Is Apple Creating “The Ultimate Car” Supply Chain?

Speaking at the Code Conference, Apple's operations chief Jeff Williams dropped the biggest hint yet that the firm is developing a car - "The car is the ultimate mobile device."

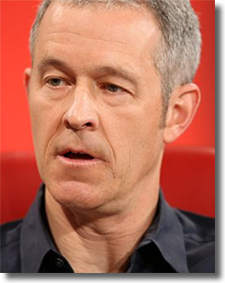

They call him Tim Cook’s Tim Cook.

Apple’s operations chief Jeff Williams may be less well known than some of the technology giant’s other senior executives, but when he stepped on the stage at the Code Conference he demonstrated a relaxed mastery of a range of topics, from the intricacies of Apple’s complex supply chain to the long-range potential of ResearchKit.

As one of Cook’s trusted lieutenants, Williams has played a significant role in Apple’s entry into new categories, including the recent debut of the company’s first smartwatch, and, before that, the mobile phone market with the launch of the iPhone. He has overseen worldwide operations for the iPhone since 2007.

Williams oversees a sprawling logistics operation that, at its peak, employs some 40,000 people to support the iPhone. Over the recent holiday quarter, Apple shipped 74 million iPhones - so many that, if stacked like pancakes, the slender mobile devices would reach the International Space Station, he notes.

“They were built, produced and shipped in 90 days,” Williams said.

Williams chafed at questions about labor conditions at factories in China, saying Apple has a team devoted to ensuring that the people who manufacture the company’s products are treated fairly. When pressed about the spate of suicides at one Foxconn facility in 2010, he and Cook personally investigated.

“We learned it had nothing to do with working conditions,” Williams said, echoing an observation Apple co-founder once made about the suicide rate at Foxconn. “[The factory had a] lower suicide rate at their biggest cluster than any place in the US. By that standard, it’s the happiest place on earth.”

Williams resisted pressure to quantify early sales of the Apple Watch, generically describing demand as “fantastic.”

“Obviously, I can’t give you that number,” Williams said Wednesday at the Code Conference, after Walt Mossberg pressed him to put some numbers next to his adjectives.

Williams confirmed that Apple will release a developer kit that will allow companies to write apps directly for the Apple Watch next week, at the start of the Worldwide Developers Conference on June 8.

“I’m a cyclist who uses Strava, so it will have access to the sensor,” Williams said.

5 Reasons Apple is Set to Create a Car Supply Chain

Why would Apple try to successfully operate an automotive supply chain on a worldwide scale? Perhaps simply because it can.

With almost $180 billion in cash reserves, the company is already on a better footing to enter the car industry than when it reinvented the smart phone market with its iPhone.

Apple has yet to announce that it is even developing an electric car, despite numerous analyst and media reports and strong indicators that it is very much indeed making sizeable investments in an electric car model it plans to produce. Apple could begin production of its car model in 2020, according to Bloomberg.

But before Apple’s project does become official, here are five reasons why Apple is more than ready to manage a multibillion dollar automotive supply chain.

1. $178 billion burning a hole in its pocket

The automotive business is traditionally a complex, low-margin industry usually requiring that automakers spend billions of dollars in capital expenditures in order to compete on a worldwide scale. Designing, producing, and selling cars also requires a lot of cash, with often low returns and losses depending on hard-to-predict and fickle market tastes and a myriad of other variables.

If and when Apple does launch its electric car, it almost certainly will not compete directly against the top-five automakers, such as General Motors, which is expected to see $9 billion in capital expenditures in 2015 and sold 9.92 million cars last year. Instead, Apple would most likely compete against newcomer Tesla, which is a niche electric car maker that offers an iPad-like infotainment system in its models. Last year, Tesla sold 22,450 cars and invested close to $1 billion in capital expenditures.

Some observers see Apple’s move into the low-margin and capital-intensive automotive industry as a sign that it does not know what to do with its cash. But with $178 billion in cash reserves,Apple can easily out produce and spend Tesla by a factor of five or even 10. It also could, if it wanted to (but will almost certainly not), match General Motors’ capital expenditures over a couple of years or more before even putting a dent in the free liquidity it has available.

2. A ready roster

Apple already has made hundreds of high-level hires who hail from the car industry. Within its top-level executive ranks, Apple CFO Luca Maestri has two decades of experience working for GM where he held finance- and operations-related executive positions.

Apple has recruited hundreds of other auto industry insiders to join its development team. According to the Wall Street Journal, Apple has recruited hundreds to work on its supposedly secret electric car project, many of whom hail from likely rival Tesla.

Among its hires, A123 Systems, an electric car battery maker, claims in it lawsuit filed against Apple this month that Apple has illegally tapped design experts and other talent from its company. Those whom Apple has hired are also violating their employment contracts, A123 Systems claims in its lawsuit. Regardless, Apple now has acquired in-house talent it needs to develop batteries, a critical component of electric cars.

3. Design genius

Apple’s products have transformed the PC, tablet, and smart phone industries with its minimalistic designs and ease of use that have helped make Apple one of the most recognized brands in the world. Given that cars still can make a fashion statement and how design largely determines whether a particular car model becomes a hit or a dud, the automotive industry would have a lot to gain from Apple’s designers’ genius. While it has been revealed above that Apple has recruited engineers to get the technology part of electric cars right, its design team certainly has the talent to make an iCar that could define mobility in a very unique and popular way as it has done in the PC, smart phone, and tablet sectors.

4. Different ways to slice the apple

Apple already sells electronic designs and software interfaces for automotive infotainment, while developing a car around that will only help its high-margin design licensing business, even if does not end up commercially launching its “iCar.”

Already, CarPlay, Apple’s iOS for automotive infotainment, is available in cars. Ferrari, Honda, Hyundai, Jaguar, Mercedes-Benz, and Volvo are among those carmakers that offer Apple’s CarPlay as an option. The interface will eventually be available in 25 million cars by 2020, according to IHS Automotive.

Apple also has a successful history of OEM design experience, which it can apply to the development of its own car or for embedded systems for car dashboards. Its infotainment systems would likely serve as in-car extensions for its PC, iPhone, iPad, and iWatch devices.

5. Global business, global supply chain

Carmakers are in a tough business. They must margins out of a complex network of suppliers, production sites, and other business operations. Often spread out in different locations around the world; large automakers typically must manage regulations and laws, sourcing channels, currency values, and demand that can vary from one region to another.

Much of Apple’s production is in Asia and it has been sourcing electronic components and other devices from around the world for decades. So managing supply chain operations around the world is something Apple is very good at. Apple will obviously be a newcomer to the automotive supply chain, but it already has a stellar resume when it comes to managing the complexities of worldwide production and procurement.

Source: Bruce Gain, EBN

Williams seemed to hint at Apple’s interest in the automotive market in his response to one question about what the company plans to dow with its huge cash hoard.

“The car is the ultimate mobile device,” Williams said, quickly adding. “We’re exploring a lot of different markets.”

Williams said that the deciding factor in choosing new businesses is not the opportunity for revenue growth, but rather “which ones are ones [in which] we think we can make a huge amount of difference.”

One area with growing potential is ResearchKit, software that allows Apple’s iPhone to be used as a tool for medical research. Williams said the technology already is being used to aid the study of Parkinson’s Disease, heart health, breast cancer and asthma.

“Usually it takes a year-plus to see results, we’re seeing (it) in weeks and months,” Williams said.

Source: Re/code

Download the Paper: Automotive Inbound Supply Best Practices

Article Topics

One Network Enterprises News & Resources

Blue Yonder announces an agreement to acquire One Network Enterprises for $839 million Blue Yonder Acquires One Network Enterprises for $839M Companies Need to Develop New Innovative Approaches to Supply Chain Design How to Improve Cost of Goods Sold Horizontally Across the Supply Chain How the Global Pandemic Accelerated Supply Chain Visibility, Digitalization, and Automation AI and Data, the Future of Supply Chain Management AI and Supply Chain Problem Solving More One Network EnterprisesLatest in Technology

Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Taking Stock of Today’s Robotics Market and What the Future Holds Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants Apple Overtaken as World’s Largest Phone Seller Walmart Unleashes Autonomous Lift Trucks at Four High-Tech DCs Talking Supply Chain: Procurement and the AI revolution More Technology