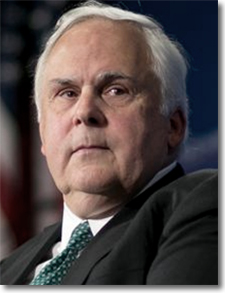

FedEx CEO Fred Smith: Uber Is Terrific But Unlikely To Be ‘Major Player’ In Logistics

There’s just an urban mythology out there that the app somehow changes the basic cost input of the logistics business or changes the patterns or the underlying business situation and that’s just not–that’s just incorrect.

Milder winter weather around Christmas helped FedEx Corp. have a happier holiday season than it did a year ago.

But despite beating analysts’ predictions for the third quarter, the Memphis shipping giant’s projections for its full fiscal year results were below Wall Street’s expectations.

That helped send company shares down about 1 percent Wednesday, closing at $173.30.

Meanwhile, CEO Frederick Smith shrugged off the potential competitive threat of ride-sharing services such as Uber, which is dipping a toe into the logistics business, albeit on a limited basis.

FedEx reported third-quarter earnings of $580 million, or $2.01 per share, compared to $378 million, or $1.23 per share, in the year-ago quarter. Analysts had expected earnings of $1.87 per share for the quarter ended Feb. 28, according to Thomson Reuters.

“We had a very successful peak season as volumes grew across all transportation segments,” CEO Smith said in a statement.

“I just don’t think they’re likely to be a major player in the logistics business”

The third quarter a year ago included a holiday shipping season beleaguered by snow delays that bogged down FedEx as well as rival shippers UPS and the U.S. Postal Service. For the 2014 holiday season, all three shippers took steps to prevent gift deliveries from being delayed again, with FedEx announcing in September it would hire some 50,000 holiday workers.

The company’s FedEx Ground division, based in Moon, reported revenue of $3.39 billion in the third quarter, a 12 percent increase from $3.03 billion in the year-ago quarter. That represented the largest year-over-year percentage increase of any FedEx division.

The Ground division’s average daily package volume was up by 7 percent. The company attributed the increase in part to higher revenue per package - it raised shipping prices in January - as well as to the milder weather.

For the fiscal year that ends in May, FedEx is predicting earnings per share between $8.80 and $8.95, but Thomson Reuters said an average of analysts were expecting $8.97.

During a conference call with analysts to discuss the earnings results, Mr. Smith was asked whether FedEx saw ride-sharing company Uber as a potential threat to its business model.

“There’s a great country and western song called, ‘I Was Country Before Country Was Cool,’ ” Mr. Smith said in response. “Well, we were Uber before Uber was there.”

Uber launched a pilot program called Uber Rush in New York City last year, which provides couriers to deliver packages in several boroughs. It has not announced any plans to expand that, but CEO Travis Kalanick told Bloomberg Businessweek shortly after the service’s launch that it was going well.

FedEx’s own same-day city service has largely met the demand for moving things the same day, and represents a small portion of the company’s business, Mr, Smith said. “It’s a much smaller market than the business of moving things that are processed on the circadian pattern we all live by. You know, go to work at 8, come home at 5,” he said, noting that most e-commerce orders are processed between 8 p.m. and midnight.

He added that Uber is a “great company” and that he uses the service himself.

But just having an effective app doesn’t mean a company like Uber could change the costs or disrupt the patterns of a major logistics operation, Mr. Smith said. “I just don’t think they’re likely to be a major player in the logistics business.”

Source: Pittsburgh Post-Gazette

Article Topics

FedEx News & Resources

FedEx and UPS to Charge Additional Delivery Fees in Major U.S. Cities Ranking the Top 50 Trucking Companies of 2024 Parcel Experts Weigh in on New Partnership Between UPS and USPS Parcel experts examine the UPS-United States Postal Service air cargo relationship amid parcel landscape UPS To Become USPS’s Main Air Cargo Provider, Replacing FedEx UPS is set to take over USPS air cargo contract from FedEx GRI Impact Analysis – Parcel Spend Management 1.0 vs. 2.0 More FedExLatest in Transportation

Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation