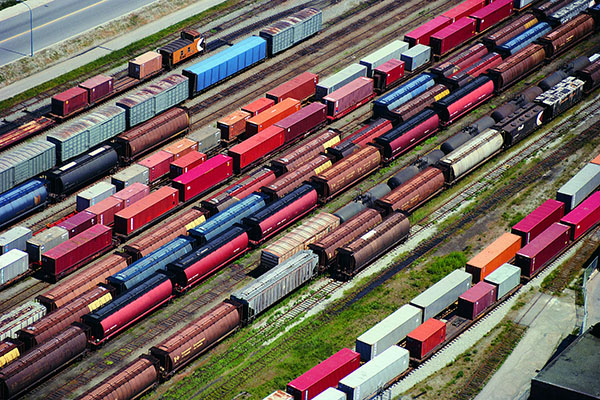

October intermodal volumes turn in solid performance, reports IANA

Total intermodal volume for the month, at 1,690,668, rose 6.1% annually.

Intermodal volumes for the month of October saw annual gains across the board, according to data recently provided to LM by the Intermodal Association of North America (IANA).

Total intermodal volume for the month, at 1,690,668, rose 6.1% annually.

Domestic containers saw the highest rate of growth in October, rising 6.9% to 729,604. Trailers headed up 4.1% to 123,371, with all domestic equipment (trailers and containers) up 6.5% to 852,975. ISO, or international containers, had the highest-volume month of all IANA metrics, rising 5.8% to 837,693.

On a year-to-date basis through October, total intermodal volume is up 6% to 15,822,277. Trailers had the highest annual growth rate, rising 13.6% to 1,195,757, and domestic containers saw a 5.5% annual gain to 6,645,020. Total domestic equipment, at 7,840,777, was up 6.7%. ISO containers, at 7,981,500, were up 5.4%.

These tallies continue to highlight how decent economic fundamentals, coupled with steady demand and strong consumer confidence numbers, continue to pace solid volume growth.

What’s more, intermodal unit volumes continue to outpace U.S. rail carload data, according to data from the Association of American Railroads.

As LM has previously reported, other factors driving solid intermodal growth include still-tight truckload capacity, coupled with the ongoing driver shortage, with the trucking market also dealing with some crimped production, due to the December 2017 implementation of the Electronic Logging Devices (ELD) mandate for motor carriers.

Last month, IANA President and CEO Joni Casey said intermodal traffic patterns are “normalizing” prior to entering peak holiday shipping season.

“Another rise is expected in the latter months of the year based on anticipated increases in e-commerce volumes, as well as potential import volume surge in advance of additional tariffs kicking in as of January,” she said.

Addressing the ongoing trailer growth, Casey described it as a “byproduct of heavy e-commerce demand, but it is also a factor of tighter over-the-road capacity,” adding “it remains to be seen if this is ‘the new normal.’”

On the ISO side, IANA explained that rising container import volumes are the main reason for segment growth, adding that barring any sort of change to trade policy, that growth should remain intact in 2018, paced by solid economic fundamentals. But should large tariffs be applied to Chinese imports, IANA said it could have a “significant impact on ISO container volume,” which would be a cause for concern, as 47% of U.S. container volume originates in China.