Global ports sector faces structurally slower growth, says Fitch Ratings

Major ports will be better positioned to weather any downturns, while small and mid-sized ports would face greater risks from a race to the bottom in prices.

Global logistics managers reliant on continued investment in ocean cargo gateways received some sobering news last week from analysts at Fitch Ratings.

According to a new report, traffic growth in the ports sector is likely to remain well below historical levels for the foreseeable future, due to fundamental structural changes in the industry and global trade, Fitch Ratings says. A move towards protectionism would represent a significant additional risk, with the potential to reverse sector growth.

In the U.S., ports that are more diversified may finish stronger, says Fitch Director, Emma Griffith.

“Florida may have over-built some ports,” she said in an interview. “At the same time, we may see more joint marketing and port relationships that can contribute to some of the state’s economic development.”

She noted that Seattle and Tacoma have created an “interesting model” with its Northwest Seaport Alliance, and that ports like Houston and Mobile in the Gulf might benefit by a similar deal.

“There’s also been talk of greater cooperation between Virginia and Savannah,” she says.

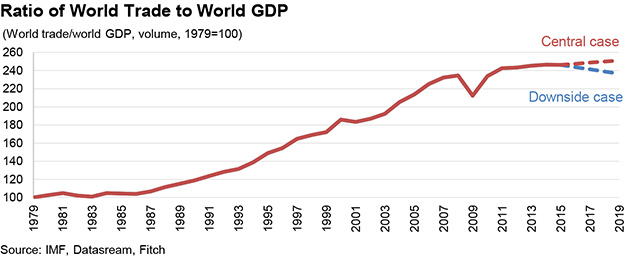

Meanwhile, global port traffic growth has slowed in recent years due to a mix of mostly structural factors, including a maturing container shipping industry, the growth of China's internal market and shifting global supply chains. Together, analysts expect these factors to result in sector growth that is much closer to global GDP growth, compared to the two decades before the financial crisis, when the growth rate in container throughput was a multiple of GDP.

Analysts note that competition is more intensive in ports than in other areas of infrastructure – particularly for containers – because they are standardized and can easily be transported to their final destination from any port. History shows competition also becomes fiercer when markets shrink. A long-term lower-growth environment therefore increases the potential for periods of intense competition.

Major ports will be better positioned to weather any downturns, while small and mid-sized ports would face greater risks from a race to the bottom in prices. Accelerating consolidation in the container shipping sector could also further erode the pricing power of smaller ports. Bigger shipping operators have more power in negotiating prices and a focus on efficiency means their fleets comprise ever-larger vessels that are physically limited to ports with the facilities to handle their size.

“A recent increase in protectionist and anti-globalization rhetoric, particularly in the U.S., represents a risk for the ports sector. While this has not yet translated into higher tariffs or non-tariff barriers, and our base case is that disputes will be resolved within the existing World Trade Organization framework, our analysis suggests broader protectionist measures would have a significant impact.”