Global Strategies to Drive Digital Transformation

Concerned with their organizations' digital capabilities, employees across all generations want to work for digitally maturing organizations.

Research released by MIT Sloan Management Review and Deloitte Digital finds that many employees across all generations are dissatisfied with their organization’s digital progress to date and are voicing a desire to work for digitally mature leaders, suggesting upcoming retention challenges for many companies.

The report further found that the ability to digitally transform and re-imagine a business is determined in large part by a clear digital strategy supported by leaders who foster a culture able to change and reinvent their organizations.

The report, “Strategy, Not Technology, Drives Digital Transformation,” is based on findings from the fourth annual global survey of more than 4,800 business executives across 27 industries and 129 countries.

It found that employees by large margins want to work for digitally maturing organizations. Nearly 80 percent of respondents want to work for a digitally enabled company or digital leader, and the sentiment crosses all age groups from 22 to 60 nearly equally.

These digitally mature organizations understand continued digital advancement depends upon retaining and developing talent. More than 75 percent of respondents from these companies agree or strongly agree that their organizations provide the necessary skills to capitalize on digital trends. Among low maturity entities, the number plummets to 19 percent.

The following are highlights of the study:

- Digital strategy drives digital maturity. Only 15 percent of respondents from companies at the early stages of what the study refers to as digital maturity - in which digital has transformed processes, talent engagement and business models - say that their organizations have a clear and coherent digital strategy. Among the digitally maturing, more than 80 percent do.

- The power of a digital transformation strategy lies in its scope and objectives. Less digitally mature organizations tend to focus on individual technologies and have strategies that are decidedly operational in focus. Digital strategies in the most mature organizations are developed with an eye on transforming the business.

- Taking risks is becoming a cultural norm. Digitally maturing organizations are more comfortable taking risks than their less digitally mature peers. More than 50 percent of respondents from less digitally mature companies see their organization’s fear of risk as a major shortcoming. To make their organizations less risk averse, business leaders should embrace failure as a prerequisite of success. They must also address the likelihood that employees may be just as risk averse as their managers and will need support to become bolder.

- The digital agenda is led from the top. Maturing organizations are nearly twice as likely as less digitally mature entities to have a single person or group leading the effort. In addition, employees in digitally maturing organizations are highly confident in their leaders’ digital fluency. Digital fluency, however, doesn’t demand mastery of the technologies. Instead, it requires the ability to articulate the value of digital technologies to the organization’s future. More than 75 percent of respondents from digitally mature companies say their leaders have sufficient skills to lead digital strategy. Nearly 90 percent say their leaders understand digital trends and technologies. Only a fraction of respondents from early stage companies have the same level of confidence: 15 percent and 27 percent, respectively.

- Stories gain employee buy in and organizational traction for digital transformation. Telling digital stories creates pride in organizations. Companies need to demonstrate their ability to tell the digital story and what it means to live in the digital world for business.

- Innovation of digital technologies must be fostered. More than 70 percent of respondents from maturing companies say that their managers encourage them to innovate with digital technologies. At lower levels of maturity, only 28 percent of respondents express the same sentiment.

- Investments in skills necessary to realize strategy. Digitally maturing organizations are four times more likely to provide employees with needed skills than are organizations at lower ends of the spectrum.

“Employees are paying attention to their organizations’ digital initiatives,” says Gerald (Jerry) Kane, associate professor of information systems at the Carroll School of Management, Boston College and co-author of the report. “Many employees are dissatisfied with their organization’s digital progress to date.”

Deloitte Digital’s Doug Palmer, co-author of the report and principal, Deloitte Consulting LLP, adds;

“The importance of having a clearly articulated digital strategy was a major finding. Those companies developing enterprise-level digital strategies are moving ahead, while those that aren’t are struggling. These digitally maturing companies embrace innovation and collaboration and have leaders who understand both technology and its potential impact on the business.”

To read the full report, please visit Strategy, Not Technology, Drives Digital Transformation.

The Digital Transformation of Industry

How important is it? Who are the winners? What must be done now?

A European study commissioned by the Federation of German Industries (BDI) and conducted by Roland Berger Strategy Consultants

The Logic of Digitization

In the future, people, machines and resources will communicate with each other directly and in real time. Rigid value chains will become dynamic value-added networks.

Why? Because value will no longer be added sequentially and subject to time lags, but within a network of units that constantly communicate with each other, respond flexibly to each other and largely organize themselves.

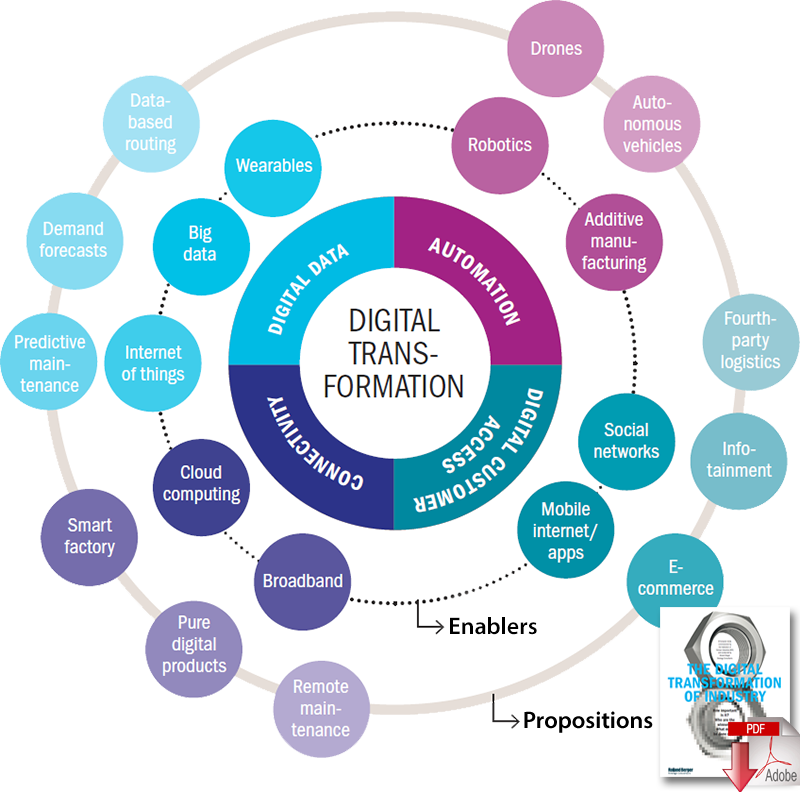

The enablers of the digital transformation of industry include the internet of things, a high-quality broadband network and the increasing automation and autonomy of production.

These enablers facilitate new market positions and value propositions such as smart fabrics, fourth-party logistics (4PL) and predictive maintenance.

All these technologies and propositions prepare the ground for disruptive developments and make them more likely to happen. Yet they are not doing so only in isolation, but as a combination.

In many cases, value is added by connecting what used to be autonomous systems and joining up hitherto separate spheres. In effect, digitization is accelerating the process of evolution.

Four Levels of Transformation

To be able to assess the risk of being “ubered”, companies must first understand the logic of digitization. The digital transformation takes effect via four levers:

Digital Data: Capturing, processing and analyzing digital data allows better predictions and decisions to be made.

Automation: Combining traditional technologies with artificial intelligence is increasingly giving rise to systems that work autonomously and organize themselves. This reduces error rates, adds speed and cuts operating costs.

Connectivity: Interconnecting the entire value chain via mobile or fixed-line high-bandwidth telecom networks synchronizes supply chains and shortens both production lead times and innovation cycles.

Digital Customer Access: The (mobile) internet gives new intermediaries direct access to customers to whom they can offer full transparency and new kinds of services.

Related: Are You Prepared For The Digital Imperative

Article Topics

Deloitte News & Resources

MHI Report: Investment increases as supply chains become more tech-forward and human-centric Global Trade Tensions, Material Shortages Not Expected to Ease in 2024 Blockchain in Supply Chain Continues to Mature Supply Chains Struggle to Access Reliable Emissions Data from Suppliers State of the industry: MHI releases annual report at ProMat 2023 MHI and Deloitte launch 2023 Annual Industry Report survey How Amazon Is Preparing For Fully-Electric Drone Delivery More DeloitteLatest in Supply Chain

TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month More Supply Chain