IMF Boosts Global Economic Forecast for 2017

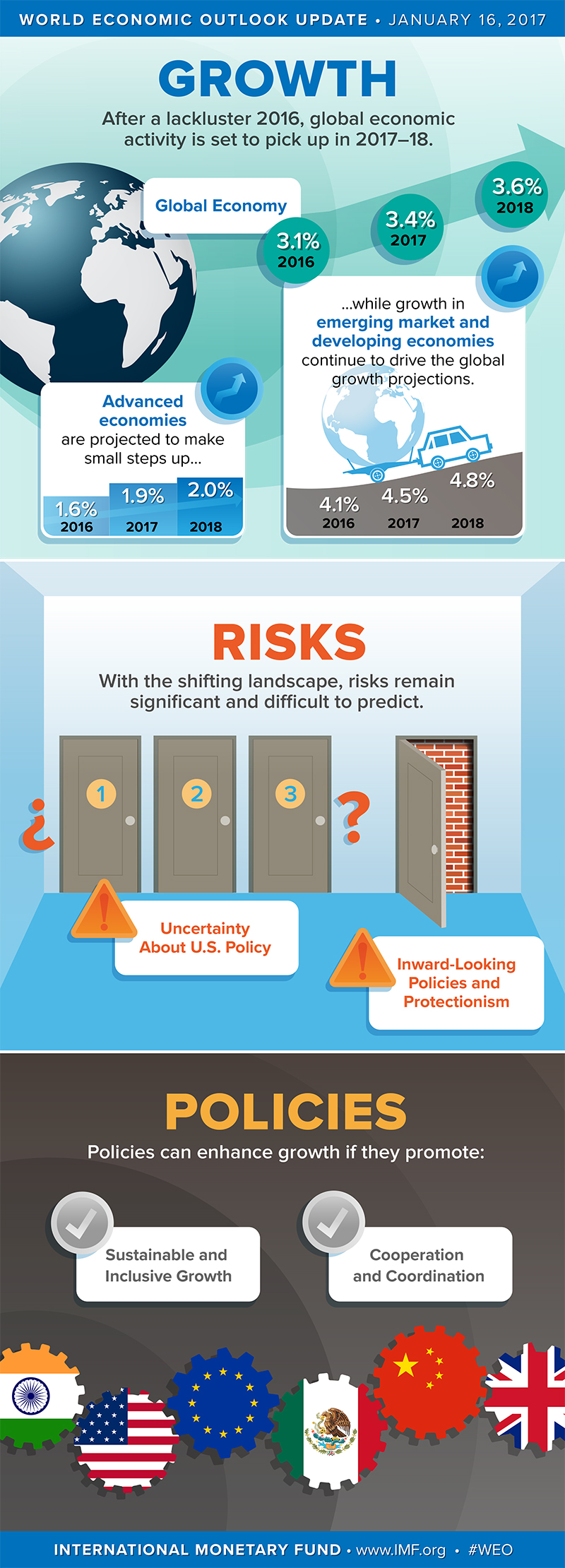

The International Monetary Fund offered a sunnier outlook for the global economy in 2017, predicting growth of 3.5 percent this year. Still, the IMF warned the world economy still "faces headwinds" and warns against protectionism.

The global economy is on course for its best performance in several years despite trade tensions and looming geopolitical threats, the International Monetary Fund said ahead of a meeting of world finance chiefs in Washington this week.

Investors are skittish over a potential U.S. standoff with North Korea, France's elections and Washington's fresh use of force in the Middle East and Afghanistan.

But global investment, manufacturing and consumer confidence are signaling strength.

U.S. growth is projected to accelerate. Europe and Japan are finally showing signs of recovery.

Meantime, oil prices have risen from 2016 lows, boosting inflation readings from exceptionally low levels and offering hope for economies dependent on commodity exports that the worst of the two-year price rout might be over.

The International Monetary Fund, in its flagship report on the state of the global economy, nudged up its forecast for world growth this year a tenth of a percentage point to 3.5%, which will be the fastest rate in five years if the IMF is correct.

“Acceleration will be broad-based across advanced, emerging, and low income economies, building on gains we have seen in both manufacturing and trade,” said IMF Chief Economist Maurice Obstfeld.

While the IMF kept its forecast pickup for U.S. growth at 2.3% for the year - up from 1.6% last year - it notched higher outlooks for all five of Europe's largest economies. The U.K.'s bump-up was the biggest, a 0.5 percentage point increase to 2% for the year.

In Asia, another dose of government stimulus has pushed China's growth forecast up a tenth of a percentage point to 6.6%, and the fund lifted Japan's outlook by 0.4 percentage point to 1.2%.

Growth in cross-border trade of goods and services this year - while still well below pre-crisis levels - is projected to nearly double to 3.8%. Consumer price inflation across advanced economies is projected to pick up to 2% on average, more than twice the previous year, and is gathering pace in emerging markets, too.

“The global economy is accelerating after a period of expansion that has been the most gradual of the past century,” Bank of Montreal chief executive officer William Downe told shareholders earlier this month.

Like many of the largest banks in the U.S., Canada's fourth-largest lender reported a better-than-expected first-quarter profits, with earnings up nearly 40% on the year.

Measures of optimism of households, businesses and investors show high hopes about growth prospects and expectations of higher inflation. Consumer confidence isn't just strong in the U.S.: It also ticked higher in March in the eurozone, underpinned by a eurozone unemployment rate that in February hit its lowest level since mid-2009.

Surveys of purchasing managers showed that activity in the first three months of the year in the eurozone's manufacturing and services sectors hit its highest measure since 2011, before the eurozone economy entered a slowdown caused by its government debt crisis.

Bellwether companies in Europe, like German car maker Daimler AG, reported sharply higher earnings in the first three months of the year. And French car parts maker Faurecia SA said first-quarter sales rose 9.8% on strong growth in the U.S. and China.

“A strengthening of the U.S. and global economy…allow us to make some positive assumptions about business conditions for the remainder of our fiscal year,” said William Furman, chief executive officer of international railroad giant, Greenbrier Company, based in Lake Oswego, Ore.

Even with the generally positive projections outlined by the IMF, however, trade frictions, political uncertainty and China's debt problems still threaten to erode and potentially upend global growth. Those and other headwinds are expected to keep world growth capped at 3.8% for the foreseeable future, according to the IMF's long-term outlook.

“The world economy may be gaining momentum, but we cannot be sure that we are out of the woods,” said Mr. Obstfeld.

Investor sentiment in U.S. growth is reliant in part on the Trump administration delivering on promises of a tax overhaul and infrastructure spending, though the president has hit speed bumps advancing his agenda.

Productivity growth around the world - a critical component of economic expansion - is still slow. Growth is also held back by still-sluggish trade growth, aging populations and the failure of the European Union to resolve the legacies of its sovereign debt crisis.

Pre-crisis growth rates were an exceptional time for major emerging markets. Many are now bumping up against the ceiling of growth gains that could prove hard to extend. The rapid economic liberalization of China, India and Eastern Europe and the development of global supply chains made the pre-crisis trade-growth trend at twice the pace of the global economy a unique period, says World Trade Organization chief economist Robert Koopman.

The WTO economist said he only sees an acceleration of trade to around 1.5 times the global growth rate.

Economic growth in China, the world's second largest economy, has also come at a cost of an unprecedented credit buildup that many economists warn could mean much weaker growth ahead and even financial turmoil.

Meantime, rising short-term U.S. interest rates could hurt highly-leveraged American firms that have loaded up on cheap credit over the past several years, the IMF said. Many emerging markets are also vulnerable to an increase in borrowing costs and a strengthening dollar, having also stocked up on debt.

All these reasons are why building trade tensions are worrying the finance ministers and central bankers gathering in Washington this week for the IMF and World Bank's semiannual membership meetings. Fears of protectionism dominated a meeting last month of the Group of 20 largest economies, and IMF chief Christine Lagarde last week warned that “a sword of protectionism” is hanging over the global economy.

With trade long an important driver of world growth, the IMF estimates a surge in tariffs and other trade barriers could sap 2 percentage points off global gross product.

The U.S. says its policies or threats don't amount to protectionism, but rather are an effort to rebalance distorted trade relationships. Trump officials say other countries' tariffs, taxes and other barriers have fueled trade deficits with most of the country's biggest trade partners at the expense of U.S. workers.

But the IMF, Germany and other nations are anxious that overly-aggressive actions by the U.S. could spark a tit-for-tat trade war that stalls global growth.

So far, however, Mr. Trump's team has shown itself in the trade arena to be less aggressive than some feared.

The White House proposal to rewrite the North American Free Trade Agreement has been more modest than many expected, and despite Mr. Trump's promises over several months to label China and other countries “currency manipulators,” the president last week reversed course, with his Treasury Department officially declining to label any country with the designation.