Omni-Channel Supply Chains Designed for a Retail World without Boundaries

Omni-channel retailing is upending the way consumers shop and interact with their favorite brands. In response, retailers must redesign their supply chains to meet growing customer expectations in a new retail world without limits.

Supply chain innovation comes in two iterations: reactive and proactive.

Reactive innovation is a response to change, including change that an organization didn’t see coming. Proactive innovation is a catalyst for change.

When a leading organization gains a competitive advantage through proactive innovation, the rest of the market has to react just to keep pace.

Both types of innovation are on display in the retail supply chain as the industry evolves from single channel to multi-channel to omni-channel retailing.

The catalyst for this evolution is Amazon Prime. Back in 2005, the online retailer announced free two-day shipping on qualified items. Designed to enhance loyalty and fuel top line sales growth, the Amazon Prime program has had a huge impact on Amazon’s success in recent years.

Related: Search Term: “Amazon”

The impact has rippled through the retail industry. Brick-and-mortar retailers, in particular, have scrambled to devise strategies to counter free shipping.

In response, they are deploying reactive innovation solutions that leverage one of their best assets—their stores. This coupled with the growth of mobile commerce and social shopping has seen the emergence of what many are calling omni-channel retailing.

In many respects, this new approach represents a kind of boundary-less retail, where the silos between brick-and-mortar, catalog, and Internet retailers have disappeared—at least as far as the consumer is concerned. Today’s shoppers are empowered by their ability to instantly connect to a global marketplace where thousands of sellers are offering an abundance of items at competitive prices.

Online shoppers have access to price comparisons and customer reviews and opinions on any product they want to purchase and any retailer from whom they want to purchase. What’s more, they can research products on social media, videos, and consumer blogs.

The growth in this segment offers both opportunities and pitfalls for retailers. In order to survive and thrive in an omni-channel world they must adapt their supply chains, order management, and order fulfillment processes to this sea change.

This article will explore the catalysts behind the movement toward omni-channel retailing; the key consumer behaviors that will affect how the strategy is deployed; and what retailers are experiencing as they redesign their supply chain operations.

Taking the Pulse of the Online Shopper

Retail analysts predict there will be more than a billion online shoppers who will spend nearly $1.3 trillion this year on e-commerce purchases—18 percent more than 2012. Given UPS’s role in the last mile of the omni-channel supply chain, we wanted to understand the pulse of the online shopper—our retail customers’ customer—and the purchasing decisions that affect order fulfillment expectations and processes.

Last February, working with comScore, a leading digital analytics firm, we asked 3,000 online shoppers which factors led them to shop more on their computers, smartphones, or tablets; abandon their shopping carts; and to recommend particular retailers to their friends. The result is the 2013 UPS Pulse of the Online Shopper: A Customer Experience Study.

The most important findings: Consumers want more choices when it comes to shopping online; more control over when their purchases will be delivered; and a convenient returns process. They’re also using social media to shop for the best deals and expect more shipping options from e-tailers. Each of these has an impact on the retail supply chain.

One of the first questions asked consumers which factors compel them to shop with an online retailer. Many respondents said they expect a streamlined process across multiple channels:

- 62 percent want the ability to purchase online and make returns in-store;

- 47 percent want a coupon or promotion sent to their smartphone when they are in-store or nearby; and

- 44 percent want the ability to buy online and pick up at the store.

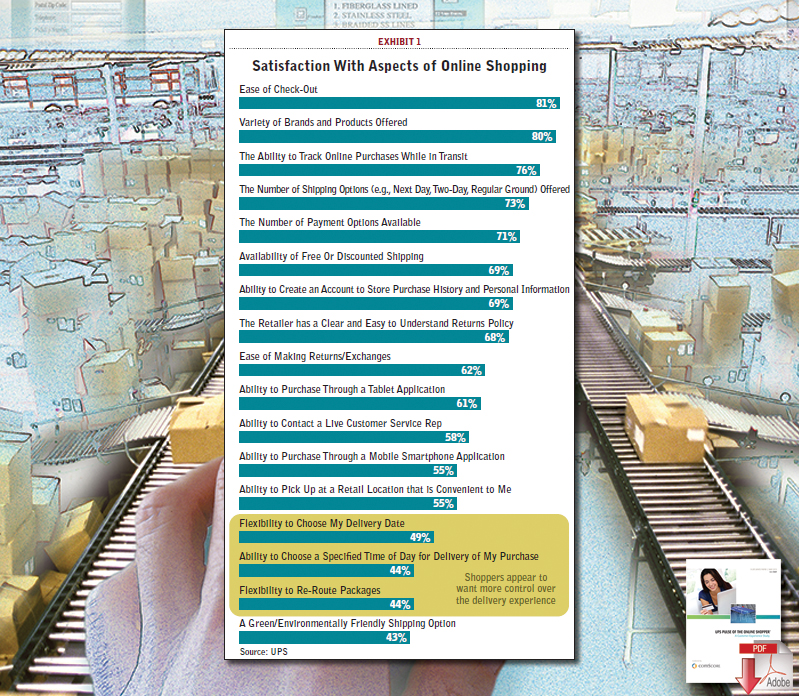

Although 83 percent of the respondents said they were satisfied with their online shopping experience, there is room for improvement. Ease of checkout, more variety of brands/products offered, and the ability to track online purchases while in-transit were most often identified as areas for improvement.

Online shoppers said they want the ability to choose their preferred delivery date, time of day for delivery, and they want options to reroute their inbound packages. They also value free shipping (Exhibit 1).

The study confirmed a recent online omni-channel shopping trend: Consumers want to shop anywhere at any time.

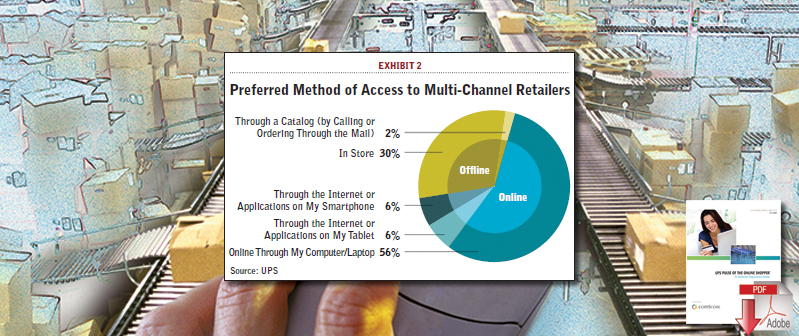

In fact, Exhibit 2 shows that 68 percent of online shoppers prefer to shop with multi-channel retailers online instead of shopping in a store, from a catalog, or by the mail. Retailers using enhanced websites and advanced mobile apps will have a competitive advantage.

When it comes to the check-out process, retailers should pay attention to cart abandonment as it continues to rise. In 2013, 88 percent of online consumers abandoned a shopping cart compared to 81 percent in 2012.

Based on our study, half of consumers said they want to see estimated shipping costs and delivery dates early in the check-out process—the second most important option after free shipping. Looking at the impact of cart abandonment due to an estimated delivery date, 85 percent of the respondents said it was because no date was given or it was longer than six days.

Online shoppers also value a hassle-free returns policy, especially repeat customers: 82 percent of consumers said they would complete the purchase if they could return the item to a store or have free return shipping; 67 percent said they would shop more with that retailer; and 64 percent would recommend the retailer to a friend.

Social channels continue to change the way online consumers shop. Not surprisingly, 84 percent said they use at least one social media site. Among Facebook users—the most popular channel— 60 percent “like” a brand to receive an incentive or promotion.

Another trend retailers are considering is same-day delivery. Like free shipping, this is a proactive supply chain innovation being driven by Amazon, eBay, and even Google. Other retailers, such as Walmart, have announced they are investigating same-day delivery options.

Through our Strategic Enterprise Fund, UPS became an investor in Shutl, a British start-up that connects retailers to local same-day courier companies.

Online shoppers can receive packages within 90 minutes or choose a one hour window for delivery. GPS tracking allows consumers to track the progress of their orders on a mobile device. We are presently conducting research to see how much consumers are willing to pay for this new level of customer service.

The Omni-channel Evolution

The omni-channel strategy that many retailers are pursuing today is being driven by e-commerce growth and consumer habits and expectations like those identified in our study. These changes are driving the need for supply chain transformation.

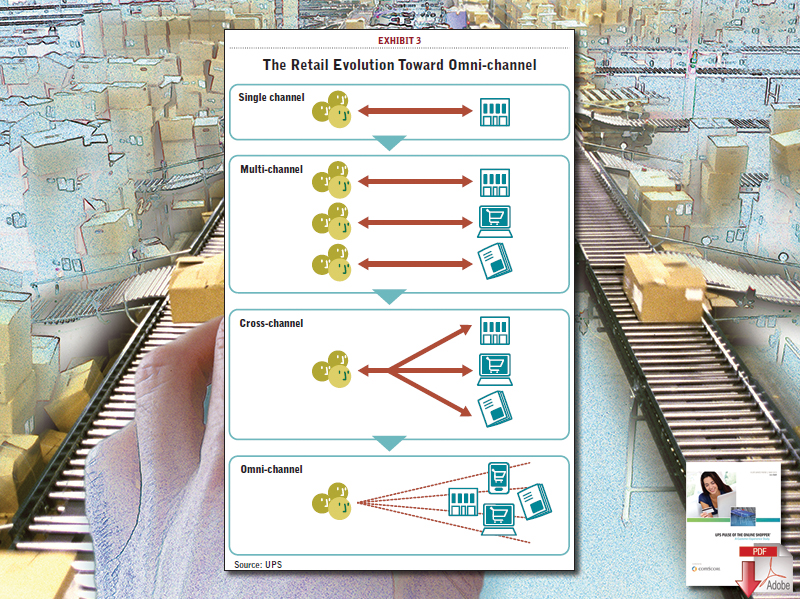

This concept did not suddenly emerge. Rather, it is a continuum of trends that were initiated in the early 90s as brick-and-mortar retailers that sold through a single channel began to expand their business by creating an online presence.

Exhibit 3 shows the first phase that was called multi-channel retailing: which means a retailer was selling through more than one channel, which could include its own stores as well as sales to wholesalers, through catalogs, or online.

In the multi-channel model, there was often little in common between what was available in the store, in a catalogue, or online. Each channel offered multiple independent touch points to the consumer—many times selling different items under separate brands. Just as often, orders were satisfied through separate supply chains. Inventory for store replenishment and wholesale orders was managed from one distribution center while inventory for online and catalog orders was managed from another facility or a third-party logistics provider.

Multi-channel evolved into the cross-channel model, as retailers started offering common branding and messaging. However, they continued to operate in separate functional silos with various touch points to consumers.

Multi-channel and cross-channel retailing innovations were driven by retailers that were trying to expand their sales. The transition from cross-channel to omni-channel retailing, on the other hand, is being driven by consumers. The increasing use of smartphones, tablets, and mobile applications in the U.S., Asia, and Mexico has created online shoppers with an insatiable appetite for information.

This omni-channel consumer is driving the desire for a seamless customer experience across all customer touch points for retailers. They want to buy from anywhere—in a store, on a laptop or PC, or from their phones and tablets; they want to pick it up from anywhere—in a store, at their place of work, at their home, or sent to a friend; and they want to return it anywhere—to a store or back to a distribution point.

Moreover, in an omni-channel world, retailers want to be able to satisfy demand from anywhere—a retail store, a distribution center, a third-party distributor, or drop-shipped from a manufacturer; and they want the ability to have an order returned to where it can generate the most value on the next sale.

Crawl, Walk, Run, Sprint

Providing such an omni-channel experience for consumers is a retailer’s “nirvana.” It is also difficult to attain. From our experience with scores of retailers, we have observed the best organizations don’t move from single channel to omni-channel retailing overnight. Instead, they use a method that is common in the deployment of technology, which is crawl to walk, walk to run, and run to sprint.

Crawl. In the early stages of implementing an omni-channel strategy, many retailers continue to function in separate channels. In the crawl phase, online can’t see what’s in the store and the stores don’t directly participate in what is being sold online or from the catalog. Marketing messages begin to align online with the stores and there are efforts to make sure the same or similar items are sold on both channels.

The process of synchronizing items can be difficult with various merchandising organizations, vendor relationships, and pack/display configurations. Some early forms of integration may be to sell online and deliver the item to the store for customer pick-up, or to allow customers to return items in-store that were purchased online. Some of the impacts to the supply chain include:

- Adjustments to the website and order management system are necessary to allow the consumer to select the desired store. The order management system must also have the correct “ship-to” address.

- Changes in outbound shipping processes to leverage the existing store replenishment network may be required. Retailers must pick the stores closest to the consumer to meet delivery expectations. Often, the online fulfillment and distribution centers are in different locations.

- Onsite pick-up in stores is challenging for sales associates. Work processes must be created to help associates separate merchandise for customer pickup from items sold in-store. The point of sales systems must also be configured.

- The point of sales system must also be altered to handle the return of items not currently in the store inventory. Another process must be configured for items that cannot be resold. Often, online fulfillment centers can be leveraged to handle this inventory; however, transportation methods will need to be established.

Walk. The next phase of development involves shared inventory as items in distribution centers and stores are now visible and available to be sold anywhere. Stores also have visibility into the availability of items in other stores and can ship directly to a customer’s home. Shared inventory visibility is the most critical—and perhaps the most difficult and expensive—step toward omni-channel retailing. Some of the capabilities do include:

- Buy Online—Ship from Store: The behind-the-scenes logic to make this happen is not simple.

- Buy at Store—Ship from Distribution Center: This option allows the store to “save the sale” instead of having the customer purchase from a competitor.

- Buy at Store—Ship from (Different) Store: This can also “save the sale” by allowing the store to locate an item at a different store and have it shipped to the customer from there.

As retailers enable these capabilities, they discover shipping from stores is not as efficient on a cost per item basis as shipping from the distribution center. We have provided several large retailers with the technology to improve and manage the productivity of in-store picking, packing, and shipping.

As retailers consider the added volume that will move to their stores from distribution centers or suppliers, and from stores to consumers, they often discover a need to re-evaluate their distribution network.

Another challenge is establishing the logic for routing orders to the stores for shipment. There are two primary strategies deployed:

- Reduce delivery time and/or costs for online orders by shipping from the nearest store to the consumer enabling next-day or second-day delivery.

- Optimize revenue by shipping merchandise sitting in stores and out-of-season to fulfill online demand. This will help reduce markdowns.

The deployment of either, or both, of these strategies can be tricky as the business models need to be coordinated between store operations, merchandising, and supply chain operations to make sure all group’s priorities are considered.

Run. A retailer that reaches the Run stage of omni-channel development has implemented universal inventory visibility. This strategy involves new ways to optimize this engine of growth:

- Create an integrated and seamless customer experience from the merchandise selection, store set-up, and catalog layout, to the web design.

- Leverage information gathered both in-store and online to create an integrated view of each consumer. The retailer will know which items the consumer purchased online, and consumers can view a history of items previously purchased. Online marketing will target ads to the consumers’ preferences.

With a single view of a consumer’s buying history, a single integrated experience becomes possible to allow consumers to buy and return anywhere.

With broad visibility into inventory and consumer profiles, retailers can begin to offer more advanced options to compete with retailers.

- Buy Online—Get Delivered Next Day: This service caters to consumers who shop online between 6 p.m. and 9 p.m. or “sit-back shoppers.”

- Same Day Delivery: For this service to be practical the merchandise needs to be near the customer.

Filling the increased volume of individual orders in omni-channel retailing is labor intensive and less efficient than conventional distribution models. This is especially true as retailers fulfill demand from retail stores.

Retailers transitioning from the Walk to Run stages of omni-channel retailing are employing several best practices to optimize their processes.

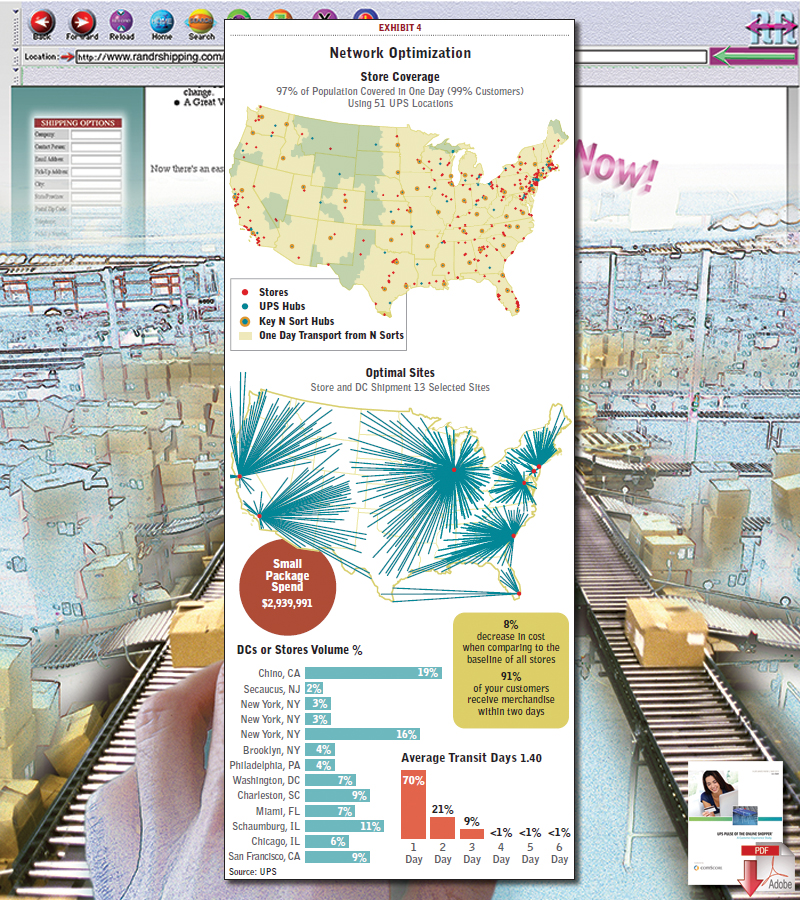

Network optimization, for instance, determines the right number of hubs and stores for the network, where those should be located, and how inventory should be positioned to meet both cost and customer service expectations.

We have worked with retailers that have realized 8 percent or better decreases in fulfillment costs while servicing more than 90 percent of their customers within two days as a result of network optimization (Exhibit 4).

Process mapping and time studies are important tools for retailers including ship from store in their strategy.

That’s because store fulfillment is the least efficient and most labor intensive method of order fulfillment.

Process mapping and time studies create a detailed chart of the steps required, or distance traveled, to fill orders in the store; how long the picking process takes; and how much time is spent walking.

That can identify areas for process improvement.

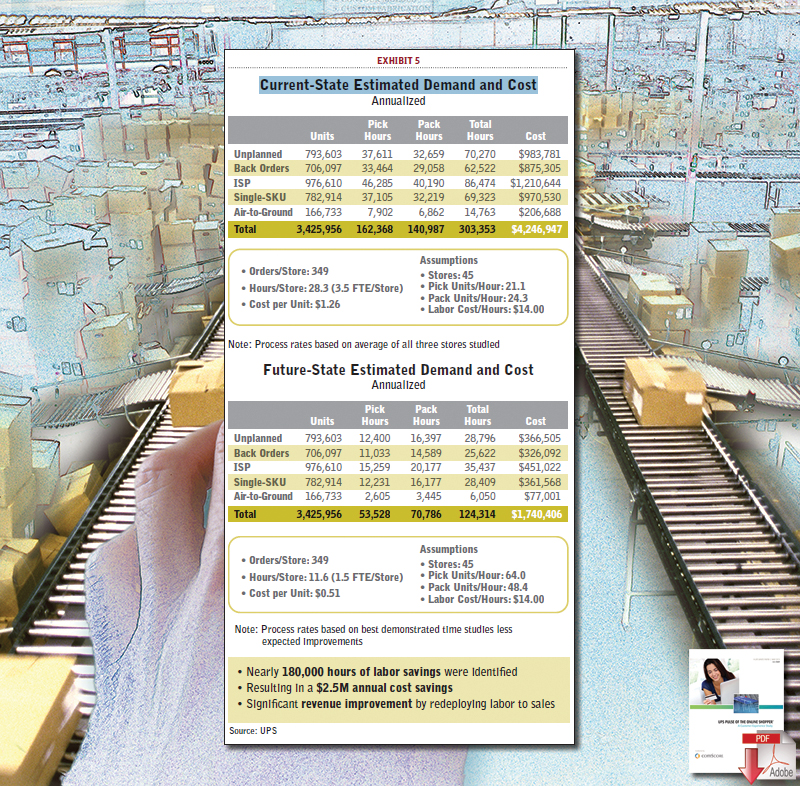

Retailers that have undertaken this process in their ship from store operations have identified as many as 180,000 hours of labor savings and $2.5 million in annual cost savings (Exhibit 5).

They are also able to re-deploy some labor used to pick orders back to the sales floor.

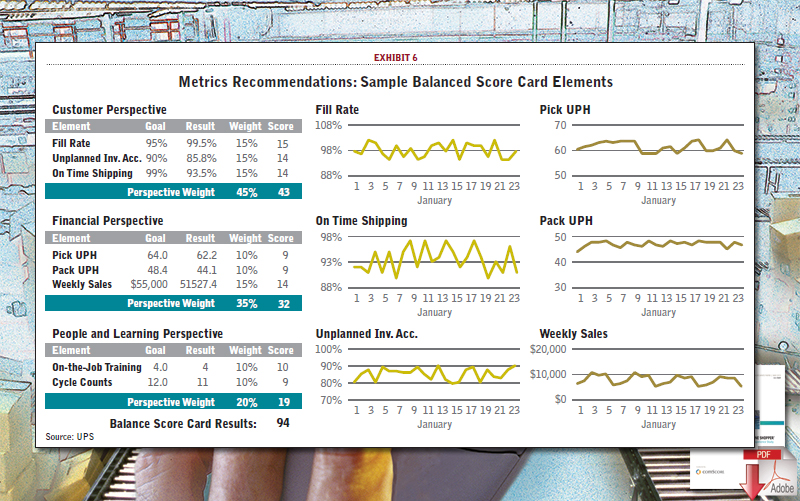

Finally, its important to create a Balanced Score Card to measure activities more commonly associated with distribution centers, such as fill rates, on time shipping and units per hour in picking and packing operations (Exhibit 6).

The point: Measurements are important to maintain the improvements designed into the process.

Sprint. In the most advanced deployments, retailers focus on improving the customer experience, increasing revenue, and optimizing supply chain operations. There are several strategies focused on inventory planning and store replenishment.

- Enhanced inventory and inbound supply planning processes incorporate the shipment from stores to online consumers. This involves anticipating store traffic and online demand to accurately plan store and distribution center inventory levels. Careful consideration of the business rules for how online orders are allocated to stores is important in this process.

- Rapid store replenishment responds to fluctuations in-store or online demand. This ensures high velocity and high profit items are available.

Another emerging technology is geo-fencing. This technology creates a virtual perimeter around the store and knows when smartphones enter or leave the area.

Once a consumer arrives, a promotional message can be sent to them based on their previous buying history.

Conclusion

In some ways omni-channel was the natural evolution from multi-channel retailing tearing down barriers between channels, synchronizing brand messages, and creating a seamless customer experience to better serve customers. However, the rapid growth of larger e-tailers, the success of mobile commerce, and changing consumer behaviors accelerated the evolution into a reactive innovation.

Retailers are discovering they need to make significant changes to their supply chain to align merchandise and make inventory visible and available across all channels.

It’s widely known online consumers want more options and have higher expectations—it’s up to retailers to meet that demand. Omni-channel is an evolving first step.

About the Author

Randy Strang is Vice President of Customer Solutions for the Retail Industry team at UPS. He leads a group of logistics professionals who design supply chain solutions for global retailers. He can be reached at [email protected].

Article Topics

UPS News & Resources

Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 FedEx and UPS to Charge Additional Delivery Fees in Major U.S. Cities Parcel Experts Weigh in on New Partnership Between UPS and USPS Parcel experts examine the UPS-United States Postal Service air cargo relationship amid parcel landscape UPS To Become USPS’s Main Air Cargo Provider, Replacing FedEx UPS is set to take over USPS air cargo contract from FedEx GRI Impact Analysis – Parcel Spend Management 1.0 vs. 2.0 More UPSLatest in Business

Ranking the Top 20 Women in Supply Chain TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process U.S. Manufacturing Gains Momentum After Another Strong Month More Business