Is Your Supply Chain Addicted to Oil?

No one can precisely foretell whether oil prices will drop, continue to stay high, or even go much higher. No one can predict the frequent, unexpected swings that might take place either.

To paraphrase President Bush, “American supply chains are addicted to oil.” In fact, they’re insidiously permeated with it.

I am old enough to remember the 1973 oil shock caused by the Yom Kippur War and the Arab oil embargo. I remember driving my Volkswagen Bug to the gas station, running on fumes, to take my car’s turn at the pump.

That shock was mostly about a shortage of oil, less about its price. Despite other oil shocks along the way, I never thought much about oil since that initial experience more than 30 years ago.

Yet it was on the top of my mind when Massachusetts Institute of Technology (MIT) Professor Yossi Sheffi was interviewing me as a candidate to manage a research project on the future of supply chain management. It was the fall of 2003, and oil prices were running over $30 a barrel after rising in spits and spurts from under $20 two years before. I postulated during the interview that in 10 to 15 years oil prices could go as high as $50 a barrel.

A year later, we revised the possibility to $100 to $200 a barrel. Oil prices had hit around $70, and it appeared likely that long-term, worldwide economic growth, especially from countries in Asia, would fos- ter competition among nations for oil into the fore- seeable future. Many experts say that oil will be readily available into 2020. The big question, of course, is at what price.

Decades of Cheap Oil

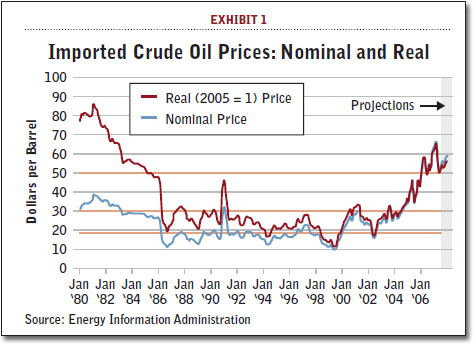

Exhibit 1 displays the real price (that is, deflated for the Consumer Price Index for All Urban Consumers) of crude oil from 1980. It also shows the nominal price—the price actually paid at the time.

Note that the price was relatively stable for a long time before it started ris- ing around the fall of 2003. For the most part, for 17 years prior to this the price varied from $20 to $30 a barrel. The only exception was a spike at the time of the Gulf War in 1991. Since June 2005 it has been above $50, a price we had not seen since the summer of 1985.

The recent oil price increases are taking their toll on many fronts but particularly on logistics costs. The Council of Supply Chain Management Professionals’ (CSCMP) latest “State of Logistics Report” showed the biggest increase in logistics costs in 17 years of tracking. The change was largely attributed to increases in interest rates and transportation costs.

SCM Based on Cheap Oil

The business discipline we know as supply chain management (SCM) has evolved over the last 12 years or so. It was during this period—and actu- ally starting a few years before it—that many supply chain process innovations took place. These innova- tions were conceived and executed during a period of relatively cheap oil. A common objective of most of them was the shortening of cycle times to squeeze inventories out of supply chains and, to some extent, to be more responsive to customer demands.

Often this meant reducing inventories through the use of speedier (and more oil-intensive) freight modes, thereby leveraging cheap oil. Here are six examples of common SCM practices that have fostered a greater consumption of oil:

- Just-in-Time Manufacturing (JIT): With JIT, materials are brought into the plant only when needed, reducing plant inventories. However, the practice often results in smaller, more frequent shipments from suppliers. This means greater use of LTL rather than full truckload.

- Offshore Sourcing: Offshore manufacturing and overseas sourcing tend to increase the distance outbound finished goods travel vis-a-vis inbound bulk materials. While this practice consumes more oil, it makes economic sense given the low production costs overseas.

- Cycle time Reductions: Short-product-lifecycle and fashion-oriented industries that source goods overseas, such as high-tech and apparel, often use air rather than ocean freight to get goods to market sooner. Because these goods command higher margins, freight costs—and hence oil consumption—takes a back seat to getting goods on the shelf quickly

- More Oil-Based Materials: More of the products in use today are made of oil-based materials as compared to a couple of decades ago. For example, we’ve seen major shifts to plastic instead of glass bottles and jars.

- Oil-Based Packaging: There’s been a steady shift away from paper toward plastics in packaging material. More oil-based packaging and wrapping means more oil consumption.

- e-Retailing: Online Internet shopping has grown substantially over the past decade—and these Internet retailers are using oil-intensive parcel shipping rather than truckload.

“No Regrets” Risk Management

Common supply chain practices such as these make business sense when oil is cheap. But they make increasingly less sense if oil prices double, triple, or even quadruple. As such practices become pervasive, supply chains become more vulnerable to oil-price shocks and disruptions.

No one can precisely foretell whether oil prices will drop, continue to stay high, or even go much higher. No one can predict the frequent, unexpected swings that might take place either. However, I don’t know many who are betting that prices will go down or stabilize over the long run.

I recommend following a “no regrets” risk management strategy when it come to oil. Decrease your supply chain’s dependence on oil to make it less vulnerable to price increases and supply chain disruptions. The first step is to recognize dependency as a problem. Hopefully, my first Insights column has convinced you that your supply chain may be too dependent upon oil. My second column will offer some ways to reduce that dependency.

Note: This column appeared in the January/February 2007 issue of Supply Chain Management Review.