FedEx’s Fred Smith Again Leads Push for Twin 33s

Truckload carriers typically use 53-foot single trailers, have no operational need for the twin 33s and view FedEx CEO Smith’s efforts to allow twin 33s as a waste of valuable political capital in the lobbying arena.

Polar opposite lobbying efforts of two major factions of the trucking industry again are on a collision course over proposed use of twin 33-foot trailers nationwide - again.

In one corner, FedEx CEO Fred Smith is leading the charge to allow twin 33s – which would be an 18 percent increase in productivity over the currently used twin 28s.

The major beneficiaries of such a change would be FedEx units and UPS and perhaps a handful of less-than-truckload (LTL) carriers.

“In several years of operations in Florida and elsewhere, FedEx drivers have told us repeatedly that they find them to be more stable,” Smith said in prepared remarks before the House Transportation and Infrastructure Committee.

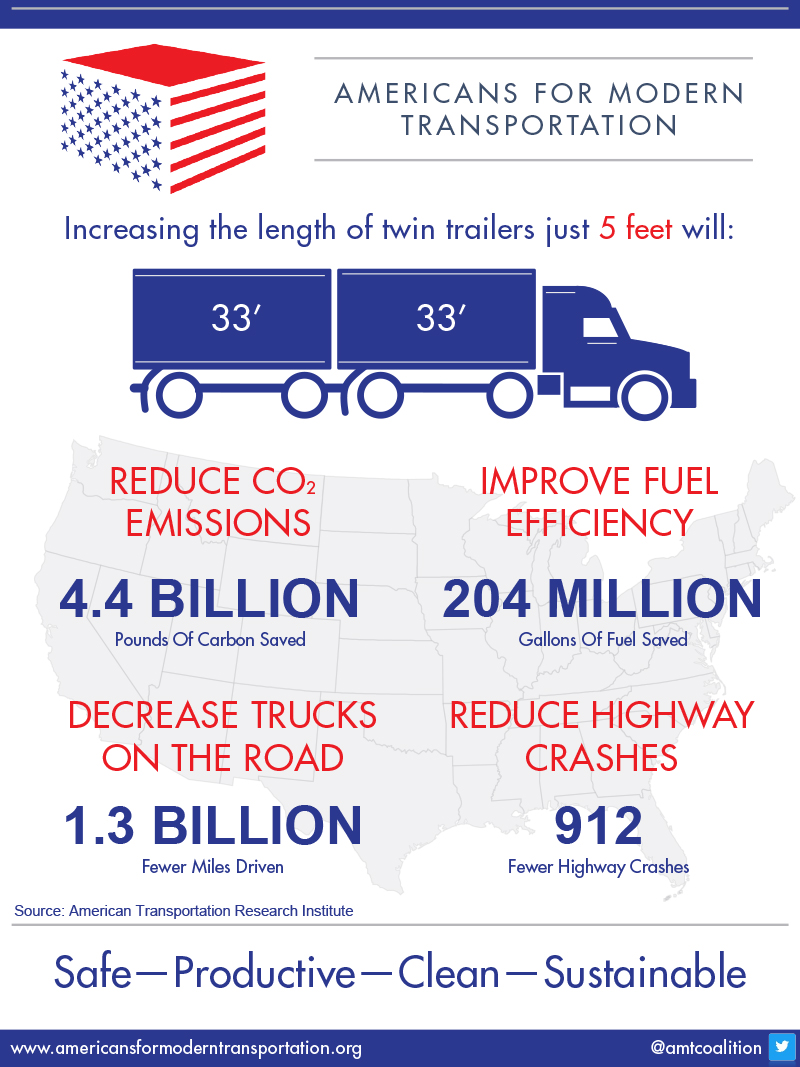

“Safety will be enhanced simply by reducing the trips and mileage driven, with industry estimates of 1.3 billion fewer miles driven.”

In the other corner is the Truckload Carriers of America, representing the $310 billion truckload sector.

Truckload carriers typically use 53-foot single trailers, have no operational need for the twin 33s and view Smith’s effort as a waste of valuable political capital in the lobbying arena.

“Lauded as an opportunity to remove trucks from our roads, twin 33-foot trailers will actually have the opposite effect,” TCA President John Lyboldt said in his letter to the T&I committee.

“In an effort to supplement and improve upon intermodal operations, our nation’s railroad container cars have been developed to accommodate the most prominent trailer configurations that exist within trucking today, the 28- and 53-foot trailers. You will soon realize that any change to these foundational trailer sizes will not only render existing truck trailers obsolete, but their corresponding railroad counterparts as well.”

Lyboldt conceded the “trucking industry is deeply divided over this issue.” That may be the trucking understatement of the century.

This is a replay of an internecine battle three years ago at the end of one congressional session. TCA led the charge against Smith’s battle for twin 33s then - and is taking the lead again now.

Lyboldt told the T&I committee the truckload segment of the trucking industry is “vast, representing over 500,000 motor carriers” that haul 78 percent of the freight moved by truck, based on revenue.

“Our industry recognizes the benefits that would be bestowed upon our Less-Than-Truckload (LTL) associates by adding additional cubic feet of freight space and how those benefits add to their productivity,” Lyboldt said.

“However, the truckload industry would yield little, if any, advantage of the added cubic space that Twin 33-foot trailers would generate. Due to the vast differences in freight delivery models, the metric of mandating Twin 33-foot trailers almost exclusively benefits LTL freight, thus putting the truckload segment of the industry at a competitive disadvantage.”

Nationwide adoption of twin 33s would not represent an increase in gross vehicle weight, but it would allow LTL carriers to increase the volume of shipments carried up to 18%, before tacking on incremental trips, Smith said.

He also said CO2 emissions would lessen by 4.4 billion pounds of carbon, resulting in savings of more than 200 million gallons of fuel annually.

House Transportation & Infrastructure Committee Chairman Bill Shuster, R-Pa., has indicated support to Smith’s proposal, but he did not say if he intends to propose authorizing the trailers in a highway reauthorization. Shuster did say he thought twin 33s were safe.

FedEx has joined UPS and Amazon in Americans for Modern Transportation (AMT), a coalition of shippers and retailers that is urging Congress to support the nationwide access of the trailers.

“We need to lay the groundwork for a modern transportation system,” the AMT told the committee.

“Central to this goal is combining infrastructure enhancements with efficient trucking and policies as well as incentives for better safety and fuel technology.”

But truckload carriers say addressing the thorny issue of truck sizes and weights is a touchy proposition in the early days of the Trump administration. Railroads, safety groups and others can be counted on to mount vigorous, and often emotional, opposition to any changes in truck configurations.

Use of 33-foot twin trailers has been recommended by the Transportation Research Board as far back as 2002. But opposition from the truckload carriers, unions, railroads and safety groups has consistently derailed its adoption.

“Our nation’s railroad container cars have been developed to accommodate the most prominent trailer configurations that exist within trucking today, the 28- and 53-foot trailers,” TCA’s Lyboldt said.

“You will soon realize that any change to these foundational trailer sizes will not only render existing truck trailers obsolete, but their corresponding railroad counterparts as well.”

But in the anything-goes lobbying atmosphere that is enveloping Washington in the early days of the Trump administration, FedEx’s Smith and others obviously feel the time is right for give it another try. Stay tuned.

Related SC24/7 Article: Coalition for Transportation Productivity Asks Congress to Take Closer Look at Truck Size & Weight

Article Topics

FedEx News & Resources

FedEx and UPS to Charge Additional Delivery Fees in Major U.S. Cities Ranking the Top 50 Trucking Companies of 2024 Parcel Experts Weigh in on New Partnership Between UPS and USPS Parcel experts examine the UPS-United States Postal Service air cargo relationship amid parcel landscape UPS To Become USPS’s Main Air Cargo Provider, Replacing FedEx UPS is set to take over USPS air cargo contract from FedEx GRI Impact Analysis – Parcel Spend Management 1.0 vs. 2.0 More FedExLatest in Transportation

Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More TransportationAbout the Author