FedEx TNT Acquisition Paying Off as Q1 Earnings Exceed Wall Street Expectations

FedEx Corporation yesterday posted much better-than-expected fiscal Q1 earnings and raised its full-year earnings outlook, spurred by sharply higher revenues and the recent acquisition of TNT Express.

The Memphis-based company reported fiscal Q1 adjusted net income of $2.90 per share, easily beating Wall Street’s view of $2.78.

Revenue surged 19.5% from last year to $14.7 billion, also topping estimates for $14.44 billion.

Looking ahead, FedEx lifted its full-year earnings outlook to a range of $11.85-12.35 per share, up from $11.75-12.25.

On average, Wall Street analysts are looking for $11.88 per share for the year.

This was the first full quarter since FedEx completed its $4.8 billion acquisition of Dutch package delivery company TNT Express in May, which it expects will add significantly to earnings in coming years.

From the FedEx Press Release:

“The integration of TNT Express is proceeding smoothly, and the level of team members’ engagement is outstanding,” said Frederick W. Smith, FedEx Corp. chairman, president and chief executive officer.

“Managing our operating companies as a portfolio of customer solutions helped FedEx achieve strong financial and operating results in the quarter, especially given the global economy’s continued low growth.”

“Our team is extremely excited about the TNT Express integration, and we are discovering many possibilities for achieving high returns,” said Alan B. Graf, FedEx Corp. executive vice president and chief financial officer.

“As we integrate these networks and take advantage of the unmatched road capabilities of TNT Express, I am confident there is going to be a tremendous opportunity to increase the earnings of FedEx Corporation.”

Like main rival United Parcel Service Inc, FedEx is seen as a bellwether of U.S. economic activity.

Read: Jeff Berman, Logistics Management, Group News Editor, FedEx Reports Solid Fiscal First Quarter Earnings Results

FedEx said it expects moderate economic growth, with U.S. gross domestic product up 1.6 percent in 2016 and rising 2.3 percent in 2017.

U.S. industrial production should fall 0.7 percent this year and grow 2.2 percent in 2017, FedEx estimated.

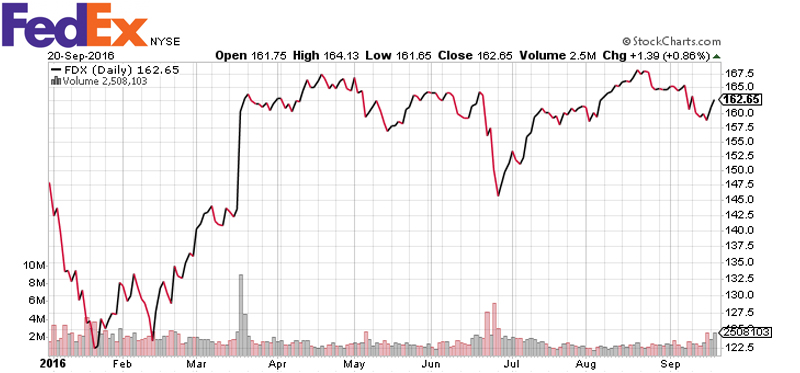

FedEx shares rose in after hours trading. Prior to yesterday’s report, FedEx had gained 9.17% year-to-date, easily eclipsing the S&P 500’s 4.67% return in the same period.

Up Go the Rates, Up Goes the Stock

Perhaps the most significant change announced by FedEx is that fuel surcharges for FedEx Express and FedEx Ground will be adjusted on a weekly basis instead of the current process in which adjustments are made on a monthly basis with a two-month lag between U.S. government published fuel indexes and the fuel surcharges.

Related: FedEx Follows Lead of UPS, Announces 2017 Rate Increases

Article Topics

FedEx News & Resources

FedEx Announces Plans to Shut Down Four Facilities FedEx and UPS to Charge Additional Delivery Fees in Major U.S. Cities Ranking the Top 50 Trucking Companies of 2024 Parcel Experts Weigh in on New Partnership Between UPS and USPS Parcel experts examine the UPS-United States Postal Service air cargo relationship amid parcel landscape UPS To Become USPS’s Main Air Cargo Provider, Replacing FedEx UPS is set to take over USPS air cargo contract from FedEx More FedExLatest in Transportation

FedEx Announces Plans to Shut Down Four Facilities The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? More Transportation