How Organizations Can Reinvent Procurement

Procurement is at an inflection point, for many leading companies, procurement has been transformed into a linchpin of enterprise strategy, and yet many remain trapped by outdated paradigms and struggle for influence within their companies.

At many leading companies, procurement has been transformed in profound ways to become a linchpin of enterprise strategy.

Meanwhile, many procurement groups continue to struggle for influence within their companies - in large part because they remain trapped by decades-old paradigms that are far too prevalent.

In this article, we will share what we have learned during our work with leading procurement organizations around the world as they seek to adapt to a future that is already upon them.

In these organizations, the need to drive innovation is paramount, and an increasing proportion of the opportunity and risk with suppliers involves not only physical materials or equipment, but also complex services and intangible assets like intellectual property, data and brand equity.

In that new environment, the strategies and skills that constituted a recipe for procurement success in the past need to be reevaluated, and to some extent upended, based on a 21st century world with new risks, threats and opportunities.

A Changing World and a Changing Context

In order to understand the future of procurement, it is useful to briefly review its history and evolution.

For a very long time, procurement was a back office function focused on processing transactions.

The selection of suppliers, and the negotiation of supplier agreements, was highly fragmented, unsystematic and non-rigorous. That began to change in the 1990s with the advent of strategic sourcing. Over the past several decades, this simple but powerful discipline has delivered enormous savings at countless companies, and earned procurement groups a substantial degree of respect and influence.

What is unacknowledged is the fact that strategic sourcing rests largely upon a set of concepts and principles laid out by Peter Kraljic in his classic Harvard Business Review article “Purchasing must become supply management” - which was published in September 1983.

The article is full of many useful examples and case studies that remain relevant, as do many of the principles and methodologies of strategic sourcing that developed later.

At the outset of his article, for instance, Kraljic asks how a company can “…guard against disastrous supply interruptions and cope with the changing economics and new opportunities brought on by new technologies? What capabilities will a profitable international business need to sustain itself in the face of strong protectionist pressures? Almost every kind of manufacturer will have to answer these questions.”

Those questions remain top of mind to business leaders who are grappling with disruptions from natural disasters, rapidly changing technologies, the digitization of business and shifting geo-political alliances.

While the article remains an often quoted classic, there is also much that is obsolete, and some that has become counter-productive.

For example, the word “innovation” never appears in this article. What’s more, it viewed procurement through the lens of a manufacturing economy; indeed, all of Kraljic’s article focused on the procurement of physical goods.

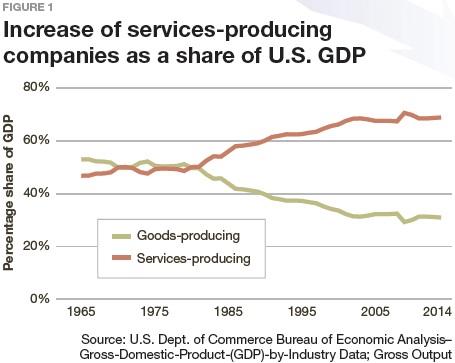

Yet in 1984, services were already approximately 55% of U.S. GDP; today the number is approximately 70% (Figure 1).

Here’s another important statistic that procurement needs to understand and grapple with. According to Leonard Nakamura, an economist at the Federal Reserve Bank of Philadelphia, U.S. companies may have intangible assets worth more than $8 trillion.

That figure is almost half of the $18 trillion market capitalization of the all the companies comprising the S&P 500 index. Moreover, according to research conducted by economist Carol Corrado and reported in the Wall Street Journal, in 2014, companies invested the equivalent of 14% of the private sector’s share of GDP in intangibles (such as their brand and data assets) versus approximately 10% in physical assets (such as factories).

Clearly, the world economy has changed, and procurement needs to catch up - quickly.

The Next Wave of Value

Procurement is, in many ways, a victim of its own success. As recently as 10 years ago, there was significant value to be gained by using competition to motivate better supplier performance and to re-balance supplier profit margins and customer costs.

But rigorous and coordinated sourcing has enabled companies to maximize purchasing leverage based on their total spend. While there will always be some suppliers with a high degree of pricing power because of a unique technology or market position, today we find a consolidated supply base, operating with profit margins kept in check by competitive pressure.

In other words, the low-hanging fruit has been picked. So what will drive the next wave of value?

Fundamentally, we believe it is innovation - not just in product design or manufacturing technology, but also in business processes and models, and in the capture and utilization of data and information.

A critical function for procurement in the future will be the capability to strike the right strategic balance with different suppliers between competitive pressure and associated uncertainty (which helps guard against supplier complacency, but also acts as a powerful disincentive to supplier investment), and deeper collaboration and longer-term commitments to suppliers (which act as a positive incentive to supplier investments).

In our experience, most companies need to re-balance their strategic focus with more emphasis on supplier commitment and joint investment.

Companies are not simply in competition for customers and revenue. They are also in competition with one another for preferred access to supplier innovation, ideas, “A-team” talent, and investment of various kinds. As firms in industries from semiconductors to bio-pharmaceuticals to financial services recognize this fact, procurement is increasingly charged with developing and implementing strategies to become a “customer of choice.”

Drivers of Past Success Will Not Drive Future Success

A service-oriented and innovation-powered economy requires procurement to develop new strategies and competencies. While still relevant, Kraljic’s original sourcing matrix is no longer sufficient. It is implicitly based on markets for physical goods and the traditional relationship between supply, demand, power and pricing in such markets.

Of course, the physical economy and associated supply chains still exist. Capacity constraints will continue to arise in many markets and lead to cost increases and/or supply shortages that lead to lost revenue.

Nonetheless, the traditional way of classifying categories of supply and suppliers focuses primarily on zero-sum power dynamics between a company and suppliers - and thus encourages an unhelpful over-emphasis on “bargaining power” and an under-emphasis on the power of engaging suppliers in the joint exploration of ways to work together that deliver mutual benefits.

Or, as Kraljic put it: “The purchasing portfolio matrix plots company buying strength against the strengths of the supply market and can be used to develop counterstrategies vis-à-vis key suppliers.”

Traditional ways of thinking about supply markets and suppliers, rooted in an industrial past, also fail to guide effective thinking about the fairly different risks and opportunities that arise in working with suppliers of services, and suppliers whose primary value derives from their intangible assets.

Services, Solutions and Innovations

Procurement groups need a new framework for driving additional value in different sourcing contexts, including complex services such as legal services, marketing and advertising, research, design and engineering and yes, even management consulting.

Such categories of spend used to be off limits, but are now increasingly managed by leading procurement organizations. Even in manufacturing contexts, companies increasingly rely on top suppliers to collaborate in early stages of new product design and development. Such suppliers may make most of their money from manufacturing parts, tools or equipment, but they also supply critical services on which their customers rely.

Sourcing services is different from sourcing physical goods in a number of ways. For one, economies of scale do not reduce unit costs in the same way as they do in a manufacturing environment. For another, the profit drivers of service supplier are different from those of manufacturers.

The primary asset of service suppliers is talent - people. And “A-Team” talent is highly mobile - in a way that physical assets are not. Procurement needs to think differently about leverage, risks, opportunities and value with suppliers whose business depends in whole or in part on selling services. Moreover, companies should often be sourcing more than discrete products and services. They should be sourcing solutions to important business needs. What do we mean by this?

Consider an industrial company we worked with for many years. For this company, the regular maintenance of chemical manufacturing and storage tanks constituted a major spend category.

Historically, procurement sourced specific services including the set up of scaffolding for maintenance workers, a number of specific cleaning and maintenance services and, when the job was complete, the breakdown of and removal of the scaffolding.

What happened when the company looked at what they needed to source in a different way? They ran a sourcing initiative without traditional requirements. Instead, they shared information they had never shared before with potential suppliers under a non-disclosure agreement (NDA) about their business model, manufacturing processes, production schedules and bottlenecks. They then asked their suppliers for new and better ways to maximize production up-time and reduce operating costs. What happened when they did this?

Most suppliers offered proposals and bids similar to those they had provided in the past. But one supplier noted that they were prototyping a new portable elevator system that might eliminate the need for scaffolding set-up and break down.

The supplier’s bid was more expensive than its conventional competitors - but it reduced maintenance and lost production time from weeks to days. The increase in revenue from more up time made up for the increased cost many times over.

Of course, as companies seek revenue and profit growth in a hyper-competitive global economy, a further mental shift toward sourcing innovation is required. In this realm, customers may not even be aware of the needs or opportunities relative to which suppliers may have new technology under development, new ideas or untapped expertise.

Procurement thus needs to engage with suppliers in completely different ways. They need to encourage and reward supplier investment and innovation - and ensure a disproportionate share of that comes to them versus their competitors. Traditional RFX and bidding processes will not go away, but they need to be augmented with greatly enhanced “upstream” engagement with key suppliers.

Such engagement may take many forms, including not only joint ideation sessions with suppliers, but also regular joint strategic business planning - during which a customer and its key suppliers exchange information about their respective strategies, business plans and technology road maps, looking many years into the future.

Customers who do this well will gain disproportionate influence over supplier investments, and the innovations that results.

Suppliers will benefit from more information to guide their investments such that risks are reduced and time to revenue is accelerated.

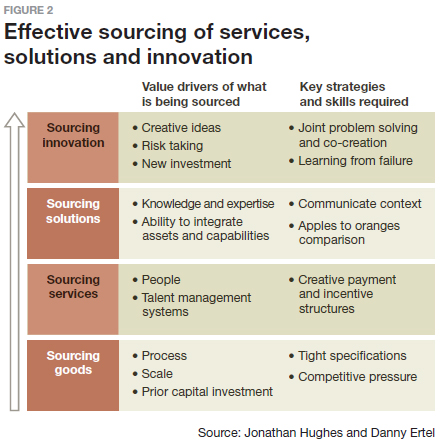

Figure 2 is by no means exhaustive, nor are the value drivers, nor are the strategies and skills for each context mutually exclusive.

Nonetheless, this framework highlights some of the critical ways in which the effective sourcing of services, solutions and innovation differs from the sourcing of physical goods.

The Questions We Ask Determine Our Answers

In our work with procurement organizations across a range of industries, we have observed that most are guided by a set of fundamental questions, often to a degree they are not consciously aware of.

- How do we extract more savings from our suppliers?

- How do we motivate suppliers to improve their performance?

- How do we get internal stakeholders to involve us earlier, and comply with sourcing strategies, policies and decisions?

- How do we define supplier requirements in a way that enables us to conduct “apples-to-apples” comparisons across suppliers and maximize competitive leverage?

- How do we get more innovation from suppliers?

There is nothing wrong with these questions. But as with any questions, they focus attention in certain ways, and reflect and reinforce assumptions that can be limiting. In any event, new solutions to business challenges and the identification and realization of new value will not come from asking the same questions.

Below are a fundamentally different set of questions. They are not meant to replace the questions above, but rather to augment them and expand the scope of solutions and opportunities that procurement can uncover and address.

- How do our suppliers make money?

- What do we do that creates cost, risk or frustration for our suppliers? How do we inhibit their ability to deliver maximum value to us?

- How can we better support the goals and strategies of our internal business partners? How can we more effectively challenge their assumptions and thinking, while also remaining open to learning from them?

- How can we help our suppliers better understand the challenges and opportunities our business faces, so that they can propose solutions based on their unique expertise and capabilities?

- How do we create more innovation with our suppliers?

A New Procurement Paradigm

Sitting at the intersection of a company and its external suppliers, procurement can play a unique role in leveraging supplier assets and capabilities to drive innovation, actively support revenue growth and deliver competitive advantage - all while minimizing risk to a company’s operations and reputation.

In other words, procurement can - and must - focus on maximizing total value from suppliers.

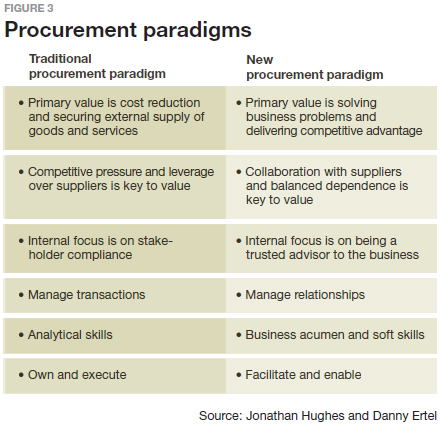

This requires a new procurement paradigm (Figure 3), or a revolution in the way procurement leaders and their teams see themselves and their role, the value they can add to their enterprise, and the ways in which they deliver value to the enterprise.

New Metrics and KPIs for Procurement

Currently, most procurement organizations focus primarily on a limited set of metrics and performance indicators - with cost-related metrics foremost amongst these. They also typically rely heavily on supplier spend levels to segment suppliers, and to make decisions about where and how to focus limited resources on supplier management.

To be successful in the future, procurement organizations will need to learn from current leaders and expand what they measure to better align with an expanded focus and delivery of broader value.

For example, levels of spend (within a commodity or category, or with an individual supplier) are often a poor proxy for the strategic importance of that category or supplier. Often a more useful metric is “revenue-at-risk” - a more complex but also more meaningful calculation that links external expenditures to the customer revenue streams that depend on supplier inputs, whether those are materials, equipment or services.

Similarly, the current emphasis on cost-savings should be expanded with broader measures of value delivered - by suppliers and by procurement. For example, a few years ago we worked with a consumer products company that was in the process of designing a new product.

Based on extensive research, the marketing organization believed that a more expensive packaging would be highly valued by consumers, which would lead to greater sales and higher profit margins.

Rather than fight a battle to select the lowest cost supplier, procurement partnered with marketing and product designers to select a supplier that had the expertise to help design and manufacture a unique packaging solution. (Incidentally, this was not the supplier that the marketing group had initially wanted to work with.) The result was a substantial cost increase - but one that paid off in expanded market share, increased revenue and higher margins.

Companies put significant emphasis on measuring their return on assets and invested capital - naturally, because the shareholders that provide them with investment capital care about these metrics.

But we now live in the world of the extended enterprise, where a majority of what goes into the products of most companies is manufactured, and often designed, by or with external suppliers; where an increasing percentage of a company’s operations are outsourced and/or enabled by third-party solutions and services; and where a company’s R&D investments and patent portfolio are usually dwarfed by the combination of innovation investments and assets of its top suppliers.

Consider that Unilever reported a few years ago that 70% of its innovations came from suppliers. World-class procurement organizations will therefore increasingly measure and report the returns they realize from supplier assets (RoSA), and the extent to which they are commanding and benefiting from a disproportionate share of supplier investment and innovation vis-à-vis their competitors.

New Competencies for Procurement

The transactional and routine activities (from PO processing to market analysis) that used to be procurement’s focus are increasingly being automated or outsourced. What remains, as we have argued above, is for procurement to take on an increasingly strategic role within the enterprise.

This entails developing the competencies that are most difficult to replace with software, and taking on a role that is so closely integrated with a company’s core competencies and sources of strategic advantage that it cannot be outsourced.

Based on our benchmarking and work with clients, there are three broad competencies that procurement organizations generally need to strengthen. The first is business acumen.

Analytical skills to calculate total cost of ownership or develop should-cost targets are valuable, but they are far less valuable than the ability to think like a business owner or executive, to understand the very different business models of different suppliers and how they make money (even when those suppliers operate in the same industry) and based on that, to determine how best to design an engagement model with a given supplier and construct contract terms as well as informal incentives to motivate that supplier to deliver maximum value.

The second competency is strategy development and strategic thinking. What passes for a category or commodity “strategy” within many procurement organizations would often be better termed a category “profile” - an often impressively researched and formatted report of past and projected spend, information about the supply market and the classification of spend or suppliers into segments like “strategic” or “bottleneck.”

Such analysis is useful, but it is not a strategy - a long-term plan that articulates important choices and explains why difficult choices and trade-offs must be made, and how.

For example, if our company is highly dependent on a particular supplier, and our business is not particularly important to them, what should we do? Invest in developing one or more alternate suppliers? Or invest in trying to make our business more attractive to our current supplier - and if so, how?

Framing such choices and rigorously articulating the costs, risk and benefits of different choices (under conditions of uncertainty) is the hallmark of true strategic thinking.

The third area of competence that is increasingly important, and often deficient, is that of soft skills, including: relationship building, influence, conflict management, negotiation, change management and leadership. For example, not too many years ago, procurement groups looking for negotiation training were often interested in the latest bargaining tactics and techniques.

More recently, we have seen an increasing interest in building skills for a more strategic approach to negotiation focused on principled persuasion and joint problem solving, while also accounting for the psychological and emotional dimensions of negotiation.

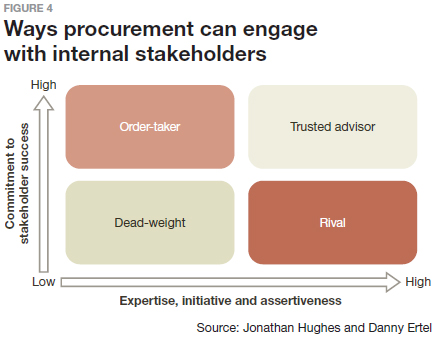

Another example: We have seen a huge upsurge in requests for training focused on stakeholder engagement, alignment, influence and how to become a trusted advisor to internal business partners (Figure 4).

This is a welcome change from a not too distant past in which many procurement organizations were focused on obtaining C-level mandates that they could use as a cudgel to enforce compliance from recalcitrant stakeholders.

A Procurement Road Map to the Future

Different industry sectors confront different procurement and supply management issues, and the pressures to bring procurement practices up to date with the realities of an innovation-driven and increasingly service-oriented economy will likewise vary.

Nonetheless, we believe that almost any procurement organization that seeks to maximize the financial and strategic value it delivers to the enterprise must evolve and mature.

As we noted at the outset: Procurement is at an inflection point. Those organizations that evolve along a maturity model will drive innovation, deliver value and enable their enterprises’ strategies. Those that remain trapped by old paradigms will continue to struggle in a 21st century world with new risks and threats, and miss out on new opportunities.

About the Authors

Jonathan Hughes is a partner at Vantage Partners, and the firm’s sourcing and supply chain management practice leader. He can be reached at [email protected]. Danny Ertel is a partner at Vantage Partners. He can be reached at [email protected].

Article Topics

ASCM News & Resources

Supply Chain Stability Index sees ‘Tremendous Improvement’ in 2023 Supply Chain Stability Index: “Tremendous Improvement” in 2023 The Right Approach for Supply Chain Education The reBound Podcast: Innovation in the 3PL supply chain Supply Chain’s Top Trends for 2024 Require Talent Investment for Success Resilience Certificate Now Available from ASCM ASCM conference highlights importance of geopolitics in the supply chain More ASCMLatest in Supply Chain

TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month More Supply Chain