Getting Intermodal Rail Back on Track

Even though volumes have flattened, an encouraging service outlook, coupled with the regulatory crunch creeping up on the trucking market, is setting the intermodal rail sector up to regain its footing.

Many freight transportation and logistics stakeholders are saying that “flat is the new growth” when it comes to assessing the state of overall volumes.

In fact, things have even flattened out in terms of intermodal volumes due to the lull in domestic volume growth, the weight of sluggish demand on volume trends, and the various fluctuations having an impact on international trade.

But lackluster growth doesn’t mean that the intermodal market is in dire straits - it just seems to come across harder times less often then its other modal brethren.

What’s more, with a promising service outlook after many issues in recent years, coupled with the regulatory crunch creeping up on the trucking market, it stands to reason that intermodal has strong potential to regain its footing - and fairly quickly - as we head into 2017.

To help put the current state of the rail/intermodal network into better perspective for shippers, Logistics Management is joined by three of the nation’s foremost experts in the market to take part in our “2016 Rail/Intermodal Roundtable.”

Our panelists this year include Tony Hatch, rail analyst and principal of ABH Consulting; Joni Casey, president and CEO of the Intermodal Association of North America (IANA); and Ed Hamberger, president and CEO of the Association of American Railroads (AAR).

How would you describe the current state of the intermodal market?

Joni Casey: Moderate, with continuing fluctuations in international shipment volumes, but steady domestic container growth. Trailers continue to fall sharply, but they’re only 7% of total North American intermodal volume.

Tony Hatch: Unfortunately, the intermodal market can only be called ‘sluggish,’ as the domestic side, roughly half and the true hope for rail growth, has been running down slightly. The reasons are obvious.

First, weak demand and higher-than-normal inventories, followed by slack truckload capacity, driver turnover running at ‘only’ 83%, ‘cheap’ diesel slowing down conversions, and the restructuring of NSC’s Triple Crown division - without which domestic overall would have eked out a slight gain. The international side has seen a puzzling new pattern - import growth not matched by rail volume increases.

Ed Hamberger: After setting annual records from 2013 to 2015, intermodal has eased a bit so far this year. But keep in mind; depending on what happens in the last four months of the year, 2016 will still be the second or third highest volume year in history.

What are your expectations for the intermodal market through the end of 2016 and into 2017?

Hatch: Luckily, while the 2015-2016 intermodal performance is the first time in modern memory that volumes significantly underachieved broad economic indicators, the near term inflection is in sight. Truck capacity is shrinking (note Class 8 truck orders); driver regulations are about to get very restrictive, cutting capacity alone by perhaps as much as 5%; and the Triple Crown restructuring will be lapped in November.

Casey: We expect the 4th quarter to resurrect some of the growth patterns from previous years, but won’t know if it will be enough to ensure overall annual growth from the past. Estimates of year-over-year outcome in international segment range between -1% to +1.5% and 2% to 3% for domestic, with overall growth of 1% to 2%. Next year looks to be a rebound year for both international and domestic intermodal volumes.

Hamberger: Much will depend largely on the state of the U.S. and world economies, and the freight rail industry is not in a position to speculate on how that will play out. What we can say is that railroads continue to focus on what they can control - providing safe, reliable service - while looking forward to the forces they can’t control turning their way.

How are current economic indicators - GDP, retail sales and industrial production - having an impact on intermodal market operations?

Hamberger: Considering that consumer goods comprise much of what is inside containers and trailers, there’s a strong positive correlation between intermodal volumes and GDP, and an even stronger correlation between intermodal volumes and consumer spending.

Casey: Economic indicators are harbingers of intermodal volume trends and don’t actually have an impact on intermodal market segments per se. For example, intermodal volumes have typically exceeded GDP (an indicator of domestic economic health) in the past, although not in recent months. Retail sales are synonymous with consumer spending, which in turn translates into both international and domestic shipment trends.

Read the Article: Rail & Intermodal Looks Healthier in 2016

According to IANA’s “2nd Quarter Market Trends Report,” the 9.3% annual decline for international volume was its steepest going back to 2009. Is this an indication of a shifting market on the international side?

Casey: Not necessarily. Month-over-month and year-to-date comparisons have been tough over the last 12 months or so based on anomalies in the international market. We had West Coast labor issues in 2015 that had an impact on cargo flows both in the early part of the year and later on, as well as higher dollar values and inventory stockpiles this year. We also continue to see all-water share and transloading trending up, which is part of the international weakness. Whether or not this is the ‘new norm’ is hard to tell at this point.

Hatch: The easy answer to the puzzle might be the eastern share gains due to the wider Panama Canal, all-water transport and slow-steaming. For example, about 50% of a boxship’s cargo goes on a railroad, either direct of via trans-load, in Los Angeles/Long Beach; whereas only about 12% or so does from a ship docking directly into New York-New Jersey. But a deeper look shows that overall imports are up; but thanks to the strong dollar, exports (which account for roughly one-third of usual international intermodal) are down quite a bit.

Hamberger: Globalization in general has been increasing for many years because it makes good economic sense for the countries involved. That said, ebbs and flows based on various economic and political considerations, both in the United States and abroad, are affecting volumes today. Over the long term, the international side will almost certainly continue to be a large and growing market segment for intermodal transportation providers.

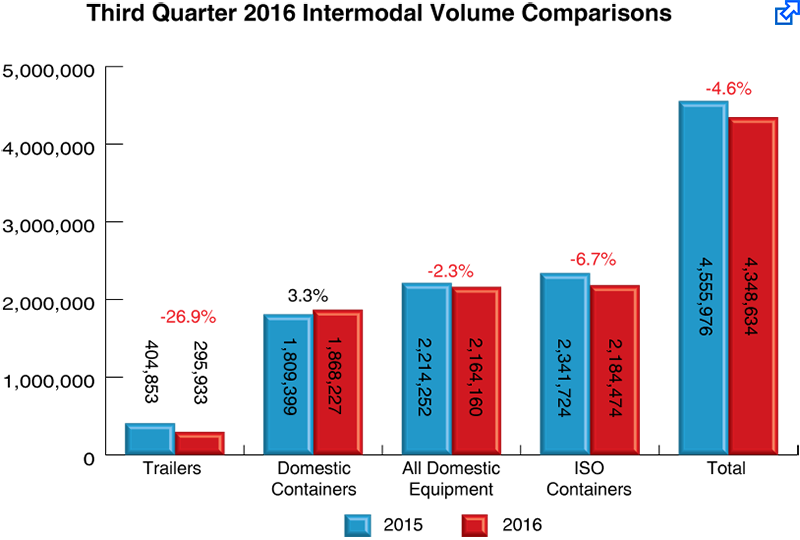

Intermodal Volumes Decline Again in Third Quarter

Domestic Containers are a Bright Spot

November 3, 2016 - Total intermodal traffic recorded another volume decline in Q3 of 2016, according to the Intermodal Association of North America’s latest quarterly Intermodal Market Trends and Statistics report. Contributing to this loss were intermodal trailer volumes which dropped 26.9 percent and international shipments which fell 6.7 percent. The domestic container business experienced gains of 3.3 percent which kept the overall volume loss to 4.6 percent.

“The Q3 results were in line with the previous quarter, reflecting sluggish market conditions,” said Joni Casey, president and CEO of IANA. “Projections for 2017 are more optimistic, based on continued increases in consumer spending and expectations that the international side of the equation will stabilize.”

How is domestic intermodal market share being affected by things like low diesel prices and excess truckload capacity, which appears to be tightening?

Hamberger: Intermodal is an incredibly competitive market segment. But like in any competitive market, intermodal competitiveness is determined at any point in time by many different factors, including fuel prices, capacity availability, capacity utilization rates, and strength or weakness in other market segments.

Casey: Domestic intermodal shipments grow more when over-the-road (OTR) capacity is tight and when diesel prices are increasing. In a “softer” market, as we have seen recently, OTR conversions have continued to grow - but at a slower rate.

How would you describe the current state of intermodal service? Have things turned the corner for the better, especially when compared to early 2015?

Hatch: Intermodal service is at - or close to - all-time highs, and is essentially fully recovered from the rolling service issues that plagued the continental rail network in 2014. This is because many of the issues that affected that year, like crude-by-rail, have corrected. But more importantly, it’s due to the rail industry accelerating its already extremely strong CapEx program to de-bottleneck the system and add necessary capacity - both intermodal specific and on the mainline. This not only means service is measurably better, and in most cases better than ever, but that rails are more productive and cost efficient.

Hamberger: Tony is right on, as rail service in general - including intermodal - is notable due to the massive investments made by freight railroads. Since 1980, the freight rail industry has invested more than $600 billion - $30 billion in 2015 alone - in new and expanded intermodal terminals, track upgrades, data sharing technology and much more. The results of these investments are more productive and reliable intermodal operations.

What is the overall effect of regulation, such as positive train control (PTC) on the rail side and hours-of-service (HOS) and electronic logging devices (ELDs) on the trucking side, on intermodal throughput?

Casey: Anything that has an impact on the railroad network could have an effect on intermodal, but I am not aware of any direct impact of positive train control (PTC) on the intermodal business. Drayage companies are subject to the same regulations as OTR motor carriers, so any decrease in the number of hours that a driver can work, or losing the ability to reset those hours, will affect intermodal truckers and push more business to intermodal.

The same holds true for electronic logging devices (ELDs), although, a lot of companies have already added this technology to their trucks and are seeing some productivity benefits. The real issue for motor carriers, whether OTR or intermodal, is ensuring that there is an adequate pool of drivers.

Hamberger: There is a direct connection between smart public policies, railroad investments and public benefits. Today’s economic regulations allow railroads to make what is necessary to provide the efficient, reliable service their customers need to grow. Yet, unfortunately, regulators continue to advance rules that would undermine railroads’ ability to earn the revenues needed to maintain and further modernize the freight rail system.

Hatch: Regulation remains a mixed bag. On the one hand, truck driver regulations will exacerbate the normal driver shortage. On the other, environmental regulation has helped decimate the core coal business permanently. Meanwhile, direct rail regulation, such as the proposed access/switching issue currently before the Surface Transportation Board (STB), only threaten to add to rail system complexity and cost at precisely the wrong time.

Meanwhile, PTC soaks up cash - some $10 billion in capital when all is said and done - that could be spent elsewhere, and to little benefit. But this serves to remind me of the irony of the federal DOT encouraging driverless technology on the publicly under-funded highway network while trying to legislate two-man crews on the private, well-funded and now PTC protected rail network.

Read the Article: Transportation Regulators Are Off The Rails, Again

What will the intermodal market look like five years from now?

Hamberger: As America’s economy and population grows, demand for intermodal will most likely grow as well. Rail intermodal is more cost effective, fuel efficient and environmentally desirable than an over-reliance on highways for freight transport. That’s unlikely to change in five years, especially with a limited amount of new highway construction and technological advancements, such as self-driving trucks.

Current and growing threats to existing and future trade agreements and new regulations from the STB abound. That is why it’s incumbent upon policy makers to recognize the challenges ahead and address them rationally, efficiently and with the urgency they deserve.

Hatch: Five years from now? That’s the $20 billion question. Intermodal has so many public policy positives - infrastructure, labor and fuel advantages, tax, emissions, safety. There’s still a huge, addressable market - and despite recent political trends, world trade is still a driving force. Next year will be better than the past two years, it seems certain.

Casey: I am not sure about five years from now because it’s been a challenge to predict even six months out. But based on overall trends, and assuming that the past is a predictor of the future, I would expect intermodal to continue to grow on an annual basis, just at a more modest rate than it has over the last five years.

We will probably see more consolidation and alliances on the marine side of the business and increases in on-dock and near-dock rail as well as inland facilities to facilitate the flow of cargo thru marine terminals. Highway to intermodal conversions will continue, fuel prices are bound to go up and an adequate supply of drivers will remain a challenge.

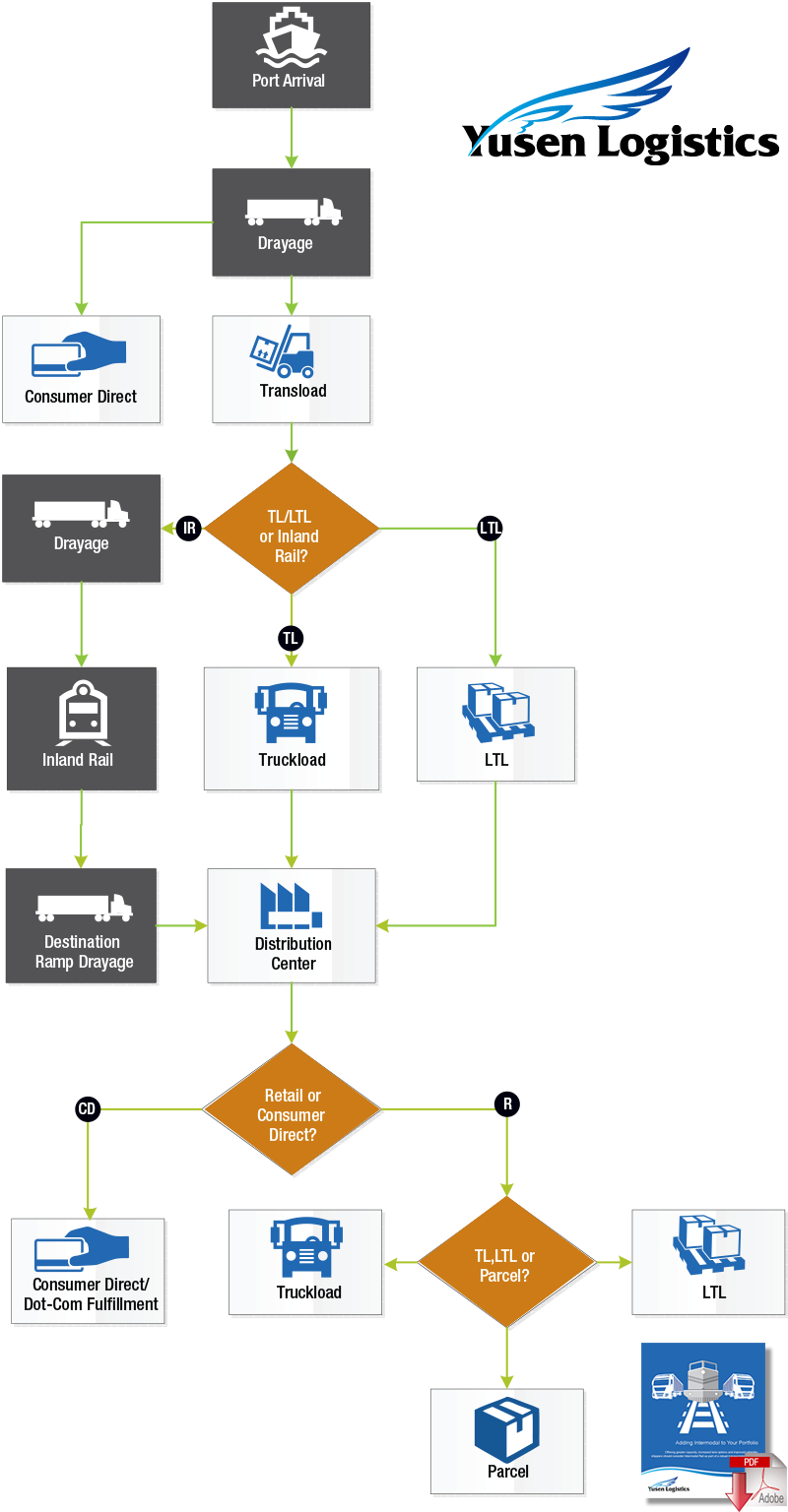

International Intermodal Flow

Taking advantage of trans-loading services near the destination port can enable the integration of intermodal as a key component of inland delivery and can minimize both transportation and inventory positioning costs for international shipments.

Intermodal Rail enables shippers to choose which type of transport is most suitable from a service delivery and economic standpoint.

The chart above represents key moves within the international intermodal transportation process that can create efficiencies and drive cost reduction. The areas in gray represent the intermodal components in the process flow.

Download the White Paper: Adding Intermodal to Your Portfolio

Article Topics

CSX News & Resources

Signs of progress are being made towards moving cargo in and out of Baltimore Top CSX executive places a sharp emphasis on railroading as a career path and service at NEARS Intermodal innovation? Crisis averted on U.S. railroads, with carriers and unions reaching tentative agreements CSX’s acquisition of Pan Am Railways is a done deal Baltimore breaks ground for double-stacking 126-year-old tunnel in ‘absolute game-changer’ CSX executive discusses railroad trends and themes at NEARS conference More CSXLatest in Transportation

Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 Trucking Association CEO on New Biden Policy: ‘Entirely Unachievable’ Two Weeks After Baltimore, Another Cargo Ship Loses Power By Bridge Examining the freight railroad and intermodal markets with Tony Hatch More TransportationAbout the Author