How to Engage Your 3PL’s With Big Data & Analytics

Savvy, global shippers that capture and analyze transactional transportation management data in collaboration with their third-party service providers have seen hard dollar savings drop to the bottom line. Here’s how they’re getting it done.

Today, logistics managers are being bombarded with software providers and integrators wanting to discuss Big Data, business intelligence (BI), and improved interconnectedness of the supply chain that - until recently - has been only a dream.

These information technology (IT) firms see an opportunity to sell web-based solutions directly into the logistics organization as a service. Logistics professionals, therefore, need to bone up on the benefits of leveraging supply chain information as part an overall improvement strategy - not just as clever negotiation tactics with carriers to improve customer service and cost.

With global shipper organizations consistently changing supplier partners, markets, and customers, the logistics function cannot simply wait for a request for rates from the business unit before exploring the market. Instead, they should constantly be seeking opportunities for cost and service improvements through data mining and analytics or business intelligence.

Those industry leaders that have grabbed the opportunity to gather, prepare, and analyze transactional data from forecasting through cash settlement activities have seen hard dollar savings drop to the bottom line.

For example, at one consumer retailer we worked with, the board was so impressed with the BI project that they asked the IT director to start reporting to the vice president of supply chain. They wanted to keep the focus on developing better actionable information on operational performance, the market, and customer buying habits.

Outcome-Based Metrics and Performance

Achieving representation, accessibility, intelligence, and decision management enables the highest form of big visibility - outcome-based metrics and performance. A necessary outcome of our evolving supply chain networks will be to make sure we place the right assets in the right place at the right time in the right amounts, all bound by real time collaboration and big data visibility. Included in this evolution will be simultaneous efforts focused on organizational change, process reengineering, and lean/six sigma program management.

As I’m seeing time and again, leading logistics managers are consistently bringing data analysis improvement ideas to management - ideas that they developed internally or with service providers that can help them transform the business strategy.

Think of global simultaneous introduction of smart phones, books, and movies as examples. When considering the possibility of mining logistics transaction data for the purposes of improving costs and service, the “motherload” for supply chain data is in international transactions. The movement of freight across borders generates valuable information from which shippers can learn of areas for innovation, margin improvement, and risk reduction.

Working with a major pharmaceutical company recently we identified 58 fields of data that they would like to have collected, cleaned, and presented to them through their logistics service providers. Initially, none of their partners could offer this level of service because they had parts of the data and often in multiple systems and formats. More importantly, the service providers didn’t see themselves as sources of data for analytics - they failed to understand its value to the customers’ whole enterprise.

When we collect and mine data we’re entering the world of BI, which is also referred to as “business analytics” or “data science.”

Today, shippers need to look at the concept of BI, the sources of their data, and the role of the international service providers - including third-party logistics providers (3PL) and freight forwarders - as the transaction data collectors and as possible analytics partners.

How can logistics services partners help?

Beyond understanding the BI basics and trends that can help identify ways that a 3PL or freight forwarder partner can help your operations, how can you tell if your logistics services partner is equipped to assist in the Big Data effort?

To help this question, I turned to someone immersed in the BI game. My son, Greg Moore, a former major in the U.S. Army and now president of Eagle River Systems, learned intelligence techniques fighting insurgents during six deployments.

He and his 30-man intelligence unit were each awarded the Bronze Star for dramatically reducing casualties from improvised explosive devices (IEDs) in Afghanistan, and he understands the value of searching for patterns in detailed event data that will help you to be innovative.

He suggests three elements that operations leaders need to have in terms of an internal or partner capability:

1. Analytics and IT. According to Moore, there are two primary skill sets that go into BI: analytics and IT. On the analytics side, the analysts, or data scientists, are applying mathematical and statistical tools to create business models to create valuable insights into trends that can inform operational and strategic decisions.

“The IT side focuses on building database infrastructure to capture, organize, and categorize data, and provide tools for discovery, analysis, and visualization for analysts and decision makers,” says Moore. “So, the idea is to decide which of these two sides of BI you can provide internally and which to contract out.”

For companies looking to leverage BI as a value-added service or an internal capability, Moore says that it can be easy to be pulled into IT discussions around features for designing dashboards that display critical information - and there are many platforms to choose from that are marketing their reporting capabilities. This is important, but you need to explore deeper. What is the software engine and how is it deployed?

“The big five are Oracle Hyperion, IBM Cognos, SAP Business Objects, SAS, and a Microsoft solution comprised of SQL Server and SharePoint. And there are a number of other solutions available to consider in specialized areas,” says Moore. “Spreadsheets are not going to cut it beyond small rudimentary studies.”

2. People. Integrating a BI solution is about more than picking out a software tool. According to Moore, it’s about having the right people who can analyze the data, understand what it means to your operations, and present it to decision makers - and for the IT specialists it’s about getting the data to the analysts.

“If your operational data is already being captured in an SQL or Oracle database, perhaps through an ERP, or tracked in Excel spreadsheets, it would make little sense to implement a new brand-name system,” Moore says. BI analysts would then have to spend time tracking down the data and getting it into the new system - rather than doing analysis and drawing insights from already captured data. “Don’t reinvent the wheel,” he says.

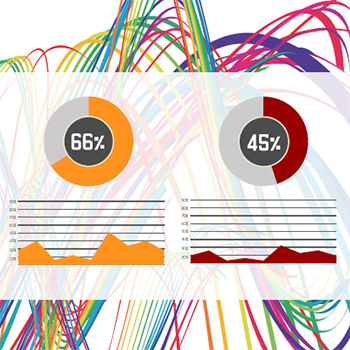

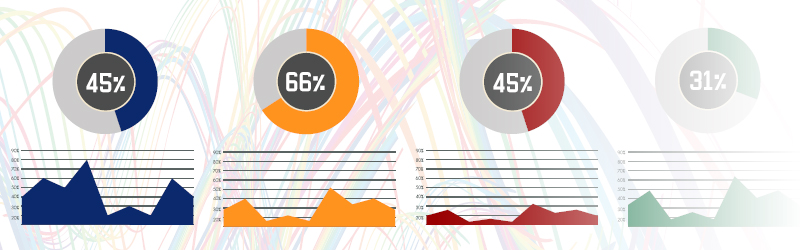

3. Put a dashboard in place. Finally, only when the right people have access to the data they need, then the discussion about the right tool for building reports and dashboards for the analysts and decision makers can take place. “Frankly,” Moore adds, “this is the easy part. Getting complete, clean, usable data is 50 percent to 80 percent of the game.”

The logistics organization will have to decide who should own this. Experience suggests IT infrastructure for collection and preparation should be done at the source - and in logistics, that’s very often the logistics service provider.

BI: Engaging your service provider

So, how can a shipper jump into a BI solution? One viable option is to hire a qualified third-party logistics service provider to manage logistics and collect the transactional data for presentation to your in-house analysts.

It is of vital importance that your contract for service with all third parties, including carriers and warehouse services, should clearly state that your company owns the data generated from your business transactions and that each service provider must deliver that as a part of each transaction.

Data collection, or “reporting,” should not be an afterthought. It should be clearly understood by all providers that you want the service and the data describing that service in detail delivered before payment is made.

I’ve been regularly asked what an analyst, either at the 3PL or the shipper’s office, can produce in savings. My professional experience has found that a qualified analyst with the right tools and skills will produce as much as a 1,200 percent return on investment (salary) for a mid- to large-size firm.

While that sounds like a massive amount of ROI, let me share an example. I was recently sitting with a new analyst right out of school at a client’s office looking at short-haul loads from a port distribution facility.

I showed him a few tricks for sorting a two-week batch of freight payment data and he immediately caught a variation in payments for the same move. After some inquiries, he found that the dispatcher was spreading out the choice local haulage work among carriers rather than following the routing guide.

This situation was corrected that day, and it turned out that the simple observation paid that analyst’s salary for two months. The more a shipper can mandate that the data is clean, timely, and in the desired format at the source, the more productive analytics will be.

Alternatively, a contract for a lead logistics provider (LLP) might also include analytics and recommendations so as to identify opportunities for your company. One advantage can be that the service provider might compare your cost and service data with other companies anonymously and provide benchmarks as well.

This full outsourcing option, however, is very difficult, as it assumes sharing of internal business information with your service provider well beyond just transactional orders. If done properly, this enables the service provider’s analysts to have a business context for their models and trend analysis.

Keep in mind that full outsourcing means involving your service provider in regular business meetings and perhaps providing office space in your building in order for them to be part of your team.

We’ve also seen shippers with limited internal resources expand their use of third-party service providers and the scope of their contracts. The tough job of logistics data collection and the cleaning and sorting (“wrangling”) is a prime area for expanded contracting.

For many freight forwarders and other third parties in international commerce, this is new territory. With investments in people, processes, and technology they’re able to offer actionable BI and analytics to their customers - at a premium.

How shippers gain value

How the value that’s produced is identified and shared is another critical question. Marketing this service to shipper customers means borrowing a few ideas from software and IT integrator firms because solution selling is different than simply selling services.

The good news is that the service provider will be breaking through to new levels at the customer’s firm.

Done correctly, service providers can expect to find themselves presenting to shipper executives who know the value of BI and are seeking reliable counsel on how to reach new markets, improve customer service globally, improve compliance, and understand and overcome local operational challenges.

If you outsource, you need to recognize the contribution made by your logistics service providers in the BI area and compensate them accordingly. To make this happen, new international service agreements need to be developed that include clearly defined data elements, shared objectives, new governance procedures, shared risk and innovation investment incentives.

With time and effort, service agreements have been improving through the use of collaborative contracting in which both parties proactively and transparently go after shared targets that help the shipper to be more successful. Remember Big Data means big opportunities for shippers and their service providers.

About the Author

Peter Moore is a partner at Supply Chain Visions, Member of the Program Faculty at the University of Tennessee Center for Executive Education and Adjunct professor at The University of South Carolina Beaufort. Peter can be reached at [email protected]

Related Article: The Road to Big Data Visibility Doesn’t Run through Your 3PL Technology

Article Topics

One Network Enterprises News & Resources

Blue Yonder announces an agreement to acquire One Network Enterprises for $839 million Blue Yonder Acquires One Network Enterprises for $839M Companies Need to Develop New Innovative Approaches to Supply Chain Design How to Improve Cost of Goods Sold Horizontally Across the Supply Chain How the Global Pandemic Accelerated Supply Chain Visibility, Digitalization, and Automation AI and Data, the Future of Supply Chain Management AI and Supply Chain Problem Solving More One Network EnterprisesLatest in Technology

SAP Unveils New AI-Driven Supply Chain Innovations U.S. Manufacturing is Growing but Employment Not Keeping Pace The Two Most Important Factors in Last-Mile Delivery Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Taking Stock of Today’s Robotics Market and What the Future Holds Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants More Technology