Holiday Season Heightens Challenges of Online Returns for Retail Supply Chains

Although online retailers are coming to terms with the high return volume that comes with online shopping, reducing the cost associated with those returns remains a top priority.

Supply Chain Reverse Logistics

When one considers how a product moves through a supply chain, it’s almost always in one direction: from the point of production to the final point of sale.

And for most sales, this is the normal flow.

However, a portion of purchases is sent back into a supply chain network that oftentimes is not designed to handle the reverse flow of goods.

The retail return rate in the U.S. and Canada averages 8% of total sales, according to retail analytics firm The Retail Equation.

With projected sales totaling up to $720 billion in the November December holiday season,(1) this equates to approximately $58 billion worth of returns mostly in the immediate aftermath of the holidays.

E-commerce, which accounts for an increasingly large portion of total retail sales, records an even higher average return rate of 30% during the holiday season.(2)

The nature of e-commerce has placed additional scrutiny and pressure on return strategies.

Without the physical experience of seeing, touching or trying on an item, e-commerce shoppers have become accustomed to buying multiple items with the intent of returning some of them.

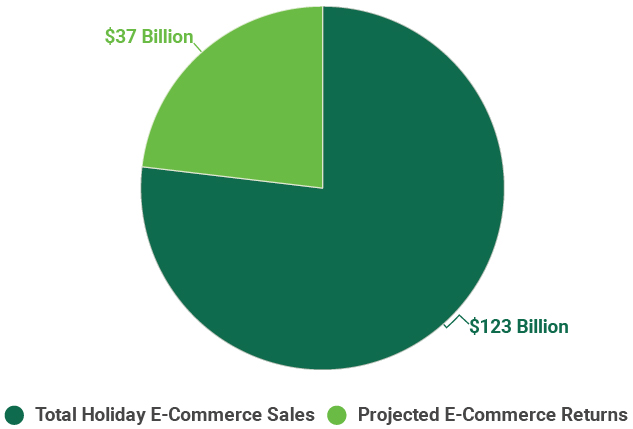

The online shopping industry is expected to have its best holiday season ever this year, with sales forecast to jump by 16.2% year-over-year to $123 billion.(3)

However, with that success comes the added stress of record returns.

Up to $37 billion in 2018 e-commerce holiday sales likely will be sent back into an already crowded and stressed supply chain.

Figure 1: Projected 2018 U.S. Holiday E-Commerce Sales and Returns

Source: Internet Retailer, September 2018; Shopify, September 2018.

The expectation from consumers is for a seamless and inexpensive (free if possible) return experience.

For e-commerce shoppers, a favorable return policy is key, as 86% of shoppers cite ease of returns as one of the top factors when deciding where to buy and 81% say they will shop somewhere else if dissatisfied with the return process.(4)

So it’s clear that a competitive return policy is a business imperative for any retailer competing in the e-commerce space. However, this service comes at a significant cost.

Read: Managing Online Shipping & Returns Expectations

The Costs of Reverse Logistics

Although online retailers are coming to terms with the high return volume that comes with online shopping, reducing the cost associated with those returns remains a top priority.

For retailers that have both an online and brick-and-mortar presence, encouraging the customer to return an item in a store is a very high priority.

This type of return has two benefits. First, the shipping and handling costs are significantly reduced. And second, encouraging customers to return online purchases to the store often leads to additional sales.

An item that is returned to a store on average results in an additional sale that is 107% of the value of the returned item, according to the International Council of Shopping Centers (ICSC).

Nevertheless, today’s consumer s increasingly prefers mailing returns.

For the average retailer, total returns cost 4.4% in lost revenue due to items that can't be resold or must be discounted, according to research firm IHL Group.

For the growing segment of returns that are not in-store, the costs of handling are twofold. The first and most direct are the shipping and handling costs.

The return process for an online order can involve several steps that include the cost of the delivery and many “touches” (that each has a labor cost) of the item as it is processed and moved back into inventory.

While these costs can vary widely depending on many factors - the size of the retailer, size of the item, location of return (both origin and destination), etc. - there is no doubt that this expense eats into profit margins.

Some online retailers are testing pricing models that offer customers a lower price for an item if they forego the right to return it. While this scheme can largely eliminate the expensive and unpredictable nature of returns, only a very small number of retailers are using it.

Due to overwhelming consumer demand, a flexible and free returns policy remains the standard for most online retailers.

The second cost is more difficult to quantify but is every bit as meaningful - the devaluation of the item as it is being returned. The longer an item stays out of inventory and is unavailable for sale, the less it's value. This fluctuates depending on the product category.

For example, according to reverse logistics software provider Optoro, consumer electronics typically have 4% to 8% depreciation per month. Fashion apparel is even higher at 20% to 50% depreciation of its value over the course of an eight- to 16-week period depending on the discount or markdown strategy.

The key to an effective reverse logistics process is the ability to quickly evaluate an item and determine where it can most likely be resold to recapture the most value. The options for this excess inventory range from restocking and reselling, which can recapture the most value, to discarding the items and taking a complete loss (an estimated 5 billion pounds of unwanted and often undamaged goods - enough to fill 250,000 garbage trucks - are thrown away each year).(5)

There are a variety of other liquidation options ranging from selling at discount to selling inventory in bulk to liquidation services. While reselling the item for full price is the goal, this can be extremely difficult. The key to having the inventory in the right place at the right time is having an efficient and nimble inventory and supply chain system.

Brick-and-mortar retailers have a decided advantage over pure e-commerce retailers when offering in-store returns. They handle returns for less cost (no shipping charge to absorb or pass-through to the customer) and can quickly display those items for resale.

This advantage is limited, however, to inventory that has a longer shelf life (for example, a team sports jersey that has consistent demand) versus fast-fashion items that can quickly become obsolete. In this case, the e-commerce retailer has the advantage of listing an item for sale to a much wider audience (the entire internet vs. shoppers at one store), which increases the chance that the product will be resold quickly and in-season.

Figure 2: The Reverse Logistics Process

Read: Recapturing Reverse Logistics Expenses Through Blockchain

Real Estate Opportunities

With e-commerce sales and returns on the rise (15.2% average annual growth rate since 2010) and many current distribution systems not optimized for the reverse flow, the need to develop a solid reverse logistics strategy is paramount. This is a growth opportunity for the industrial real estate market.

The two most likely solutions to a reverse logistics problem both involve warehouse and distribution centers and will ultimately drive user demand.

First, if a company decides to handle the returns in-house, it will need to expand its logistics footprint. Due to their manual and unpredictable nature, returns require substantial labor and space.

According to Optoro, a reverse logistics supply chain requires, on average, an additional 15% to 20% more space than a traditional outbound supply chain.

This footprint has often been allocated to excess space in distribution and warehouse facilities that are largely handling the fulfillment of outbound orders. However, this tends to be inefficient and adds time and costs to an already expensive process.

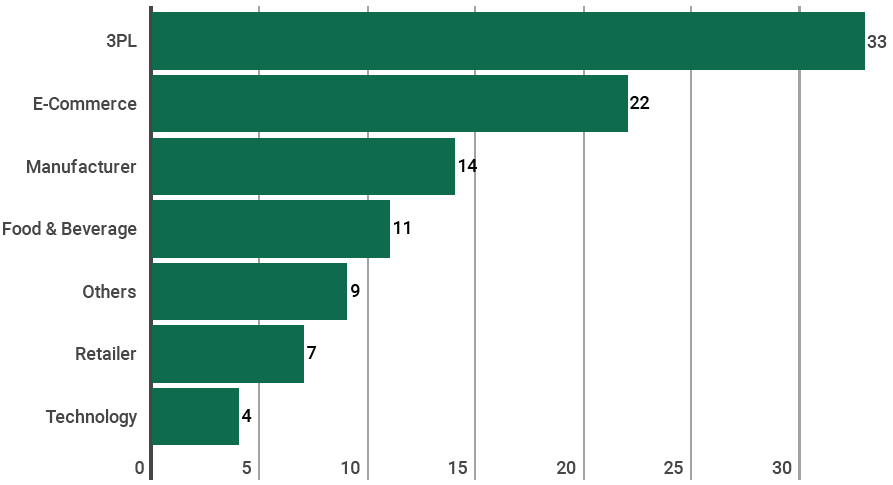

The second option, which is becoming increasingly common, is outsourcing some, if not all, of the process to a 3PL firm.

While retailers would continue to make inventory management decisions, the 3PL would oversee the collection, handling, and distribution of the goods. This has become a preferred choice for many retailers with a less-robust supply chain network. It allows them to benefit from the best-in-class logistics systems and locations employed by most 3PL firms. In the end, the efficiencies gained by outsourcing result in lower costs and more excess inventory value.

Indeed, 3PLs have become a major driver of industrial real estate demand. In the first half of 2018, a study by CBRE Research found that 3PLs accounted for more than half of the largest warehouse leases in the U.S. Nationwide, it’s estimated that 3PLs occupy approximately 700 million sq. ft. and have been growing at 3% to 5% annually.(6)

Figure 3: 100 Largest U.S. Warehouse Leases by Industry, H1 2018

Source: CBRE Research, 2018.

The problems posed by growing retail returns are a serious business challenge for all types of retailers. Likewise, efforts to make the return experience as seamless as possible for consumers have created immense complexity on the back end.

The right solution is different for every company depending on its service promise, margin leverage, and existing infrastructure. Regardless of the solution, they all require supply chain and industrial real estate as part of the answer.

For more information on holiday trends, please refer to the 2018 U.S. Retail Holiday Trends Guide Holiday Sales Forecasts: Optimism, Omnichannel & Blurred Lines

(1) National Retail Federation, October 2018.

(2) Shopify 2018 E-commerce Holiday Returns Guide, September 2018.

(3) eMarketer.com, October 2018.

(4) JDA Consumer Survey, 2018.

(5) Optoro, October 2018.

(6) CBRE Global Supply Chain Services, 2018.

Source: CBRE Industrial & Logistics ViewPoint – December 2018

Related: Strong Holiday On-Time Delivery Performance for USPS, UPS, and FedEx

Related 'Returns/Reverse Logistics' White Papers

The Dark Side of Ecommerce Returns

Find out how efficient returns solutions can enable a smooth experience for consumers, accelerated availability of returned goods, lower intralogistics personnel costs, and higher storage density, logisticians who take a holistic approach to handling returns turn a challenge into an opportunity. Download Now!

Returns Management Strategy: Recapture Revenue

The following paper provides a contextual overview of U.S. business practices with regard to managing returns, and examines the advantages of a properly maintained returns process and discuss important options to consider in developing a reverse logistics strategy. Download Now!

Unwrapping the Hidden Value of a Parcel System

This white paper looks closely at the value of using forward-looking assessments during parcel solution selection phase; explains how the right parcel system supports returns, supplier coordination, and order entry/e-commerce ratings and tracking. Download Now!

What The Future of Retail Delivery Looks Like and What This Means for Logistics

Consumers are creating and managing orders and returns across channels, and retailers will need to offer a consistent customer experience at every touch point. Download Now!

More SC24/7: “Reverse Logistics” White Papers

Article Topics

CBRE News & Resources

CBRE report points to a decrease in ‘megawarehouse’ leases from 2022 to 2023 CBRE report highlights a decrease in ‘megawarehouse’ leases from 2022 to 2023 CBRE report highlights the ever-growing role of holiday season reverse logistics operations Top 20 Warehouses 2023: Demand soars and mergers slow Top 20 Warehouses 2023: Demand soars, mergers slow CBRE report highlights mixed Q3 industrial real estate directions Q3 Commercial Construction Starts Fall 37% vs. Q2 More CBRELatest in Transportation

Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation