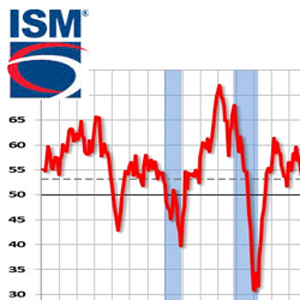

ISM Manufacturing Report Unchanged from March

The pace of U.S. manufacturing growth held at its slowest in almost two years in April, as a rebound in new orders was offset by employment shrinking to its lowest level in more than five years, according to an industry report released on Friday.

The latest ISM Manufacturing report came in below expectations.

At 51.5, it was below the forecast of 52.0, and unchanged from 51.5 in March.

Respondents noted that lower energy costs helped their earnings, but the strong dollar is hurting revenue.

It also noted that manufacturing employment is contracting at a faster rate, down 1.7% month-over-month.

This release followed the PMI print from Markit Economics release earlier, which showed that manufacturing activity slowed to the weakest this year in April.

At 54.1, it was slightly below expectations for a reading of 54.2, staying flat from the previous month.

A reading above 50 signals growth and a reading below 50 indicates contraction.

The release noted that output and new orders grew at a slower rate, partly because of the dollar’s strength.

News Release

Purchasing Managers’ Index™

MARKET SENSITIVE INFORMATION

EMBARGOED UNTIL: 0945 EDT 1 May 2015

Markit U.S. Manufacturing PMI™ – final data

U.S. Manufacturing Sees Slowest Output Growth in 2015 So Far

Key points:

- Production expands at slowest rate since December as new order growth eases

- New export business falls for first time in five months

- Input prices decline for fourth month running

Markit U.S. Manufacturing PMI (seasonally adjusted)

Summary

April survey data from Markit indicated a loss of momentum in the U.S. manufacturing economy, following a strong end to the first quarter of 2015. Output and new orders increased at slower rates and new export business declined for the first time since November, partly linked to the strong dollar. The currency also generated downward pressure on import prices, and average input costs at manufacturers fell for the fourth month running as a result. That said, the underlying strength of business conditions remained solid, with backlogs and employment both rising further.

The seasonally adjusted final Markit U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) registered above the 50.0 no-change threshold in April, thereby signalling an overall upturn in business conditions. The index fell to a three-month low of 54.1, from March’s 55.7, but still signalled a solid rate of improvement and was above its long-run trend level of 52.2.

Weighing most on the PMI in April was a slower rise in production. The rate of growth moderated to the weakest in 2015 so far, although it remained strong overall. Similarly, firms continued to increase their purchasing activity at a robust, albeit slower, pace. Suppliers’ delivery times lengthened further as a result, with ongoing mention of delays associated with the recent West Coast port shutdowns.

The other main factor contributing to the fall in the headline index during April was a slower rise in incoming new business. New order growth eased to a three-month low, but remained strong in the context of historic survey data. Weaker international demand linked to the strong dollar was evident as new export business declined for the first time since November.

Other survey indicators suggested the underlying health of the manufacturing sector remained firm. Employment rose for the twenty-second consecutive month, and at a robust pace. Meanwhile, backlogs of work rose for the fifth month running, while stocks of inputs also expanded as firms addressed order book requirements.

Price indicators from the latest survey continued to point to downward pressure on manufacturing input prices. Average input costs fell for the fourth month running, at a rate little-changed from March. Anecdotal evidence linked lower cost pressures to reduced prices for metals and oil-based inputs, as well as a general deflationary impact of the strong dollar on import prices. Output prices continued to rise, albeit at a fractional pace.

Company Size and Sector Analysis

The slower rise in output in April reflected weaker expansions at small and medium-sized firms, while large firms (those employing more than 500 staff) registered the strongest rate of growth and the fastest expansion in 2015 to date. Large firms also registered stronger workforce growth than small and medium-sized companies.

By market group, consumer goods producers continued to drive output growth in April, followed by intermediate goods companies. Makers of investment goods recorded only a marginal increase in output in April, and also registered the slowest rate of job creation among the three monitored sectors.

Comment

Commenting on the final PMI data, Chris Williamson, Chief Economist at Markit said:

“With manufacturing output growth slowing to the weakest seen so far this year and exports falling for the first time since November, the survey results raise worries that the dollar’s appreciation is hurting the economy.

“The slowing in the economy is accompanied by a renewed weakening of price pressures, linked to the exchange rate bringing down the cost of imports. Input prices showed one of the steepest falls seen since the recession, a cost-saving which producers often passed on to customers. Prices charged rose at the slowest rate seen for almost three years.“The weakening growth trend and fall in price pressures add to a growing clutch of disappointing numbers which suggest the Fed will err on the side of caution and hold off from rate hikes until a clearer picture emerges of the economy’s health. Any policy tightening therefore looks likely to be deferred until at least September, but the fact that both manufacturing and services continue to grow at reasonably robust rates at the start of the second quarter suggest that rate hikes towards the end of the year should not be ruled out.”

Related: ISM Manufacturing Data Sees a Slight Gain in April, Reports ISM

Article Topics

Institute for Supply Management News & Resources

U.S. Manufacturing Gains Momentum After Another Strong Month Services sector sees continued growth in March, notes ISM Manufacturing sees growth in March, snaps 16-month stretch of contraction Services sector activity sees continued growth in February, ISM reports Services sector activity sees continued growth in February, reports ISM February manufacturing output declines, reports ISM February manufacturing output declines amid strong seasonal factors More Institute for Supply ManagementLatest in Business

Ranking the Top 20 Women in Supply Chain Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility More Business