Freight Condition Index Signals New Challenges for Supply Chain Managers

The big change to the operating environment comes in 2016 when numerous regulations in the pipeline start being implemented.

The most recent edition of the Shippers Condition Index (SCI) from freight transportation consultancy FTR made it clear that tougher times are back for supply chain managers.

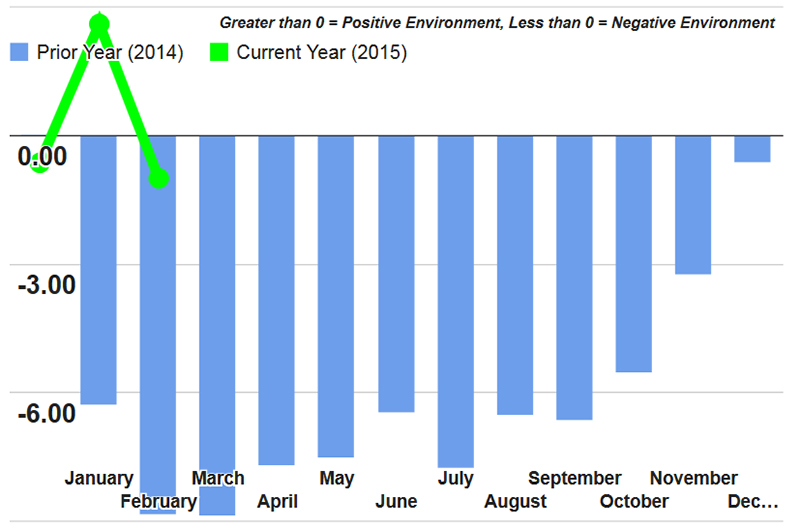

FTR describes the SCI as an indicator that sums up all market influences that affect shippers, with a reading above zero being favorable and a reading below zero being unfavorable and a “less-than-ideal environment for shippers.”

For February, the month for which most recent data is available, the SCI dropped to -1.0 from January’s 2.6, with FTR explaining that the short term positive impact from one-time adjustments for rapidly dropping diesel prices and the suspension of the 2013 motor carriers hours-of-service expires later this year.

FTR’s Shippers Conditions Index

February declined from January to a -1.0 reading, as the short term positive impact from one-time adjustments for rapidly dropping diesel prices and reversal of the 2013 Hours of Service changes runs out. From here, the index is expected to deteriorate under pressures building from new regulations hitting the trucking sector along with continued freight growth and expected upward movement in energy prices.

As for the coming months, FTR said that the SCI will likely see further declines in the coming months, due to new regulations impacting the trucking industry, coupled with ongoing freight gains and expected gains in energy prices.

“February was a tough month to get a good reading on the state of the economy,” said Jonathan Starks, FTR’s Director of Transportation Analysis, in the report. From bad weather to port stoppages to weak economic data, it came as no surprise that the SCI remained close to a neutral reading for February.

For shippers, spot market capacity has certainly eased from the very tight market in 2014, with Truckstop.com showing a 15 percent increase in available trucks in February versus last year.

However FTR estimates that the contract side of the business remains well above 95 percent utilization. While down from the extreme levels of last year, it is still strong enough to force shippers and carriers to deal with the coming regulatory tsunami.

Starks also made mention that the ongoing declines in fuel costs are ending soon, with FTR’s March data expected to show that shippers will once again be in parity with what truckers are paying and charging for fuel.

“Conditions for shippers will likely stay modestly negative for the balance of 2015 - an improvement over the last couple of years,” he said. “The big change to the operating environment comes in 2016 when numerous regulations in the pipeline start being implemented. If (and that’s a big if) the economy can keep growing in 2016 and 2017, the capacity problems of early 2014 will look small in comparison.”

At the NASSTRAC (National Shippers Strategic Transportation Council) Conference and Transportation Expo in Orlando earlier this month, Candace Holowicki, Director of Global Transportation and Logistics, TriMas Corp., said that at the moment securing truckload capacity is not as tight as it has been in recent months, but things have been “spotty” overall.

“We have a DC in South Bend, Indiana, which is where I usually see capacity problems first,” she explained. “There is a lot of Midwest distribution in that area, and it is in close proximity to Chicago and the rail hubs, which can be challenging on the truckload side. My concern is that we need to be ready in case there is a glitch (that can negatively impact capacity), which we dealt with a bit in regards to the West Coast port congestion earlier this year. Shippers need to continually focus on augmenting relations with carriers and be ready for any hiccups.”

Fuel Dip “Savings” Offset By Surge in Costs for Drivers, Equipment, and Healthcare