From Risk to Resilience: Using Analytics & Visualization to Reduce Supply Chain Vulnerability

Complex supply chains require sophisticated, connected tools to monitor risks, predict disruptions, and support rapid recovery as part of a resilience strategy - this has led to an increase in adoption of advanced analytics and visualization tools.

In March 2012, Lululemon Athletica, Inc., a clothing manufacturer, published its annual report, which noted that the company was “at risk of overly relying on a limited number of suppliers.”

In fact, Luon, a fabric the company used in its popular yoga pants was supplied by a single Taiwanese manufacturer.(1) The following year, risk turned to reality when the company discovered that its black yoga pants were too sheer and needed to be recalled.

While this was not Lululemon’s first case of risk pertaining to product quality, it was certainly a costly lesson in supply chain vulnerability:(2) The recall resulted in an estimated $18 million in lost revenues, shaved 12 percent off the company’s stock price, and cost the company’s chief product officer her job.(3) In addition, investors filed a class-action lawsuit against the company, alleging $2.6 billion in shareholder losses.(4) Lululemon’s share price valuation eventually recovered, but the luxury brand’s shortcomings in quality control linger in the minds of would-be customers and investors.

Over the last decade, supply chain risk became an increasingly pertinent issue for many business leaders. A survey of nearly 600 global manufacturing and retail executives about the outcomes of supply chain risks reemphasized a troubling picture.(5) Among surveyed executives, 48% reported an increase in the frequency of supply chain risk events that had negative outcomes in the last three years, compared to only 21% who reported a decrease.

Not only are these risks becoming more frequent, they’re also becoming more costly, according to 53% of the survey’s respondents. The three most costly outcomes of supply chain risk events are the erosion of margins (54% of respondents), shifts in demand that elude effective management (40%), and disruptions in the flow of physical products (36%). From restaurants to pharmaceuticals to consumer products, supply chain risks continue to permeate a wide range of sectors.

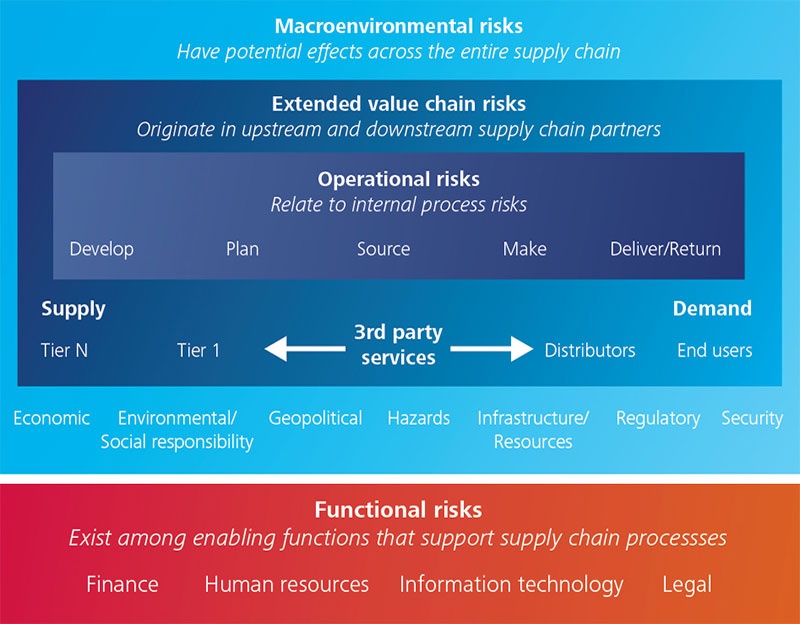

Broadly speaking, supply chain risks fall into four baskets:

- Macroenvironmental Risks, which originate from sources outside a company’s supply chain;

- Extended Value Chain Risks, which originate from upstream or downstream partners in a company’s supply chain;

- Operational Risks, which originate in a company’s internal processes; and

- Functional Risks, which originate in a company’s enabling areas, including finance, human resources, information technology, and legal (see figure 1).

Figure 1. Supply Chain Risks

Graphic: Deloitte University Press | DUPress.com

Eliminating risk may be a fool’s errand, given the overwhelming number of ways that things can go wrong in an intricate supply chain. And even if a company could concoct effective responses to every conceivable supply chain risk event, it could still fall victim to inconceivable “Black Swan” events, which by definition, defy rational expectations.(6) But perhaps eliminating risk isn’t the point. In the past decade, a promising suggestion arose: Rather than making large investments with the hope that they might be able to eliminate risk, companies can actually better help themselves by making their supply chains more resilient to the infinite number of risks that may become realities.

In other words, companies can bolster the resilience of their supply chains by making targeted investments in areas that proactively mitigate risk: enhancing the visibility of their supply chains, collaborating with suppliers, improving the control of key operational and quality processes, and enhancing flexibility to improve responses to adverse changes in the external environment. The ability to continue to meet supply chain objectives by preventing or, if necessary, recovering quickly from risk-related disruptions may be more fruitful than merely crossing corporate fingers and hoping these risks never materialize.

Companies across diverse industries have widely accepted the fact that complex global supply chains require sophisticated, connected tools to monitor risks, predict disruptions, and support rapid recovery as part of an overall resilience strategy. For leading companies, this line of thinking has given way to an increase in the adoption of advanced tools grounded in analytics and visualization. Risk indices, risk-sensing services, supplier data, supply chain modeling and simulation, and supply chain mapping are all helping companies build resilience in the marketplace.

Resilience in The Real World

Unfortunately, however, building a resilient supply chain is easier said than done. While 71 percent of surveyed executives consider supply chain risk an important part of strategic decision making, only 30 to 40 percent of their companies have effectively implemented analytics and data visualization tools within their supply chain risk management programs. This disparity suggests that companies recognize the importance of having a resilient supply chain, but they lack the capability to effectively use these tools to make better decisions.

Amid a rising sea of available data, many companies are investing in advanced analytics without a clear idea of how they can glean insights that can improve their decision making. While supply chain resilience is widely accepted as a valuable way to reduce a supply chain’s exposure to risk events, companies often struggle with implementing or realizing the full value of the tools they have at their disposal.

These survey results suggest that tactical approaches to strengthening supply chain resilience are anything but clear in the eyes of many executives. Despite a broad acceptance of supply chain resilience as a critical part of managing risk exposure and the demonstrated value of data-driven techniques to build resilience, companies frequently fail to use the latter to achieve the former. According to the survey, a spectrum of reasons drive this disparity when it comes to effectively managing supply chain risk: 32% of respondents reported a lack of acceptable cross-functional collaboration as one of their top two barriers to effectively managing supply chain risk, 27% cited the costs associated with implementing risk management strategies for their supply chains, 24% lack the data they need to build these capabilities, and 21% are unable to measure the benefits of deploying risk management strategies or lack clear ownership of supply chain risks.

Nonetheless, some companies are developing practical approaches to building supply chain resilience and overcoming these commonly observed obstacles. These companies are addressing their critical vulnerabilities—chinks in the supply chain armor that expose a company to risk in the first place—as a means of building resilience. By addressing vulnerabilities that companies have a degree of control over, they build resilience to risks that are otherwise uncontrollable. Often, addressing these critical vulnerabilities requires a portfolio approach to resilience investments, given the frequently interrelated nature of vulnerabilities.

Vulnerability

Vulnerability, as it pertains to supply chains, refers to a gap in a company’s internal capabilities or supply chain maturity that increases either the likelihood or the severity of a risk event. For example, the failure of a seaport infrastructure becomes more severe for companies that lack flexible distribution strategies and transportation modes. While companies may not have the ability to prevent the failure of a seaport infrastructure, they can reduce their vulnerability to such an event by investing in capabilities that enable early identification and quick recovery. In fact, building resilience by addressing the root vulnerability could end up being a competitive differentiator in the event of a seaport shutdown, as it is not difficult to imagine that the company that most quickly recovers may be able to gain market share, while unprepared competitors remain mired in operational challenges.

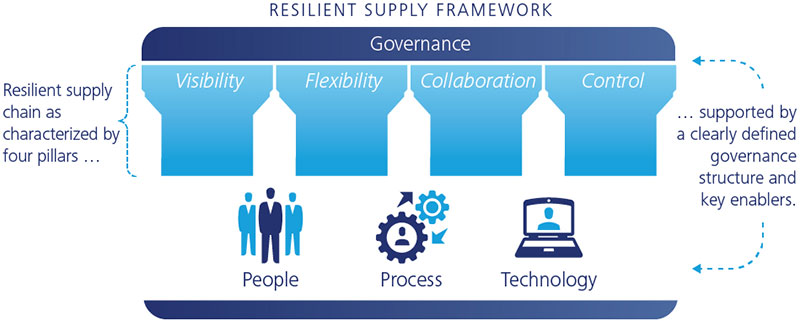

On an intellectual level, business leaders tend to accept resilience as a worthwhile pursuit, but the path to its implementation remains elusive. The inherent complexities of multitier supply chains make measurable results hard to come by. But this doesn’t mean resilience needs to be an academic abstraction. Companies can tactically prioritize and deploy analytics and visualization technologies to strengthen four fundamental “resilience pillars” (see figure 2):

Figure 2. Key Attributes of a Resilient Supply Chain

Graphic: Deloitte University Press | DUPress.com

- Visibility encompasses a company’s ability to track and monitor supply chain events and patterns and proactively turn these insights into actions.

- Flexibility refers to a company’s ability to adapt to disruptions without significantly increasing its operational costs.

- Collaboration refers to a company’s ability to develop symbiotic, trust-based relationships with supply chain partners and other key strategic networks.

- Control refers to a company’s ability to implement policies and execute processes that prevent disruptions.

Examining the practices of companies that have successfully bolstered the resilience of their supply chains can provide insights for companies trying to achieve similar results.

Visibility and Corporate Social Responsibility

At first glance, visibility seems the easiest of the resilience pillars to conquer, but it requires a company-wide commitment, given the geographically diverse span of many modern supply chains, to overcome organizational barriers and data siloes. For example, a global apparel retailer built a strong reputation in the marketplace as a leader in corporate social responsibility (CSR). Since its founding, the retailer was a mission-driven company. It experienced significant growth, and this growth introduced new challenges as it tried to responsibly manage its increasingly global supply chain. The company struggled under the weight of its own growth as it attempted to scale up its supply chain to account for its new size. Vulnerabilities arose from the company’s own halo effect: Its social mission and its brand were one and the same, so the manufacturer had everything to lose as its supply chain expanded. But its inability to monitor—much less identify—the practices of its scaled-up supply base introduced the potential for negative brand-value outcomes, given its core commitment to social responsibility.

Additionally, the company’s growth placed pressure on its production schedules, which were accelerated when demand increased, so the company found its focus shifting toward these tight production deadlines and away from its core CSR values.

In order to protect its brand, the company needed to improve the resilience of its supply chain by using analytics and visualization tools to improve the visibility of its partners. To this end, the company began by cataloging its entire supply chain—from the sourcing of its raw materials to the delivery of its end consumer products—to ensure that each component of its business was aligned to its social focus. In addition, this company used Google Earth to visualize its supply chain from end to end, and when it overlaid key supplier risk data, it gained a previously unmatched understanding of its supply chain partners and their operations. This visual interface helped the company to garner insights about its supply chain from flow-based as well as geography-based views.

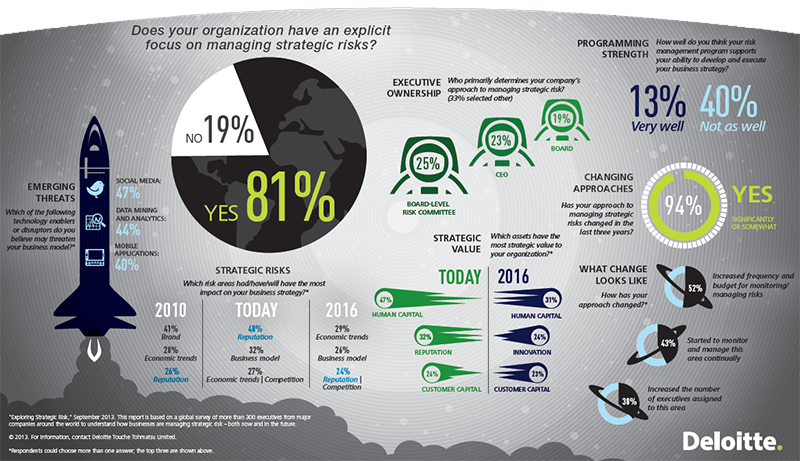

Exploring Strategic Risk

While early astronomers first focused on what they could see, their modern counterparts develop insights on the universe well beyond what is visible with telescopes. A similar transition is unfolding in the area of strategic risk management, where executives are actively seeking new ways to understand and respond to the entire universe of risks—those that are familiar, and others that may have been off the radar. Business executives around the world say their understanding of the universe of strategic risk is changing. Here’s how.

“Exploring Strategic Risk,” September 2013. This report is based on a global survey of more than 300 executives from major companies around the world to understand how businesses are managing strategic risk – both now and in the future.

© 2013. For information, contact Deloitte Touche Tohmatsu Limited.

*Respondents could choose more than one answer; the top three are shown above.

Download the White Paper: Exploring Strategic Risk

Furthermore, the company used risk-based metrics to segment its suppliers according to their level of risk and tailor its approach to efficiently allocate supplier-management resources. The highly visual representation of the company’s supply chain and its corresponding risk potential gave the company’s executives a deeper understanding of the underlying operational complexity and reaffirmed the need for action to mitigate vulnerabilities within its supply base.

Given the company’s deepened understanding of its suppliers, it used its newly heightened visibility to identify disparities between its headquarters and its suppliers. For example, the company identified a cultural disparity between its CSR-focused headquarters and its Chinese apparel manufacturers. Manufacturers in China maintained a focus on cost arbitrage, while the company’s leadership was willing to pay a premium for quality products and responsible behavior among its supply chain partners.

To counteract this philosophical gap, the company also enhanced the way it uses visibility to improve the way it audits key suppliers. It abandoned random audits for audits’ sake in favor of a more robust process wherein the company started evaluating suppliers more carefully and identifying key performance themes. The company started using benchmarks to assess and measure the performance of its suppliers, which transformed what had been a cursory exercise into an opportunity to identify specific areas for improvement as well as suppliers that were consistently complying with the company’s CSR mission. The company also produced a list of specific recommendations related to its supply chain CSR governance structure, code of conduct, supplier assessment tools, and external communications. By carefully documenting its supply chain objectives and its lack of tolerance for CSR incidents, the company was able to use these new tools to enhance the overall visibility and transparency of its supply chain. After identifying priorities and measuring progress, the company was able to launch a set of near-term priorities to reaffirm alignment between supply chain operations and its underlying CSR mission, despite its new global reach.

Additionally, the outcomes of this company’s investment in resilience and supply chain visibility also helped it to reassess how and where it was targeting adjacent social-impact initiatives so they could better align with its new, global scale. For example, 99 percent of the company’s manufacturing was done in China, but the markets the company sought to serve with its charitable initiatives were much broader. Visualizing the supply chain convinced the company to geographically diversify its manufacturing base, which improved both operational efficiency and brand recognition as a CSR leader by creating jobs in the underdeveloped regions that the company was trying to serve, not to mention reducing the company’s potential for supply chain disruption in the event of a Chinese risk event.

In these ways, this clothing company improved the visibility of its supply chain and reduced its most critical vulnerabilities and exposure to supply-base risk, ultimately protecting a core element of its brand promise to its customers.

Supply Chain Flexibility in the Ring of Fire

The earth shook in March 2011. An earthquake, a tsunami, and a nuclear meltdown—now called the “Great East Japan Earthquake”—devastated the country and forced Toyota to halt a large portion of its production. In the wake of this natural disaster, the company’s supply chain and its oft-studied Toyota Production System were unexpectedly devastated. In fact, it took Toyota six months to recover,(7) and the company lost production of about 160,000 vehicles during fiscal year 2012.(8) This downtime and the resulting loss in production caused the company’s profits to fall by over 30 percent,(9) not to mention costing the company its well-entrenched top place in global vehicle sales. Shinichi Sasaki, the company’s executive vice president, spoke of the company’s supply chain vulnerability: “Our assumption that we had a total grip on our supply chain proved to be an illusion.”(10)

The one silver lining, however, was that the earthquake and the tsunami helped the company identify vulnerabilities in a supply chain that was once considered unbreakable, and these vulnerabilities prompted the company to enhance the flexibility of its supply chain.

Toyota began an ambitious project to use analytics and visualization tools to reduce its recovery speed from six months down to two weeks or less.(11) The company identified three specific actions that could help make its supply chain more flexible and resilient. First, it used analytics and visualization tools to map its supply chain and identify 20 of its suppliers that occupied its most “at risk” category because they were a sole source of materials or highly susceptible to earthquakes. This gave the company a clear sense of how to prioritize its efforts to improve the flexibility of its supply base. Furthermore, it gave the prioritized suppliers specific insights that helped them develop responses to catastrophic outcomes from supply chain risks.

During this process of mapping its supply chain, the company realized that tier 1 suppliers that it thought were unrelated were actually reliant on the same tier 2 suppliers, which created dangerous levels of dependency. In other words, suppliers that the company thought were unrelated were actually receiving input components from the same suppliers. Therefore, a disruption at one of these tier 2 suppliers could impact a wide range of Toyota’s immediate supply base. Based on this insight, Toyota enhanced the flexibility of its supply chain by asking this group of priority, at-risk suppliers to redistribute their production capacities to multiple locations to hedge against future disruptions.(12)

As a second step, Toyota used insights gleaned from its supplier analytics and visualization tools—the geographic makeup of its supply base and the modeling of various disruption scenarios—to improve its flexibility by securing contingency sources for parts so future geographically centralized disruptions in the Ring of Fire could be addressed more efficiently. Competitive pressures prompted some of the company’s suppliers to refrain from sharing their sources. In these cases, it secured a commitment from them to recover production within two weeks of a disruption.

Lastly, the company consolidated similar parts across different models, which reduced component costs and gave suppliers an incentive to build additional facilities. In 2012, Toyota regained its position as the world’s biggest manufacturer of automobiles and recovered its position as a leader in supply chain innovation, supported by its new level of supply chain resilience.(13)

Modeling a Supply Base to Strengthen Post-Merger Collaboration

The marriage of two large companies rarely comes without a bevy of operational challenges. Adding distributed operations and supply chains begets a whole new level of complexity and potential risk exposure. For example, a manufacturer consolidated with an overseas competitor, and this new relationship resulted in an increasingly global supply base. Given the additional complexities that resulted from this partnership, the company set out to establish a process to protect its global operations and minimize disruptions to its newly expanded supply chain by improving the way it collaborates with a new partner and its suppliers.

The company began by prioritizing vulnerabilities within its post-partnership supply chain. The company acknowledged that its understanding of its complex, multitiered supply chain suffered in the wake of its new relationship with an international partner. Supply chain data was located across a wide array of systems, which significantly hindered the company’s ability to monitor and track performance and to collaborate with its extensive supply base.

This lack of direct access to data for business users resulted in hesitation and drawn-out decision making, as well as an inability to communicate effectively with suppliers to resolve concerns. For example, suppose a supplier provides a critical commodity to five different plants. Inefficiencies inevitably arise if each plant places distinct orders using disparate systems without a company-wide approach to order prioritization or issue resolution. In the absence of cross-organizational collaboration, a large order from one plant could compromise the supplier’s ability to serve the other four.

To begin to remediate these vulnerabilities and cross-organizational data gaps, the company used risk and operational history data to build out weighted indices to identify the level of risk and complexity for each of its 2,000 direct suppliers, which accounted for a collective $30 billion in annual spending. In parallel, the company consolidated disparate data sources, developed risk profiles for each of its suppliers, and ranked them accordingly. It used a tool that scores each of its suppliers according to their complexity (as measured by the criticality of their products, number of parts, number of programs, number of facilities, and annual spend) and their risk (according to their capacity, performance, delivery, and structure), all of which ultimately impact the amount of exposure to supply-side disruption. The company used these analytic tools to identify at-risk suppliers with the highest levels of both complexity and risk and prioritize 20 key interventions to improve a wide range of issues from inventory levels to quality metrics.

Based on this risk-prioritized supplier list, the manufacturer began immediate remediation and performed a risk-maturity assessment of different aspects of its supply chain, further emphasizing its supplier-management challenges. As part of this effort, the company used historical data to identify trends in supplier risk. With this, suppliers with a deteriorating risk profile could be prioritized for active interventions to reduce risk exposure within the extended value chain. This structuring also became the basis for a framework that provides ongoing, proactive monitoring and identifies opportunities for intervention. These analytic tools gave the company valuable insight into the nature of the risks experienced by each supplier, which gave way to specific actions the company could take to mitigate these risks.

For example, the company believed some of its suppliers had capacity issues when they failed to meet quotas and deadlines. By using these analytic tools and various inventory-usage scenarios, this manufacturer discovered that these problems were of its own making, rather than shortcomings from its suppliers. The company realized that it was establishing expectations that were contrary to its agreements with suppliers. Rather than continuing to blame suppliers for falling short of capacity requirements that they couldn’t handle in the first place, the company identified this disparity and adjusted its expectations accordingly.

In a similar effort, the company used analytic tools to develop a financial monitoring system that preemptively issues warnings when a privately held supplier experiences a risk event. This gave procurement leadership the much-needed flexibility to shift supply contracts to compensate for problems with suppliers as they materialized. Furthermore, the company improved collaboration between its suppliers by creating a centralized data repository that combines supply chain, purchasing, and ERP systems to foster better communication between partners.

These analytic tools helped the company see its newly expanded supply chain from both a holistic and a granular level. Both of these vantage points are giving the company a better perspective of how its complex supply chain works as well as how to collaborate and resolve specific problems as risks materialize.

The Tools For a Big Job

Through analytics and data visualization tools, supply chain resilience doesn’t have to be an academic abstraction. Focused investments in these tools are helping companies make their supply chains more resilient by improving the visibility, flexibility, collaboration, and control of their various partners and suppliers. These technologies can also help a company prioritize its efforts pertaining to supply chain resilience, measure the results of its investments, and strengthen its ability to address vulnerabilities and respond effectively when issues inevitably arise.

Endnotes

- Yimou Lee and Euan Rocha, “Lululemon supplier says recalled yoga pants made to specs,” Reuters, March 19, 2013

- Francine Kopun, “Lululemon pulls yoga pants for being too revealing; shares plunge,” The Star, March 19, 2013

- Christopher Matthews, “No, the Lululemon CEO didn’t get fired for see-through yoga pants,” Time, June 14, 2013

- Aaron Smith, “Lululemon sued for see-through yoga pants,” CNN, July 3, 2013

- Deloitte Consulting LLP, “The Ripple Effect: How manufacturing and retail executives view the growing challenge of supply chain risk,” 2013

- Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable, Random House, 2007

- “Global Supply Chain News: Toyota Taking Massive Effort to Reduce Its Supply Chain Risk in Japan,” Supply Chain Digest, March 7,2012

- Toyota, “Impact of the Disasters and Recovery Efforts,” Annual Report 2012 (PDF)

- Gerhard Plenert, Mohanish Makharia, and Ramanan Sambukumar, “Supply Chain Vulnerability in Times of Disaster,” Wipro Consulting Services (PDF)

- “Global Supply Chain News: Toyota Taking Massive Effort to Reduce Its Supply Chain Risk in Japan,” Supply Chain Digest, March 7, 2012

- Chang-Ran Kim, “Toyota aims for quake-proof supply chain,” Reuters, September 6, 2011

- “Toyota Taking Massive Effort to Reduce Its Supply Chain Risk in Japan,” Supply Chain Digest, March 7, 2012

- Chester Dawson, “Toyota Again World’s Largest Auto Maker,” The Wall Street Journal, January 28, 2013

About The Authors

Kelly Marchese

Kelly Marchese is a principal with Deloitte Consulting LLP.

Jerry O’Dwyer

Jerry O’Dwyer is a principal with Deloitte Consulting LLP.

Acknowledgements

The authors would like to acknowledge the contributions of James Cascone from Deloitte & Touche LLP; Ashwin Patil, Siva Paramasivam, Erik Kiewiet de Jonge, and Andrea Hartman from Deloitte Consulting LLP; and Ryan Alvanos from Deloitte Services LP.

Copyright Notice

Copyright © 2014 Deloitte Development LLC. All rights reserved.

Source: Deloitte University Press

Download Resources:

- The Ripple Effect

How manufacturing and retail executives view the growing challenge of supply chain risk. - Exploring Strategic Risk

Business executives around the world say their understanding of the universe of strategic risk is changing. Our survey of 300 major companies reveals how.