NAFTA at 20: Canada and Mexico Emerge as Biggest Winners

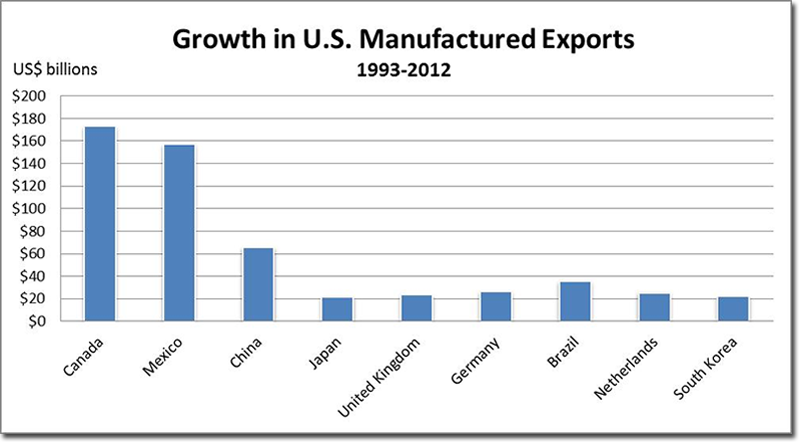

U.S. manufactured goods to Canada and Mexico more than tripled since 1993, growing some $173 billion through 2012 and accounting for over 18% of the total growth in U.S. manufactured exports.

Expanded manufacturing. Increased exports. Improved competitiveness, integration and partnership. That is the NAFTA story for U.S. manufacturers.

January 1, 2014 marks the 20-year anniversary of the North American Free Trade Agreement’s (NAFTA) implementation and there is strong evidence of the pact’s positive impact on manufacturing in the United States.

Since 1993, value-added manufacturing in the United States has expanded from $1.06 trillion to $1.87 trillion in 2012. The increased exports, improved competitiveness and greater industry integration helped contribute to this 76 percent expansion in manufacturing output.

As U.S. manufactured exports more than doubled since 1993, the largest growth market for our manufactured exports has been our two NAFTA partners – Canada and Mexico, which purchase more from the United States than any other country.

U.S. manufactured goods to Canada and Mexico more than tripled since 1993, growing some $173 billion through 2012 and accounting for over 18 percent of the total growth in U.S. manufactured exports over that period.

NAFTA’s impact on U.S. competitiveness in an increasingly challenging global economy has also been powerful. NAFTA has promoted greater integration, new partnerships and improved connectivity between our economies. U.S. cross-border investment grew five-fold to $453 billion in 2012, while Canadian and Mexican investment into the United States increased nearly six-fold, expanding to $240 billion.

Underneath this investment are cross-border supply and production chains that are improving North American competitiveness, innovation and efficiency.

Notably, the Wilson Center estimates that some 40 percent of the content of U.S. imports from Mexico and 25 percent of the content of U.S. imports from Canada represents U.S. value-added manufacturing, meaning that imports from our neighboring countries actually support U.S. manufacturing jobs:

NAFTA: 20 Years On, Time for a Change

By Christopher Wilson, the Wilson Center

The North American Free Trade Agreement was signed twenty years ago today by US President George H.W. Bush, Mexican President Carlos Salinas, and Canadian Prime Minister Brian Mulroney, and while an update is long overdue, the one needed is probably of a different nature than many would expect.

To be sure, the agreement was no panacea, but it is still fundamentally strong. NAFTA eliminated barriers to trade and investment, and as a result, US trade with Mexico has more than quintupled while bilateral foreign investment holdings have risen to more than six times their pre-NAFTA levels.

The change truly needed is one of perception. Popular opinion on NAFTA and free trade is still mired in the same tired debates of twenty years ago. Modern day refrains of Ross Perot’s “giant sucking sound” still echo. Opponents of trade agreements still measure job loss by subtracting imports from exports, while free traders still retort that a bigger trade pie means more to eat for everyone.

The debates are the same, but the world is not. Globalization has changed the very nature of trade, and if our perception does not catch up with reality, there is little doubt that we will be caught with a strategy from yesterday in the world of tomorrow.

At one point, imports and exports were what they appeared to be—the purchase of foreign products and the sale of domestically produced goods abroad. This is no longer the case. US imports from Mexico, for example, actually contain, on average, 40% US content. The tag may say Hecho en Mexico, but almost half of the labor, materials and parts that went into an import from Mexico were actually made right here in the United States. That means imports from Mexico, not just exports, strongly support US jobs and industry.

Far from a North American peculiarity, the regionalization and globalization of supply chains is occurring worldwide. Two decades ago when NAFTA was signed, 20% of the value of global exports came from a country other than the one selling the product, but that portion has since doubled. That is, 40% of the materials, parts and services that go into building an export are now first imported.

An iPhone, for example, according to the fine print on the back, is “Designed by Apple in California Assembled in China.” In truth, many more countries contribute significantly to its production. Only 4% of the value of the iPhone actually comes from China, but its entire value—several hundred dollars—is credited to China in the traditional trade accounting methods used to create national import and export statistics.

Globalization ruled for much of the last two decades, but the most recent trend is toward a regionalization of supply chains. High energy costs have made transportation more expensive, and the increased use of computers and robots in advanced manufacturing is decreasing the need to chase cheap wages across the globe. The regional nature of many supply chains means that US inputs are not used equally in production throughout the world. While goods we buy from our neighbors, Canada and Mexico, contain 25%-40% US content, goods from China are just 4% US-made.

This brings up the second major paradigm shift needed regarding NAFTA. Canada and Mexico are not the United States’ economic competitors, but our partners. With parts whizzing back and forth across our borders several times as a product is manufactured, the competitiveness of North American products on the global market depends on the ability of each partner to build its parts efficiently and to transport them quickly to next step in the supply chain.

Related: A Surprising Report on How Much of Apple’s Top Product is US-Manufactured

As we all take stock of NAFTA at 20, manufacturers are also looking forward. We are working with government officials in all three countries to expand efforts to reduce regulatory barriers and improve trade flows and cross-border mobility.

All three countries are also back at the negotiating table as part of the Trans-Pacific Partnership (TPP) negotiations, which provide an important opportunity to improve the rules that govern trade between our countries.

And finally, manufacturers are working diligently to support Trade Promotion Authority so that new agreements that eliminate barriers and put in place even stronger rules can be completed and help level the playing field for America’s manufacturers.

Related: NAFTA 20 years later: “2.0” Still Alive for US & Canadian Supply Chain Managers

Source: Scarbrough, International