High-Tech Company Interest in Near-Shoring Grows as Supply Chain Strategies Shift

Executives shifting gears to improve customer service.

High-tech companies are making strategic shifts to their supply chain models to enable greater customer-centricity, meet changing consumer demand patterns and capture new growth opportunities. Findings come from the 4th annual global UPS Change in the (Supply) Chain survey, conducted by IDC Manufacturing Insights.

Interest in near-shoring has more than tripled since 2010. Globally, 27% of high-tech logistics executives are embracing near-shoring as one strategy to improve their customer service. When asked globally about the top drivers for near-shoring, 77% said they wanted to improve service levels by bringing production closer to demand and almost 55% cited improving control over quality and intellectual property.

Other high-tech executives, including 82% in the U.S., will continue to use their existing supply chain strategies. Survey respondents cited the cost benefits of low-cost manufacturing countries and the location of key suppliers as the top reasons for not considering near-shoring.

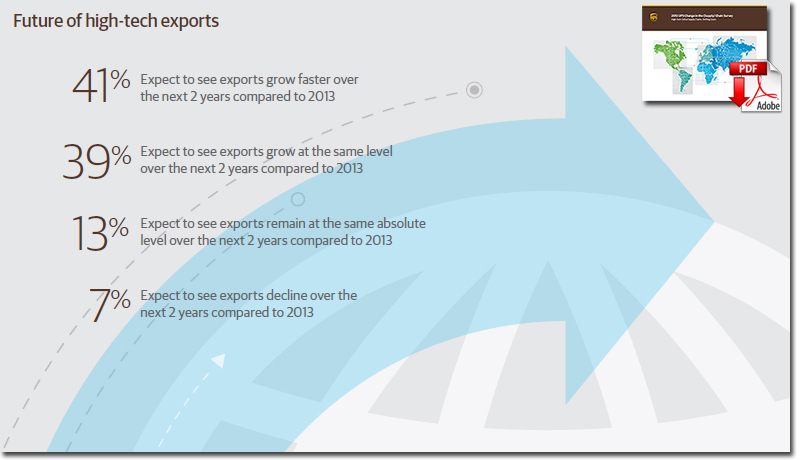

Survey findings also show that 41% of high-tech executives expect to see exports grow faster over the next two years compared to 2013. Another 39% expect to see exports to grow at the same level over the next two years.

Emerging Market Growth

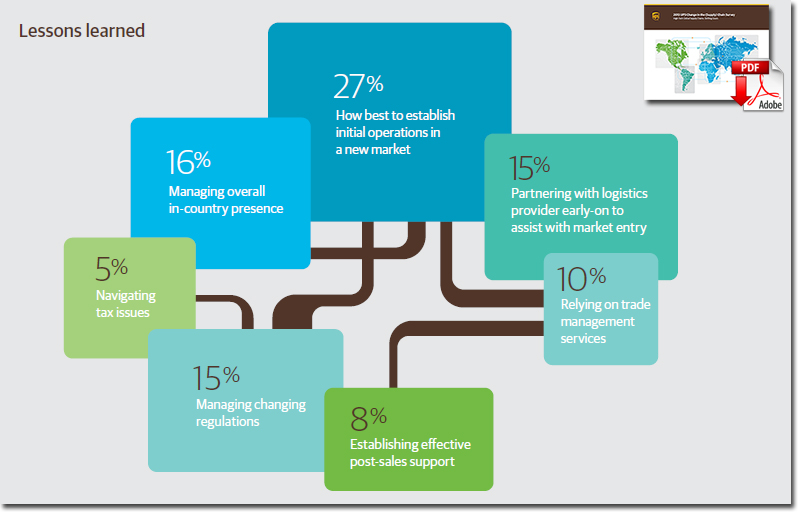

Growth for high-tech products is significant in emerging markets, with nearly two-thirds of high-tech executives having either already established a presence in emerging markets or expecting to do so within a year. North American companies are the most aggressive when it comes to emerging market expansion, with 80% either in emerging markets today or planning to be there within a year.

However, some barriers to global expansion remain, with the top two cited as: difficulty understanding the appeal of products in a new marketplace (19%) and challenges executing new in-market strategies (17%).

Customer-Centricity

To differentiate their products in the face of growing global competition, many high-tech companies are shifting from product quality as the primary focus to making their supply chains more customer-centric. For example:

- 39% of those surveyed said their supply chains are built to be primarily customer-centric today and will grow to 44% in the next two years.

- For those high-tech companies re-focusing their efforts on customer-centricity, several changes are planned to improve customer service, including: reducing lead times (71%), improving planning (71%), improving fulfillment (68%) and improving post-sales/returns capabilities (66%).

High-Tech Product Lifecycle Challenges

When it comes to high-tech product lifecycle management, almost 60% of high-tech logistics executives rank themselves as “market leaders” in product innovation, but their confidence in capabilities drops along the entire product lifecycle. Less than half of high-tech logistics executives globally think they are “market leaders” when it comes to reverse logistics (34%), product retirement (40%) and even global product launches (46%). For example:

- 48% of executives surveyed cited that a firm’s ability to carry out a high-profile, global product launch is becoming increasingly important.

- 26% of high tech companies said establishing product security throughout the supply chain of a product launch remains a top concern.

“Shifting market dynamics such as end consumer demand, emerging market growth and increased global competition are having significant implications for high-tech supply chains at every stage of the product lifecycle,” said Ken Rankin, high-tech marketing director at UPS.

“It’s critical for high-tech companies to align their supply chain strategies to broader business goals and build competencies around each stage of the product lifecycle to achieve greater customer centricity while also improving operational efficiencies and driving growth in new markets.”

Survey Methodology: IDC Manufacturing Insights conducted this survey with 337 high-tech manufacturers in North America, Europe, Asia Pacific and Latin America. Qualified respondents were senior-level decision makers responsible for supply chain and logistics. Surveys were conducted in July and August 2013.

View all UPS content on SC24/7