, and how change management can address those concerns.”

Overall, the major expectation for logistics service providers is cost savings. This entrenched focus essentially commoditizes logistics services, creating a self-perpetuating cycle in the marketplace where 3PLs resist investing in innovation since their customers don’t yet believe that innovation will drive cost savings more effectively than traditional methods.

“This pushes logistics services further towards blandness without any meaningful differentiation,” Blake concludes. “Both sides need to come together if logistics service innovations are to take root and see the light of day.”

Partnership Pays Off

As cost control remains a key priority for supply chain professionals - and no doubt will remain so for many years to come—initiatives such as horizontal collaboration and supply chain sustainability are becoming increasingly important.

Researchers at London-based Eyefortransport say that their recent survey of global chief supply officers indicates relationships between supply chain executives and 3PLs are increasingly improving as these providers are perceived to be more proactive in suggesting strategic partnering.

Some prominent U.S. shippers agree. “Given the ongoing talent-gap in the supply chain industry, we see a greater reliance on outsourcing key functions,” says Craig Boroughf, senior director, global sourcing for U.S. Gypsum Company, a subsidiary of USG Corporation. “While we continue to invest in our own human resources, 3PLs can augment that effort by providing skilled workers as we need them.”

Boroughf is responsible for USG’s procurement, including supplier management and strategy of raw materials, indirect goods, and services and freight transportation services. He maintains that 3PLs are showing a greater willingness to become strategic partners, but must continue to demonstrate that they’re putting shipper value ahead of pure cost.

“As in any customer-supplier dynamic, 3PLs should concentrate on economies of scale when budgeting in the procurement arena,” says Boroughf.

Frank McGuigan, president of transportation management at 3PL Transplace, says that closing ranks with his customer base comprising USG and others is important, but requires a new “play book.”

“The 3PL has undergone tremendous change in recent years,” says McGuigan, “and we are aware that shippers can hedge their bets by working with several 3PLs at the same time. But as their reliance on outsourcing becomes greater, the exposure to risk becomes more of a concern.

Trust But Verify

As President Reagan was fond of saying: “Trust but verify.” That adage is winning currency with 3PL consultants as well. Steve Banker, who leads the supply chain and logistics team at market research firm ARC Advisory Group, says 3PLs that are seeking to optimize their relationships with shippers should invest carefully in a transportation management system (TMS).

“Before committing to any TMS demonstration, we suggest that the 3PL asks about shipper ‘onboarding,’” says Banker.

The 3PL must be able to leverage the configuration settings used to support shippers with templates that can be setup for various implementations. Shippers have unique workflow rules, Banker adds, and require 3PLs to have flexible billing capabilities to meet specific needs.

“Both third-party providers and shippers need a TMS that manages multi-leg, multi-mode, time-phased planning and execution,” says Banker

Is there a limit to the number of legs or modes? “For shipments that cross an ocean, that time-phased element is important,” says Banker. “If you look at a dray move to port, 27 days on sea, do you really want a pre-planned truck move on the other side of the ocean? A lot can happen in 27 days.”

Which brings security into the picture. Banker says that there should be “logical barriers” between a 3PL’s client base so that on shipper can’t see another’s shipment performance or billing.

A new study by Accenture reinforces the idea that 3PL/shipper relationship optimization will be focusing on risk in the future. “As demonstrated by the leaders in our study, a centralized, top-down approach to supply chain risk management tends to generate the highest ROI on risk management,” says Mark Pearson, senior managing director of Accenture Strategy Operations.

“Such a commitment to risk management between the two parties can also help managers guard against business disruptions in the wake of natural disasters, geo-political events, shifts in commodity or shipping prices, or any number of circumstances that can endanger a company’s operations,” adds Pearson.

Supply Chain Risk Weighs Heavy In Relationship Optimization

The majority of shippers see supply chain risk management as a vital element on the way to optimizing their relationships with third-party logistics providers (3PLs).

According to a new study by Accenture, however, only seven percent of shippers are generating returns of over 100 percent on their supply chain risk management investments.

Indeed, the study suggests that 3PLs hoping to optimize their services for shippers should develop distinct approaches toward risk mitigation.

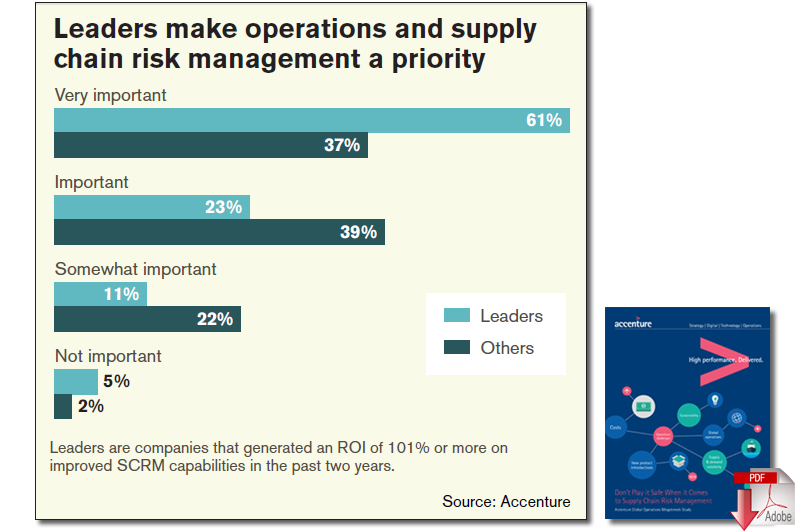

Seventy-six percent of companies participating in the Accenture Global Operations Megatrends Study - Focus on Risk Management describe supply chain risk management as “important” or “very important.” Of the more than 1,000 companies represented across 10 industries, 25 percent plan increased investments of at least 20 percent in supply chain risk management in the next two years.

The analysis reveals that while nearly all of the companies represented in the study receive a return on their investment (ROI) in risk management, the leaders - those seven percent that generated returns exceeding 100 percent—had three practices in common that distinguished them from others:

- Make risk management a priority. The leaders make risk management a strategic imperative and recognize the importance of capabilities that help them gain greater visibility and predictability across their supply chains.

- Centralize their responsibility for risk management. They have a central risk management function led by an executive in the C-suite or a vice president who oversees all of their risk management activities.

- Invest aggressively in risk management with a specific focus on end-to-end supply chain visibility and analytics. Leaders were nearly three times as likely to say they planned to boost their investment in risk management by 20 percent or more in the next two years.

“Although unforeseen events or natural disasters lead some to give up on risk management, most risks can be managed to not only minimize the downside, but also to gain a competitive advantage as a result of being prepared to respond to circumstances when they arise,” says Mark Pearson, senior managing director of Accenture Strategy Operations. “Scenario planning and robust analytics can play a key role in developing effective risk mitigation strategies.”

More: Supply Chain Risk Management Now a Priority for Most Businesses

Related: 2015 Third-Party Logistics Study Takes Deep Dive into Omni-Channel Supply Chain