Latest Freight Data Indicates Alarming Global Trade Slowdown

While the US stock market and economy continue to remain stubbornly immune to the ongoing trade war, the same can not be said for global trade as observed and measured by world freight shipping and volumes.

Global Trade Slowdown

According to the latest Goldman freight data, there has been a gradual slowing in global trade since 4Q17, and the July readings suggest an alarming continuation, and in some cases acceleration, of this trend.

The deceleration has closely tracked a tightening in global financial conditions, particularly evident in Emerging Market data, which in turn has largely been a manifestation of the ongoing escalation in trade tensions between the US and China.

Indeed, the implementation of the first round of US-China tariffs in early July may also have had an impact: US West Coast inbound port volumes were -1% in July (5% in 1H), while Chinese ports’ throughput growth slowed to 2% (6% in 1H), worse than implied by the close historical correlation with Chinese export orders.

At the same time, air cargo growth at Europe’s key hubs turned negative (-2%) in July, with weakness cited on Asia-Europe.

Looking forward, global manufacturing export orders in June/July were consistent with slightly positive, albeit slowing growth.

Breaking down freight by segment, here are some observations from a recent Goldman report:

- Sea & air freight (volume growth positive, momentum negative): Freight datapoints have indicated a deceleration in growth since 4Q17. July data appears to have stabilized in Sea, with volumes growing c.3% in line with June, while Air freight growth has decelerated further; e.g. EU airport cargo -2% yoy from 1% in 1H, 7% in 2017.

- Container: Active fleet growth continues to slow following announced capacity cuts (6% in August vs. 9% in 1H); Goldman expects further slowing to c.2% by mid-2019. While overcapacity in 1H limited carriers’ ability to pass on rising bunker and charter costs, there are now clear signs of supply rationalization, as carriers begin to hand back capacity and new orders remain low.

- Airlines (momentum weaker): While the market environment has remained broadly positive for EU-airlines ytd, growth in load factors has been slightly weaker recently. Forward capacity data suggests stable short-haul capacity trends in Europe, while long-haul supply growth is decelerating.

- Infrastructure (volume growth positive, momentum stable): Airport (EU hub) traffic grew 4% in July, a slight deceleration from 6% growth in 1H18/2017/2016. Looking at scheduled airline seat capacity for the coming months suggests near-term traffic growth will remain at similar levels, albeit with growth slowing from high levels in Frankfurt, Spain, and Portugal.

- Commodities shipping (freight rates improving, momentum better): In dry bulk, rates have been slightly stronger owing to improved Asian demand and low supply growth of c.2%. Oil tanker rates have been weak over the past year but appear to have stabilized, and slowing fleet growth could be supportive of rate upside. LNG tanker rates have improved ytd from historical lows as higher Asian imports have boosted demand.

View the slideshow to see how global trade has slowed down recently in charts.

Source: ZeroHedge

Trump's Trade War Could Destroy 4% of Global Trade

If US President Trump follows through on his threats to stage a trade war against his former allies in Europe, China, and other countries, it could reduce world trade by 4% and wipe away 0.4 percentage points of global GDP (about $800 billion), according to Oxford Economics.

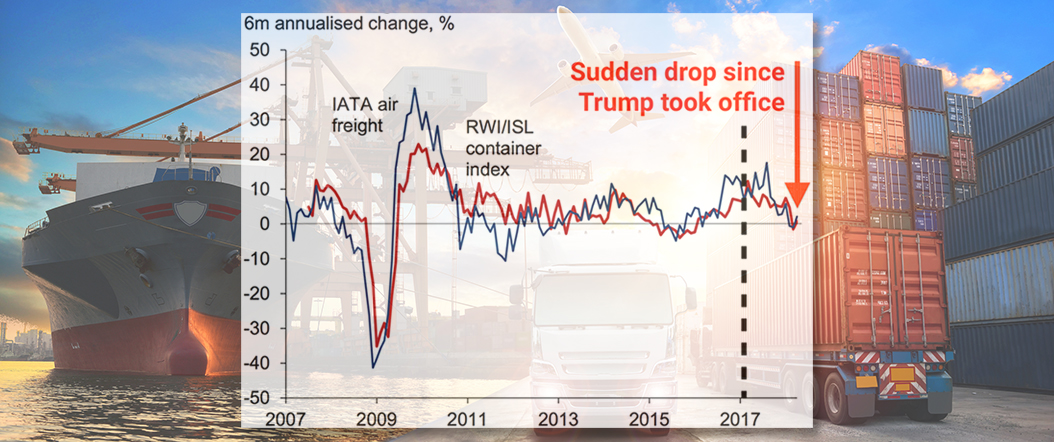

World: Freight Indicators

It would be especially bad for the global economy because it would come right as oil prices and interest rates are both rising globally.

“The threat to world growth is significant,” Oxford lead economist Adam Slater wrote in a recent note to clients.

His warning is the latest in a string from researchers, investment banks, and politicians.

“Recent tariff threats, if realised, would extend high tariffs to over 4% of world imports - a tenfold rise. This comes just as the global upturn shows signs of faltering. The threat to world growth is significant: in a scenario of escalating tariffs, our modelling suggests world GDP could be cut by up to 0.4 percentage points in 2019,” Slater wrote.

Currently imposed tariffs only total about $60 billion (or 0.3%) of world trade. But all the upcoming proposed and threatened tariffs bring the total to $800 billion (4%).

Between 2015 and 2017 world trade had been growing. But that trend reversed after Trump took office at the beginning of 2017.

“The upsurge in protectionism comes at an inopportune time for the global economy. World trade growth appears to have slowed notably in recent months. Freight-based indicators are especially worrying, with six-month annualised growth having subsided from 6-7% in January to around zero in April. There are also broader indications of a slowdown. The Citigroup economic surprises indices for the G10 and emerging markets have turned deeply negative, with disappointing data releases dominating.”

The US has some buffer room given that its economy is currently growing more quickly than the other major economic blocs. But that is threatened if a full-blown trade war arrives as central banks increase interest rates and oil prices go up, Slater believes.

Source: Business Insider

Controlling Shipping Costs via Multi-Modal Freight Rate Visibility

The majority of shippers today are concerned with rising transportation costs, fueled by an increasing demand in shorter consumer delivery times and an expanding network of inventory distribution points.

Managing each stage of shipments is very complex for shippers, and most transportation management systems lack a single, multi-mode solution that handles contract rate and schedule data for domestic trucking and LTL haulers, as well as ocean and air carriers

Download this eBook and learn more about how an automated multi-mode solution solution can help you find the most advantageous and cost-effective routes across numerous contracts.

View All Amber Road Global Trade Resources

Article Topics

Amber Road News & Resources

Logistics Platforms: Ways Companies Can Win In the Digital Era Ethical Sourcing – The Business Imperative (and Advantage) How Rules of Origin Really Do Make a Difference for Sourcing Practices E2open’s acquisition of Amber Road is a done deal E2open Completes Acquisition of Amber Road Bridging the Data Gap Between Sourcing and Logistics Medical Technologies Company Remedies Complex Compliance Operations More Amber RoadLatest in Supply Chain

TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month More Supply Chain