Knight Transportation & Swift Transportation Merge in $6 Billion Deal

Knight Transportation Inc. and Swift Transportation Co. have announced they are merging in an all-stock deal with a combined enterprise value of $6 billion, the combined entity will be called Knight-Swift Transportation Holdings Inc.

The transaction, first reported by the Wall Street Journal, will involve share swapping, with each share of Swift will converted to a 0.72 share of the new company which will be executed through a reverse stock split.

Shares of Knight Transportation will be swapped one-for-one.

Following the formation of the new company, existing shareholders of Swift will own 54% and rest 46% will go to Knight Transportation.

The merger deal values Swift shares at $22.07, which represents around 10% premium on its Friday’s closing price of $20.02 per share.

Swift is the fifth-largest trucking company in the U.S. in terms of revenue and Knight is 22nd, according to industry researchers SJ Consulting Group - behind competitors including United Parcel Service Inc. and FedEx Corp.

Swift and Knight, both based in Phoenix, are among the top carriers in the highly fragmented market for truckload services, in which customers including retailers and manufacturers buy space on entire trucks for long transport runs, typically more than 500 miles.

The combination will create a $5 billion behemoth, which will make the transaction the largest deal in the history of the U.S. trucking sector, beating the XPO Logistics’ purchase of Con-way for $3 billion in the year 2015.

Read: How To Analyze The Transportation Industry

Despite sluggish performance from the American trucking sector in recent times, one of the largest trucking companies, Schneider National Inc. managed to list its IPO successfully last week.

It values the company at $3.3 billion at a price of $19 per share. (For more, see Schneider National Will Begin Trading Today.)

Press Release

April 10, 2017 07:00 AM Eastern Daylight Time

Knight Transportation and Swift Transportation Announce All Stock Transaction with a Combined Enterprise Value of $6 Billion

- Companies to Maintain Distinct Brands and Operations

- Creates Attractive Financial Benefits and Is Expected to Be Accretive to Adjusted EPS

- Certain Stockholders of Both Knight and Swift Have Agreed to Vote in Favor of the Transaction

PHOENIX - (BUSINESS WIRE) - Knight Transportation, Inc. (NYSE:KNX) (“Knight”) and Swift Transportation Company (NYSE:SWFT) (“Swift”) today announced that their boards of directors have unanimously approved a merger of Knight and Swift in an all-stock transaction that will create the industry's largest full truckload company. The combined company will be named Knight-Swift Transportation Holdings Inc. (“Knight-Swift”) and will trade under the ticker “KNX.”

This transaction combines under common ownership two long-standing industry leaders creating North America's premier truckload transportation company with $5 billion in annual revenue and a “Top 5” truckload presence in dry van, refrigerated, dedicated, cross-border Mexico and Canada, and a significant presence in brokerage and intermodal. The holding company structure will enable the Knight and Swift businesses to operate under common ownership and share best practices, while maintaining distinct brands and operations. The company will remain headquartered in Phoenix, Arizona operating with approximately 23,000 tractors, 77,000 trailers, and 28,000 employees.

Under the terms of the definitive agreement each Swift share will convert into 0.72 shares of Knight-Swift by means of a reverse stock split. Each share of Knight will be exchanged for one Knight-Swift share. Based on the $30.65 closing price of Knight shares on April 7, 2017, the last trading day prior to the announcement, the implied value per share of Swift is $22.07. Upon closing of the transaction, Swift stockholders will own approximately 54 percent and Knight stockholders will own approximately 46 percent of the combined company. Based on Knight’s closing share price on April 7, 2017, the number of combined company shares expected to be outstanding after closing and the combined net debt of Swift and Knight as of December 31, 2016, the combined company would have an implied enterprise value of approximately $6 billion.

Knight is expected to be the accounting acquirer, and the transaction is expected to be accretive to adjusted earnings per share (“Adjusted EPS”) with expected pre-tax synergies of approximately $15 million in the second half of 2017, $100 million in 2018, and $150 million in 2019.

Knight Executive Chairman, Kevin Knight, said: “In Knight’s 26-year history, we have built a truckload company with industry leading margins and investment returns. When the two companies began discussions, we had four goals in mind: create a company with the best strategic position in our industry; identify significant realizable synergies that would create value for both sets of stockholders; create a business that over the long-term will operate at Knight's historical margins and financial returns; and agree on a leadership and corporate governance framework that will benefit all stakeholders. I am confident we have achieved those goals.”

Swift Chairman, Richard Dozer, stated: “This is a terrific opportunity for our stockholders, who stand to benefit from the significant upside potential of this transaction. Indeed, by coming together under common ownership, the companies will be able to capitalize on economies of scale to achieve substantial synergies. This is an exciting chapter in the Swift story and everyone who is a part of it should be both proud of what we bring to the table and excited about what lies ahead. I am confident in this new team, in the new structure and in the future of Swift in the industry.”

Knight Chief Executive Officer, Dave Jackson, added: “Under this ownership structure, we will be able to operate our distinct brands independently with experienced leadership in place. We look forward to learning from each other’s best practices as we seek to be the most efficient company in the industry. We are dedicated to a seamless transition and ensuring continuity for our customers and professional Driving Associates.”

Swift Chief Executive Officer, Richard Stocking, stated: “I am proud of all Swift has accomplished and that it will be a significant part of this new venture, which brings together the most robust, respected and reliable truckload providers in North America. I am especially proud of the fact that both companies will remain devoted to delivering a better life to employees, customers, and communities. Throughout this transition, I encourage everyone to work together to continue building the Swift brand.”

Swift founder and controlling stockholder, Jerry Moyes, added: “I cannot think of a better combination. The Knight and Moyes families grew up together, and the Knights helped me build Swift before starting their own company and making it an industry leader in growth and profitability. I am confident that we have the right approach to maximizing the contribution of both teams, and I look forward to helping the Knight-Swift leadership team in any way I can to continue the legacy of both great companies.”

Outlook and Synergy Opportunities

Knight has been among the most efficient truckload motor carriers and Knight-Swift expects to employ a cross-functional team to generate significant synergies across both brands. The transaction is expected to be accretive to adjusted earnings per share and to generate pre-tax revenue and cost synergies of approximately $15 million in the second half of 2017, $100 million in 2018 and $150 million in 2019. Synergies are expected to be realized from sharing best practices from each company, improving yield, identifying purchasing economies, benefitting from broader geographic scale and capitalizing on an enhanced cash flow profile to reduce interest costs.

Preliminary Combined Financial Information

On a combined basis, Knight and Swift generated approximately $5.1 billion in total revenue, $416 million in adjusted operating income and $806 million in Adjusted EBITDA for 2016. The combined financial information excludes synergies, transaction and related expenses, and transaction accounting, including amortization of intangibles.

On a combined basis, as of December 31, 2016, net debt was approximately $1.1 billion, and Knight-Swift’s leverage ratio (net debt/Adjusted EBITDA) was approximately 1.3x. The Swift credit facilities are not required to be refinanced in connection with the closing but may be refinanced in the future on more attractive terms. Post-closing, Knight-Swift expects to pay its stockholders quarterly dividends of $0.06 per share. On a combined basis, free cash flow was approximately $495 million for 2016. The companies expect net capital expenditures to be approximately $345 million to $410 million for the full year 2017.

Leadership and Corporate Governance

The Board of Directors of Knight-Swift will comprise all Knight directors and four current Swift directors. The Jerry Moyes family will initially be entitled to designate two directors reasonably acceptable to the Board, one of whom must be independent, with the initial designees being Glenn Brown and Jerry Moyes. The remaining two directors were chosen by the Swift board and will be Richard Dozer and David Vander Ploeg. Kevin Knight will serve as Executive Chairman of the Board and Gary Knight will serve as Vice Chairman.

The executive team of Knight-Swift will be led by Kevin Knight as Executive Chairman, Dave Jackson as Chief Executive Officer and Adam Miller as Chief Financial Officer. Following the close of the transaction, Kevin Knight will serve as President of the Swift operating entities. Jerry Moyes will serve as a non-employee senior advisor to Kevin and Gary Knight.

Richard Stocking, Chief Executive Officer of Swift, and Ginnie Henkels, Chief Financial Officer of Swift, have chosen to pursue other opportunities following the closing of the transaction. In the interim, both Mr. Stocking and Ms. Henkels will continue to lead Swift to ensure a smooth transition.

Knight-Swift will have a single class of stock outstanding with one vote per share. In the transaction, Swift’s existing Class B common stock with two votes per share held by members of the Jerry Moyes family will be converted on a one-for-one basis into Class A common stock. Those shares, like all other Class A shares of Swift, will convert into 0.72 shares of Knight-Swift and there will be no shares of Class B common stock outstanding following the close of the transaction. After giving effect to the transaction, the Jerry Moyes family will beneficially own approximately 24 percent of the Knight-Swift stock and has agreed that any shares they are entitled to vote in excess of 12.5 percent of the combined company’s shares will be voted as directed by a committee comprising Jerry Moyes, Kevin Knight and Gary Knight, except in the case of a vote of any sale of Knight-Swift. In addition, the Jerry Moyes family has agreed to certain standstill restrictions and provisions designed so that any share sales by the Jerry Moyes family are implemented in an orderly manner. Certain members of the Knight family have also agreed to such restrictions.

Approvals and Close

The transaction is subject to customary conditions, including the approval of the stockholders of Knight and Swift, as well as antitrust approvals. The Jerry Moyes family, which holds approximately 56 percent of the Swift voting power, and Kevin Knight and Gary Knight, who hold approximately 10 percent of the Knight voting power, have agreed to vote their shares in favor of the transaction.

Following the close of the transaction, which is expected to occur in the third quarter of 2017, Knight-Swift is expected to have approximately 176.1 million shares outstanding and 178.9 million shares on a fully diluted basis. The Knight-Swift shares are expected to trade on the New York Stock Exchange under the symbol “KNX.”

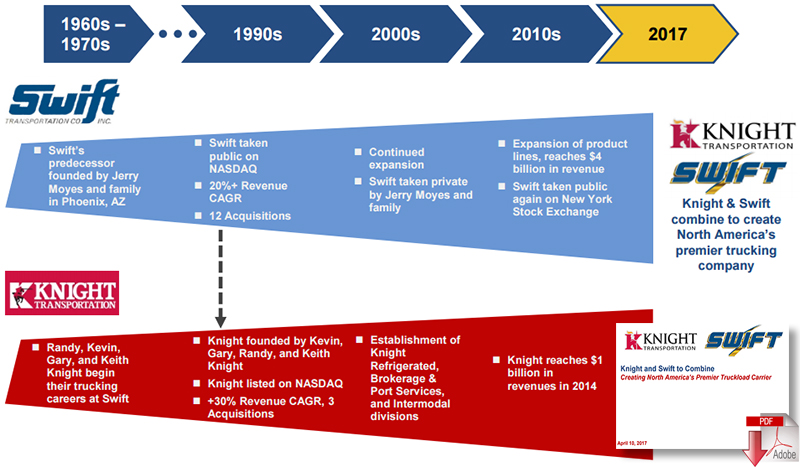

Uniting Two Leading Trucking Companies With a Successful History

The combination of Knight & Swift brings together two Phoenix-based organizations whose leaders have common roots going back half a century

Article Topics

Knight Swift Transportation News & Resources

Knight-Swift Adds 400 Trucks/Drivers with Abilene Acquisition Knight Transportation & Swift Transportation Merge in $6 Billion Deal SmartDrive Debuts SmartIQ Beat - a Transportation Industry Insights and Trends Blog Wall Street Question Amazon’s Logistics PlansLatest in Transportation

Talking Supply Chain: Doomsday never arrives for Baltimore bridge collapse impacts Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation