New Perspectives on the Value of Demand Sensing

Demand sensing tools are easing inventory burdens in many industries. Recent research points to which types of companies have been investing in those tools and when, and what kinds of results they have been seeing.

Last holiday season, many retailers and their suppliers were shocked by 11th hour shifts in demand, with much of the surprise coming from a surge in e-commerce orders.

As recently as a decade ago, it wasn’t unusual for businesses to be hit with much larger or smaller orders than they had been expecting - and for those orders to arrive earlier or later than anticipated.

But since then, the discipline of forecasting has improved markedly, with mathematically tractable models providing more useful predictions of demand.

So why, in the first decade of the 21st century, are businesses still surprised - and hobbled - by sharp shifts in demand?

The truth is that lack of accuracy still plagues forecasting efforts. A precision forecast of demand is essential for the successful utilization of advanced planning tools.

Until recently, demand forecasting primarily involved analyzing historical information using quantitative and qualitative methods. But in categories such as e-commerce, the historical data is too thin to be truly useful.

Today, as the shape of consumer demand continues to change dramatically, what’s needed is a far broader look at all of the factors that influence demand - in other words, a picture of “true demand.”

The pursuit of true demand supports financial goals as well as supply chain goals.

In fact, “understanding true demand” was the first of “5 Lessons for Supply Chains from the Financial Crisis,” published in Supply Chain Management Review last October.

A Refresher on True Demand

The term “true demand” refers to the demand for the products and services that consumers truly want. For retailers, true demand can be hidden by stock-outs or by sales of substitute items. True demand is more elusive for companies upstream in the supply chain because they must estimate true demand from orders received from retailers or wholesalers.

What is Demand Sensing and Why Does it Matter in Supply Chain Planning?

With the rush of so-called “big data” - notably the escalation of real-time data - now available for demand forecasting, new toolsets are required to drive advanced inventory planning. Such tools are now available: They synthesize massive amounts of data - much of it real-time - such as multiple customer point-of-sale (POS) data streams, variables related to weather conditions, economic indicators, sales of competing products, social media hype, and a host of additional indicators. The Journal of Business Forecasting notes that demand sensing sorts out the flood of data in a structured way to recognize complex patterns and to separate actionable demand signals from a sea of “noise.”

Demand sensing technology has already been adopted by companies that are recognized as having the most progressively managed supply chains. Indeed, investments in demand sensing solutions are growing more rapidly than supply chain spending in general.

According to a recent IDC Marketscape assessment of sensing and planning vendors published in September 2013, demand sensing initiatives accounted for 8.5 percent of supply chain spending in 2013, and are expected to reach 8.7 percent in 2015.

In the balance of this article, we describe a demand sensing study we conducted at the University of North Florida (UNF), share observations regarding the role of demand sensing in supply chain planning, and summarize the impact of demand sensing on supply chain management.

This study includes four key observations regarding demand sensing that are important to supply chain managers:

(1) demand sensing can support inventory reduction and profit generation;

(2) it is pursued in organizations where inventory is important;

(3) demand sensing is possibly a response to low inventory turns; and

(4) supply chain leaders have adopted demand sensing early.

A Study of Demand Sensing

In 2012, we began to collect publicly available information about companies that started adopting demand sensing solutions as early as 1999, together with data on software and solutions vendors that have entered the demand-sensing market in the last decade. In analyzing this market data, and combining the information with publicly available financial data on the adopting companies, we were able to better understand what demand sensing means for supply chain managers.

In general, these managers acknowledge that there are many invaluable real-time variables not found in the historical records that drive current time-series forecasting analyses. Adding these real-time inputs to the prediction process brings companies closer to understanding real customer requirements based on actual customer circumstances and business priorities –in other words, closer to true demand.

Specifically, we were curious about when and why leading supply chain practitioners adopted demand sensing. What was the situation that compelled them to investigate and adopt demand sensing? We thought that by tracking the investments in demand sensing made by supply chain leaders, we would learn more about what compelled adoption of the technology.

This UNF study investigates the exponential increase in adoption of demand sensing software in the past decade. Exhibit 1 illustrates the growth of adoption of demand sensing applications in that period. The study also indicates that the dollar volume of inventory managed by demand sensing tools is on the rise, from less than $1 billion in 1999 to potentially more than $25 billion in 2012.

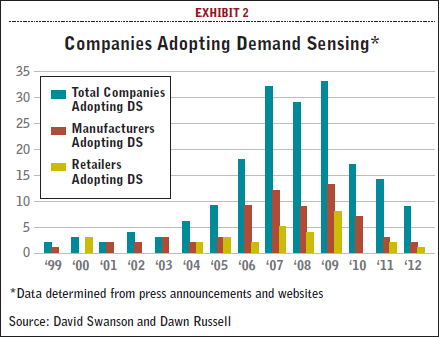

The data shows that in the early years, demand sensing was a fairly novel concept, and related applications were largely prototypes. But market momentum for the adoption of applications began to increase in 2005 and 2006 and reached a peak in 2008.

So what types of companies have been making these investments? Our research discussions centered on topics such as: industries using the software; differences between large and small adopting companies; and corporate characteristics. Information on adoptions of demand sensing from 1999 to 2012 came from two sources: press announcements found through Lexus/Nexus, and customer announcements on the Web sites of demand sensing solutions vendors.

This study is based on observations of 237 companies that have adopted demand sensing during the period discussed. Of the 237 public announcements, 141 were public companies, and 109 of those public companies identified the year and quarter of adoption. We then narrowed our study to 80 of these companies, which could unambiguously be linked to financial data from Compustat. The mean size of those companies was just under $22 billion in annual revenue, with roughly $2.4 billion in inventory on hand.

The number of software companies that publicize the sales of their demand sensing solutions has multiplied from three in 2000 to more than 25 in 2012, affirming the potential effectiveness of the toolset. It is interesting to see that the list of software vendors includes several time-tested supply chain technology companies such as JDA, SAS and SAP as well as new specialized players such as Terra Technology and alqemyiQ.

From 1999 to 2012, 26 vendors supplied the market, which appears to be dominated by eight companies that have announced 10 or more demand sensing offerings each. Looking at which industries are the most prominent adopters, manufacturing led the field, followed by retail. (See Exhibit 1.)

Consumer packaged goods (CPG) and retail companies were the most frequent early adopters, and industries such as healthcare and food services were late to do so. The first adoptions from these laggard industries in our dataset were announced in 2008, nine years after the first sales of the software.

Further, almost half of the adoptions of demand sensing in our database of public companies have been from companies associated with the food industry. This includes farmers, food manufacturers, food retailers, and restaurant chains. Given the industry’s famously slim margins, coupled with the importance of logistics in getting its products to market, demand sensing appears to be a tool to which the food industry has migrated.

Four Key Observations Relevant to Supply Chain Managers

As our UNF team more closely examined the market environment and statistics surrounding the adoption of demand sensing applications, other interesting insights began to emerge, along with a picture of some of the specific characteristics of the adopters. Following are four of the most important insights.

1. Demand sensing can support inventory reduction and profit generation, even during economic downturn.

The popular press has documented multiple stories about companies mired in excess inventory when customers’ orders screeched to a halt during the recession. Yet growth of demand sensing remained positive throughout the recent economic downturn in the United States.

The three years with the highest number of adoptions of demand sensing software were 2007 through 2009. (See Exhibit 2.)

From this we draw two possible insights. First, companies struggling to remain profitable through the downturn had to turn to new and promising ways to optimize their supply chains; their managers were motivated to adopt changes that may have been postponed until the need was paramount. Second, it could be assumed that the relative expenditure for demand sensing solutions was inconsequential compared to the potential payback, so as companies grasped the usefulness of the tools, they adopted them because the return on investment (ROI) was attractive, even during tough economic times. Business norms would indicate that when companies are pressed to maintain profit margins in such times, they start looking at how to improve returns on their most important investments - inventory included.

For the companies in the UNF study, inventory is one of their largest investments. Demand sensing helps improve the understanding of true demand, so it is very likely to have been deemed valuable during the downturn.

There is further confirmation of demand sensing’s contribution to ROI in “Estimating Benefits of Demand Sensing for Consumer Goods Organizations,” a 2012 article in Database Marketing and Customer Strategy Management. The article profiles Unilever, Del Monte, and Procter & Gamble - all CPG companies for which demand planning and inventory management are critical elements of business performance.

Although the cases do not reveal the specific products on which demand sensing techniques were used, they do report a trial period in 2006 for the Unilever case that shows a 25 percent decrease in forecast error. They also report that one year after implementation in 2009, the benefits of demand sensing included “seven day demand forecast improved by 40 percent on average and …a 16 percent improvement in the 28 day forecast across all brands.” The Unilever case also reports “the impact was a reduction in finished goods safety stock of three days, which also led to reduced freight costs because of less stock movement and lower inventory in the system.”

2. Demand sensing is pursued when inventory is important.

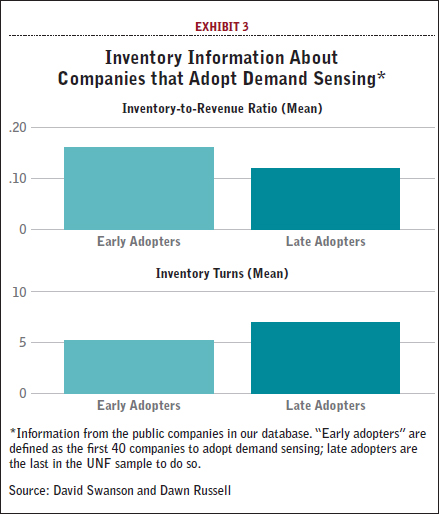

To determine which companies would adopt demand sensing software, an expert would seek to understand which companies need it most. For this purpose we use relative inventory, defined as the inventory-to-revenue ratio. Our data indicates that the companies that adopted the applications early do in fact have higher inventory-to-revenue ratios. (See Exhibit 3.) These metrics would suggest that the companies to which inventory is most important were among the first to adopt these new tools.

In what ways would inventory be more important? We see two possibilities. First, a higher inventory-to-revenue ratio indicates that the company spends more of its resources on inventory, relatively speaking. For example, between a shoe retailer and a stockbroker producing equal annual revenues, the former would have a higher relative inventory. A second explanation for high ratios among adopters of the tools may be that companies with too much inventory relative to sales believe that they are relatively inefficient, so they are adopting the tools to improve their inventory management performance.

The available literature and inventory theory suggest that CPG companies, which are heavily represented in this study, and others with high inventory and demand volatility, would obtain the most benefit from demand management tools such as demand sensing and therefore would aggressively adopt demand sensing toolsets. We see evidence in our dataset that CPG companies are indeed aggressively adopting demand sensing.

Furthermore, in 2012, the Journal of Business Forecasting reported that one-third of North American CPG companies were already using demand sensing tools. The journal further noted that demand sensing is useful in many business situations, including new product introductions, forecasting high and low volume items, seasonality, promotions, etc.

3. Demand sensing could be a response to low inventory turns.

We examined financial performance numbers for further insights that could explain the adoption of demand sensing. By all accounts, mean inventory turns were unimpressive for both early and late adopters, but the early adopters had lower turns than the companies that adopted later. (See Exhibit 3.)

The early adopters’ lower inventory turns could indicate inventory management challenges and earlier steps to address them with demand sensing solutions.

In case studies by other researchers, there were several indications that demand sensing drives improved inventory turns. Examining inventory turns provides another metric in addition to absolute inventory levels. Companies that can cycle inventory more rapidly demonstrate superior operational responsiveness and typically display stronger financial performance.

The Del Monte case highlighted in the Database Marketing and Customer Strategy Management article noted improvements in return on invested capital, increased sales and profits, and lower operating expenses after beginning demand sensing initiatives in 2006. The P&G case highlighted forecast error reduction, safety stock reduction, and increased cash flow. These are all indicators that inventory velocity and turns are improving. This may also indicate that the companies that manage inventory most efficiently are those that are quick to adopt promising technologies such as demand sensing.

4. Supply chain leaders were early adopters of demand sensing.

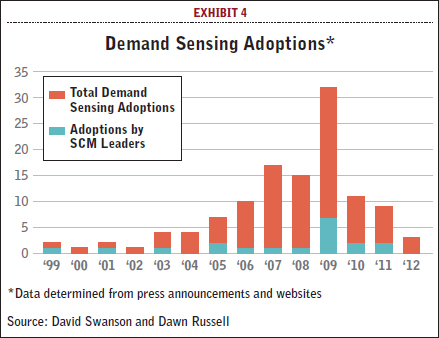

Referencing the companies listed in the Gartner “Supply Chain Leaders” report, we found that the high-ranking companies in that report were early buyers of demand sensing solutions. We have been able to identify the year and the quarter in which 181 companies adopted those applications. Of those companies, a quarter rank high on the Gartner list. (See Exhibit 4.)

Our research points to a clear connection between uptake of demand sensing solutions and companies noted for their progressive supply chain operations. The study highlights particular benefits of the solutions, such as their positive impact on inventory turns. The leading companies use demand sensing as a supplement to other demand forecasting tools, which collectively are used to estimate future demand as part of their advanced inventory planning solutions.

The commitments made by the leading companies testify to the importance of demand sensing applications for use in supply chain management and the capability of companies to use the tools to impact profit.

Demand sensing is a tool that will enable more and more companies to capitalize on the prevalence of big data. It is a tool for our complex, dynamic times and there is clear evidence that it can help companies in many industries glean more meaningful business insights - by gaining a clearer picture of true demand.

About the Authors

David Swanson, Ph.D., is an Assistant Professor of Transportation and Logistics in the Coggin College of Business at the University of North Florida in Jacksonville, Fla. He can be reached at [email protected]. Dawn Russell, Ph.D., is an Assistant Professor in the Department of Marketing and Logistics in the Coggin College of Business at the University of North Florida. She can be reached at [email protected]. For more information, visit www.unf.edu.

Related: Demand-Shaping With Supply in Mind

Article Topics

Blue Yonder News & Resources

Blue Yonder announces an agreement to acquire One Network Enterprises for $839 million Blue Yonder Acquires One Network Enterprises for $839M Frictionless Podcast: Understanding Your Supply Chain Goals with Ann Marie Jonkman Blue Yonder announces acquisition of flexis AG Supply Chain Management (SCM) applications keep the supply chain humming How Collaborative Efforts Can Enhance Reverse Logistics Netlogistik partners with SVT Robotics to resell SOFTBOT platform More Blue YonderLatest in Supply Chain

TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month More Supply Chain