FedEx TNT Executives Provide Insights on Acquisition

With FedEx being successful in acquiring TNT Express, David Bronczek, President and CEO, FedEx Express, David Binks, President of FedEx Express Europe and Tex Gunning, CEO of TNT Express provide updates on the integration process.

With the ink on FedEx’ $4.8 billion acquisition of TNT Express NV now dry, the integration process begins in earnest.

That was a major theme of a conference call hosted by TNT’s new owners in the Netherlands on Wednesday, which featured David Bronczek, CEO and president of FedEx Express, David Binks, president of FedEx Express in Europe, and Tex Gunning, TNT Express CEO.

Now that the deal, which had to clear several regulatory hurdles in multiple countries, is official, the executive trio was able to speak a little bit more freely, albeit being somewhat guarded in regards to certain specifics at the same time.

Bronczek noted that this deal marks a “coming together” of two great companies to create an even stronger one going forward that will create even more value than either one could have done individually.

And Gunning explained that while this deal went through some ups and downs, it is the right thing for TNT’s customers, its employees, and the industry.

As was noted yesterday, Bronczek (pictured right) said the beginning stages of integration now begin in earnest.

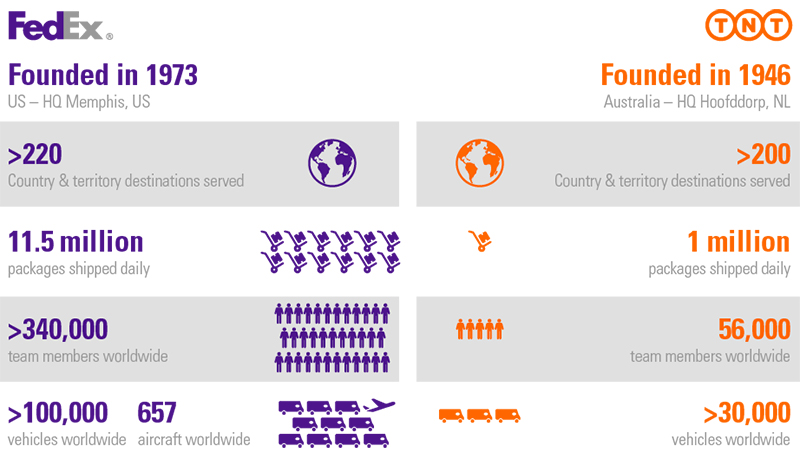

“Both companies have an extensive reach,” he said. “FedEx now serves 220 countries and regions around the world, linking more than 95 percent of the global GDP in 1-3 business days, with combined companies having nearly 400,000 employees around the world.”

He added FedEx moves 11.5 million packages per day, and TNT moves more than 1 million shipments per day, with the companies cumulatively possessing more than 150,000 vehicles. FedEx has 657 aircraft globally, which makes it one of the top five airlines in the world.

With the integration process now in effect, Bronczek said that both companies for now will continue to operate as they have in the past, with a strong focus on its customers and its people.

“Together these two companies will transform the worldwide express playing field, there is no doubt…we have a complete portfolio of services now,” he said.

“By combining the largest express international global business of FedEx with an unparalleled European road network of TNT. This provides customers with greater global access, broader services, and extended portfolio services. Together our future looks incredibly bright. This will unlock opportunities to global growth that benefits FedEx and TNT team members around the world”

FedEx has spent more than four decades expanding and simplifying its global network that spans around the world, coupled with its extensive experience in acquisition integration in creating the global network it has today. Bronczek explained that the company’s customers have varied needs, and FedEx has continued to expand its service portfolio so that it can provide the right network for the right customer at the right cost.

FedEx’ Binks (pictured right), who is also now the president of TNT, said that FedEx is committed to Europe, which he described as a highly competitive marketplace with multiple strong players, with FedEx now having strong European roots to go along with its strong U.S. roots.

“We believe that acquiring TNT will propel our position and positioning as a major competitor in this part of the world,” he said.

“In other words, an already global service has become more global. We have enhanced our global network with a European road network that connects more than 40 countries and that is going to be good news for our customers since that network will allow us to move goods faster and more reliably across borders and offer our customers more options and more choice. As a result, we believe FedEx and TNT customers and new customers we hope to bring in tomorrow can improve their supply chain and identify new opportunities for growth so that the growing intra-European business of FedEx will increase revenues and profitability.”

And at $60 billion U.S., or $53 billion euros, the European express market is a large and growing business, he explained, with e-commerce continuing to be a significant growth factor, not only here in Europe but globally. Binks estimated that the growth rates for the total e-commerce market in Europe are growing at around 15 percent per year, and could grow to more than $600 billion euros by 2017.

“This acquisition offers significant opportunity in that marketplace for a combined FedEx and TNT and…our customers will benefit from the strong intercontinental network capability of FedEx and TNT and the combination of the air and ground capabilities”

As for the focus of the integration process, he said it will be to maintain the high quality of service that customers have come to expect from both companies, with things business as usual, coupled with the potential for a much broader reach and scope.

Binks stressed that it is important to understand this is an acquisition based on future growth in a growing marketplace, with the major FedEx hubs in Paris and Cologne and the TNT facility in Liege will all remain as major entities for the combined operation moving forward.

“The details of how the operations will work together will be determined through the integration planning process, which really starts right now,” he said. “We also expect our employees to have more growth opportunities than either company could have provided separately. This acquisition is one of the most strategically important we have experienced in FedEx’ history. We also know from our experience in dealing with acquisitions and integrations that it will take time. We will take the proper amount of time to get it right and execute with absolute precision.”

As for integration processes from a financial perspective, Binks said there is only so much commercial-sensitive information FedEx and TNT can currently share, noting it is too early to put costs around that as it relates to the integration planning, as it begins to map out the details and planning and begin rolling out an implementation timetable and put some costs behind that. When that has moved along, he said more information will be shared at that time.

Bronczek said that integration costs relating to this deal will be broken out separately in FedEx earnings reports going forward. And while there is no profitability projection for Europe resultant of this transaction yet, he said that the e-commerce market is booming globally, with a huge opportunity to grow the e-commerce market.

“There are big e-commerce players we do business with today in the U.S. and not necessarily [in Europe] that are telling us they would like to see more of a lower cost delivery network for their e-commerce positioning in Europe,” he said. “I think you are going to see very high growth, especially in the e-commerce market, going forward”

This deal will also impact FedEx business in other parts of the world like China and Brazil, with its global service partners looking at how to combine the businesses for better service, opportunities to grow revenue, and profitability.

Binks praised TNT’s strengths in other parts of the world like South America and Asia-Pacific, as well as the Middle East.

“We talk a lot about the European trucking network, which Tex Gunning (pictured right) refers to as the ‘jewel in the crown’ of TNT, and we should not forget about the excellent trucking network TNT established in the Middle East and also in southeast Asia as well, which are notable additions to our network and give us more opportunity to get more customers for network solutions for both express- and ground-based services. The majority of the integration work will be European, but a significant part will be in other parts of the world as we see this as a global effort, not just a European initiative.”

As for the market share this deal brings, Shipware LLC President Rob Martinez said that in Europe, it is estimating that that FedEx and TNT combined will have 22-24 percent market share, compared to approximately 41 percent for DHL and 25 percent for UPS.

“Apart from the shift in global market share, the merger portends significant benefits for FedEx that include savings related to facility and asset rationalization, productivity improvement due to pickup and delivery route optimization, and cost reduction related to air network and linehaul synergies,” he said.

“FedEx is planning a 4-year integration, and we are already hearing of collaboration of key customers towards alignment.”

Related: FedEx Officially Acquires TNT Express in $4.8B Deal

Article Topics

FedEx News & Resources

FedEx and UPS to Charge Additional Delivery Fees in Major U.S. Cities Ranking the Top 50 Trucking Companies of 2024 Parcel Experts Weigh in on New Partnership Between UPS and USPS Parcel experts examine the UPS-United States Postal Service air cargo relationship amid parcel landscape UPS To Become USPS’s Main Air Cargo Provider, Replacing FedEx UPS is set to take over USPS air cargo contract from FedEx GRI Impact Analysis – Parcel Spend Management 1.0 vs. 2.0 More FedExLatest in Transportation

Talking Supply Chain: Doomsday never arrives for Baltimore bridge collapse impacts Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More TransportationAbout the Author