Fuel Dip “Savings” Offset By Surge in Costs for Drivers, Equipment, and Healthcare

Shippers negotiating with carriers over 2015 freight rates ought not be swayed by the dramatic lowering of diesel fuel costs into believing their carriers’ overall cost of doing business are lessening.

Shippers negotiating with carriers over 2015 freight rates ought not be swayed by the dramatic lowering of diesel fuel costs into believing their carriers’ overall cost of doing business are lessening. In fact, they are rising.

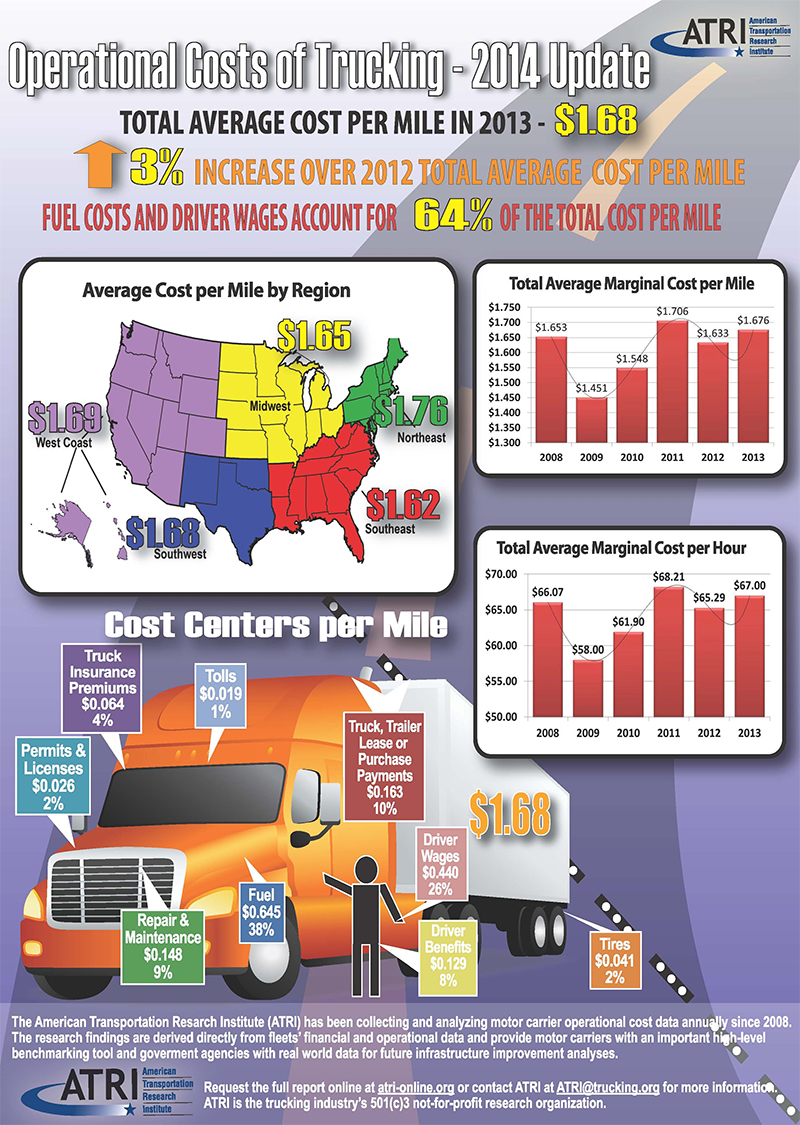

A new report by the American Transportation Research Institute (ATRI), an arm of the American Trucking Associations, confirms what most trucking executives have been saying publicly for years: trucking costs are rising, with some components increasingly sharply.

“Everything is up - I mean everything,” says Myron P. “Mike” Shevell, chairman of the Shevell Group, Elizabeth, N.J., parent company of New England Motor Freight, the nation’s 18th-largest LTL carrier expected to do approximately $400 million in revenue this year.

“The cost of finding, recruiting, training and keeping drivers is steadily rising,” Shevell says. “Equipment costs are through the roof. A new Class 8 truck costs about $135,000. Tires, insurance, terminal costs have all risen substantially. Plus, we’re hit with rising health care costs for our people.”

The ATRI study, “Analysis of the Operational Costs of Trucking,” has been tracking truckers’ costs annually since 2008. It is derived directly from carriers’ financial and operational data and provides a vital benchmarking tool for both carriers and shippers.

It found the average marginal cost per mile was $1.68 per mile in 2013. That was a 3 percent increase over the previous year. That compared with $1.45 per mile in 2009, the start of the recession for the trucking industry.

The single biggest cost driver was drivers, according to ATRI. Average driver wage per mile was 44 cents in 2013, up from 42 cents the previous year. The average truck driver benefit cost rose a penny to 13 cents per mile, according to the study.

That was largely caused by driver pay and benefit increases necessary to attract and retain drivers in the current tight labor market for truck drivers, the study concluded.

The ATA has estimated there is currently a shortage of about 30,000 drivers caused largely by changing demographics, tight entry-level requirements, mandatory drug and alcohol testing and other regulations. That shortage could reach 240,000 in the next decade, according to ATA projections.

“The truck driver problem is as bad as it’s ever been - and it’s expected to get worse in the near term,” Bob Costello, ATA chief economist, said recently.

Truck driver turnover exceeded 100 percent annually at large truckload carriers last year and was at 94 percent for smaller TL carriers, according to ATA data.

Truck driver pay, in real inflation-adjusted dollars, has not kept pace. According to the Bureau of Labor Statistics, average annual pay for heavy truck drivers was $40,900 in 2013 – compared with 43,500 in 2003.

Carriers have been forced to react with higher pay packages for drivers. Among the hundreds of carriers which have raised driver pay recently, Con-way set aside $60 million dollars for driver pay increases, including increasing layover pay from $60 to $75 per day.

U.S. Xpress, a major TL company, increased driver pay 13 percent last year, with starting new-hire pay now 42.5 cents per mile. Melton Truck Lines, a Tulsa-based flatbed carrier, raised driver pay 2 cents a mile. And they were hardly alone.

If driver pay were trucking fleets’ only line item to rise, most executives say they might be able to adjust. But nearly all fleet cost components are rising - sometimes sharply.

Chuck Hammel, president of Pittsburgh-based Pitt Ohio, the nation’s 17th-largest LTL carrier, recently delineated some of his fleets’ expenses –and how they have risen in the past five years.

According to Hammel, one of the most respected trucking executives in the nation, Pitt Ohio’s trucking rates have gone up on average by 11 percent since 2009. But the cost of his power units have risen 24 percent, trailers 18 percent, tires more than 50 percent, parts 14 percent and wages 16 percent during that span.

Hammel says there is no way his rates have risen commensurately with those sharp increases in operating costs.

The ATRI study confirms that Pitt Ohio was hardly alone. It showed that truck repair and maintenance costs rose to 14.8 cents a mile in 2013, up a penny from the previous year. This could be caused by the rising average age of truck fleets, which rose to 7.8 years in 2013 from 7.3 years in 2012.

The Northeast, where NEMF and Pitt Ohio largely operate, is the most expensive geographic area in which to run trucks. The ATRI report showed the average operating cost in the Northeast was $1.76 per mile.

Even the drop in diesel fuel costs is described by carrier executives as a double-edged sword. While they do get a break as diesel has dipped to around $3.00 a gallon, down about $1 over the past 12 months, that savings is nearly entirely offset by the drop in fuel surcharges, carriers say. It is not, they insist, going to their bottom lines.

Article Topics

American Transportation Research Institute News & Resources

ATRI heralds the launch of its annual Top Industry Issues Survey Trucking interests support DOT’s call for more safe trucking parking The Upside of COVID-19 Pandemic-Induced Truck Driver Shortages First comprehensive review of wild, wild West ‘nuclear verdict’ is” bad news for truckers New round of data from ATRI highlights how COVID-19 is affecting trucking movements ATRI Driver Detention Impacts On Safety & Productivity ATRI Critical Issues in the Trucking Industry – 2019 More American Transportation Research InstituteLatest in Transportation

Talking Supply Chain: Doomsday never arrives for Baltimore bridge collapse impacts Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation