New Crowdsourced Delivery Models Pose Serious Challenges to UPS, FedEx, and USPS Monopolies

The millennial generation is much less loyal to legacy brands than generations past, and data shows consumers are hungrier for better, faster and more transparent shipping and delivery services, and they don’t much care who provides it.

Legacy delivery companies like FedEx Corp. and United Parcel Service Inc. (UPS) played a huge role in the decline of the U.S. Postal Service, but it’s time for them to pay the piper.

Technology has brought FedEx and UPS face-to-face with their own competitive threat: Amazon.com, Google, Uber, Postmates, and other startups.

Mobility, brought upon by the proliferation of smartphones, apps and connected devices, has created a climate of instant gratification and given way to a fast-growing market for on-demand delivery services, such as Postmates.

The millennial generation is much less loyal to legacy brands than generations past.

Data shows consumers are hungrier for better, faster and more transparent services - from shipping to cable - and don’t much care who provides it.

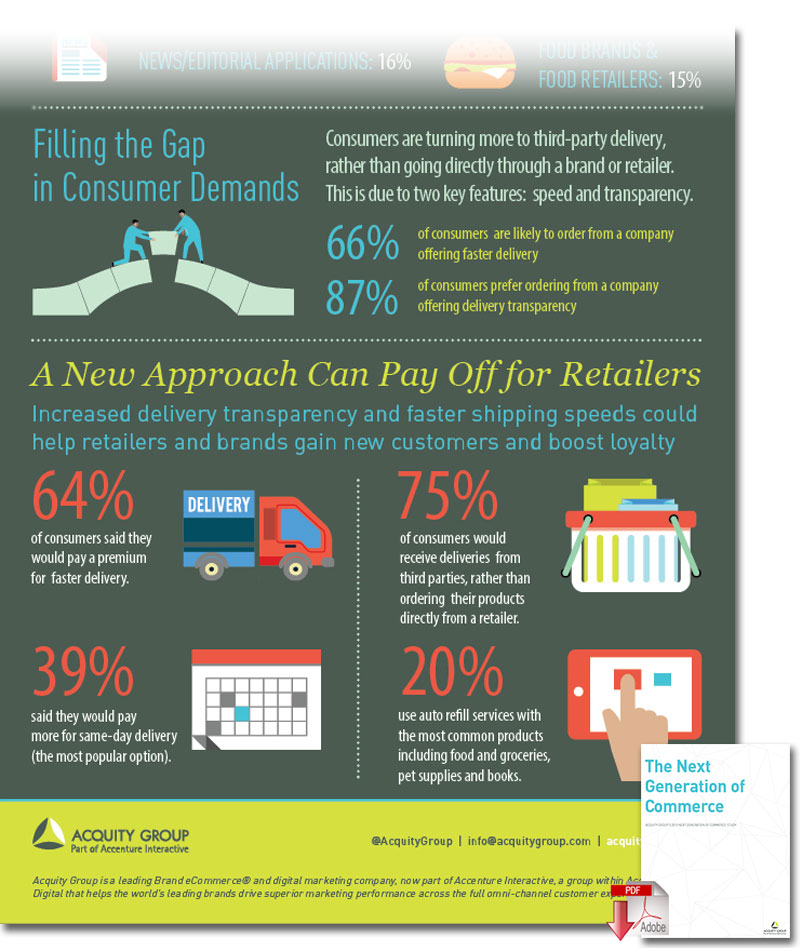

In a study of 2,000 U.S. consumers released last week by Acquity Group, 64% said they would pay a premium for faster delivery. Roughly 75% said they would be open to receiving deliveries from third parties, but just 12% reported using pop-up next-generation services, such as Postmates, so far.

Acquity said that gap presents significant opportunities for tech and crowdsourcing companies, assuming they can maintain their competitive advantage.

Infographic: The Next Generation of Commerce

It seems everyone wants to get involved in the delivery business these days, with the costs of entry declining thanks the affordability provided by crowdsourcing - which in this case is the idea of using localized fleets and regular people to deliver household goods faster and more efficiently.

Postmates, founded in 2011, has been expanding rapidly across the U.S., delivering anything from prepared foods to Starbucks coffee and lingerie for Valentine’s Day.

Third-party delivery companies that don’t focus on shipments at their core, such as ride-sharing company Uber, are also trying to hop on board.

Uber has been testing a service to deliver items through its fleet of 200,000 active drivers, while Amazon.com already testing delivery drones, is said to be testing an Uber-like app that would, in some cases, pay regular people to deliver packages en route to their own destinations.

Google has also made announcements that the express online shopping-and-shipping service it has been testing for months in northern California and parts of Los Angeles, New York City, Boston, Chicago, and Washington, D.C. promises same-day shipping. The service, originally dubbed Google Shopping Express and now shortened to just Google Express, allows shoppers to place orders online or via mobile device with partner retailers such as Walgreens, Costco, Staples, Barnes & Noble, and Sports Authority.

These pop-up delivery services haven’t put much of a dent in FedEx and UPS’s delivery monopoly just yet, but FedEx on Wednesday called fiscal 2015 a “transformative year” after reporting a 4% decline in third-quarter express-delivery revenue and a 27% year-over-year increase in operating expenses, which outpaced overall revenue growth of 2%.

“It’s a changing of the guards,” said Roger Kay, a technology analyst and founder of consulting company Endpoint Technologies Associates “If the old guards can’t provide a comparable experience and comparable price, in some sense they aren’t going to be competitive anymore.”

UPS has fared a bit better that FedEx. Its revenue rose 1.4% to $14 billion in its most recent quarter, while total operating expenses stayed flat at around $12.3 billion. However, its revenue growth has decelerated on a sequential basis in each of the last three quarters.

Of course high costs aren’t just a problem for the legacy companies: Amazon’s shipping costs rose 30% last fiscal year, and the regulations governing crowdsourcing companies, like Uber, are still being tested in the U.S. court system.

Last Wednesday, the California Labor Commission ruled that an Uber driver who filed a compliant there was an employee of the company and not an independent contractor as Uber claims. While the ruling is being appealed and may be overturned, if it is upheld and applied to all Uber drivers, it would weigh heavily on the company financially.

Rob Enderle, a tech consultant and founder of the consulting company Enderle Group, said challenges like these make it more difficult to knock legacy delivery giants off their pedestals.

“If Uber drivers become employees, you’d expect FedEx and UPS to strengthen until we figure out the drone thing or get self-driving delivery cars on the roads,” said Enderle. “Although, you can expect FedEx and UPS to be investing in those as well.”

However, Kay said the very real threat of the newcomer in today’s competitive marketplace at the very least should push legacy companies to evolve.

“Companies that pretended the cyber thing wasn’t an issue ended up going belly up,” he said. “They can’t just let it go.”

Source: MarketWatch

Related: FedEx Isn’t Worried About Amazon or Uber Delivery

Article Topics

Acquity Group News & Resources

Infographic: The Next Generation of Commerce New Crowdsourced Delivery Models Pose Serious Challenges to UPS, FedEx, and USPS Monopolies The Next Generation of CommerceLatest in Transportation

Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 Trucking Association CEO on New Biden Policy: ‘Entirely Unachievable’ Two Weeks After Baltimore, Another Cargo Ship Loses Power By Bridge More Transportation