New Report Examines Current State of Freight Transportation & Logistics Markets

The report examines trends, including capacity shortages’ effect on transportation prices, the ascent of non-asset 3PLs in recent years, and future growth drivers in the freight transportation and logistics sectors.

A new report from Chicago-based freight transportation and logistics consultancy CarrierDirect, entitled “Eat or Be Eaten: The Year of Separation in Freight,” takes a deep dive various aspects of current market trends on freight transportation and logistics.

The report examines trends, including capacity shortages’ effect on transportation prices, the ascent of non-asset 3PLs in recent years, and future growth drivers in the freight transportation and logistics sectors.

CarrierDirect President Joel Clum said that since July 2014, when freight levels were coming off of a very strong second quarter due to the aftereffect of the early 2014 Polar Vortex and pent-up demand, it raised the question of whether the growth was for real or more tied to the challenges that occurred during the first quarter of 2014.

“Things just kept growing,” he said. “Tonnage levels headed up, driver capacity certainly was not figured out from a shortage standpoint, and rates continued to rise in the spot market and the contractual market for truckload and pricing power continued to be in the asset-based carriers’ corner, with many finding ways to increase base rates as the year went on. What we started seeing mid-year was not an anomaly and was real. The biggest thing that changed was that it did not stop, even though December tailed off a bit but not at the typical level of drop-off that we usually see.“

Perhaps the most notable change in recent months, though, according to Clum, has been the steep decline in fuel and oil prices, which has, in turn, been a boon to freight transportation and logistics services providers primarily in the form of lower operating costs, while at the same time tremendously aiding carriers and providers serving retail-based customers, as lower fuel prices have dramatically impacted the amount of discretionary income consumers have. That has led to increased spending by consumers, which Clum said has minimized the typical post-holiday consumer spending malaise to a degree.

And on the carrier side he explained low fuel prices have also had a big impact on things like empty miles in that it helps to make things more affordable from an operations perspective.

For asset-based carriers, the report stresses how without a sharp focus on asset utilization, it becomes much more difficult to carriers to effectively compete.

“If you are not investing in the right kind of technology focused on asset utilization and driving efficiency in carrier networks, it is that much harder to be competitive,” Clum explained. “The days pushing for value propositions are not gone but are very much so complimented by the need for technology and new insights. Senior leadership at many trucking companies come with a different mindset about what they need to be doing as a company. It is involved much more in technology and data analytics that you are seeing much more of now than even a few years ago going back to pre-recession days.”

This shift is helping carriers drive out inefficiencies to increase their bottom lines and provide more consistent pricing to customers so they can better manage fluctuations in supply chain costs, adding that no carrier can be accused of “making too much money right now” as most have operated on very low margins over the last eight-to-ten years. And if carriers can get to the point where they can squeeze out more operating profit to invest in things like new fleets and technology, it will have a long-term benefit for both them and their customers.

On the rate side, the report observed that linehaul rates continued on an aggressive upward trend across all modes in 2014 due to a tight capacity marketplace, driving large increases in spot rates for dry van and reefer.

And large shippers, Clum said, have mostly given carriers everything they are going to give, in terms of pricing, at the moment, and barring a significant event like a Polar Vortex, they won’t be having conversations with carriers this year in which carriers say they want to raise rates 5-to-7 percent to boost driver pay.

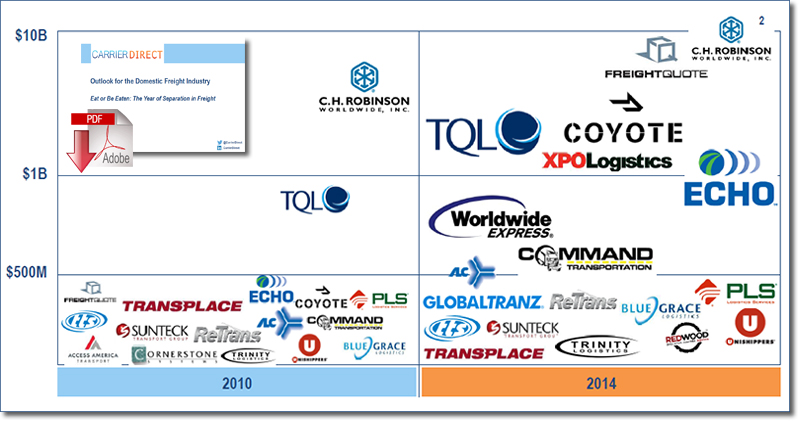

2010 through 2014 showed huge growth in the (primarily1) non-asset logistics segment that focuses on handling domestic transportation management for small and mid-sized shippers

“Small- and mid-sized shippers might see a bit of an incremental cost increase on linehaul expenses, with fuel serving as a large [variance] and carriers would start coming back to customers and saying they need to take a base rate increase whereby when fuel comes back up these prices will be locked in,” he said. “It is surprising that not many carriers have been doing that. Some LTL increases have taken increases in their fuel surcharge, but the overarching theme of 2015 for rates is likely to be one of more incremental rate growth but not beyond inflation in the 6-to-10 percent range for truckload carriers, which was more of the case in 2014.

The ongoing theme of growth through acquisition was noted on the report, as M&A continues to drive consolidation in the asset-light and non-asset logistics space as companies are finding that its cheaper to buy vs. build in the current economic environment, according to CarrierDirect.

Looking at the vast majority of non-asset 3PL that are either owned by private equity firms of have a significant amount of private equity funding behind it, or, in some cases are privately owned, Clum said in contrast to truckload carriers, there are lots of economies of scale for truckload brokerage, where many non-asset 3PLs are heavily involved.

“The big brokers are growing in such a way that they are taking out a lot of the risk of that business model and systemizing it really well,” he said. “They are using the economies of scale they have by leveraging their technology and data and carriers rely on them more to help them run more effectively.”

The report cited some key themes for what is ahead in the freight market and what asset and non-asset companies should be doing, including:

- investing in new technologies and service offerings that will continue to support innovation in the global supply chain to reduce costs and provide better reliability to freight movements;

- consolidation in the non-asset 3PL sector will give way to larger, full-service brokerages vs. a fragmented marketplace with small, independent firms with single mode competencies; and

- in 2015 carriers and 3PLs should be focused on a handful of core initiatives in order to compete in a changing marketplace where customers and competitors are doing new things

Article Topics

CarrierDirect News & Resources

The Case for Lowering LTL Limits of Liability CarrierDirect white paper takes deep dive into benefits of dimensional LTL pricing Outlook for the Domestic Freight Industry - Eat or Be Eaten: The Year of Separation in Freight New Report Examines Current State of Freight Transportation & Logistics Markets New CarrierDirect report examines current state of freight transportation and logistics markets Another Rate Increase from Less-than-Truckload Carriers Can Dimensional Pricing Be The Financial Champion For The Less-than-Truckload Sector? More CarrierDirectLatest in Transportation

Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More TransportationAbout the Author