Logistics Yard Management Systems Integrate Drone Visibility Technology

Yard management systems vendors are rolling out new capabilities and incorporating advanced technology to help logistics operations gain better visibility over exactly what’s going on in their yards at any time.

Any logistics professional who is currently managing the assets out in the yard using clipboards, two-ways radios, or mobile phones probably can’t conceive of this management task being enabled by flying drones.

But thanks to advances in technology, unmanned aerial vehicles (UAVs) flying around a yard, either autonomously or with the help of a remote control, are coming sooner than one might think.

Just ask the folks at PINC Solutions, the software vendor that recently introduced PINC Air, an autonomous real-time location system (RTLS) aerial robot that can survey large areas of densely-packed assets for the purposes of inventory reconciliation or pinpointing where certain inventory is located.

PINC Air is autonomous in that it takes off and lands from the same location automatically, with obstructions in its flight path automatically detected and avoided. The drones use PINC’s RTLS capabilities and upload the RTLS and video data via wi-fi upon return to their ground stations.

Clint Reiser, research analyst with ARC Advisory Group, sees potential in combining drones with the management of yard-based assets, particularly for shippers that have expansive yard operations.

“Basically, we’re talking about the development of low-cost drones that serve as ‘readers’ in performing tours of the yard to confirm where the assets are and that those assets are, in fact, out in the yard,” he says.

Secondly, Reiser says that the same equipment can be used to track assets in heavy manufacturing facilities - where high-value assets are located outside of the four walls of the plant - and in lay-down yards where equipment is literally “thrown in piles over several acres of land.”

In each of these applications, the UAVs serve as a second set of eyes for shippers that want to gain better visibility over the activities taking place in, and the equipment located in, their yards.

Of course, yard management systems (YMS) don’t have to be overly technical and situated in an aerial position to be effective and valuable for shippers.

Over the next few pages we’ll explore current YMS adoption, show how these systems are being put to work in the yard, and hear from a company that has experienced positive results over the five-year span that it has been using YMS.

The Four Forces Driving Supply Chain Innovation

When supply chain professionals discuss supply chain execution, their focus is typically put on transportation management systems and warehouse management systems, the yard management systems capability and importance is mistakenly undervalued.

American businesses spend more than $1.45 trillion annually in the transportation and logistics industry, which amounts to 8.3 percent of Gross Domestic Product - two-thirds of which involves over-the-road freight movement of approximately 500 million trailer shipments across 250,000 facilities.

Because companies still depend upon outmoded means to track and manage transportation, it is not unusual for trailer shipments to go missing temporarily or even permanently.

This coupled with the inherent inefficiencies of how trailers are handled, translate into time delays, increased labor, lost inventory and, more importantly, customer dissatisfaction.

In this paper we will look at how companies can embrace these four forces to improve collaboration, control and efficiency of supply chains:

- Customer Focus: Now more than ever, organizations must turn everything upside down to understand why they’re doing what they are doing. Ultimately, it’s all about providing value to the end customer and aligning organizational resources accordingly.

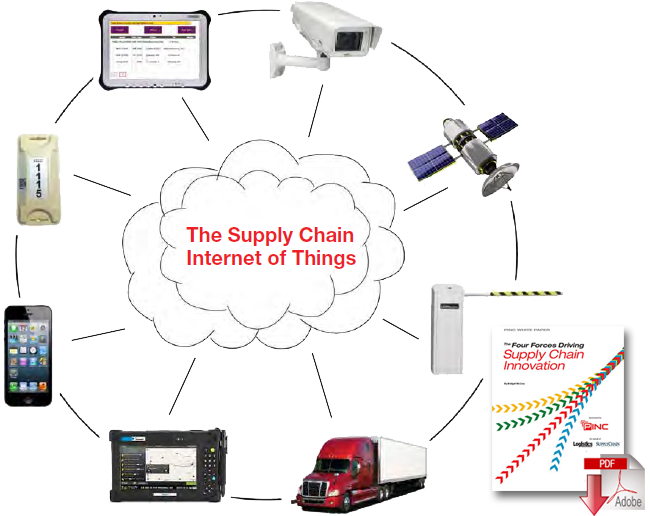

- The Internet of Things: Much like the use of motion and smoke detectors in the context of home security, how can you leverage sensor technology to accurately locate, track and measure the movement of inventory?

- Execution: Companies understand that the path to greater efficiencies and predictable quality of service is to have their supply chain processes standardized, consistently executed, and continuously analyzed for improvement. This is all about specialization, repetition, automation, replication, and analysis. Today most approach this problem with their continuous improvement teams analyzing problems with time and motion studies. Is there a better approach?

- Convergence: There still exist masses of paper trails and manual processes in the supply chain. How do you replace this paper trail with systems that are integrated into your logistics information system grid so you and your partners are on the same page.

Tracking Valuable Yard Assets

As the software systems that track the movement of trucks, trailers, and other assets in the yard of a warehouse, distribution center, or manufacturing facility, YMS fills in a critical gap left open by traditional transportation management systems (TMS) and warehouse management systems (WMS).

Where the latter oversees the activities within the four wall of the warehouse, and the former takes over when trucks pull out of the front gate, YMS provides visibility over shipments, inventory, and even security out in the yard. The applications are offered as standalone entities from software vendors like PINC, come as part of larger WMS or TMS applications, or are integrated into enterprise resource planning (ERP) systems.

In addition to PINC, companies like Zebra Technologies, C3 Solutions, and Exotrac all offer their standalone YMS, while WMS providers like Manhattan Associates, HighJump Software, SAP, and Oracle have built YMS functionalities into their broader applications.

In return for their YMS investments, logistics operations typically gain better control over yard equipment as well as track assets in real-time, improve dock door scheduling, and reduced unload/wait times. And while the business case associated with YMS can be compelling, actual software adoption rates among operations remain fairly low. According to Logistics Management’s most recent Technology Usage Study, just 8.3 percent of companies surveyed are currently using YMS, and of those that purchase WMS, just 3.9 percent cite YMS as the key reason for making that investment.

According to Dwight Klappich, research vice president for Gartner, YMS tends to come into play when a logistics operation has more than 250 parking spaces out in the yard. Those with fewer than that tend to “gravitate to their WMS” yard management, he says. “When the environment isn’t too complex, and when all the shipper needs is check-in and check-out with a guard at the gate, or to find out the exact location of a container, many of the WMS vendors have good enough functionality to manage those activities.”

Now, increase the number of parking spaces to 1,500 or more, says Klappich, and the need for RTLS-based systems, radio frequency identification (RFID), and other advanced capabilities becomes more prevalent. “We’re seeing more and more interest in these capabilities from companies that have big yards basically because they’re dealing with a lot more complexity.”

Where the shipper with 200 parking spaces may be working with 10 shipping and receiving docks and 100 trucks a day, for example, the one with 1,500 spaces is probably moving 100 tractor trailers around per hour. The odds that assets will get lost in the latter scenario are much higher, says Klappich, who expects RFID technology to continue gaining traction in YMS as more of those large shippers turn to technology to help control and manage their expansive yard activities.

Klappich says shippers that are working with “yard of yards” scenarios - where a manufacturer has one yard at its plant and other, multiple yards at its distribution centers - are also looking more closely at YMS as a way to manage their complex distribution operations. In such cases, companies may be producing widgets at one location, sending them via truck to a DC, and then returning those vehicles back to the plant from the DC. Traditionally, logistics managers and dispatchers had just a single viewpoint of one yard versus more global visibility over multiple locations.

“These shippers would like to have an enterprise view of all of their yards,” says Klappich, who again points to PINC as one of the software vendors making strides in this arena. “They want to be able to drill down and gain better visibility over demurrage charges, freight movement, and other important measures across multiple yards.”

More Functionality Ahead

Reiser, whose firm covers the YMS arena as part of its TMS and WMS coverage, says that JDA Software recently introduced an “intelligent fulfillment strategy” that integrates planning and execution functionality. He sees a connection between this strategy and the typical yard.

“JDA is looking to incorporate execution on the fulfillment and planning side and sort of blend them with one another,” says Reiser. For example, he says that a shipper may use the application to factor dock door constraints or limitations into its planning optimization run via a TMS. And because the yard is strategically situated between the warehouse and the transportation network, incorporating yard-related constraints could help companies optimize their supply chains.

“This will take things to the next level as far as yard management is concerned,” says Reiser, who envisions a time when companies can leverage YMS to gain better visibility by breaking down the silos that can exist between warehouse operations, transportation networks, and yard-based activities/assets.

The time horizon for this strategy, and the potential to eke out incremental savings from it, could still be far off for many shippers, adds Reiser. “Conceptually, the idea sounds great, but in reality, adoption will be on a case-by-case basis.”

Related: Enterprise Supply Chain Orchestration Solutions Powered by the Internet of Things

Article Topics

PINC News & Resources

Transport Analytics for Enterprise Rail Visibility Mobile Device Procurement, Service, and Support for Industrial & Finished Goods Shippers Merger of Best-in-Class Supply Chain Companies PINC, ShipXpress, and RailCarRX Providing Enhanced Yard Management Services and Solutions to Enterprise Customers 2020 State of Yard Management Report: Identifying a Truckload of Savings Across Your Network The Impact of Digital Yard Management on Enterprise Transportation Costs and Capacity The Increasing Demand for Digital Yard Management Systems More PINCLatest in Transportation

The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws More TransportationAbout the Author