Ocean Carrier Trends: Will global shipping alliances restore stability?

Hedging your bets on securing capacity may be an ongoing gambit this year, say ocean shipping industry experts. The big players have only gotten bigger, but that’s no guarantee that service and reliability will improve.

Last year ushered in the formation of three major ocean carrier alliances, all with the hope that this dysfunctional transportation sector would at long last begin to find a way to provide shippers with sustainable service while managing to keep its capacity in check.

First came 2M, comprising Maersk and MSC. Then came Ocean Alliance, which includes CMA-CGM, Cosco Group, OOCL and Evergreen. Finally, we saw the creation of The Alliance, made up of Hapag Lloyd, NYK, Yang Ming, MOL and K-Line. And it’s not over—not by a long shot.

Keep in mind that by April 2018, shippers will see even more changes in the configuration of ocean partnerships as Japanese shipping groups K Line, MOL and NYK merge their businesses into Ocean Network Express, or ONE. Still later in the year, OOCL will become part of Cosco, thereby creating a scenario where just seven operators will control nearly 90% of global trade.

Keep in mind that by April 2018, shippers will see even more changes in the configuration of ocean partnerships as Japanese shipping groups K Line, MOL and NYK merge their businesses into Ocean Network Express, or ONE. Still later in the year, OOCL will become part of Cosco, thereby creating a scenario where just seven operators will control nearly 90% of global trade.

At first glance, it could appear that these developments would present shippers with more economy-of-scale choices than ever before; however, analysts caution that all of this consolidation may actually limit deployment and port-of-call options for logistics managers this year.

Bullish forecast

Driven by strong volume growth across all main regions, the global container throughput growth is on track to exceed 6% in 2018, according to Paris-based ocean shipping consultancy Alphaliner.

Following a strong first half growth estimated at 6.7%, third quarter throughput figures have remained robust. Chinese ports (including Hong Kong) led the way, recording a 9.3% growth in the period from July to September. Total volumes at Chinese ports increased by 9.1% in the first nine months of the year.“

The strong container volume growth this year is expected to elevate the twenty-foot equivalent units [TEU] to gross domestic products (GDP) multiplier to 1.7 times global GDP growth, reversing the recent downward trend that has seen the multiplier drop to below 1.0 in the previous two years,” says Stephen Fletcher, Alphaliner’s commercial director.

According to Fletcher, predictions that the container trade had reached a mature phase of its development, with volume growth expected to grow only on par with GDP, “proved to be overly pessimistic, even though container volume growth is unlikely to see a return to the two-to-three times GDP ratio that it had enjoyed prior to 2008.”

At the same time, global economic recovery is continuing, with the International Monetary Fund lifting its global GDP growth forecast for 2017 and 2018 to 3.6% and 3.7% respectively in the latest World Economic Outlook report released in October, rebounding strongly from last year’s 3.2% growth rate which was the lowest annual growth rate since the global financial crisis in 2009.

“The improved outlook is reflected in the latest container lifting statistics,with both the Asia-Europe and trans-Pacific headhaul routes registering 5.3% growth,” adds Fletcher.

Indeed, in its latest review of the liner market, analyst Trevor Crowe of Clarksons Research in London notes that here were “improvements to build on,” and that the sector had “come a long way since the collapse of Hanjin Shipping” in the summer of 2016. “With capacity supply growth set to remain fairly moderate for the next few years,” he says, “favorable fundamentals look set to provide ongoing support if the demand side holds.”

Indeed, in its latest review of the liner market, analyst Trevor Crowe of Clarksons Research in London notes that here were “improvements to build on,” and that the sector had “come a long way since the collapse of Hanjin Shipping” in the summer of 2016. “With capacity supply growth set to remain fairly moderate for the next few years,” he says, “favorable fundamentals look set to provide ongoing support if the demand side holds.”

However, Crowe contends that risks remain on the demand side, but in 2018 the containership sector will be looking to push on and build further on the progress made in 2017. Does this foretell a “golden age” for existing carriers as they try to recover from a generation of soft rates and overcapacity?

Analysts for Panjiva say that it will, if, and only if, they can maintain their discipline on building new capacity and pricing. “On the former, they have concerns,” says Panjiva research director Chris Rogers. “Recent news of orders from Evergreen Marine come on top of extensive plans from Hyundai Merchant Marine, CMA-CGM and MSC and suggest that capacity discipline shouldn’t be taken for granted. Similarly it has taken the container lines several months to pass through the rally in bunker fuel costs to customers.”

According to Rogers, the major deals launched last year should also begin to yield improved efficiency that may be reflected in earnings this year. With nearly 400 different vessel operators plying their trade worldwide, there’s plenty of competition and potential for more M&A activity.

More consolidation?

Analysts for the London-based consultancy Drewry Supply Chain Advisors certainly agree that more consolidation may take place. At the same time, they observed that the collapse of freight rates during the second half of last year is far out of line with the underlying supply and demand fundamentals. Furthermore, it suggests that carriers have not yet rid themselves of certain “self-sabotaging”traits.

But it’s not all doom and gloom, says Drewry’s Philip Damas, who observes that the carriers are heading towards a brighter future, while also acknowledging that there are several temporary factors that have created a bump in the road to recovery.“

One area that might have been expected to provide more immediate benefit was the significant consolidation occurring in the market,” says Damas. “The fact that mergers and acquisitions haven’t materially changed anything so far is not that surprising. The latest consolidation wave has barely become operational, with most transactions either just concluded or still pending.”

Moreover, Damas explains that even after all of the latest deals are finalized, they alone don’t have sufficient weight to move the industry all the way to being a “non-collusive oligopoly,” which Drewry previously outlined as being necessary to herald a new era of “liner paradise.”

“If anything, we perhaps overlooked the risk that the merger activity would make some predators more aggressive with their pricing to minimize shipper attrition,” adds Damas.

Unstable pricing

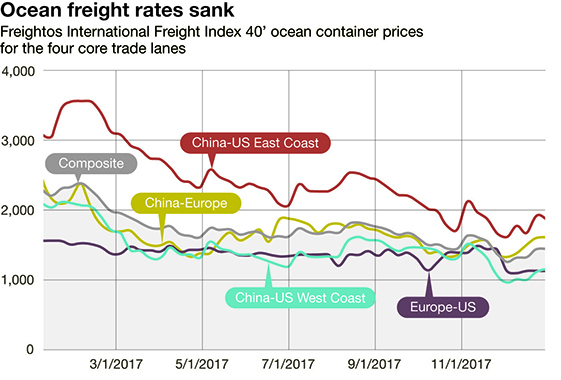

Freightos, an SaaS-enabled logistics technology provider focused on instant freight quotes for freight forwarders and shippers, notes that chronic oversupply, rather than seasonality, was the main factor driving ocean freight prices in 2017. Furthermore, they contend that increasing container slot supply will continue unabated in 2018.

According to Freightos data, despite several carriers pushing back some deliveries until next year, the global containership fleet is still expected to grow by 5.6%.

“With TEU growth exceeding the growth in demand, prices dropped last year,” says Dr. Zvi Schreiber, Freightos founder and CEO. “So, while an early August 2017 uptick raised hopes that peak season was commencing,

it couldn’t stem the downward trend of pricing.”

On average, 2017’s peak season lagged 19% behind the previous year. The prices may have been lower, but they were also more stable, according to Freightos. Aggregating weekly median pricing on the three China lanes, the standard deviation for 2017 was $351,compared with $414 for the previous year. “Opacity and pricing fluidity continues to plague the industry,” says Schreiber. The upshot is that spot market prices for forwarders can diverge radically, and shippers presumably face an even higher variance.”

MAERSK/IBM: A very “Big Blue” venture

When A.P. Moller-Maersk and IBM announced their intent to establish a joint venture to offer blockchain technology to the ocean cargo industry, many analysts greeted the news with some skepticism. But the unique business partnership insists that their jointly developed platform will be built on open standards and will address the need to provide more transparency and simplicity in the movement of goods across borders and trading zones.

The companies note that more than $4 trillion in goods are shipped each year, and the maximum cost of the required trade documentation to process and administer many of these goods is estimated to reach one-fifth of the actual physical transportation costs.

According to The World Economic Forum, by reducing barriers within the international supply chain, the central goal of blockchain, global trade could increase by nearly 15%.

“Blockchain technology is ideally suited to large networks of disparate partners,”says Bridget van Kralingen, senior vice president, IBM Global Industries, Solutions and Blockchain. “A distributed ledger technology, blockchain establishes a shared, immutable record of all the transactions that take place within a network and then enables permissioned parties access to trusted data in real time.”

The companies say that by applying the technology to digitize global trade processes, a new form of command and consent can be introduced into the flow of information, empowering multiple trading partners to collaborate and establishing a single shared view of a transaction without compromising details, privacy or confidentiality. For an industry that has suffered one major bankruptcy—Hanjin—and red ink returns for the past decade, many in the ocean cargo industry believe that such a reversal cannot come too soon.