Fifth Annual UPS Change in the (Supply) Chain Survey Takes Deep Dive into High-Tech Supply Chains

High-tech companies expect robust growth in their industry, and they're preparing for it by weighing a broader range of factors when building their manufacturing supply chain networks.

As the supply chains of high-tech shippers continue to mature and innovate, coupled with rapid growth, it is not a huge surprise to see them further leverage current strategies and lay the groundwork for newer ones, when it comes to further expanding their manufacturing supply chain capabilities.

That was a key theme in the fifth Annual UPS Change in the (Supply) Chain (CITC) survey that was rolled out today.

The survey was conducted by IDC Manufacturing Insights, and its findings were based on feedback from 516 high-tech logistics executives in North America, Latin America, Europe, and Asia.

Like in previous iterations, the survey focused on various facets of high-tech supply chains, including: export growth; right-, near-, and off-shoring; selling products in China; and using 3D printing, among other subject areas.

Not surprisingly, the theme of continued growth for high-tech exports remained firmly intact with a cumulative 74 percent of respondents stating that exports will grow faster (28 percent) or at the same rate (46 percent) over the next two years. And the regions most optimistic about high-tech export growth increasing were Latin America (46 percent) and North America (36 percent).

UPS Vice President of Segment Marketing Derrick Johnson explained in an interview that export growth remaining firmly intact is viewed as top of mind for both UPS and its high-tech shipper customers.

“The optimism around exports means there is robust global demand for technology, which is encouraging for our customers and also for us,” he said. “They are thinking about it as part of their strategy, and we want to make sure we can help them execute on it. As we talk to IT executives around the world, they continue to say the high level of demand is encouraging.”

A key theme of the survey focused on right-, near-, and off-shoring, with:

- 47 percent focused on off-shoring, which the survey defines as moving manufacturing and/or assembling products to traditional low-cost countries based on historical labor rate differentials;

- 45 percent focused on near-shoring, which the survey defines as moving manufacturing and/or assembly closer to the location of demand (where the products are consumed); and

- 35 percent focused on right-shoring, which the survey defines are optimizing supply chain to take advantage of cost and necessary resources (skills and infrastructure) for the best overall margin performance and customer satisfaction

Johnson said that when looking at all three shoring-related segments the trend of moving towards near-shoring where it makes sense if a shipper of leveraging off-shore capabilities and also ways in which it is moving products closer to the point of consumption.

“We have seen that more so in high-tech than in other industries that a smart and flexible supply chain is absolutely critical, which makes a shoring strategy critical,” he noted. “If you think about the product lifecycle and the rates of obsolescence occurring in technology, there is a tight window of sourcing opportunity. That makes shoring strategies a greater concern because products can be a great distance from where they are needed globally and there is a higher degree of risk introduced into high-tech supply chains because of that. We see high-tech shippers as being very smart about their shoring strategies and will continue to see more right-shoring, especially as we start looking at the global economies and how they are merging from sourcing and manufacturing standpoints.”

Flexibility is Key in Shoring Decisions

As high-tech companies seek to capitalize on global growth opportunities while optimizing their supply chains, the sourcing debate continues: off-shoring, near-shoring or right-shoring?

Manufacturing Sourcing Strategies

Note: Multiple responses were allowed.

Our survey shows that companies are leveraging all of these strategies, indicating that the most important strategy is flexibility. These findings illustrate the importance of making sourcing decisions based on a variety of factors such as company size, customer demands and individual product specifications, among others, rather than taking a one-size-fits-all approach.

CITC found that shippers are leveraging different shoring strategies, with 35 percent of respondents indicating they plan to incorporate near-shoring strategies, marking a 25 percent gain since 2010.

It also added that in 2013 68 percent of companies moved manufacturing closer to demand, while this year the most common approach was moving assembly closer to demand. As for the future, it said high-tech shippers are like to add assembly (20 percent) or manufacturing (23 percent).

Looking at emerging market growth opportunities, UPS found that expansion into Asia was at the head of the class, with 71 percent of respondents already in China, 45 percent in India, and another 45 percent in other Asian markets.

What’s more, it pointed out that some of the markets once considered as emerging have “now emerged,” with more on the way, explaining that the three top emerging markets atop high-tech shippers’ wish lists are Brazil (21 percent), Russia (20 percent), and India (20 percent).

“For Brazil, Russia, India, and China and the regulatory environment in which these countries operate…it is key to partner with organizations that have a high degree of understanding of how regulations work in those regions,” said Johnson. “We work regularly with our public affairs team on this, and customs and brokerage folks to fully understand how products move into and out of those countries. This is also because these countries have evolving economies, and the volatility that takes place and the changes that are occurring may be difficult for some [shippers] to take risks and move into those economies, because they may need to pull out after a short period of time or adjust their strategies once they are there.”

On the 3D printing front, CITC found that 75 percent of respondents are now using 3D printing in the design process for new products, with the top benefits being faster product development and a faster manufacturing process. And with 50 percent of China-based high-tech shippers surveyed saying they are using 3D printing, the Asia Pacific region is well ahead of the U.S. in terms of 3D adoption, with the U.S. at 29 percent.

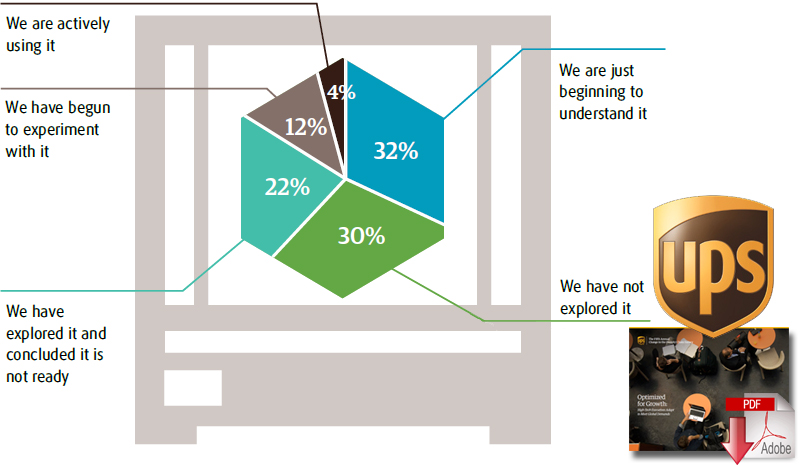

3D Printing is Gaining Traction in High-Tech

High-tech manufacturers are at the forefront of innovation and 3D printing is among the latest areas gaining traction in the industry. Seventy percent of survey respondents report having hands-on experience with 3D printing.

Role of 3D Printing in Your Business

Globally, survey respondents are using 3D printing to help in the design process for new products (75%) with top benefits including faster product development and a faster manufacturing process. Driven by China at 50%, APAC is using 3D printing more for production purposes than North America (29%).

Other 3D printing-related data points showed that 35 percent are using it to quickly generate samples or product “mock-ups,” 34 percent are using it for production of finished goods, and 24 percent for generation of spare parts.

Even with these levels of usage, the overall role of 3D printing for high-tech shippers remains on the low side, with: 4 percent actively using it; 32 percent just beginning to understand it; 30 percent not having explored it; 22 percent having explored it and concluding it is not ready; and 12 percent having begun to experiment with it.

The topic of sustainability was viewed has having “a clear business impact on high-tech companies in the survey, with the top two drivers for going green being cost reduction (73 percent) and meeting customer demands (71 percent). As for key drivers of sustainability, the survey cited that along with cost reduction and meeting customer demands, other ones included improving brand perception and reputation (58 percent), competitive differentiation (40 percent), protect consistency of supply (35 percent), and being the right thing to do (21 percent).

Risk management also received attention, too, with the two risk management-based priorities for helping high-tech shippers to mitigate and manage future risk for their supply chains being improving collaboration with suppliers (53 percent) and enabling better supply chain visibility (40 percent). Rounding out the top 5 were implementing supply chain traceability (35 percent), improving factory maintenance and oversight (34 percent), and enhancing reverse logistics and repair parts management (33 percent).

Related: FedEx Corporation To Face Tough Competition From UPS Despite TNT Acquisition

Article Topics

UPS News & Resources

Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 FedEx and UPS to Charge Additional Delivery Fees in Major U.S. Cities Parcel Experts Weigh in on New Partnership Between UPS and USPS Parcel experts examine the UPS-United States Postal Service air cargo relationship amid parcel landscape UPS To Become USPS’s Main Air Cargo Provider, Replacing FedEx UPS is set to take over USPS air cargo contract from FedEx GRI Impact Analysis – Parcel Spend Management 1.0 vs. 2.0 More UPSLatest in Supply Chain

TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month More Supply ChainAbout the Author