Four Reasons 2014 Will Be The “Year of The Global Distribution Center”

2014 is starting off with high demand from e-commerce and other users who are in the market for large, sophisticated space, and lots of it.

According to research by Jones Lang LaSalle (JLL) industrial markets nationwide have been recovering for more than four full years, with 15 consecutive quarters of positive net absorption.

Last year marked a five-year high, with 168 million square feet of net absorption, and, with current forecasts, this figure could top 180 million square feet in 2014. So, what’s behind this momentum?

“2014 is starting off with high demand from e-commerce and other users who are in the market for large, sophisticated space, and lots of it,” said Craig Meyer, President of Industrial Brokerage at JLL.

“This will make 2014 the “year of the distribution center.” Modern space with proximity to population centers and a robust logistics infrastructure will dominate the industrial real estate sector in 2014.”

Bob Silverman, JLL’s executive vice president, said that while “Big Box” space was growing, not all supply chain managers were demanding it.

“For many of the more agile and responsive shippers, smaller customized space is just as valuable,” he says. “The important take away is that their lead logistics providers can locate space near fluid distribution channels.”

JLL anticipates the overall national vacancy rate will settle at a cyclical low of 7.5 percent in 2014.

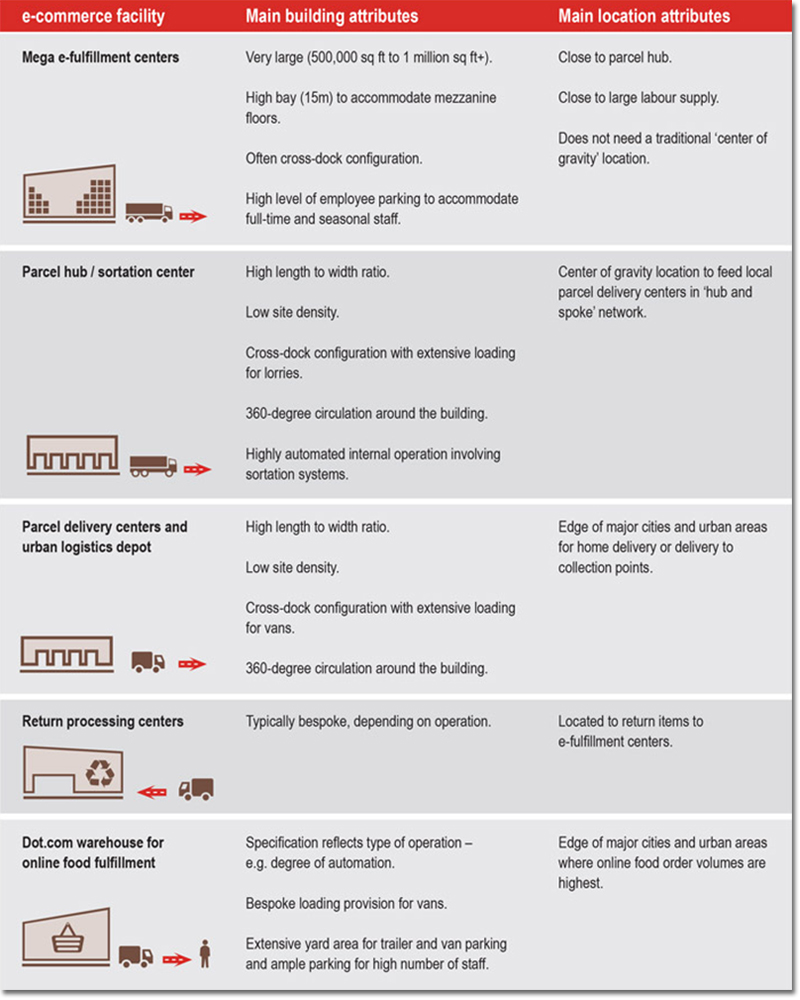

Emerging new types of logistics facilities

Here are four trends driving this momentum:

- Demand is spreading into secondary markets: Tenant requirements for large, modern warehouse space to accommodate evolved distribution strategies and material handling processes outweighs supply in prime distribution hubs such as Los Angeles, Chicago and New Jersey. As a result, development will spill into markets with land ready for new construction like Phoenix and Indianapolis. Demand is already red hot in traditional distribution corridors, especially the Inland Empire, Dallas and Philadelphia / Harrisburg.

- Build-to-suits are the new spec: In 2013 half of all U.S. construction began with pre-leases in place. Underwriting criteria for big box space made true speculative construction difficult and many developers sought pre-commitments prior to ground breaking. This means today’s build-to-suits are less about special purpose buildings, or design-build-projects, but are more about kicking off semi-spec buildings.

- Focus on rail: With the cost of trucking on the rise, developers and investors are focusing on markets with solid intermodal infrastructure in place such as Dallas, Columbus and Memphis. For the seaport markets such as Oakland and Miami there is a push to enhance on-and near-dock rail capabilities; Miami’s new rail system, for example, will give the port access to 74 percent of the U.S. population.

- Growth driven by ‘clicks’ surpassing ‘bricks’: A staggering 40 percent of big-box industrial requirements are correlated to e-commerce; a sector growing globally by 20 percent each year. As retailers develop new real estate models to support their omni-channel logistics models, they are looking at six primary types of warehouse space (see “Emerging new types of logistics facilities” chart above), ranging from mega-distribution centers to smaller delivery centers in urban areas. In 2014, we expect to see demand for urban logistics centers to support same-day package delivery.

E-commerce boom triggers transformation in retail logistics

It’s not as easy as translating your bricks and mortar strategy to an online platform. Nor can you simply upgrade your existing e-tail model. No, global e-commerce is highly complex because market conditions vary hugely between countries due to differences in internet penetration, smart phone usage, demographics, regulatory climate, logistics and transport infrastructure, and industrial real estate options. Mastering these factors can provide a platform for your success.

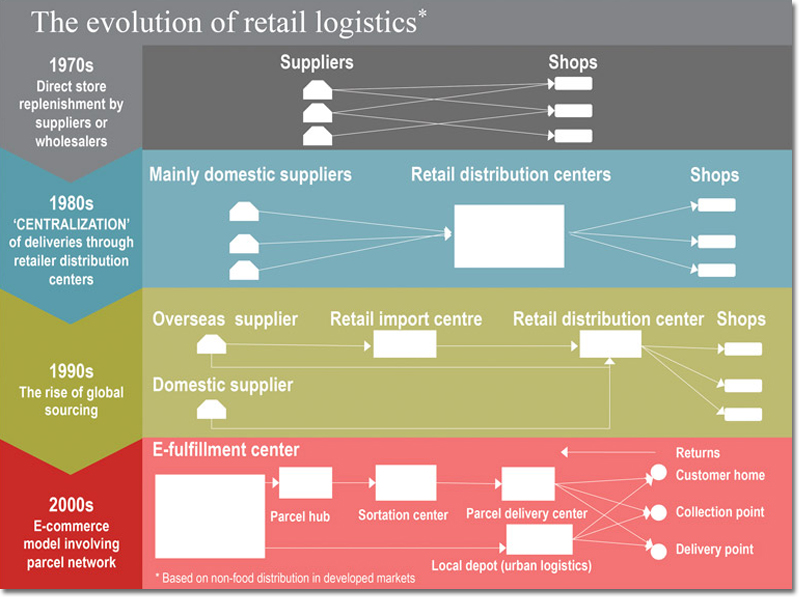

The evolution of retail logistics

Key points

- Global online retail has grown 14.8% on average per year, 2007 to 2012. Total B2C e-commerce sales are expected to exceed $1.2 trillion this year alone.

- Online retail only accounts for 4% of total global retail sales—meaning there is enormous opportunity for growth in this sector.

- Markets vary greatly between countries, especially between developed and developing nations.

- Factors that affect e-commerce include: internet penetration, fixed and mobile broadband costs, smart phone usage, demographics, the regulatory climate, the logistics and transport infrastructure, and industrial real estate options.

- Successful e-commerce depends on adopting new logistics models and utilizing distribution properties that may include mega e-fulfillment centers, parcel hubs and delivery centers, local ‘urban logistics’ depots for rapid order fulfillment, and returns processing centers.

- Moving from multi-channel to omni-channel management enables retailers to meet customer demand in a fully integrated and seamless way from whatever location is positioned to provide the best customer experience.

- Feet-on-the-ground knowledge, particularly of supply chain, properties, real estate transactions and cross-border commerce opportunities, is vital.

- Delivering efficiency and a superior consumer experience can give retailers enhanced brand value.

Article Topics

JLL News & Resources

JLL Q2 report shows ongoing strong industrial real estate market trends Q1 industrial real estate activity sees continuation of strong market conditions, states JLL Q1 industrial real estate activity sees continuation of strong market conditions, reports JLL JLL research highlights the supply and demand imbalance for industrial real estate space JLL report highlights the supply and demand imbalance for industrial real estate space JLL’s industrial real estate report: Q3 trends point to record-setting 2021 Q3 industrial real estate data points to a potential record-setting 2021 More JLLLatest in Business

Ranking the Top 20 Women in Supply Chain Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility More BusinessAbout the Author